Dublin, April 10, 2024 (GLOBE NEWSWIRE) -- The "Global Endocrine Testing Market Size, Share & Trends Analysis Report by Test Type (TSH, hCG Hormone), End-use (Hospitals, Commercial Laboratories), Technology (Immunoassay, Clinical Chemistry), and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

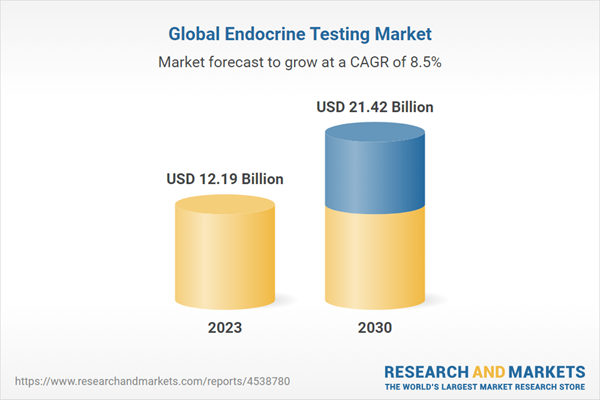

The global endocrine testing market size is expected to reach USD 21.42 billion by 2030, registering a CAGR of 8.5%

The growing prevalence of life style diseases such as obesity coupled with diabetes & thyroid among the adult as well as the geriatric population is driving the need for endocrine testing. The routine endocrine testing in individuals will help in overall maintenance of health and thus this awareness of better health is significantly contributing to the global endocrine testing market growth.

As per the statistics by WHO, more than 39 million children in 2020 who were under the age of 5 were overweight or obese. The sedentary life along with unhealthy diet choices have contributed to obesity as well as diabetes in the general population. This occurrence of diseased conditions has also prompted many researches into the metabolic functions and related hormonal disorders.

Funding from government and private organizations has also driven the scientific community. For instance, the NIDDK (National Institute of Diabetes and Digestive and Kidney Diseases) by NIH drives many sponsored research programs towards improving health by better understanding of diseases. One such effort by NIDDK was the mid-atlantic symposium conducted in September 2022 for diabetes and obesity research. This will enable scientific knowledge exchange and interactions and allow collaboration at the regional level. Such initiatives will drive the understanding of endocrine function in the human body and will further enable the endocrine testing market growth.

The lack of awareness in underdeveloped and developing countries is anticipated to slow the growth of endocrine testing market. The developing health care settings and absence of reimbursement models restrain the individuals in these regions to undergo routine endocrine testing. However, with the growing consciousness of a healthy system during the COVID-19 pandemic is expected to upswing the testing frequency for these countries as well.

The outbreak of COVID-19 has created lucrative opportunities for the application of endocrine testing. COVID-19 infections cause a systemic disease that injures many organs. Therefore, these patients have many metabolic and hormonal disturbances that led to an increase in the number of endocrine research.

In addition, the limitation of movement and restrictions due to the lockdown encouraged the digital platform for medical consultation and at home sample collection services as well. The availability of point-of-care devices and kits for the detection of hormone levels at home is also driving the overall growth of endocrine testing market.

The market players are also expanding their regional presence due to various factors that are anticipated to grow the endocrine testing market. Collaboration, partnerships and global expansions are some of the business strategies by the key players to drive revenue generation. For instance, in February 2022 Laboratory Corporation of America Holdings (Labcorp) announced opening of a new laboratory in Indiana, U.S. The new diagnostics business in South Bend, Indiana will enhance the company's services and make their offerings accessible to both patients as well as physicians in this region.

Endocrine Testing Market Report Highlights

- By test type, thyroid stimulating hormone (TSH) test segment led the market and accounted for the largest revenue share of 28.0% in 2023. The increasing prevalence of thyroid disorders and rising awareness of early detection drive the demand for TSH tests.

- By technology, the tandem mass spectrometry segment accounted for the largest revenue share of 24.5% in 2023. This is because it is often used in conjunction with liquid chromatography, helping in obtaining more accurate results.

- By end-user, commercial laboratories is estimated to register the fastest CAGR from 2024 to 2030. The outsourcing of diagnostic services, cost-effectiveness, and specialized testing capabilities contribute to the growth of endocrine testing in commercial laboratories.

- North America had the highest revenue generated in 2023 for endocrine testing market. This is attributed to the vast presence of thyroid disorders, diabetes and obesity within the US population. Additionally, developed healthcare and increased spending pattern in this region also led to higher revenue generation.

Company Profiles

- Abbott Laboratories

- AB Sciex

- Agilent Technologies Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Ortho Clinical Diagnostics

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 180 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $12.19 Billion |

| Forecasted Market Value (USD) by 2030 | $21.42 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Endocrine Testing Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Growing prevalence of the endocrine disorders

3.2.1.2. Rising demand of home health care and awareness of routine testing

3.2.1.3. Advancements in product technologies

3.2.1.4. Increasing investments in research activities for disease understanding

3.2.2. Market restraint analysis

3.2.2.1. High Cost of Advanced Endocrine Testing Devices

3.2.2.2. Lack of Awareness in Underdeveloped and Developing Countries

3.3. Endocrine Testing Market Analysis Tools

3.3.1. Industry Analysis - Porter's

3.3.2. PESTEL Analysis

3.3.3. Pricing Analysis

Chapter 4. Endocrine Testing Market: Test Type Estimates & Trend Analysis

4.1. Test Type Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Endocrine Testing Market by Test Type Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Estradiol (E2) Test

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Follicle Stimulating Hormone (FSH) Test

4.4.3. Human Chorionic Gonadotropin (hCG) Hormone Test

4.4.4. Luteinizing Hormone (LH) Test

4.4.5. Dehydroepiandrosterone Sulfate (DHEAS) Test

4.4.6. Progesterone Test

4.4.7. Testosterone Test

4.4.8. Thyroid Stimulating Hormone (TSH) Test

4.4.9. Prolactin Test

4.4.10. Thyroid Stimulating Hormone (TSH) Test

4.4.11. Cortisol Test

4.4.12. Insulin Test

Chapter 5. Endocrine Testing Market: Technology Estimates & Trend Analysis

5.1. Technology Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Endocrine Testing Market by Technology Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Tandem Mass Spectrometry

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Immunoassay

5.4.3. Monoclonal & Polyclonal Antibody Technologies

5.4.4. Sensor Technology

5.4.5. Clinical Chemistry

Chapter 6. Endocrine Testing Market: End-use Estimates & Trend Analysis

6.1. End-use Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Endocrine Testing Market by End-use Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Hospitals

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.2. Commercial Laboratories

6.4.3. Ambulatory Care Centers

Chapter 7. Endocrine Testing Market: Regional Estimates & Trend Analysis

7.1. Regional Market Share Analysis, 2023 & 2030

7.2. Regional Market Dashboard

7.3. Global Regional Market Snapshot

7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company/Competition Categorization

8.3. Vendor Landscape

8.3.1. List of key distributors and channel partners

8.3.2. Key customers

8.3.3. Key company market share analysis, 2023

For more information about this report visit https://www.researchandmarkets.com/r/ychyne

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment