Dublin, May 01, 2024 (GLOBE NEWSWIRE) -- The "Global DRAM DIMM Market: Focus on Application, Memory Technology Type, Capacity, Type, and Country-Level Analysis - Analysis and Forecast, 2023-2033" report has been added to ResearchAndMarkets.com's offering.

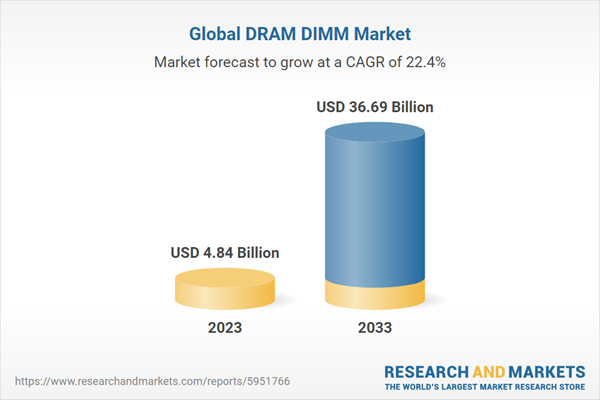

The global DRAM DIMM market was valued at $4,845.9 million in 2023 and is expected to reach $36,693.8 million by 2033, growing at a CAGR of 22.44% between 2023 and 2033.

The global DRAM DIMM market has experienced remarkable growth. The transition from one interface technology to another typically unfolds as industries recognize the need for advancements to tackle the challenges posed by new, data-intensive applications. Technological advancements and increasing demand for high-performance computing devices drive the DRAM DIMM market to flourish.

The development of faster and more energy-efficient DRAM modules fuels demand from various sectors, including data centers, gaming, artificial intelligence, and automotive industries. Some of the strategies adopted by DRAM DIMM manufacturers are new product launches, business expansions, mergers and acquisitions, partnerships, and collaborations. Mergers and acquisitions, partnerships, and collaborations have been the most preferred strategies in the market.

The growing demand for data centers, majorly in the U.S. and Canada, due to the proliferation of cloud computing, big data analytics, artificial intelligence, and Internet of Things (IoT) applications is driving the need for high-performance memory solutions such as DRAM DIMMs. In the North America region, industries such as finance, healthcare, research, and engineering are increasingly relying on high-performance computing (HPC) systems for complex simulations, modeling, and data processing. DRAM DIMMs are essential components in HPC systems to ensure fast and efficient data access.

The gaming industry in the region is also witnessing significant growth, fueled by the popularity of eSports, virtual reality (VR), and high-definition gaming experiences. Gaming PCs and consoles require high-capacity and high-speed memory solutions such as DRAM DIMMs to deliver smooth performance and immersive gameplay. As applications become more data-intensive and memory-hungry, there is a growing demand for DRAM DIMMs with higher memory densities in North America. This allows for more data to be stored and processed simultaneously, improving overall system performance and efficiency.

Additionally, the adoption of cloud computing and the Internet of Things (IoT) further boosts the demand for DRAM DIMMs. DRAM DIMM manufacturers have been focusing on advancements such as higher memory densities, faster data transfer rates, and lower power consumption to meet the requirements of evolving computing systems.

SK HYNIX INC., Rambus, and Renesas Electronics Corporation. are some of the leading players globally in the DRAM DIMM market. G.SKILL International Enterprise Co., Ltd. and Synology Inc. are some of the emerging private companies that have remained in the limelight for the last few years in the DRAM DIMM market.

Laptops and Tablets to Lead the Global DRAM DIMM Market

The demand for DRAM DIMM modules in laptops and tablets is influenced by several factors, including technological advancements, consumer preferences, and industry trends. As laptops and tablets become more powerful and capable of handling demanding tasks such as gaming, multimedia editing, and multitasking, the need for higher-performance memory solutions grows. DDR4 and DDR5 DRAM DIMMs offer higher data transfer rates and capacities, meeting the performance requirements of modern laptops and tablets. While consumers desire thinner and lighter laptops and tablets for portability, manufacturers face challenges in integrating memory modules into compact form factors.

DDR4 to Lead the Global DRAM DIMM Market (by Memory Technology Type)

DDR4 has become the standard memory technology for modern computing systems, including desktops, laptops, servers, and high-performance workstations. DDR4 offers significant performance improvements over its predecessors, such as DDR3. With higher data transfer rates and increased bandwidth, DDR4 DIMMs enable faster data processing and improved system responsiveness, making them ideal for demanding applications such as gaming, content creation, and data analytics.

2GB to 8GB to Lead the Global DRAM DIMM Market (by Capacity)

In data center and cloud computing environments, the demand for DRAM DIMMs varies based on workload requirements, virtualization density, and data processing needs. While high-capacity DIMMs (e.g., 8GB and above) are commonly used in servers to support virtualization and database applications, lower-capacity modules may be sufficient for certain lightweight workloads or edge computing scenarios.

UDIMM to Lead the Global DRAM DIMM Market (by Type)

Unbuffered dual in-line memory module (UDIMM) type DRAM DIMMs are commonly used in consumer and commercial desktop PCs. The demand for these PCs fluctuates based on factors such as economic conditions, technological advancements, and the replacement cycle of hardware. As businesses and individuals upgrade their PCs or build new systems, there is a corresponding demand for UDIMM-type memory modules. Small and medium-sized businesses (SMBs) often rely on standard desktop PCs for their computing needs.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 140 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value (USD) in 2023 | $4.84 Billion |

| Forecasted Market Value (USD) by 2033 | $36.69 Billion |

| Compound Annual Growth Rate | 22.4% |

| Regions Covered | Global |

Market Dynamics Overview

Trends: Current and Future Impact Assessment

- Growing Adoption of Energy-Efficient and Area-Efficient Computing

- Rise in DDR5 Adoption

Market Drivers

- Growing Number of Data Centers Due to Growing Adoption of Cloud Platforms

- Upgradation from One Interface Technology to Another

- AI Boom to Boost Server Consumption

Market Challenges

- Slowdown in the Mobile Device, Tablet, and Laptop/PC Demand

- High Initial Cost Involved in DRAM Design and Production

Market Opportunities

- Growing Adoption of Internet of Things Devices

- Focusing on Higher Density DIMMs

Supply Chain Overview

- Value Chain Analysis

- Market Map

Research and Development Review

- Patent Filing Trend (by Year and Country)

Regulatory Landscape

Stakeholder Analysis

- End User and Buying Criteria

Impact Analysis for Key Global Events- COVID-19, Russia/Ukraine, and Red Sea Crisis

Company Profiles

- Renesas Electronics Corporation.

- Rambus

- Samsung

- Micron Technology, Inc.

- SK HYNIX INC.

- Kingston Technology Europe Co LLP

- IBM Corporation

- Transcend Information, Inc.

- ADATA Technology Co., Ltd.

- Super Micro Computer, Inc.

- Nanya Technology

- G.SKILL International Enterprise Co., Ltd.

- Synology Inc.

- Apacer Technology Inc.

- Innodisk Corporation

Competitive Benchmarking

- Top Products/Product Portfolio

- Top Competitors

- Target Customers

- Key Personnel

- Analyst View

- Market Share, 2022

Application

- Workstations and Desktop Computers

- Laptops and Tablets

- Servers and Data Centers

- Others

Memory Technology Type

- DDR3

- DDR4

- DDR5

- Others

Capacity

- 2GB to 8GB

- Above 8GB to 16GB

- Above 16GB

Type

- UDIMM

- RDIMM

- LRDIMM

- SODIMM

- Others

For more information about this report visit https://www.researchandmarkets.com/r/5i81qv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment