Dublin, March 26, 2024 (GLOBE NEWSWIRE) -- The "Medicated Feed Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019 - 2029" report has been added to ResearchAndMarkets.com's offering.

Global Medicated Feed Additives Market Growth Trajectory

The Medicated Feed Additives Market shows a promising growth forecast, with expectations to advance from USD 12.47 billion in 2024 to USD 16.29 billion by 2029, paving the way for a CAGR of 5.5% within the five-year period. Despite the COVID-19 pandemic's impact on industries worldwide causing a downturn, the market is anticipated to recover and expand due to increasing awareness of feed quality and nutritional needs of livestock.

Medicated Feed Additives and Their Role in the Food Industry

Medicated feed additives have proven to be crucial in the improvement of feed quality, contributing to the growth, health, and development of animals. These additives are vital not only for enhancing feed intake but also for preventing the spread of zoonotic and foodborne diseases. Such preventative measures become increasingly important as global health awareness rises, underpinning the surge in demand for nutrient-rich meat products.

Shifting Trends: Antibiotics to Alternatives

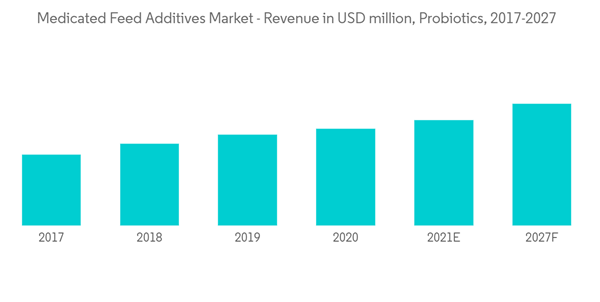

The market is witnessing a pivotal shift due to regulatory bans on antibiotics in livestock feed across several countries. These measures have driven the growth in alternative segments such as probiotics, essential oils, and prebiotics, which are gaining importance as effective substitutes to promote livestock health without the use of antibiotics.

Asia-Pacific Dominance in the Medicated Feed Additives Sector

Amidst adversity such as the spread of the African Swine Fever, Asia-Pacific holds its ground as the leader in the medicated feed additives market. Initiatives like China's campaign to eliminate antibiotic usage in livestock feed by 2020 signify the region's decisive actions to innovate and adapt to the evolving market landscape. Additionally, the adoption of herbal feed additives attests to Asia-Pacific's commitment to sustainable livestock practices.

Market Landscape and Key Players

The medicated feed market is largely held by leading global and regional players. The aggressive focus on R&D and the introduction of innovative products are strategies rooted in maintaining market dominance and meeting consumer needs. Investments are channeled towards expanding product lines with a principal focus on enhancing quality and efficacy, as evidenced by a significant company's recent launch of its natural essential oils-infused poultry feed.

The medicated feed additives industry's evolutionary path is marked by technological advancements and stringent regulatory standards aimed at ensuring food safety and animal welfare. The market's potential appears robust with increased consumer demands for optimum animal nutrition and health management.

A selection of companies mentioned in this report includes

- Phibro Animal Health Corporation

- Provimi Animal Nutrition

- Zoetis Inc.

- Cargill Inc.

- Archer Daniels Midland Company

- CHS Inc.

- Purina Animal Nutrition (Land O' Lakes)

- Adisseo France SAS

- Kemin Industries

- Alltech Inc.

- Biostadt India Limited

- Zagro

- HI-PRO Feeds

Key Topics Covered:

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.3 Market Restraints

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products

4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

5.1 Type

5.1.1 Antibiotics

5.1.2 Vitamins

5.1.3 Antioxidants

5.1.4 Amino Acids

5.1.5 Prebiotics

5.1.6 Probiotics

5.1.7 Enzymes

5.1.8 Other Types

5.2 Mixture Type

5.2.1 Supplements

5.2.2 Concentrates

5.2.3 Premixes

5.2.4 Base Mixes

5.3 Animal Type

5.3.1 Ruminants

5.3.2 Swine

5.3.3 Poultry

5.3.4 Aquaculture

5.3.5 Other Animal Types

5.4 Geography

5.4.1 North America

5.4.1.1 United States

5.4.1.2 Canada

5.4.1.3 Mexico

5.4.1.4 Rest of North America

5.4.2 Europe

5.4.2.1 Germany

5.4.2.2 United Kingdom

5.4.2.3 France

5.4.2.4 Spain

5.4.2.5 Russia

5.4.2.6 Italy

5.4.2.7 Rest of Europe

5.4.3 Asia-Pacific

5.4.3.1 China

5.4.3.2 India

5.4.3.3 Japan

5.4.3.4 Australia

5.4.3.5 Rest of Asia-Pacific

5.4.4 South America

5.4.4.1 Brazil

5.4.4.2 Argentina

5.4.4.3 Rest of South America

5.4.5 Middle-East and Africa

5.4.5.1 Saudi Arabia

5.4.5.2 South Africa

5.4.5.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

6.1 Most Adopted Strategies

6.2 Market Share Analysis

6.3 Company Profiles

6.3.1 Phibro Animal Health Corporation

6.3.2 Provimi Animal Nutrition

6.3.3 Zoetis Inc.

6.3.4 Cargill Inc.

6.3.5 Archer Daniels Midland Company

6.3.6 CHS Inc.

6.3.7 Purina Animal Nutrition (Land O' Lakes)

6.3.8 Adisseo France SAS

6.3.9 Kemin Industries

6.3.10 Alltech Inc.

6.3.11 Biostadt India Limited

6.3.12 Zagro

6.3.13 HI-PRO Feeds

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 IMPACT OF COVID-19 ON THE MARKET

For more information about this report visit https://www.researchandmarkets.com/r/rric9f

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment