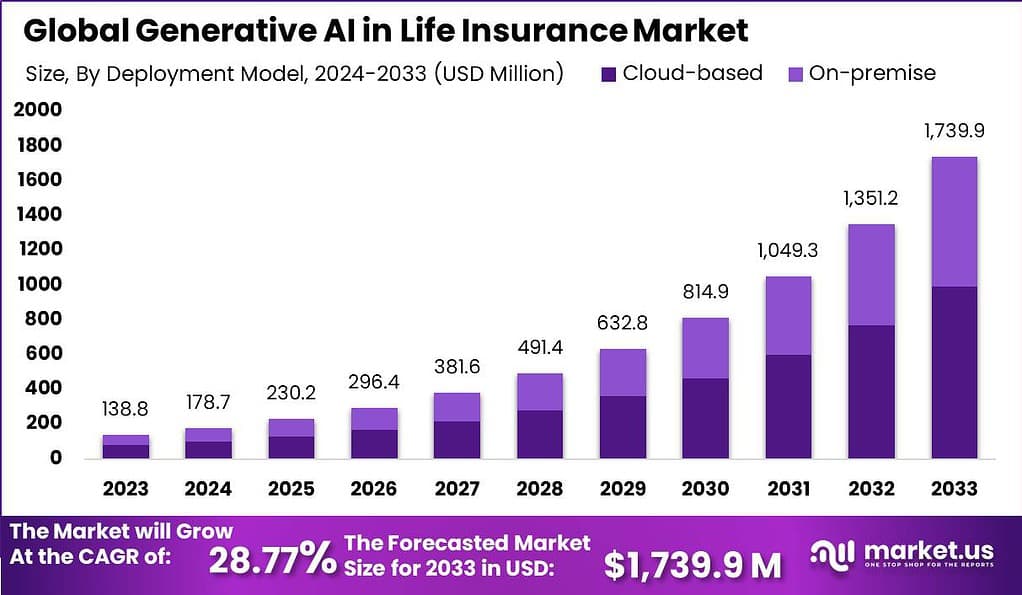

New York, Feb. 12, 2024 (GLOBE NEWSWIRE) -- According to Market.us, The projected value of the Generative AI in Life Insurance Market is anticipated to be USD 138.8 Million in 2023 and is expected to witness substantial growth, reaching USD 1,739.9 Million by 2033. The market is poised for a remarkable surge, with a projected Compound Annual Growth Rate (CAGR) of 28.77% during the forecast period from 2024 to 2033.

Generative AI, with its ability to generate realistic and diverse data, has found applications in the life insurance industry. Generative AI in life insurance involves the use of machine learning algorithms to create synthetic data that can be utilized for various purposes, such as risk assessment, underwriting, customer profiling, and product development. This technology has the potential to revolutionize the life insurance sector by improving efficiency, accuracy, and customer experience.

The market for generative AI in life insurance is expected to witness significant growth in the coming years. As life insurance companies strive to enhance their operational processes and gain a competitive edge, they are turning to generative AI solutions. These solutions enable them to leverage large volumes of data, generate synthetic data to augment their datasets, and develop advanced predictive models. By harnessing the power of generative AI, life insurers can make more informed decisions, streamline operations, and deliver personalized products and services to their customers.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=114557

Important Revelation:

- Market Projection: The Generative AI in Life Insurance Market is projected to reach a value of USD 1,726.7 million by 2033, indicating a notable growth rate of 4.5% during the forecast period.

- Dominance of Cloud-Based Solutions: Cloud-based solutions dominate the market, capturing over 70% share in 2023, offering scalability, flexibility, enhanced accessibility, cost-effectiveness, and rapid deployment advantages to insurers.

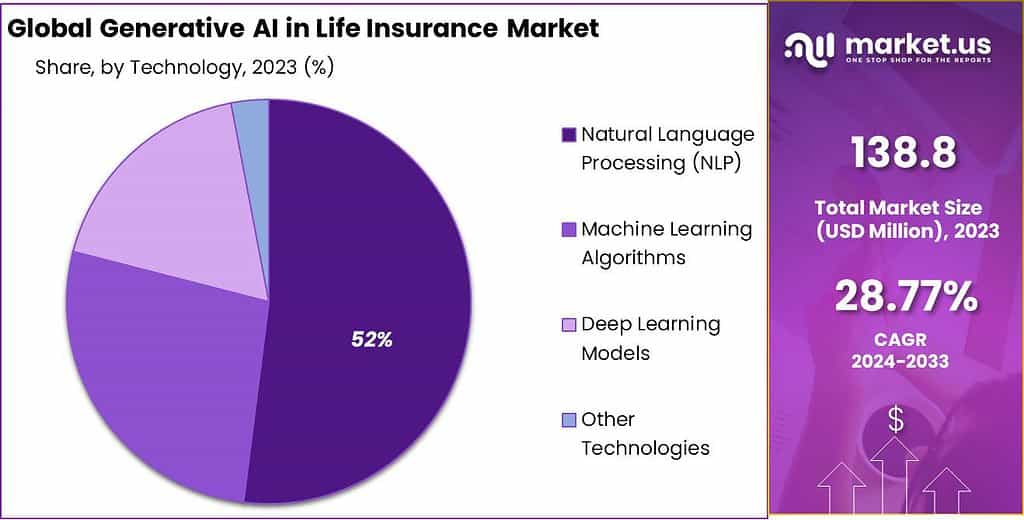

- Role of Natural Language Processing (NLP): Natural Language Processing (NLP) emerges as a key technology segment, holding a dominant market position in 2023, with a share of more than 52%. NLP plays a crucial role in transforming customer interactions, streamlining claims processing, and ensuring compliance and fraud detection.

- Leadership in Personalized Policy Recommendations: The Personalized Policy Recommendations segment leads the market, capturing over 25% share in 2023. This is driven by the growing demand for customized insurance products tailored to individual customer needs and preferences.

- Dominance of Life Insurance Companies: The Life Insurance Companies segment dominates the market, capturing a significant share of more than 30% in 2023. This is attributed to leveraging generative AI for accurate risk assessment, personalized underwriting, and enhancing actuarial capabilities.

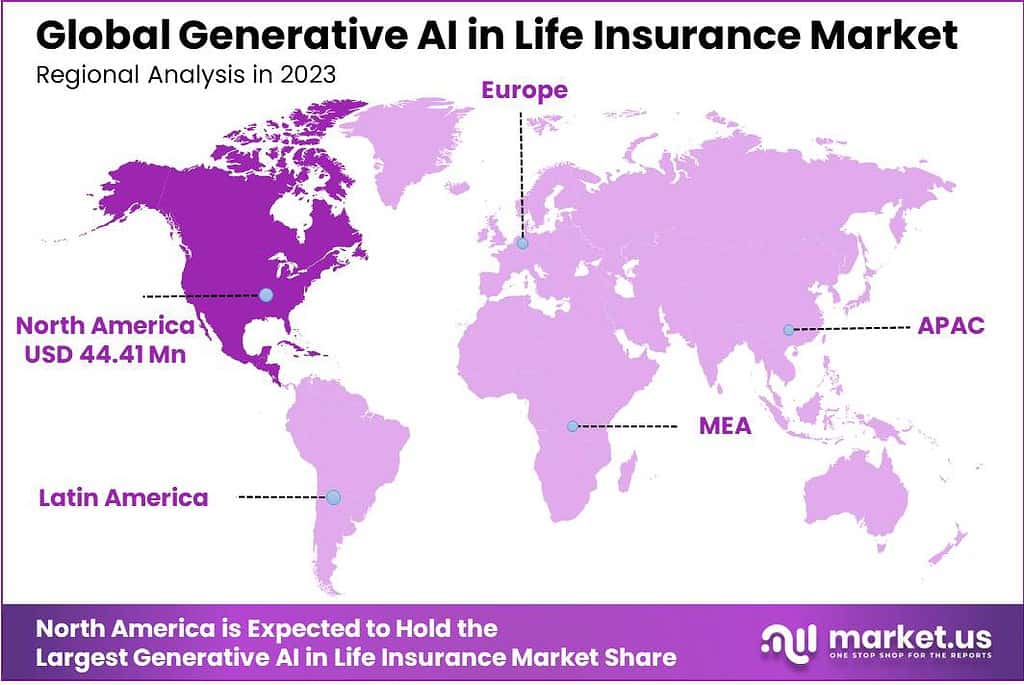

- Regional Leadership of North America: North America leads the market with a dominant share of over 32% in 2023, owing to a mature and technologically advanced life insurance industry, robust digital infrastructure, and high insurance awareness among the population.

Request for Research Methodology to Understand Our Data-sourcing Process in Detail: https://market.us/report/generative-ai-in-life-insurance-market/request-sample/

Key Influencers in the Generative AI in Life Insurance Market Growth

- Increasing Volume and Variety of Data: The life insurance industry generates a massive amount of data, including customer demographics, medical records, financial information, and historical claims data. Generative AI enables life insurers to leverage this vast and diverse data to generate synthetic data that can augment their datasets and improve predictive modeling and risk assessment.

- Regulatory Environment and Compliance: The life insurance industry is subject to stringent regulatory requirements. Generative AI can assist in meeting these regulatory obligations by providing synthetic data for testing and validation purposes. It enables life insurers to simulate scenarios, predict outcomes, and ensure compliance with regulatory frameworks such as privacy laws and anti-discrimination regulations.

- Enhanced Underwriting and Risk Assessment: Generative AI can significantly impact the underwriting and risk assessment processes in the life insurance industry. By generating synthetic data that represents a wide range of demographic and health profiles, life insurers can develop more accurate underwriting models and make better risk assessments, leading to more precise pricing and personalized insurance offerings.

- Customer Experience and Personalization: Generative AI enables life insurers to analyze customer behavior, preferences, and needs to deliver personalized products and services. By generating synthetic data that represents different customer profiles and preferences, insurers can tailor their offerings, provide customized recommendations, and enhance the overall customer experience.

- Collaboration and Partnerships: Collaboration between life insurance companies and technology providers is a key influencer in the generative AI market. Partnerships enable the exchange of knowledge, access to advanced AI technologies, and the development of tailored solutions that address the specific needs of the life insurance industry.

Regional Analysis:

In 2023, North America emerged as the frontrunner in the Generative AI in Life Insurance market, consolidating its dominant position by capturing a substantial share of over 32%. This regional dominance underscores the advanced technological infrastructure, robust regulatory frameworks, and strong market demand for innovative insurance solutions within North America.

The region's early adoption of generative AI technology, coupled with strategic investments in research and development, has propelled its leadership in harnessing artificial intelligence to optimize life insurance operations. Moreover, the presence of major industry players, coupled with a large consumer base receptive to technological advancements, further solidifies North America's pivotal role in shaping the trajectory of the generative AI in life insurance market.

Access the Complete Report Methodology Now: https://market.us/report/generative-ai-in-life-insurance-market/request-sample/

Report Segmentation

Deployment Model Analysis:

In 2023, the Cloud-Based segment held a dominant market position in the Generative AI in Life Insurance market, capturing more than a 70% share. Cloud-based deployment refers to the utilization of cloud computing infrastructure and services to host and deliver generative AI applications. The dominance of the cloud-based segment can be attributed to several factors. Cloud-based deployment offers scalability, flexibility, and cost-effectiveness, allowing life insurance companies to access and leverage generative AI capabilities without significant upfront investments in hardware or infrastructure.

Additionally, cloud-based solutions provide easy integration with existing systems, enabling seamless implementation and rapid deployment of generative AI technologies in life insurance operations. The cloud-based approach also facilitates data sharing, collaboration, and real-time updates, enhancing the efficiency and effectiveness of generative AI applications in the life insurance industry.

Technology Analysis:

In 2023, the Natural Language Processing (NLP) segment held a dominant market position in the Generative AI in Life Insurance market, capturing more than a 52% share. Natural Language Processing is a branch of artificial intelligence that focuses on the interaction between computers and human language. NLP enables generative AI systems to understand, interpret, and generate human-like language, facilitating communication and interaction between life insurance companies and their customers.

The dominance of the NLP segment can be attributed to the increasing emphasis on customer-centricity and personalized communication in the life insurance industry. NLP-based generative AI applications enable life insurers to analyze customer inquiries, extract insights from unstructured text data, and generate personalized responses. This technology also supports automated chatbots, virtual assistants, and voice recognition systems, enhancing customer service and improving operational efficiency in life insurance companies.

Application Analysis:

In 2023, the Personalized Policy Recommendations segment held a dominant market position within the Generative AI in Life Insurance market, capturing more than a 25% share. Personalized policy recommendations refer to the use of generative AI to analyze customer data, preferences, and risk profiles to generate tailored insurance policy recommendations. The dominance of this segment can be attributed to the increasing demand for personalized insurance offerings in the life insurance industry.

Generative AI applications enable life insurers to leverage customer data, such as demographics, financial information, and health records, to generate personalized policy recommendations that align with individual customer needs and risk profiles. By utilizing generative AI for personalized policy recommendations, life insurance companies can enhance customer satisfaction, improve conversion rates, and optimize their product portfolio.

End-User Analysis:

In 2023, the Life Insurance Companies segment held a dominant market position in the Generative AI in Life Insurance market, capturing a significant share of more than 30%. The dominance of this segment can be attributed to the direct adoption and utilization of generative AI technologies by life insurance companies themselves. Life insurance companies leverage generative AI to enhance various aspects of their operations, including underwriting, risk assessment, customer service, claims management, and product development.

By incorporating generative AI into their processes, life insurance companies can improve efficiency, accuracy, and customer experience. The dominant position of the Life Insurance Companies segment reflects the industry's recognition of the transformative potential of generative AI and its proactive adoption to gain a competitive advantage in the market.

Access Exclusive Market Insights - Purchase now: https://market.us/purchase-report/?report_id=114557

Top Market Leaders

- IBM Corporation

- Google LLC

- Microsoft Corporation

- Salesforce

- Amazon Web Services (AWS)

- Cognizant

- Accenture

- Intel Corporation

- Palantir Technologies

- Guidewide

- Insurify

- Lemonade

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 138.8 Million |

| Forecast Revenue 2033 | USD 1,739.9 billion |

| CAGR (2024 to 2033) | 28.77% |

| North America Revenue Share | 32% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Market Segments

By Deployment Model

- Cloud-based

- On-premise

By Technology

- Natural Language Processing (NLP)

- Machine Learning Algorithms

- Deep Learning ModelsOther Technologies

By Application

- Underwriting and Claims Processing

- Personalized Policy Recommendations

- Customer Service and Chatbots

- Fraud Detection

- Risk Management and Predictive Analytics

- Natural Language Processing (NLP) for Policy Analysis

- Document Processing Automation

By End-User

- Life Insurance Companies

- Brokers and Agents

- Educational Institutions

- Reinsurers

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore Extensive Ongoing Coverage on Technology and Media Reports Domain:

- Catalog management system market is expected to witness substantial growth, reaching USD 13.2 billion by 2033 with a projected CAGR of 10.2%

- AI Voice Generator Market is expected to be valued at USD 4,889 Mn by 2032 from USD 1,210 Million with a CAGR of 15.4%

- Disaster Recovery Solutions Market size is expected to be worth around USD 95.0 bn by 2033, growing at a CAGR of 23.4%.

- 3D Gaming Console market value is expected to increase from USD 11.3 Bn in 2022 to USD 44.1 bn by 2032, at CAGR of 15%.

- Conversational system market size is projected to surpass at USD 182.5 bn by 2032 and it is growing at a CAGR of 27.4% from 2024 and 2033.

- Managed security services (MSS) Market size is expected to be worth around USD 74.2 Billion by 2032 , growing at a CAGR of 11.40%.

- Curved TV Market is anticipated to achieve a value of roughly USD 37,612.6 million by 2032, expand at a CAGR of 15.9%.Collision Avoidance Sensor Market size is expected to be worth around USD 15.1 Billion by 2032, growing at a CAGR of 11.90%.

- Voice Search Market Size Was USD 20.3 Billion In 2022 And Projected To Reach a Revised Size Of USD 112 Billion By 2032; CAGR of 19.2%

- Generative AI in Fintech Market will exceed USD 6,256 million by 2032, rising from USD 865 million in 2022; at a CAGR of 22.5%.

- Enterprise Blockchain Market valuation is set to reach USD 287.8 billion by 2032, increase at 47.5% CAGR throughout the forecast period.AI Video Generator Market is to reach USD 2,172 Mn by 2032 from USD 415 Mn in 2022, with a CAGR of 18.5% during the forecast period.

- Podcast Advertising Market reaching a total valuation of approximately USD 43.0 billion by 2032; leading to a projected CAGR of 14.5%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: