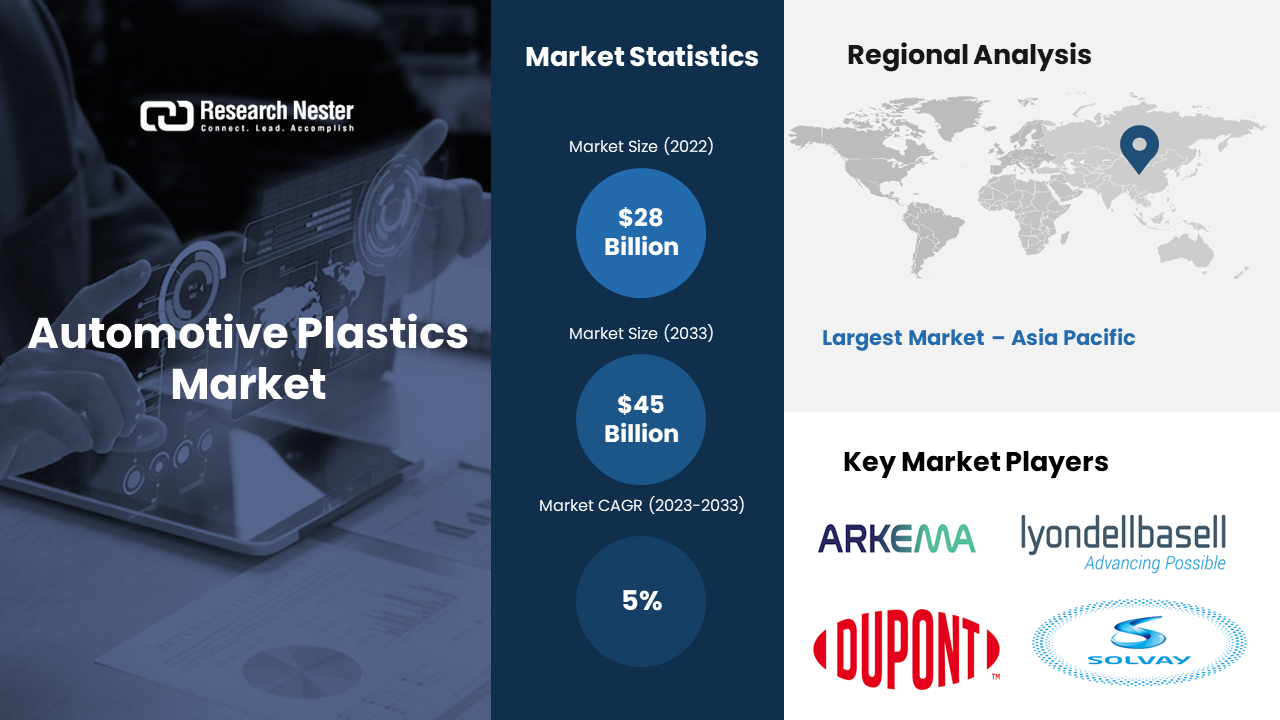

New York , Jan. 30, 2024 (GLOBE NEWSWIRE) -- The global automotive plastics market size is projected to grow at a CAGR of over 5% from 2023 to 2033. The market is expected to garner a revenue of USD 45 billion by the end of 2033, up from a revenue of USD 28 billion in the year 2022. The primary factor that is attributed to fuel the market growth in the forecast period is the rapid expansion in the automotive industry. Recent calculation stated that the revenue generation by global automotive industry is anticipated to stand at almost USD 9 trillion by 2030. Car manufacturers are highly focusing on building improved designs to reduce the weight of vehicles.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-4501

Plastics are easy to produce which can be sourced from renewable materials are easy to handle for improved designs. As a result, automotive plastics are preferred over the rest in the automotive industry. This rapid growth of automotive industry has also propelled the employment rate to increase in the sector considerably. In fiscal year 2018, the Indian automotive industry employed approximately 2 million people. There is a growing emphasis on the recyclability and sustainability of automotive plastics, with manufacturers exploring eco-friendly alternatives and recycling processes. Automotive manufacturers are increasingly incorporating lightweight materials, including plastics, to meet fuel efficiency standards and reduce emissions.

Automotive Plastics Market: Key Takeaways

- Market in Asia Pacific to propel highest growth

- The conventional cars segment to garner the highest growth

- Market in North America to grow at a highest rate

Increasing Middle Income of Population across the Globe to Boost Market Growth

With the increase of middle income, people are turning towards adopting upgraded version of vehicles for more comfort. A growing middle class contribute to increased entrepreneurship and innovation as more people have the financial means to start businesses or invest in new ideas. Automotive plastics which are useful component for manufacturing lightweight vehicles with fuel-efficient properties and enhanced on-road performance are preferred option for the population. Thus, with the rising income levels, the adoption rate of automotive plastics is anticipated with the expansion of the automotive plastics market. According to World Bank, the total population with middle income in the world rose from 5.51 billion in 2015 to 5.86 billion in 2021. As per Organization of Motor Vehicle Manufacturers, the global production of vehicles was 80 million units in 2021. This is a rise from 77 million units in 2020. Plastics are extensively used in the interior of vehicles for components such as dashboards, door panels, seats, and consoles. Interior design trends often drive the demand for new and aesthetically pleasing plastic materials. Regulatory requirements related to emissions and fuel efficiency standards influence the adoption of lightweight materials like plastics in the automotive industry.

Automotive Plastics Industry: Regional Overview

The global automotive plastics market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Rising Vehicle Production to Drive the Market Growth in Asia Pacific Region

The automotive plastics market in Asia Pacific region is estimated to garner the largest revenue by the end of 2033. The significant increase in vehicle production across the APAC region, particularly in countries like China, Japan, and India, has propelled the demand for automotive plastics. As automakers strive to meet stringent fuel efficiency standards, lightweight plastics are increasingly preferred for their role in reducing overall vehicle weight, enhancing fuel efficiency, and lowering emissions. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, APAC accounted for approximately 53.7% of the global motor vehicle production, with China being the largest contributor. To comply with these standards, automakers are turning to advanced materials like automotive plastics to achieve weight reduction, contributing to improved fuel efficiency and lower emissions. This regulatory push aligns with the global trend towards sustainable and eco-friendly automotive solutions. The growing awareness of environmental issues and the desire for fuel-efficient vehicles have led consumers to favor automobiles incorporating lightweight materials. Automotive plastics play a crucial role in achieving weight reduction, thereby enhancing fuel efficiency and addressing consumer preferences for eco-friendly options.

Emphasis on Vehicle Light Weighting for Fuel Efficiency to Propel the Growth in the North America Region

The North America automotive plastics market is estimated to garner the highest CAGR by the end of 2033. The pursuit of enhanced fuel efficiency and compliance with stringent emission standards has fueled a strong emphasis on vehicle light weighting. Automotive plastics, known for their lightweight properties, are increasingly integrated into vehicle design to achieve weight reduction, thereby contributing to improved fuel efficiency and reduced greenhouse gas emissions. According to the U.S. Environmental Protection Agency (EPA), for every 10% reduction in vehicle weight, fuel economy improves by approximately 6%-8%. The accelerating adoption of electric vehicles, driven by environmental concerns and government incentives, has opened new avenues for automotive plastics. EV manufacturers leverage plastics for various components, including battery enclosures and interior elements, to optimize weight and support the unique design requirements of electric vehicles.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-4501

Automotive Plastics Segmentation by Vehicle Type

- Conventional Cars

- Electric Cars

Amongst these segments, the conventional cars segment is anticipated to hold the largest share over the forecast period. Consumer trust in the reliability and proven technology of conventional engines remains a pivotal factor in their continued popularity. Established familiarity with internal combustion engines and concerns about the charging infrastructure for electric vehicles contribute to the sustained preference for traditional cars. According to a survey, in 2020, 64% of global consumers expressed trust in conventional gasoline-powered engines, citing concerns about electric vehicle technology as a barrier to adoption. The ongoing focus on enhancing fuel efficiency in conventional cars addresses environmental concerns and aligns with regulatory standards. Technological advancements, such as direct injection and turbocharging, contribute to improved fuel economy, making traditional vehicles more attractive to consumers mindful of both performance and environmental impact. Continuous innovation and integration of advanced technologies enhance the appeal of conventional cars. Features such as adaptive cruise control, lane-keeping assistance, and collision avoidance systems contribute to improved safety and comfort, attracting consumers who value these technological advancements in their vehicles.

Automotive Plastics Segmentation by Process

- Injection Molding

- Blow Molding

- Thermoforming

- Others

Amongst these segments, the automotive plastics market injection molding segment is anticipated to hold a significant share over the forecast period. The automotive sector's continuous expansion is a major driver for the injection molding segment. Automotive manufacturers rely on injection molding for producing a wide range of components, including interior and exterior parts, contributing significantly to the growth of the injection molding market. According to the Plastics Industry Association, the automotive industry accounted for 16.1% of the total injection molding market in the United States in 2019. The packaging industry's increasing demand for cost-effective, durable, and customizable solutions propels the injection molding segment. Packaging applications include containers, caps, closures, and various other items, with injection molding being a preferred method for achieving high-volume production and design flexibility. The medical sector's growing reliance on plastic components, particularly for medical devices and disposable products, fuels the demand for injection molding. The precision, consistency, and scalability of injection molding make it a preferred method for meeting the stringent requirements of the medical industry.

Automotive Plastics Segmentation by Application

- Interior

- Exterior

- Under Bonnet

Automotive Plastics Segmentation by Product

- Polyurethane

- Polyvinyl Chloride

- Polyethylene

- Others

Few of the well-known market leaders in the global automotive plastics market that are profiled by Research Nester are Arkema, BASF, Saudi Basic Industries Corporation, LyondellBasell Industries N.V., LG Chem, DuPont de Nemours, Inc., Covestro AG, Evonik Industries AG, Solvay Group, Borealis AG, and other key market players.

Recent Development in the Automotive Plastics Market

- BASF has launched styling polymer Luviset 360 that offers strong, flexible and long-lasting hold as well as low flaking along with anti-pollution properties and allows for new textures.

- Arkema has decided to acquire Agiplast, a leader of high performance polymersspecialty polyamides and fluoropolymers. This acquisition is expected to bolster the company’s capacity to offer a full service to customers in terms of materials circularity.

Read our insightful Blogs and Data-driven Case Studies:

- Novel Approaches to Food Packaging - Will effective food packaging reduce food waste?

Explore the eco-friendly solutions for food packaging that benefit our planet and promote healthy lifestyle. Discover how sustainability meets the food industry and also know the recent trends in the industry.

https://www.researchnester.com/blog/packaging/novel-approaches-to-food-packaging

- How has a packaging company incorporated a sustainable approach to master its ecologically unfriendly product?

This case study discusses the issues faced by a packaging company due to environmental concerns. Know how the company overcame loss and gained a strong market adopting solutions & suggestions provided by our analysts.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.