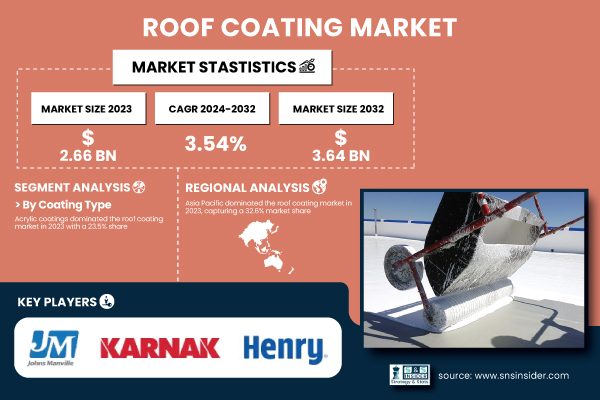

Austin, April 09, 2025 (GLOBE NEWSWIRE) -- The Roof Coating Market Size was valued at 2.66 Billion in 2023 and is expected to reach USD 3.64 Billion by 2032, growing at a CAGR of 3.54% over the forecast period of 2024-2032.

Surging Demand for Sustainable Roof Coatings Boosts Market Growth with Technological and Regulatory Advancements

The Roof Coating Market is experiencing significant growth, primarily due to increasing demand for energy-efficient and sustainable roofing solutions. Roof coatings provide enhanced durability, energy conservation, and environmental benefits, making them highly favored for both residential and commercial applications. The popularity of cool roofs and reflective coatings is rising, driven by technological advancements and growing environmental awareness. Additionally, government initiatives promoting energy efficiency and reducing carbon footprints are further accelerating the adoption of these coatings. In the U.S., programs like the Department of Energy's energy-efficient building initiatives and the International Code Council's focus on integrating energy-saving materials in building codes are key drivers of this growth. The market is also witnessing a shift towards the use of sustainable, non-toxic materials, in line with regulations and incentives encouraging eco-friendly construction practices. This combination of factors positions the Roof Coating Market for continued expansion.

The US Roof Coating Market Size was valued at 0.60 Billion in 2023 and is expected to reach USD 0.80 Billion by 2032, growing at a CAGR of 3.32% over the forecast period of 2024-2032.

The U.S. Roof Coating Market is poised for growth, driven by rising demand for energy-efficient materials and awareness of reflective coatings. Government initiatives like the U.S. Energy Star program enhance adoption, promoting cool roofs in commercial buildings to reduce energy consumption and combat urban heat.

Download PDF Sample of Roof Coating Market @ https://www.snsinsider.com/sample-request/6096

Key Players:

- GAF Inc. (TOPCOAT Membrane, TOPCOAT Flashing)

- Johns Manville (TopGard 4000, TopGard 5000)

- Karnak Corporation (670 Karna-Sil, 501 Elasto-Brite)

- Henry Company (Henry 280DC, Henry 287 Solar-Flex)

- Polyglass U.S.A. Inc. (PG 700, Elastoflex SA P)

- Siplast, Inc. (Parapro Roof Membrane, Paraflex Roof Coating)

- Gardner-Gibson, Inc. (Sta-Kool 780, Black Jack 1000)

- Anvil Paints & Coatings, Inc. (Anvil 925, Anvil 910)

- ICP Group (Astec 2000, HydroStop FoundationCoat)

- National Coatings Corporation (AcryShield A400, AcryPly Roof Restoration)

- Tropical Roofing Products (924 Silicone Roof Coating, 710 Acrylic Roof Coating)

- APOC (a division of ICP Group) (APOC 252 Sunwhite, APOC 264 Flash-N-Seal)

- American WeatherStar (AWS Ure-A-Sil System, AWS Silicone 410)

- Lucas Roof Coatings (Lucas 6000, Lucas 8000)

- Lanco Paints & Coatings (Ultra Siliconizer 1510, Aqua-Proof 1360)

- United Coatings (a division of GAF) (Unisil High Solid Silicone, Kymax Coating)

- Armor Coat Roof Coatings (Armor Coat Acrylic, Armor Coat Silicone)

- Duro-Last Roofing, Inc. (Duro-Shield Silicone, Duro-Shield Acrylic)

- TAMKO Building Products LLC (TAMKO CoolRidge, TAM-PRO 813)

- Western Colloid (800 Acrylic, 970 ELS)

Roof Coating Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 2.66 Billion |

| Market Size by 2032 | USD 3.64 Billion |

| CAGR | CAGR of 3.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coating Type (Acrylic, Bituminous, Silicone, Epoxy, Polyurethane, Others) • By Roof Type (Flat, Low-Slopped, Steep-Sloped, Others) • By Substrate (Asphalt, Metal, Bitumen, Plastic, Others) • By Technology (Water-Based, Solvent-Based) • By End-Use Sector (Residential, Non-residential) |

| Key Drivers | • Advancements in Cool Roof Technology Enhance Energy Efficiency, Driving the Growth of the Roof Coating Market. |

If You Need Any Customization on Roof Coating Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6096

Key Factors Driving the Supply Chain of the U.S. Roof Coating Market from Raw Materials to End-User Adoption

- Raw material suppliers provide essential components like acrylic, silicone, and polyurethane for roof coatings.

- Manufacturers create coatings that meet performance standards and distribute them to various distributors.

- Distributors deliver finished products to regional dealers and contractors for residential and commercial applications.

- Contractors and installers apply roof coatings on-site, ensuring they meet energy efficiency and durability standards.

- End-users, such as building owners, drive demand by selecting coatings based on energy efficiency and sustainability.

By Coating Type, Acrylic Roof Coating Dominated the Roof Coating Market in 2023 with a 23.5% Market Share

Their popularity is attributed to their cost-effectiveness, ease of application, and excellent UV resistance. Acrylic coatings also provide superior weathering protection, making them ideal for both commercial and residential buildings. The growing demand for eco-friendly and energy-efficient solutions has contributed to the market’s dominance. The global push for sustainable architecture is driving this segment, with companies like Sherwin-Williams offering advanced formulations that improve energy efficiency.

By Roof Type, Flat Roofs Segment Dominated the Roof Coating Market in 2023 with a 52.6% Market Share

This dominance can be attributed to the widespread use of flat roofs in both residential and commercial buildings due to their cost-efficiency and simplicity. Additionally, flat roofs provide larger surface areas for roof coatings to be applied, increasing the overall demand for these products. Flat roofs are commonly found in industrial and commercial buildings, where roof coatings help with water resistance, insulation, and UV protection. Major industry players, such as GAF, have expanded their product offerings specifically designed for flat roof applications.

By End-Use Industry, Non-Residential Dominated the Roof Coating Market in 2023 with a 57.4% Market Share

This sector’s demand is largely driven by the construction of commercial buildings, such as offices, warehouses, and industrial facilities, where roof coatings play a crucial role in enhancing energy efficiency and extending roof lifespan. The focus on sustainable and green building practices in urban areas has spurred the adoption of roof coatings in non-residential applications, with companies like Owens Corning and CertainTeed offering specialized coatings tailored for these environments.

Asia Pacific Dominated the Roof Coating Market In 2023, Holding A 32.6% Market Share.

The dominance is driven by rapid urbanization, increased construction activity, and government incentives promoting energy-efficient buildings. With countries like China and India experiencing substantial infrastructure growth, the demand for durable, cost-effective roof coatings is on the rise. Additionally, the region’s growing focus on sustainability and energy conservation has led to a surge in the use of reflective roof coatings. The Asia Pacific market is expected to maintain its dominant position over the forecast period, driven by the region's expanding construction sector and government policies favoring green buildings.

North America is The Second Largest Region in Roof Coating Market with a Significant Growth Rate in The Forecast Period

North America accounted for the second-largest share of the Roof Coating Market in 2023. The growth is largely driven by increasing demand for energy-efficient roofing solutions in the U.S. and Canada. Government incentives, such as tax rebates and green building certifications, have contributed to the rising adoption of roof coatings in the region. Leading companies, including GAF and CertainTeed, continue to innovate and promote sustainable roof coating solutions to cater to the growing consumer demand for energy-saving products.

Recent Developments

March 2023: NanoTech Inc. launched Nano Shield Cool Roof Coat through a nationwide partner program. The product improves energy efficiency by reducing HVAC usage, lowering internal temperatures by up to 30°F, and extending roof life by 10 years. It promotes sustainability and offers a significant ROI for customers.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Roof Coating Market Segmentation, By Coating Type

8. Roof Coating Market Segmentation, By Roof Type

9. Roof Coating Market Segmentation, By Substrate

10. Roof Coating Market Segmentation, By Technology

11. Roof Coating Market Segmentation, By End-Use Sector

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practice

15. Conclusion

Buy Full Research Report on Roof Coating Market 2024-2032 @ https://www.snsinsider.com/checkout/6096

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.