Dublin, March 13, 2024 (GLOBE NEWSWIRE) -- The "Immersion Cooling In Data Centers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019-2029" report has been added to ResearchAndMarkets.com's offering.

The Immersion Cooling Market in Data Centers Industry is expected to grow from USD 0.78 billion in 2024 to USD 2.34 billion by 2029, at a CAGR of 24.42% during the forecast period (2024-2029).

Dealing with high-density power consumption drives the market, as many industry estimates put cooling costs at around 40% of the data center's energy consumption. The immersion cooling is able to reduce the data center's energy usage by over 60%. It was identified that 38% of the electricity needed in data centers equipped with traditional air-based cooling technologies is utilized to cool the electronic components.

Liquid cooling is another commonly used method for heat management in data centers, alongside air cooling. However, liquid cooling is considered more beneficial than air cooling, as water is more efficient than air as a heat removal medium and may reduce cooling power needs by 70%.

Technological advancements have made liquid cooling simple to maintain, easily scalable, and affordable. They have reduced liquid usage by more than 15% for data centers in built-in hot and humid climates and 80% in cooler areas. The energy dedicated to liquid cooling may be recycled to heat buildings or water, effectively shrinking the carbon footprint of air conditioning due to advanced engineering coolants.

However, as the liquid is both corrosive and conductive with electricity, any type of breach or risk in the data center liquid cooling system can be dangerous for the facilities and systems. This presents a major challenge for the data center liquid cooling sector in the market studied.

The COVID-19 pandemic hastened the adoption of digital technologies, increasing the need for cooling systems and data centers. Following the pandemic, data center operators started to consider immersion coding technology because of its advantages for sustainability and energy efficiency. Immersion coding developed and became more important in the data center sector as a result of increased industry investments and innovations with a higher focus on residence and sustainability. The usage of these technologies is anticipated to grow as the digital economy continues to develop.

Edge Computing to Witness Major Growth

Growing research and development in edge computing are creating new opportunities for establishing new data centers worldwide. Edge computing is altering the data storage and processing fields, driving the demand for a new generation of edge micro data centers and thereby increasing the demand for immersion cooling for these data centers.

Immersion cooling helps reduce energy consumption in high-performance edge computing data centers. Companies in the Asia-Pacific region, especially in developing economies such as India, carefully consider the technologies and methods of cooling for their data centers to operate more efficiently. The construction of large data centers nationwide has increased investment in single-phase immersion cooling backed by hybrid silicone-organic fluids. Mineral oil is expected to enhance the data center's performance with its cooling ability and high thermal conductivity.

With a rising demand for artificial intelligence, higher computing densities are emerging. Liquid immersion cooling is becoming a suitable option for increasing demand for AI at the edge, where traditional air cooling has much lower thermal conductivity than liquid. To cater to this situation, vendors offer their best-in-class liquid cooling technology, the fastest and least disruptive way to adopt liquid cooling for AI and edge computing.

Overall, the deployment of large-scale edge computing data centers to cater to the growing fifth-generation (5G) networks, IoT, industrial IoT (IIoT) devices, autonomous vehicles, virtual and augmented reality, artificial intelligence, machine learning, and data analytics, has urged data center operators to opt for immersive cooling solutions to provide dramatic energy-saving benefits, augmenting market demand.

The market studied reflects high competitiveness and is expected to intensify further during the forecast period. Key players, including Fujitsu Limited, Green Revolution Cooling Inc., Submer Technologies SL, Liquid Stack Inc., and Asperitas Company, are actively employing strategies like partnerships, collaborations, and acquisitions to fortify their product portfolios and secure sustainable competitive advantages.

Key Topics Covered:

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

4.1 Market Overview

4.2 Industry Attractiveness - Porter's Five Forces Analysis

4.3 Assessment of the Impact of COVID-19 on the Industry

4.4 Industry Supply Chain Analysis

4.5 Fluorine-based Liquid Suppliers/Manufacturers

4.6 Immersion Cooling Bath Equipment Vendors

4.7 Data Center Vendors

5 MARKET DYNAMICS

5.1 Market Drivers

5.1.1 Increase in the Number of Hyper-scale Data Centers

5.1.2 Dealing with High-density Power Consumption

5.2 Market Restraint

5.2.1 High Investment with Greater Capital Expenditure

6 TECHNOLOGY SNAPSHOT

6.1 Evolution of Data Center Cooling

6.2 Energy Consumption and Computing Density Metrics, and Key Considerations

6.3 Teardown of Fluid, Processor, GPUs, Racks, and Infrastructure Providers

7 MARKET SEGMENTATION

7.1 By Type

7.1.1 Single-Phase Immersion Cooling System

7.1.2 Two-Phase Immersion Cooling System

7.2 By Cooling Fluid

7.2.1 Mineral Oil

7.2.2 Deionized Water

7.2.3 Fluorocarbon-Based Fluids

7.2.4 Synthetic Fluids

7.3 By Application

7.3.1 High-performance Computing

7.3.2 Edge Computing

7.3.3 Artificial Intelligence

7.3.4 Cryptocurrency Mining

7.3.5 Other Applications

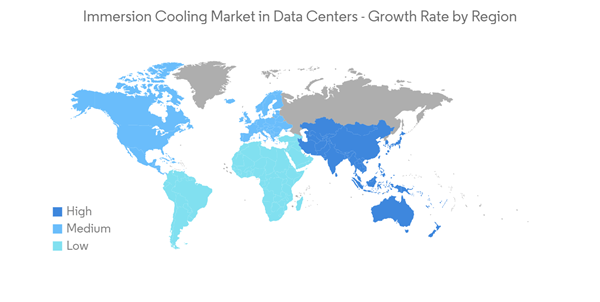

7.4 By Geography

7.4.1 North America

7.4.2 Europe

7.4.3 Asia Pacific

7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

8.1 Company Profiles

8.1.1 Fujitsu Limited

8.1.2 Green Revolution Cooling Inc.

8.1.3 Submer Technologies SL

8.1.4 Liquid Stack Inc.

8.1.5 Asperitas Company

8.1.6 LiquidCool Solutions

8.1.7 Midas Green Technologies

8.1.8 Iceotope Technologies Ltd.

8.1.9 Wiwynn Corporation

8.1.10 DCX Ltd.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

For more information about this report visit https://www.researchandmarkets.com/r/nmnaex

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment