Pune, May 29, 2025 (GLOBE NEWSWIRE) -- High-speed Interconnects Market Size Analysis:

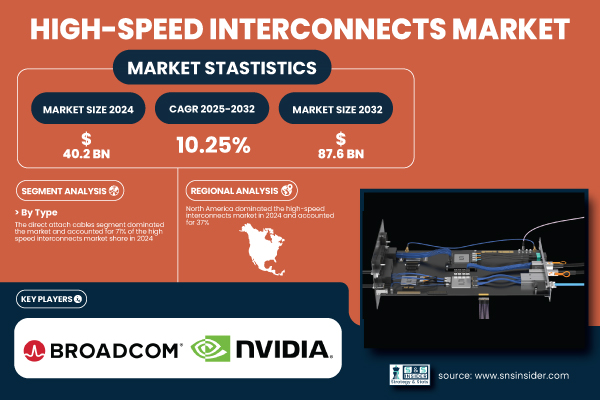

“According to the latest report by SNS Insider, the High-speed Interconnects Market was valued at USD 40.2 billion in 2023. It is projected to reach USD 87.6 billion by 2032, growing at a CAGR of 10.25% during the forecast period 2024–2032.”

The US High-speed Interconnects Market was valued at USD 11.81 billion in 2024 and is projected to reach USD 25.5 billion by 2032, growing at a CAGR of 10.1%. Growth is driven by strong AI adoption, hyperscale data center expansion, and 5G infrastructure investments. Rising demand for low-latency, high-bandwidth connectivity will sustain robust market momentum through 2032.

Get a Sample Report of High-speed Interconnects Market@ https://www.snsinsider.com/sample-request/7160

Major Players Analysis Listed in this Report are:

- Broadcom

- Intel

- Cisco Systems

- NVIDIA (Mellanox)

- Amphenol

- TE Connectivity

- Molex

- Samtec

- Huawei Technologies

- Leoni AG

- Others

High-speed Interconnects Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 40.2 Billion |

| Market Size by 2032 | US$ 87.6 Billion |

| CAGR | CAGR of 10.25 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Segments | • By Type (Direct Attach Cables (DAC), Active Optical Cables (AOC)) • By Application (Data Center, Telecom, Consumer Electronics, Networking & Computing) |

| Key Growth Drivers | Rising Demand for Data-Intensive Applications Is Driving the Adoption of High-Speed Interconnects |

Do you have any specific queries or need any customization research on High-speed Interconnects Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/7160

By Type: DAC Dominates, AOC Grows Fastest

In 2024, the Direct Attach Cables segment accounted for a larger share of more than 42% of revenue share, primarily due to their economical cost and low power consumption for short-distance data center data transmissions. DAC solutions are prevalent in ToR connectivity due to their high level of performance but low cost.

The fastest CAGR of 2024–2032 will be for Active Optical Cables (AOC) segment. The long-distance, high-bandwidth, low-electromagnetic-interference capability of AOC is essential in the evolving enterprise networks and cloud infrastructure, especially as AI and high-density computing drive new bandwidth scaling levels.

By Application: Data Centers Dominate, Telecom Grows Fastest

The High-speed Interconnects Market is dominated by data centers on account of increasing investment with regards to cloud storage, colocation and enterprise data infrastructure. It needs ultra-fast interconnects as all the data processing is real-time and in a multi-tenant environment.

Due to global 5G rollout and transition to virtualized network architectures, the Telecom segment is expected to exhibit the fastest CAGR. With telecom operators increasingly moving toward software-defined networking and network function virtualization, high-speed interconnects will be critical to enable seamless data transmission and scaling of services.

Buy an Enterprise-User PDF of High-speed Interconnects Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/7160

Regional Insights: North America Leads with Infrastructure Strength, Asia-Pacific Sees Rapid Uptake in Emerging Economies

North America dominated the market and accounted for 37% of revenue share in 2023. Due to the presence of a large number of cloud service providers in the region with great digital infrastructure & the early adoption of cutting-edge technologies. The presence of multiple hyperscale data centers and sustained growth in AI and HPC research further drives the high levels of market growth in the region.

Asia-Pacific is expected to grow at the fastest CARG over the forecast period as the investments for data centers, telecom upgrades, and government plans for smart infrastructure in countries such as China, India, and Japan further propel the growth. There are significant opportunities for high-speed interconnect providers in connection with the region's growing tech ecosystem and digital economy.

Recent Developments in 2024

- March 2024: NVIDIA introduced a new generation of NVLink interconnects for AI data centers, enhancing bandwidth capacity by 2.5x over its predecessor.

- April 2024: Intel launched its optical interconnect solutions under the Light Peak initiative, aiming at reducing latency in cloud-native applications.

Access Complete Report Details of High-speed Interconnects Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/high-speed-interconnects-market-7160

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. High-speed Interconnects Market Segmentation, by Type

8. High-speed Interconnects Market Segmentation, by Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.