Dublin, April 10, 2024 (GLOBE NEWSWIRE) -- The "Global Automotive Lighting Market for ICE & Electric Vehicle by Technology (Halogen, LED, Xenon), Position and Application (Front, Rear, Side, Interior), Adaptive Lighting, Electric Vehicle, Two-Wheeler Position Type and Region - Forecast to 2030" report has been added to ResearchAndMarkets.com's offering.

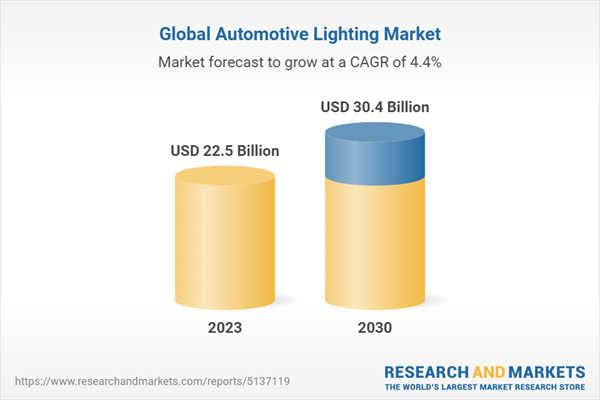

The Global Automotive Lighting Market is estimated to grow from USD 22.5 billion in 2023 to USD 30.4 billion by 2030 at a CAGR of 4.4% during the forecast period. Increasing production of mid-priced cars equipped with LED lighting, growing luxury car & SUV sales in developed countries, and increased focus on on-road safety persuade OEMs to focus on innovation and advancement in automotive lighting. The key players in the automotive lighting market are Koito Manufacturing Co. Ltd. (Japan), Magnetic Marelli (Italy), Valeo (France), HELLA GmbH & Co. KGaA (Germany) and Stanley Electric Co. Ltd. (Japan).

Passenger cars are to be the largest automotive lighting market

The passenger car segment is estimated to be the most promising and fastest-growing segment for automotive lighting. The growth is mainly attributed to the highest share of the passenger cars segment, with more than 70% in overall vehicle production. To attract more customers, automotive OEMs offer connected LED headlamps and taillamps starting from mid-priced cars. Furthermore, this segment allows OEMs to push their boundaries by developing and installing cutting-edge technologies without compromising vehicle safety and style. The penetration of ambient lighting features is expanding beyond luxury and premium segments, with mid-range models like Kia Soul, Mini Hardtop, and Chevrolet Camaro increasingly incorporating this feature.

Passenger car segment D, led by luxury and premium offerings like Mercedes-Maybach S-Class and BMW X7, is projected to dominate the market in the coming years. This trend, coupled with the expected growth in the production of larger SUV models like the Hyundai Palisade, is expected to propel the technological advancement in interior lighting of the vehicles. For instance, OEMs are deploying advanced driver assistance systems (ADAS) to increase vehicle sales, which will prompt the growth of adaptive lighting systems in passenger cars.

Most passenger vehicles that fall in Class D and above are mostly installed with adaptive lighting technology. European and North American countries have higher demand for SUVs and the luxury vehicle segment, which have starting costs of more than USD 45,000 and are equipped with high-end technologies for smart matrix LED or OLED headlamps, laser lights, tail lamps, adaptive high Beam Assist, auto on/off, bending/cornering, and ambient lighting. Some models like the Alfa Romeo Giulia, Audi A4, BMW 3 Series, Ford Mondeo, and Lexus IS, among others, are equipped with advanced lighting systems. Thus, the growing demand for premium and luxury cars loaded with advanced features will spur the adoption of advanced lighting technologies in the passenger cars segment.

Ambient lighting will be the fastest developing automotive adaptive lighting market during the forecast period

Factors such as increasing adoption of LED-based lighting in C, D, and above segment cars to provide more personalized and distinct features, rising adoption of mood lighting, and growing acceptance of multicolor ambient lighting in premium cars are driving the ambient light market. OEMs are trying to accommodate luxury features, such as ambient lighting, infotainment units, and exotic interior design in lower to mid-range cars to attract more consumers. Some new cars are offered with ambient lighting for various applications, such as center consoles, dashboards, headliners, footwells, doors, and armrests, among others.

These ambient lights are decorative and boost the cabin feel and ambiance. Further, luxury cars such as Mercedes-Benz, BMW, Audi, Lexus, Porche, and Land Rover, among others, offer vibrant and attractive ambient lighting options for their modern car models. Improving the economic condition of developing regions such as Asia Oceania with rising acceptance of Class C, D, and high-range cars loaded with ultra-luxurious features will allow the ambient lighting market to boost at the fastest rate under the review period.

Asia Pacific is the prominent region in the automotive lighting market

Asia Pacific is estimated to be the largest market for automotive lighting during the forecast period. The Asia Pacific region has emerged as a hub for automotive production in recent years and holds the largest share in global vehicle production, with more than 60% in 2023. Also, growing demand for premium and luxury cars and increasing sales of electric vehicles in countries like China, India, and Japan are propelling the growth of automotive lighting. China and Japan are leading the automotive lighting market, followed by India and South Korea during the forecast period. The growing SUV market in the Asia Pacific region is driving a significant increase in demand for automotive lighting, particularly with features such as LED lights, adaptive headlamps, and integrated infotainment consoles often paired with ambient lighting. This trend is particularly pronounced in the full-size SUV segment, contributing substantially to the projected growth of the regional automotive lighting market.

China has emerged as a key market for premium vehicles. LED lighting in passenger cars in China is increasing due to the growing popularity of premium and luxury cars. To take this as a growth opportunity, lighting manufacturers are partnering with Chinese players and expanding their businesses in the Chinese market. For instance, Hella opened a second manufacturing unit with Minth Group in Jianxing, China. Also, Hella partnered with Wuling Automotive Industry to work together on automotive lighting technologies for the Chinese market, focusing on developing headlamps for the volume segment. Through these agreements and expansions, Hella can focus more on the untapped market in China. Also, In Japan, automakers must equip all new vehicles sold in Japan with automatic headlamps, making it likely the first country in the world with such a mandate. The move mandating headlamps with an automatic on function was implemented on April 1, 2020.

Many global manufacturers of lighting have a strong presence in the Asia Pacific region, such as Koito Manufacturing, HELLA GmbH, Valeo, Magnetic Marelli, Stanley Electric, Pvt. Ltd.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 379 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $22.5 Billion |

| Forecasted Market Value (USD) by 2030 | $30.4 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

Premium Insights

- Rise in Demand for Electric Vehicles to Drive Market

- LED Segment to Dominate Market During Forecast Period

- Passenger Cars to Surpass Other Vehicle Types During Forecast Period

- Front Lighting to Have Largest Market Size by 2030

- LED to be Largest Technology Segment During Forecast Period

- Front Lighting to Register Highest CAGR During Forecast Period

- Ambient Lighting Segment to Lead Market from 2023 to 2030

- Asia-Pacific to Register Highest CAGR During Forecast Period

Market Dynamics

- Drivers

- Increase in Demand for Premium Vehicles

- Stringent Lighting Regulations for Better Visibility and Safety

- High Demand for Adaptive Lighting Systems in Passenger Cars and Entry-Level SUVs in Emerging Economies

- Restraints

- High Cost of LED Lights

- Low Penetration of Advanced Lighting Systems in Hatchbacks, Compact Sedans, and Entry-Level SUVs

- Opportunities

- Partnerships Between Automotive OEMs and Lighting System Manufacturers

- Evolution of New Technologies

- Development of Advanced Lighting Solutions for Autonomous Vehicles

- Challenges

- Volatility of Raw Material Prices

- Increasing Competition from Local Companies Offering Counterfeit/Retrofit Solutions

- Less Penetration of Advanced Lighting Systems in Commercial Vehicles

- Development of Software Capabilities to Incorporate AI and Other Technologies in Adaptive Lighting Systems

Technology Analysis

- Adaptive Driving Beam

- Laser Technology

- OLED

- Micro AFS LED

- Bend Lighting

Case Study Analysis

- Case Study: LED Intelligent Light System

- Case Study: Dynamic Interior Lighting

- Case Study: Object Recognition System

Companies Featured

- Koito Manufacturing Co. Ltd.

- Hella GmbH & Co. KGaA

- Valeo SA

- Osram GmbH

- Continental AG

- Hyundai Mobis

- Magneti Marelli

- Ichikoh Industries, Ltd.

- Stanley Electric Co. Ltd.

- Signify (Koninklijke Philips N.V.)

- Tungsram Group

- Zizala Lichtsysteme GmbH

- Robert Bosch GmbH

- NXP Semiconductors N.V.

- Grupo Antolin

- Federal-Mogul Corporation

- Gentex Corporation

- Flex-N-Gate

- North American Lighting

- Denso Corporation

- Renesas Electronics Corporation

- Keboda

- Varroc

- Lumax Industries

- Seoul Semiconductor Co. Ltd.

- Infineon Technologies

- Samvardhana Motherson

For more information about this report visit https://www.researchandmarkets.com/r/d98aou

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment