New York, NY, Feb. 14, 2024 (GLOBE NEWSWIRE) -- A latest research report [115+] pages with 360-degree visibility, titled “Carbon Credit Market Share, Size, Trends, Industry Analysis Report, By Type (Compliance, Voluntary), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-use, By Region, And Segment Forecasts, 2024-2032" published by Polaris Market Research in its research repository.

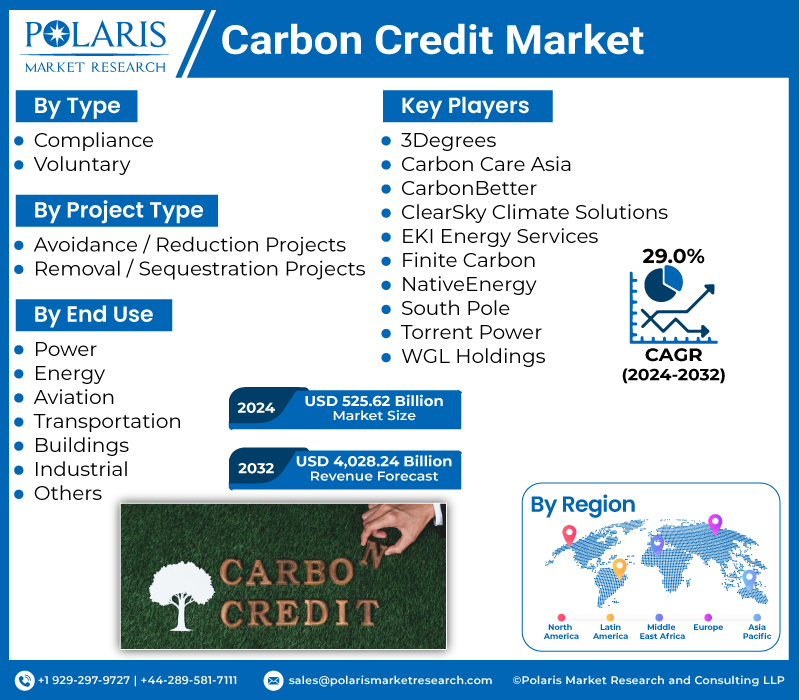

The global carbon credit market size and share are currently valued at USD 408.05 billion in 2023. It is anticipated to generate an estimated revenue of USD 4,028.24 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 29.0% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024-2032.

Market Definition

- What is Carbon Credit? How Big is Carbon Credit Market Size & Share?

Carbon credits are sanctions that permit the owner to release a specific amount of carbon dioxide or alternate greenhouse gases. One credit allows the release of one ton of carbon dioxide or the analogous alternate greenhouse gases. The rapidly rising demand for carbon credit market can be attributed to the fact that the firms that contaminate are bestowed credits that permit them to persist in contaminating up to a specific ceiling, which is decreased frequently. In the meantime, the firm might vend any unrequired credits to another firm that requires them. Private organizations are, therefore, in two ways motivated to decrease greenhouse emissions.

The carbon credit market growth can be attributed to carbon credit being instruments that permit firms to balance their carbon release by buying credits from projects that decrease greenhouse gas emissions. These projects can involve green energy production, replantation, energy efficacy inventiveness, and more. By purchasing carbon credits, firms can balance a part of their release and cause the entire curtailment of greenhouse gases. Complimentary government approaches and restrictions intend to decrease release, and several nations have pledged to the Paris Agreement, which establishes objectives for decreasing greenhouse gas emissions. Carbon credits can assist firms in encountering their responsibilities under these pacts.

Explore Our Carbon Credit Market Research: Request a Free Sample Copy of the Report @ https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market/request-for-sample

(The sample of this report is readily available on request. The report sample contains a brief introduction to the research report, Table of Contents, Graphical introduction of regional analysis, Top players in the market with their revenue analysis, and our research methodology.)

OR

Purchase a Thorough Analysis Report with an Extensive Table of Contents, List of Key Players, Key Segment Analysis & Detail Regional Insights @ https://www.polarismarketresearch.com/buy/2536/2

Carbon Credit Market Key Companies

- 3Degrees

- Carbon Care Asia

- CarbonBetter

- ClearSky Climate Solutions

- EKI Energy Services

- Finite Carbon

- NativeEnergy

- South Pole

- Torrent Power

- WGL Holdings

Request for a Discount on this Report Before Purchase @ https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market/request-for-discount-pricing

Key Highlights

- By purchasing carbon credits, firms can balance a part of their release and cause the entire curtailment of greenhouse gases, which pushes the market expansion.

- The carbon credit market segmentation is primarily based on types, project type, end-use, and region.

- Europe dominated the market in 2023

Market Developments

- Growth Drivers:

Reduction of greenhouse gas emissions: Governments are growingly performing schemes and directives to decrease greenhouse gas releases and alleviate climate change globally. One customary perspective is to establish targets for release curtailment and initiate executive skeletons that need firms to execute operations to balance their release. The carbon credit market size is expanding as these directives frequently involve apparatus that stimulate or require firms to buy carbon credits to balance their emissions. Carbon credits constitute a decrease or elimination of greenhouse gas emissions separately confirmed and validated as per the identified norm. By buying carbon credits, firms can productively offset a part of their release by reinforcing projects that cause emissions curtailment or viable practices.

Balancing of surplus emissions: Demand for carbon credits in the nation is propelled by countrywide level initiatives and voluntary markets. Many states in the US have executed cap and trade initiatives that establish a restriction on the aggregate amount of greenhouse gas release permitted within a state. The carbon credit market sales are soaring as the firms that transcend their granted emission grants are needed to buy carbon credits to balance their surplus emissions. The proceeds created from the sale of these allocations are frequently reinfused in clean energy projects or utilized to reinforce climate mitigation endeavors.

- Industry Trends:

Increasing governmental schemes: Firms that pollute acquire an established aggregate of credits that permit them to persist in contaminating up to specific restrictions. These credits are then moderately decreased over time. In the meantime, firms may disburse their unrequired credits to alternate firms that require them. Therefore, they generate budgetary stimulus for organizations to decrease gas emissions. Organizations that cannot decrease their greenhouse gas emissions are nevertheless permitted to function at an escalated fiscal price. With the increasing execution of governmental schemes and directives to decrease greenhouse gas emissions, the market is anticipated to witness a sizeable growth.

Decreasing carbon footprint: Several organizations identify the significance of viability and decreasing their carbon footprint as a proportion of their corporate social responsibility capabilities. In the carbon credit market, biosphere sustainability is important not only for diminishing climate change but also for sustaining their social permit to function and encounter stakeholder assumptions. Therefore, organizations are diligently looking for ways to decrease their greenhouse gas emissions and illustrate their allegiance to viable practices.

- Restraints

Price unpredictability: Price unpredictability of carbon credits creates provocations for firms that depend on secure costs to propose and finance discharge curtailment projects. Predictability can render it challenging to estimate the fiscal viability and return on investment for such estimates. To diminish these probabilities, firms may engage policies such as onward arrangements, constrain contrivance, and durable buying agreements to handle their submission to price variation.

To Know More About the Research Report, Speak With Our Research Analyst @ https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market/speak-to-analyst

Segmentation Overview

- The Compliance Segment Witnessed a Steep Rise

Based on type, the compliance segment witnessed a steep rise. The carbon credit market demand is on the rise as it comprises firms contingent on government restrictions or particular dominance that command balancing the carbon emissions. These directives establish emission decrease objectives or restrict or need firms to buy carbon credits to remunerate for their surplus release. The bought carbon credits appear for confirmed emissions curtailment from accepted projects such as renewable energy attachments, energy coherence inventiveness, or other acceptable ventures.

- Avoidance/Reduction Segment Dominated the Market

Based on the project, the avoidance/reduction segment dominated the market. The carbon credit market trends include renewable energy proposals such as wind farms, solar power induction, or hydroelectric plants creating carbon credits by circumventing or overriding releases that would have taken place if the electricity had been created from fossil fuel well springs such as coal-fired power plants. The circumvented releases are deliberated depending on the distinction in greenhouse gas emissions in the middle of renewable energy proposals and the onset framework constituting the release that would have taken place without renewable energy projects.

Inquire more about this report before purchase @ https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market/inquire-before-buying

(Inquire a report quote OR available discount offers to the sales team before purchase.)

Carbon Credit Market: Report Scope & Dynamics

| Report Attribute | Details |

| Revenue Forecast in 2032 | USD 4,028.24 Billion |

| Market size value in 2024 | USD 525.62 Billion |

| Expected CAGR Growth | 29.0% from 2024 – 2032 |

| Base Year | 2023 |

| Forecast Year | 2024 – 2032 |

| Top Market Players | 3Degrees, Carbon Care Asia, CarbonBetter, ClearSky Climate Solutions, EKI Energy Services, Finite Carbon, NativeEnergy, South Pole, Torrent Power, and WGL Holdings., among others |

| Segments Covered | By Type, By Project Type, By End Use, By Region |

| Customization Options | Customized purchase options are available to meet any research needs. Explore customized purchase options |

Browse Detail Press Release: Carbon Credit Market Size Worth $4,028.24 Billion By 2032 | CAGR: 29.00%

Regional Insights

Europe: This region held the largest carbon credit market share due to its superiority in the context of revenue. It can be credited to the abiding existence and cultivation of the EU ETS and the thorough scope of attachments covering several European nations. The EU ETS has effortlessly confirmed a strong carbon market framework, encouraged emissions bartering, and inspired a transformation to a low-carbon fiscal state.

North America: This region registered a robust growth rate due to price unpredictability, creating scope for firms to set foot in the market and captivate in release peddling as well as for magnets seeking probable gains in the carbon market. This unpredictability merged with the possibility for market-dependent motives and the inclination to encounter emission curtailment objectives, has captivated the interest and has resulted in the approval of carbon credit.

Browse the Detail Report “Carbon Credit Market Share, Size, Trends, Industry Analysis Report, By Type (Compliance, Voluntary), By Project Type (Avoidance/Reduction Projects, Removal/Sequestration Projects), By End-use, By Region, And Segment Forecasts, 2024-2032” with in-depth TOC: https://www.polarismarketresearch.com/industry-analysis/carbon-credit-market

For Additional Information OR Media Enquiry, Please Mail At: sales@polarismarketresearch.com

Key Questions Addressed in the Report:

- What are the main companies in the carbon credit market?

Ans: Some of the key companies in the market are 3Degrees, Carbon Care Asia and CarbonBetter

- What is the CAGR to be deliberated for the market?

Ans: The CAGR to be deliberated for the market is 29.0%

- What are the key segments covered?

Ans: The key segments covered are types, project type, end-use, and region.

- What are the key driving factors in the market?

Ans: The key driving factors in the market are the reduction of greenhouse gas emissions and the balancing of surplus emissions.

Polaris Market Research has segmented the carbon credit market report based on type, project type, end use, and region:

By Type Outlook

- Compliance

- Voluntary

By Project Type Outlook

- Avoidance / Reduction Projects

- Removal / Sequestration Projects

- Nature-based

- Technology-based

By End Use Outlook

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

By Region Outlook

- North America (U.S., Canada)

- Europe (France, Germany, UK, Italy, Netherlands, Spain, Russia)

- Asia Pacific (Japan, China, India, Malaysia, Indonesia. South Korea)

- Latin America (Brazil, Mexico, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, Israel, South Africa)

Browse More Research Reports:

Wood Activated Carbon Market Size & Share

Personal Cooling Device Market Size & Share

Canine Atopic Dermatitis Market Size & Share

Space Sensors Market Size & Share

Masterbatch Market Size & Share

About Polaris Market Research:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR’s clientele spread across different enterprises. We at Polaris are obliged to serve PMR’s diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR’s customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR’s customers.

Contact:

Likhil G

30 Wall Street

8th Floor,

New York City, NY 10005,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Blog: https://polarismarketresearch.medium.com