Ottawa, Dec. 22, 2025 (GLOBE NEWSWIRE) --

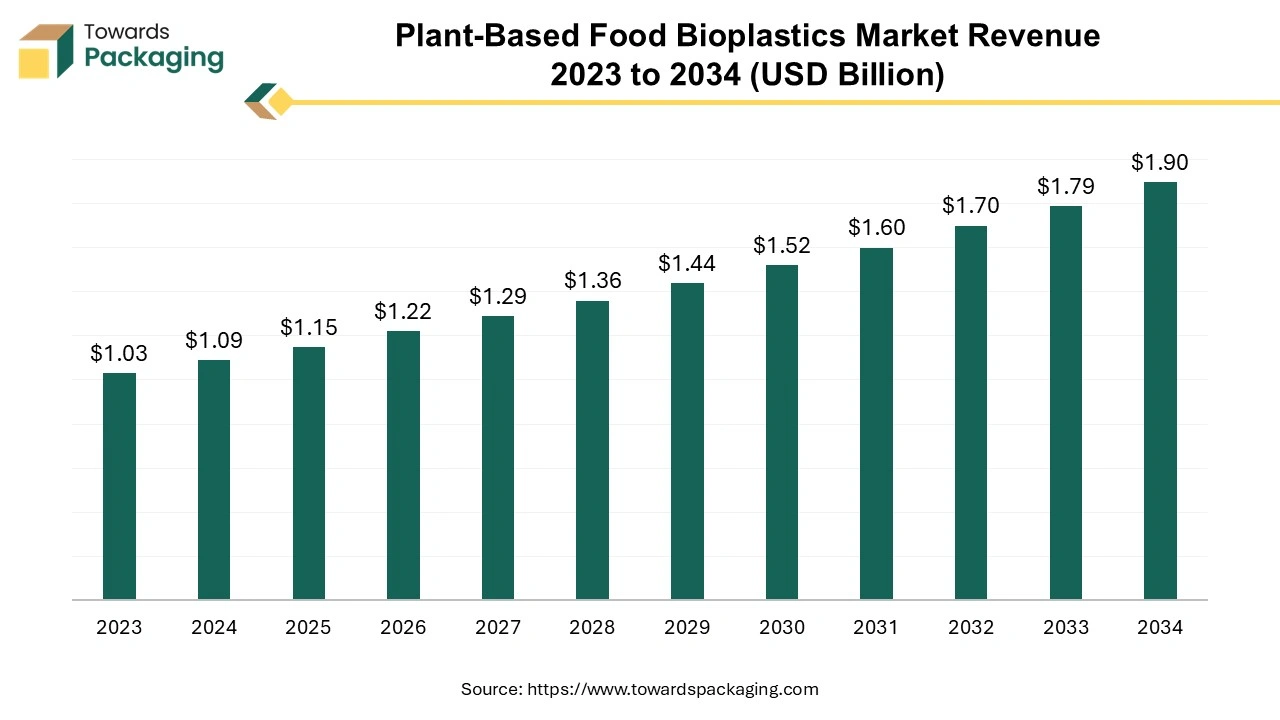

The global plant-based food bioplastics market size was recorded at USD 1.15 billion in 2025 and is forecast to increase to USD 1.90 billion in 2034, as per findings from a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Plant-Based Food Bioplastics?

Plant-based food bioplastics are biodegradable or compostable materials derived from renewable plant sources, such as corn starch, sugarcane, cellulose, or potato starch, and are used primarily for packaging food products. Unlike conventional plastics made from petroleum, these bioplastics reduce environmental impact by minimizing plastic waste and carbon footprint.

The market is driven by growing consumer preference for sustainable packaging, stringent government regulations against single-use plastics, increasing adoption of eco-friendly materials by the food industry, and innovations enhancing the performance and durability of plant-based bioplastics. Europe has dominated the market due to stringent environmental policies, high awareness of plastic pollution, and widespread adoption of renewable biopolymers in food packaging, supported by major regional manufacturers and innovators.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5318

Major Government Initiatives for the Plant-Based Food Bioplastics Industry:

- India’s Plastic Waste Management (Amendment) Rules 2025: This regulation mandates 100% digital traceability via QR codes for all packaging and provides tax rebates and fast-track clearances for startups manufacturing certified compostable and biodegradable plant-based alternatives.

- EU Bioeconomy Strategy 2025 Update: This refreshed strategy places bioplastics at the heart of Europe's industrial transition, introducing legally binding bio-based content targets to help the region scale up the production of polymers like PHA and PLA from renewable biomass.

- U.S. BioPreferred® Program Streamlining (2025): Managed by the USDA, this initiative mandates federal agencies to prioritize bio-based products and has introduced a "Streamlining Rule" in 2025 to simplify the certification process for plant-based food service ware and packaging.

- EU Circular Economy Act (2025 Implementation): Entering a critical phase in 2025, this framework includes the Packaging and Packaging Waste Regulation (PPWR), which harmonizes rules across member states to ensure that food packaging is either reusable or industrially compostable.

- China’s 14th Five-Year Plan for Bioeconomy: Extending through 2025, this national policy provides massive subsidies and R&D funding to establish China as a global leader in high-performance bio-based materials, specifically targeting the replacement of petroleum-based plastics in the food sector.

What Are the Latest Key Trends in the Plant-Based Food Bioplastics Market?

1. Advanced Biopolymer Innovation

Research and development in next‑generation biopolymers like enhanced PLA, CPLA, PHA, and other plant‑derived materials are enabling stronger, more heat‑resistant, and higher‑barrier packaging solutions. These innovations make plant‑based bioplastics more competitive with conventional plastics, expanding their use across diverse food packaging applications while improving compostability and environmental performance.

2. Regulatory and Policy‑Driven Adoption

Stricter global regulations on single‑use plastics and government mandates for biodegradable materials are rapidly accelerating plant‑based bioplastics adoption. Policies in Europe, North America, and other regions incentivize sustainable packaging, creating market pull for eco‑friendly alternatives and compelling brands to shift toward renewable plant‑based solutions.

3. Feedstock Diversification & Circularity

The industry is increasingly shifting from traditional agricultural feedstocks (like corn and sugarcane) to second‑generation and waste‑derived biomass, such as agricultural residues. This approach reduces competition with food supply, enhances sustainability credentials, and supports circular economy models by valorizing waste streams into valuable bioplastic materials.

4. Flexible & Functional Packaging Growth

Flexible plant‑based bioplastic packaging formats such as films, pouches, and wraps are gaining traction due to their lightweight nature, cost efficiency, and ability to preserve food quality. Innovations that enhance barrier properties against moisture and oxygen broaden applicability across perishables, snacks, and beverages.

5. Consumer & Brand Sustainability Demand

Increasing consumer awareness of plastic pollution and strong demand for sustainable products are pushing food brands to adopt plant‑based bioplastics. Companies use this trend not only to meet environmental goals but also to improve brand reputation and meet eco‑conscious consumer preferences, especially in markets like Europe where sustainability is a key purchasing factor.

What is the Potential Growth Rate of Plant-Based Food Bioplastics?

Stringent Government Regulations & Rising Environmental Awareness

Rising environmental awareness and stringent government regulations are key drivers of the plant-based food bioplastics industry. Consumers are increasingly concerned about plastic pollution and its ecological impact, creating strong demand for sustainable, biodegradable packaging.

Simultaneously, governments worldwide, especially in Europe, are implementing bans on single-use plastics and providing incentives for eco-friendly alternatives. These combined pressures encourage food manufacturers and packaging companies to adopt plant-based bioplastics, fostering innovation, wider adoption, and accelerated market growth while aligning with global sustainability goals.

More Insights of Towards Packaging:

- Diaper Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Contoured Bottles and Containers Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Transparent Plastic Packaging Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis (2026-2035)

- Box and Carton Overwrap Films Market Size, Share, Trends, Regional Outlook, Segmentation and Competitive Analysis to 2035

- Cardboard Sheet Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape, and Trade Analysis 2025-2035

- Cardboard Boxes Market Size, Trends, Segments, Regional Outlook, and Competitive Analysis Report 2025-2035

- Plantable Packaging Market Insights, Forecast and Competitive Strategies

- Wafer Level Packaging Market Size, Trends, Segmentation, Regional Outlook, and Competitive Landscape Analysis

- Dietary Supplement Packaging Market Size, Trends, Segments, Regional Analysis (NA, EU, APAC, LA, MEA), Manufacturers, Competitive Landscape & Value Chain Insights

- Alcoholic Beverage Glass Packaging Market Size, Trends, Regional Insights (NA, EU, APAC, LA, MEA), Segments, Competitive Landscape, and Trade Analysis Report 2025-2035

- Flexible Paper Packaging Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis (2025-2035)

- Pouch Materials for Pharmaceutical Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Polypropylene Containers Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Disposable Food Containers Market Size, Trends, Segmentation, Regional Outlook & Competitive Intelligence Report (2025-2035)

- Polypropylene Corrugated Packaging Market Size, Share, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Manufacturers

- High-Density Polyethylene (HDPE) Bottles Market Size, Trends, Segmentation, Regional Outlook & Competitive Intelligence Report (2025-2035)

- Molded Plastic Packaging Market Size, Trends, Segments, Share, Company Profiles with Manufacturers and Suppliers Data

- PP Rigid Plastic Packaging Market Size, Share, Trends, Segmentation, Regional Outlook Trade Analysis, and Manufacturer & Supplier Insights 2025-2035

- High Impact Polystyrene (HIPS) Film and Sheet Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Ready-to-Use Pharmaceutical Packaging Market Size, Trends, Segmentation, Regional Insights & Competitive Landscape 2035

Regional Analysis:

Who is the leader in the Plant-Based Food Bioplastics Market?

Europe dominates the market due to strict environmental regulations, high consumer awareness of sustainability, and strong government initiatives promoting biodegradable and renewable packaging. Advanced infrastructure for bioplastic production, widespread adoption of eco-friendly food packaging, and proactive efforts by manufacturers and retailers to reduce plastic waste further strengthen Europe’s leadership, making it the most influential region in driving market growth and innovation.

The UK Plant-Based Food Bioplastics Market Trends

The UK leads the European market due to stringent government policies on single-use plastics, high consumer demand for sustainable packaging, and strong environmental awareness. Robust investments in bioplastic research, widespread adoption by food manufacturers, and initiatives supporting renewable and biodegradable materials further strengthen the UK’s position as a key driver of innovation and market growth in Europe.

How is the Opportunistic is the Rise of the Asia Pacific in the Plant-Based Food Bioplastics Industry?

The Asia-Pacific region is the fastest-growing market for plant-based food bioplastics due to rapid urbanization, rising disposable incomes, and increasing awareness of environmental sustainability. Expanding food and beverage industries, supportive government initiatives, and growing adoption of eco-friendly packaging by manufacturers are driving strong demand across key countries in the region.

China Plant-Based Food Bioplastics Market Trends

The China’s plant‑based food bioplastics market is expanding rapidly as the government enforces strict plastic pollution controls and promotes biodegradable alternatives, especially for packaging and e‑commerce applications. Local investment in PLA and other bioplastic R&D and production capacity is increasing, driving innovation and cost efficiencies.

Growing environmental awareness and rising demand for sustainable packaging from food and beverage companies further accelerate adoption, while China positions itself as a leading producer and exporter of bioplastics in Asia.

How Big is the Success of the North America Plant-Based Food Bioplastics Market?

North America is experiencing considerable growth in the market due to increasing consumer demand for sustainable packaging, stringent government regulations limiting single-use plastics, and growing corporate commitments to environmental responsibility. Technological advancements in biopolymer production, rising adoption by food and beverage manufacturers, and strong awareness of eco-friendly alternatives further support the region’s expanding market presence.

U.S. Plant-Based Food Bioplastics Market Trends

The U.S. dominates North America’s market due to stringent environmental regulations, high consumer demand for sustainable packaging, advanced bioplastic manufacturing infrastructure, and strong adoption by food and beverage companies committed to reducing plastic waste and promoting eco-friendly solutions.

How Crucial is the Role of Latin America in the Plant-Based Food Bioplastics Market?

Latin America is witnessing notable growth in the market due to increasing environmental awareness, supportive government policies promoting biodegradable materials, and rising demand from the food and beverage sector. Expanding manufacturing capabilities and growing investments in sustainable packaging solutions further accelerate market adoption across the region.

How Big is the Opportunity for the Growth of the Middle East and Africa Plant-Based Food Bioplastics Industry?

The Middle East and Africa present significant growth opportunities in the market due to rising environmental awareness, increasing government initiatives promoting sustainable packaging, and growing demand from the expanding food and beverage industry. Investments in bioplastic production and renewable material adoption are driving market potential in the region.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Type Insights

What made the Biodegradable and Compostable Packaging Segment Dominant in the Plant-Based Food Bioplastics Market in 2024?

The biodegradable and compostable packaging segment dominates the market due to increasing consumer preference for eco-friendly solutions, stringent regulations against single-use plastics, and growing corporate sustainability initiatives. Its ability to reduce environmental impact, improve waste management, and meet regulatory compliance drives widespread adoption across food packaging applications globally.

The recyclable plastic packaging segment is the fastest-growing in the market due to rising demand for sustainable yet durable packaging solutions. Its ability to be reused multiple times, compatibility with existing recycling infrastructure, and support for corporate sustainability goals encourage food manufacturers to adopt recyclable bioplastics, driving rapid market expansion.

Application Insights

How the Flexible Packaging Dominate the Plant-Based Food Bioplastics Market in 2024?

The flexible packaging segment dominates the market due to its lightweight, cost-effective, and versatile nature, suitable for a wide range of food products. Enhanced barrier properties, ease of customization, and strong demand from the food and beverage industry for convenient, sustainable packaging solutions further strengthen its leading position in the market.

The stand-up pouches segment is the fastest-growing in the plant-based food bioplastics market due to their convenience, versatility, and efficient shelf-space utilization. Their lightweight design, strong barrier properties, and suitability for various food products make them highly attractive to manufacturers. Rising consumer demand for portable, eco-friendly, and resealable packaging further accelerates adoption and market growth.

Recent Breakthroughs in the Plant-Based Food Bioplastics Industry:

- In August 2025, SMX partnered with Bio‑Packaging in Singapore to launch an innovative biodegradable packaging system featuring molecular traceability tied to blockchain technology. This solution enables detailed tracking of raw materials, production sites, and end‑of‑life composting results. By enhancing transparency and authenticating sustainability claims, this development supports extended producer responsibility (EPR) compliance and builds consumer trust in eco‑friendly packaging.

- In June 2025, UKHI, a green technology company, launched EcoGran, a next‑generation biodegradable biopolymer derived from agricultural waste such as sugarcane residue. Designed for both flexible and rigid packaging applications, EcoGran delivers high tensile strength and complete biodegradability.

- In May 2025, Intec Bioplastics, Inc. launched the EarthPlus Hercules Bioflex Stretch Wrap, a sustainable stretch wrap made with 35% plant‑based material designed for food and pallet wrap applications. Certified for biodegradability and tested for high stretch performance, it offers strong temperature tolerance and reduces reliance on fossil plastics. Customers have reported repeat orders, reflecting the market’s positive reception.

- On May 27, 2025, Balrampur Chini Mills Limited officially launched Balrampur Bioyug, India’s first branded PLA biopolymer. The event, attended by government and industry leaders, highlights a national push toward sustainable materials. Produced from sugarcane, this PLA brand represents a cornerstone in India’s journey to scale plant‑based bioplastic production. While full industrial‑scale plant construction continues into 2026, Bioyug sets the stage for future compostable packaging innovation.

- In March 2025, NatureWorks unveiled its Ingeo Extend platform, marking a major technological advancement in plant‑based bioplastics. The new Ingeo Extend 4950D PLA grade enables biaxially oriented PLA (BOPLA) films to be produced more efficiently and at lower cost on equipment traditionally used for polypropylene. These films also biodegrade up to eight times faster than conventional PLA, offering enhanced compostability, high clarity, and improved sealing, making them ideal for single‑serve food packaging and flexible film applications.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Top Companies in the Global Plant-Based Food Bioplastics Market & Their Offerings:

- Tetra Pak: Produces beverage cartons using sugarcane-derived polyethylene for caps and protective coatings.

- Vegware: Manufactures a full range of compostable foodservice disposables made from Polylactic Acid (PLA).

- Plantic Technologies: Creates high-barrier packaging films derived from renewable, home-compostable corn starch.

- TIPA: Develops fully compostable flexible packaging films designed to mimic the performance of traditional plastics.

- Uflex: Offers a variety of green-certified films and biodegradable barriers for flexible food packaging.

- DuPont: Supplies high-performance, bio-based polymers like Sorona® derived from renewable plant feedstocks.

- Innovia Films: Produces NatureFlex™ cellulose films sourced from sustainable wood pulp that are fully compostable.

- Huhtamaki Group: Provides fiber-based and bio-plastic food containers designed for circularity and reduced fossil-fuel use.

- Amcor: Features the AmFibre™ line of paper-based and bio-based high-barrier packaging solutions.

- Mondi Group: Focuses on "EcoSolutions" that utilize plant-based fibers and hybrid materials for food protection.

- Be Green Packaging: Specializes in molded fiber containers made from renewable bulrush, bamboo, and sugarcane.

- Biopak: Offers a diverse catalog of carbon-neutral, plant-based foodservice items including bagasse and PLA products.

- Biomass Packaging: Distributes compostable food containers and cutlery made from corn, wheat, and potato starches.

- Eco-Products: Manufactures renewable foodservice ware, including sugarcane-based containers made without added PFAS.

Segments Covered in the Report

By Type

- Biodegradable and Compostable Packaging

- Paper Based

- Recyclable Plastic Packaging

By Application

- Flexible Packaging

- Stand-up Pouches

- Trays

- Containers

- Bottles

- Other

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5318

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Security Printing Services Market Size, Segments, Companies, Value Chain & Trade Analysis 2025-2034

- Child Resistant Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Pharmaceutical Packaging Equipment Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Asia Pacific Food Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- North America Pharmaceutical Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Dairy Product Packaging Market Size, Segments, Share and Companies (2025-34)

- Baby Food Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Automotive Thermoformed Plastic Parts Packaging Market Growth, Key Segments and Regional Dynamics

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Growth, Key Segments, and Suppliers Data

- Reusable Packaging Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Recyclable Packaging Market Size, Segmentation, and Competitive Landscape Analysis

- Tube Packaging Market Size, Segmentation, Regional Insights, and Competitive Dynamics

- Non-Corrugated Boxes Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Europe Transfer Molded Pulp Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Post-Consumer Recycled Plastics Food Packaging Market Growth, Key Segments, and Suppliers Data

- Plastic Compounding Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Anti-Corrosion Packaging Products Market Size, Segments, Regional Data (NA/EU/APAC/LA/MEA), Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Asia Pacific Anti-Rust Packaging Products Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Sterilized Packaging Market Size, Segmentation, Regional Insights & Competitive Landscape Report 2025–2034

- Containerboard Market Size, Segments, Regional Data & Competitive Analysis 2025-2034