Dublin, March 13, 2024 (GLOBE NEWSWIRE) -- The "Global Commercial Vehicle Telematics Market by Offering (Software (Fleet Management, Telematics Productivity), Services), Vehicle Type (LCV, MHCV), Propulsion Type (IC Engine, Electric, Hybrid), Sales Channel, End-user and Region - Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

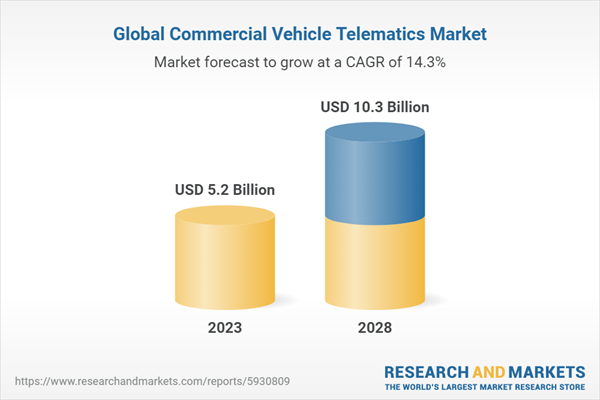

The commercial vehicle telematics market is projected to grow from USD 5.2 billion in 2023 to USD 10.3 billion by 2028, at a compound annual growth rate (CAGR) of 14.3% during the forecast period

The report offers valuable insights into the commercial vehicle telematics market, providing market leaders and new entrants with revenue approximations for both the overall market and its subsegments. This information aids stakeholders in understanding the competitive landscape, enabling them to better position their businesses and devise suitable go-to-market strategies. Additionally, stakeholders can gain a deeper understanding of market dynamics, including key drivers, restraints, challenges, and opportunities.

The growth of the commercial vehicle telematics market is primarily attributed to the pressing need for streamlined fleet management, the increasing demand to reduce vehicle fuel consumption and downtime, as well as stricter regulations emphasizing passenger and vehicle safety.

A competitive assessment is conducted, offering an in-depth analysis of market shares, growth strategies, and service offerings of leading players such as Verizon Connect (US), Geotab (Canada), Trimble (US), PTC (US), TomTom (Netherlands), Omnitracs (US), Masternaut Limited (United Kingdom), Microlise (United Kingdom), Inseego Corporation (US), and Samsara (US), among others.

By offering, telematics compliance software segment is expected to register the fastest market growth rate during the forecast period

Telematics compliance software in the commercial vehicle telematics sector is expected to experience the fastest growth rate during the forecast period due to increasing regulatory requirements. Governments worldwide are implementing stringent standards related to driver safety, emissions, and operational protocols.

Telematics compliance software offers fleet operators a comprehensive solution to efficiently manage and adhere to these regulations, ensuring both legal compliance and operational optimization. As the regulatory landscape evolves, the demand for telematics compliance solutions is anticipated to surge, driving rapid growth in this segment.

By sales channel, aftermarket segment is expected to account for the largest market share during the forecast period

The aftermarket segment of the commercial vehicle telematics market is poised to capture the largest market share during the forecast period primarily due to the increasing trend of retrofitting existing fleets with telematics solutions. Fleet operators are recognizing the benefits of post-purchase installations, such as cost-effectiveness and flexibility, enabling them to upgrade vehicles with the latest telematics technologies without the need for significant upfront investments. This trend is expected to drive substantial growth in the aftermarket segment as businesses seek to enhance operational efficiency and stay competitive in the evolving landscape.

By Region, Asia Pacific is slated to grow at the fastest rate and North America to have the largest market share during the forecast period

The Asia Pacific region is anticipated to experience accelerated growth in the commercial vehicle telematics market due to factors such as rising urbanization, increased e-commerce activities, and stringent regulatory measures promoting road safety and environmental sustainability. Meanwhile, North America is projected to hold the largest market share, driven by the region's advanced infrastructure, widespread adoption of telematics solutions, and a matured transportation industry. The combination of these factors positions North America as a dominant market player, while Asia Pacific showcases significant potential for rapid expansion.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 393 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $5.2 Billion |

| Forecasted Market Value (USD) by 2028 | $10.3 Billion |

| Compound Annual Growth Rate | 14.3% |

| Regions Covered | Global |

Premium Insights

- Amplified Demand for Fleet Optimization and Real-Time Asset Monitoring to Drive Market Growth

- Electric Vehicle Propulsion Segment to Account for Highest Growth Rate During Forecast Period

- Software and Fleet Operators to be Largest Shareholders in Market in North America in 2023

- North America to Hold Largest Market Share in 2023

Case Study Analysis

- Krp Rentals and Trucking Improves Productivity and Safety with Verizon Connect

- Shaziman Transport Improves Performance, Saves Money, and Reduces Environmental Footprint with Data

- Middlesboro Coca-Cola's Move to Tmt SaaS for Fleet Maintenance Generates Measurable Savings

- Vestergaard Company Leverages IoT to Optimize Efficiency of Its Mission-Critical Aircraft Equipment

- Merchants Foodservice Applying Advanced Technologies to Ensure Drivers and Products Arrive Safely, on Time, and Intact

- Jaga Brothers Optimized Management of Trucks & Trailers, Generating Fuel Savings and Reducing Downtime Across Entire Fleet

Market Overview and Industry Trends

Drivers

- Increasing Need for Efficient Fleet Management

- Rising Demand for Reduced Fuel Consumption and Vehicle Downtime

- Increasing Regulatory Mandates to Improve Safety & Security of Vehicles and Passengers

- Growing Awareness of Predictive Maintenance

Restraints

- Dependence on Fluctuating Vehicle Demand

- Integration Complexity of Telematic Solutions

- High Initial Cost of Implementing Telematics Systems

Opportunities

- Potential of V2X Communication and Autonomous Driving Integration

- Integration of Advanced Analytics & AI-Powered Insights with Telematics Software

- Expansion of Transportation and Logistics Industry

- New Revenue Stream Offered by Eld Mandate for Existing Vendors

Challenges

- Reduced Efficiency of Data Communication with Advanced Computing Processing Units due to Legacy Telematics Hardware

- Complete Network Coverage and Elimination of Blind Spots

- Lack of Standardized Systems

Evolution of Commercial Vehicle Telematics

Types of Telematics Systems

- Obd II Telematics Systems

- Bluetooth-Powered Telematics Systems

- Smartphone-based Telematics Systems

- Blackbox Telematics Systems

- OEM Hard-Wired Telematics Systems

- 12V Plug-In Self Installation Telematics Systems

Ecosystem/Market Map

- Telematics Software Providers

- Telematics Service Providers

- Original Equipment Manufacturers (OEMs)

- System Integrators

- End-users

- Government & Regulatory Bodies

Technology Analysis

Key Technology

- Global Positioning System (Gps)

- Telematics Control Unit (Tcu)

- IoT Connectivity

- Advanced Driver Assistance Systems (Adas)

Complementary Technologies

- Edge Computing

- Cloud Computing

- Machine Learning and Artificial Intelligence

- Mobile App Integration

Adjacent Technologies

- Blockchain

- 5G Connectivity

- Augmented Reality (Ar)

- Cybersecurity

Regulations: Commercial Vehicle Telematics Market

- North America

- Electronic Logging Device (Eld) Mandate

- California Consumer Privacy Act (Ccpa)

- Transportation of Dangerous Goods (Tdg) Regulations

- Europe

- General Data Protection Regulation

- Ecall Regulation

- Eu Regulation 2019/2144 on Co2 Emission Performance Standards for New Heavy-Duty Vehicles

- Asia-Pacific

- India: Ais-140 (Automotive Industry Standard 140)

- China: Gb/T 32960

- Australia: Telematics Data Privacy Guidelines

- Middle East & Africa

- South Africa: Road Traffic Management System (Rtms) Act 2008

- Nigeria: National Road Traffic Regulations

- United Arab Emirates (UAE): Federal Law on Road Transport and Traffic

- Latin America

- Brazil: Contran Resolution 245/2007

- Mexico: General Law of National Public Security

- Argentina: Resolution 39/2017 - Ansv

Commercial Vehicle Telematics Business Models

- Software Vendor Model

- Consulting Services Model

- OEM Collaboration Model

- Data Monetization Model

- Fleet Management-As-A-Service Model

Company Profiles

Key Players

- Verizon Connect

- Geotab

- Ptc

- Trimble

- Tomtom

- Omnitracs

- Masternaut Limited

- Microlise

- Inseego Corporation

- Samsara

- Octo Telematics

- Mix Telematics

- Zonar Systems

- Teletrac Navman

- Spireon

- Lytx

- Volkswagen Commercial Vehicles

Startup/SME Profiles

- Motive

- Nauto

- Greenroad Technologies

- Otonomo Technologies

- Fleetx.Io

- Onfleet

- Vontier

- Tangerine

- Mojio

- Gurtam

- Fleetable

- Avrios

- Platform Science

For more information about this report visit https://www.researchandmarkets.com/r/h99qu5

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment