Dublin, March 26, 2024 (GLOBE NEWSWIRE) -- The "Ethylbenzene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2019 - 2029" report has been added to ResearchAndMarkets.com's offering.

The Ethylbenzene Market size is estimated at 34.95 Million tons in 2024, and is expected to reach 40.56 Million tons by 2029, growing at a CAGR of 3.03% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. However, the market recovered significantly in the 2021-22 period, and the construction and automotive manufacturing activities have reinstated the demand for ethylbenzene-based polymer and other products, including automotive dashboards, exterior panels, styrene-acrylic emulsions, solvents and reagents for paints and coatings, and others. The pandemic had increased the demand for packaging from the food and e-commerce industries, thereby stimulating the demand for the market studied.

Key Highlights

- The increasing demand for styrene from various end-user industries and the increasing usage of ethylbenzene in the recovery of natural gas are expected to drive the market's growth.

- On the other hand, strict rules about using ethylbenzene are likely to slow the growth of the market that was studied.

- Ethylbenzene application as a solvent and reagent in the production of various products, such as paints and coatings, adhesives, and cleaning materials, will likely provide new growth opportunities for the market.

- Asia-Pacific dominated the market across the world, with the largest consumption coming from countries such as China and South Korea.

Styrene Production to Dominate the Market

- Styrene production will have a positive influence on ethylbenzene market demand. Styrene is a precursor to several industrial polymers, including acrylonitrile-butadiene-styrene, polystyrene, styrene-butadiene elastomers and latex, styrene-acrylonitrile resins, and unsaturated polyester.

- The aforementioned styrene-based polymers, elastomers, and resins find a wide range of applications in various end-user industries, such as electronics, packaging, agriculture, petrochemicals, and construction. Polystyrene is majorly used in disposables, packaging, and low-cost consumer products.

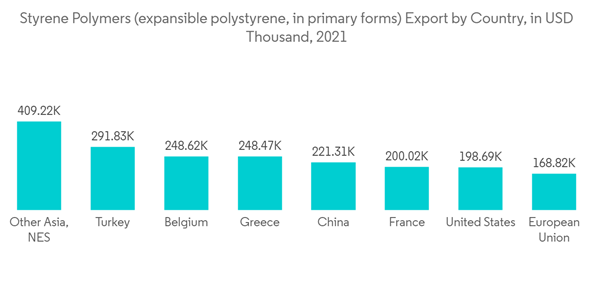

- According to World Bank, in 2021, the top exporters of styrene polymers were the Netherlands (USD 620,100.91 thousand), Turkey (USD 291,832.22 thousand), Belgium (USD 248,619.88 thousand), and Greece (USD 248,471.97 thousand).

- According to OEC, in September 2022 China's styrene polymers exports accounted for USD 73.9 million. Between September 2021 and September 2022 the exports of China's styrene polymers have increased by USD 21.9 million (42.1%) from USD 52 million to USD 73.9 million.

- According to the World Bank, United States exports of styrene polymers (expansible polystyrene) in primary forms was USD 198,686.76 thousand and a quantity of 97,729,500 Kg.

- The cyclic hydrocarbon styrene imports in India stood at 907.04 kilotons in FY2021-22, and the consumption is likely to increase as per the rising demand in the country.

- The demand for styrene is continuously growing due to an increased demand for rubber tires. According to the European Rubber Journal's annual global sector survey, sales among leading Chinese suppliers increased by 30% year-on-year in 2021 to reach USD 1,561 million. It is further expected to increase in the upcoming year

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. With growing construction and packaging industries and increasing applications as solvents and reagents in paints and coatings, dyes, perfumes, inks, and synthetic rubber in countries such as China, India, and Japan, the usage of ethylbenzene has been increasing in the region.

- Ethylbenzene is mainly used for the production of styrene, which further gets processed to form polystyrene, a major raw material for packaging products. According to the India Brand Equity Foundation, India is emerging as a key exporter of packaging materials in the global market. The export of packaging materials from India grew to USD 1,119 million in 2021-22 from USD 844 million in 2018-19. This increase in the demand for packaging within the country is stimulating the demand for the market studied.

- With increasing investments in public infrastructure, renewable energy, infrastructure, and commercial projects, the construction sector is expected to record growth at a moderate pace over the next few years, thereby improving both consumer and investor confidence and, in turn, stimulating the demand for ethylbenzene over the forecast period.

A selection of companies mentioned in this report includes

- Carbon Holdings Limited (Cairo)

- Changzhou Dohow Chemical Co. Ltd

- Chevron Phillips Chemical Company LLC

- Cos-Mar Company

- Dow

- Guangdong Wengjiang Chemical Reagent Co., Ltd.

- Honeywell International Inc

- INEOS

- J&K Scientific Ltd.

- LyondellBasell Industries Holdings B.V.

- LLC 'Gazprom neftekhim Salavat'

- PJSC "Nizhnekamskneftekhim"

- ROSNEFT

- Shanghai Myrell Chemical Technology Co., Ltd.

- Sibur-Khimprom CJSC

- TCI Chemicals (India) Pvt. Ltd.

- Versalis S.p.A.

- Westlake Chemical Corporation

For more information about this report visit https://www.researchandmarkets.com/r/p86vqq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment