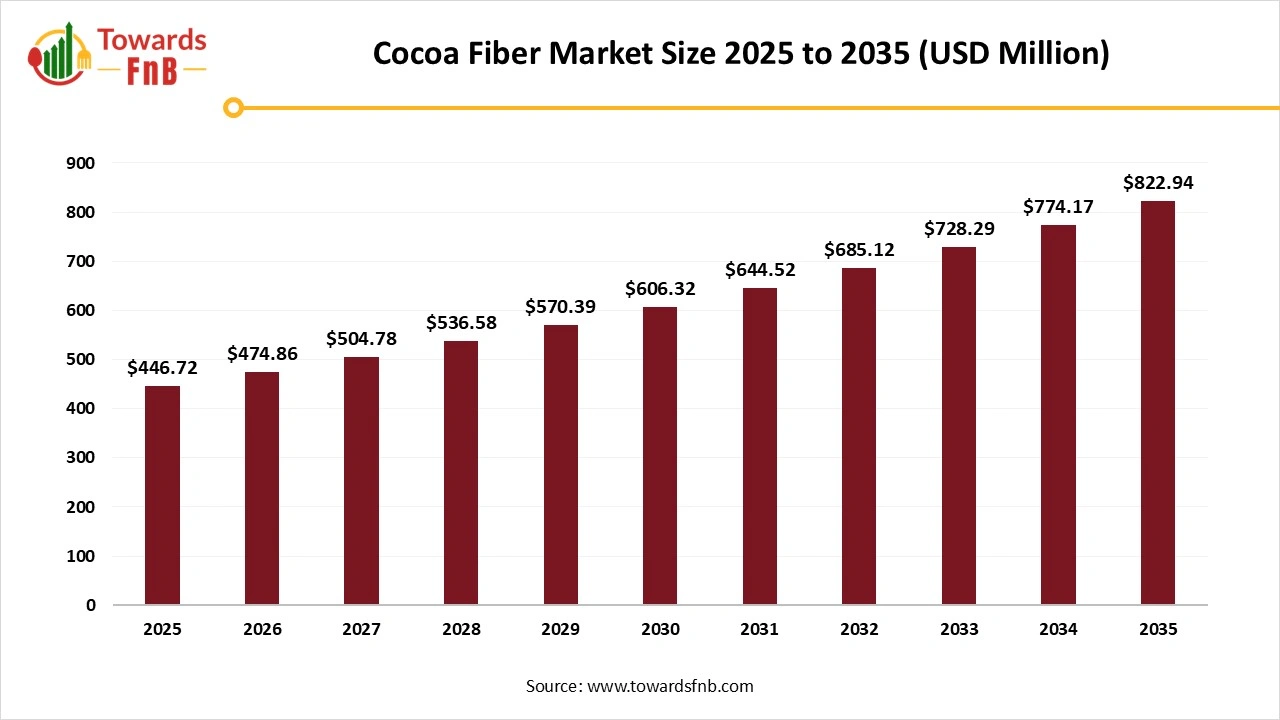

Ottawa, Dec. 22, 2025 (GLOBE NEWSWIRE) -- The global cocoa fiber market size stood at USD 446.72 million in 2025 and is predicted to increase from USD 474.86 million in 2026 to reach around USD 822.94 million by 2035. As reported by Towards FnB, a sister firm of Precedence Research, market momentum is being supported by increased investments in cocoa by-product utilization, improvements in fiber extraction technologies, and growing interest from food manufacturers seeking clean-label and cost-effective fiber solutions.

Market growth is primarily driven by increasing consumer demand for high-fiber diets that support digestive health and overall wellness. In parallel, a noticeable shift toward sustainable, plant-based, and upcycled ingredients is accelerating the adoption of cocoa fiber in functional foods, reduced-sugar formulations, and health-focused product innovations, positioning it as a key ingredient in next-generation nutrition products.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5962

Key Highlights of Cocoa Fiber Market

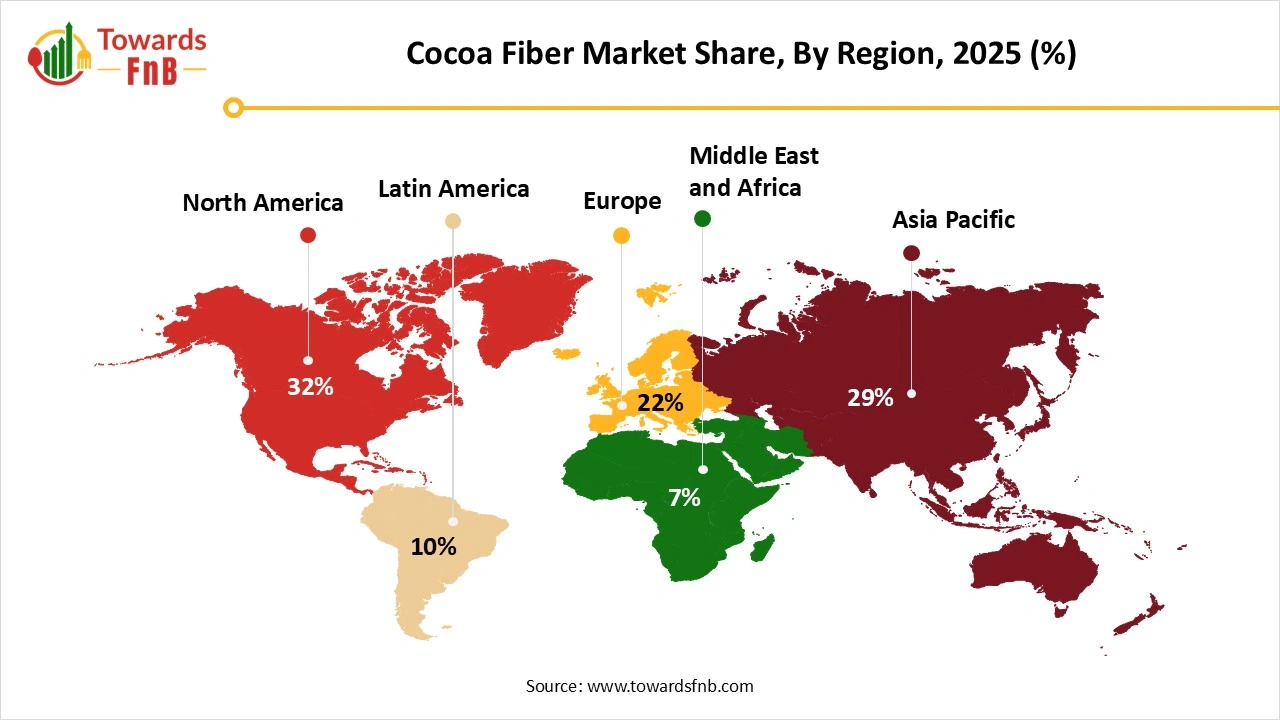

- By region, North America led the cocoa fiber market with highest share of 32% in 2025.

- By region, Europe is expected to grow in the foreseeable period.

- By region, the Asia Pacific is observed to have a notable growth in the foreseen period.

- By nature, the conventional segment led the cocoa fiber market in 2025.

- By nature, the organic segment is expected to grow in the forecast period.

- By application, the food and beverage segment led the cocoa fiber market in 2025.

- By application, the pharmaceuticals segment is expected to grow in the foreseeable period.

Rising Health and Wellness Trends are helpful for the Growth of the Cocoa Fiber Industry

The cocoa fiber market is observed to grow due to rising sustainable upcycling trends and higher demand for fiber-enriched options. The market is also seeing growth driven by higher demand for clean-label, high-fiber, organic, and plant-based options. Use of sustainable options across different domains and applications is another major factor driving the market's growth. Such options help to maintain the environmental balance, further fueling the market’s growth.

The cocoa fiber, being rich in fiber, is widely used across various domains and applications, which is beneficial for the growth of the cocoa fiber market. It is widely used in various applications, such as the manufacture of fiber-rich food and beverages, cosmetics, pharmaceuticals, mattresses, biodegradable packaging, animal feed, and other products. Hence, cocoa fiber is a major sustainable option, useful across multiple domains, helping to drive market growth.

Technological Innovations are Helpful to Propel the Growth of the Cocoa Fiber Market

Technological innovations such as the integration of AI, precision farming for sustainability, and the development of novel applications such as biopolymers and biofuels help enhance product quality and quantity, further fueling the growth of the cocoa fiber market. Such innovations help improve purification and extraction, such as ultrasound, microwave, and enzymatic methods, thereby reducing waste, improving cost-efficiency, and enhancing the quality of new products. Such methods help improve the quality of the final product by reducing contaminants, which is beneficial for market growth.

Impact of AI in the Cocoa Fiber Market

Artificial intelligence (AI) is influencing the cocoa fiber market by improving raw material utilization, strengthening process control, and enabling more targeted application development in food, beverage, and nutritional products. Cocoa fiber is derived from cocoa shells and other byproducts of cocoa processing, and AI plays a key role in maximizing the value of these materials. In raw material management, AI tools analyze cocoa bean origin data, shell composition, moisture levels, and particle characteristics to determine suitability for fiber extraction. This helps processors reduce variability caused by differences in cocoa varieties, fermentation methods, and roasting conditions.

During processing, AI-driven systems monitor the grinding, separation, and drying stages to control particle size distribution, fiber purity, and water-holding capacity. Machine learning models adjust processing parameters to preserve functional properties such as fat binding, bulking capacity, and mouthfeel contribution. This level of control is important for cocoa fiber used in bakery products, dairy alternatives, cereals, and reduced-sugar or reduced-fat formulations.

New Trends of Cocoa Fiber Market

- Higher demand for fiber-rich options, helpful for satiety, weight management, and healthier alternatives, helps to fuel the growth of the market.

- Higher demand for upcycling sustainable options is another major factor for the growth of the cocoa fiber market in the foreseeable period.

- Technological innovations that help separate fiber from solids cleanly also help propel the market's growth.

- Cocoa fiber is derived through a plant-based and organic formulation, which is helpful for the growth of the cocoa fiber market, along with maintaining sustainability.

- Expanding applications of cocoa fiber in various industries such as cosmetics, pharmaceuticals, and even textiles.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/cocoa-fiber-market

Recent Developments in the Cocoa Fiber Market

- In November 2025, WK Kellogg announced a new look to its Froot Loops portfolio. The new launch is formulated with cocoa featuring six essential vitamins and minerals. The new product is enriched with iron and fiber and has no artificial colors.

- In October 2025, Bio&Me launched their daily boost fiber + protein bars. The brand's latest launch highly appeals to female consumers.

Cocoa Fiber Market Dynamics

What are the Growth Drivers of the Cocoa Fiber Market?

Higher demand for fiber-enriched options is a major factor driving market growth. Such options help to maintain gut health, improve digestion, and lower bowel issues. Higher demand for functional, clean-label, organic, and sustainable options also fuels market growth. It also offers multiple health benefits, including cholesterol management and blood sugar control, further fueling market growth. Higher demand for functional food options, driven by the use of cocoa fiber in various confectionery and bakery items, also helps fuel the growth of the cocoa fiber market. Cocoa fiber is also considered an upcycled product of cocoa beans, further fueling the market's growth. Cocoa fiber also acts as a natural texturizer and bulking agent, helping propel market growth.

Supply Chain and Raw Material Issues Obstructing the Growth of the Market

Extracting food-grade fiber from cocoa beans for the preparation of various food and beverage options, bakery items, and confectionery items involves specialized processing. The processing cost may be higher than other traditional food processing options. Hence, such issues may hamper the growth of the cocoa fiber market. High costs limit the adoption of processing techniques by smaller companies, further constraining market growth. High infrastructure costs and other related issues hamper the market’s growth.

Higher Usage in Cosmetic Industry helpful for the Growth of the Cocoa Fiber Market

Cocoa fiber is full of antioxidants and anti-inflammatory properties. Hence, it is a versatile ingredient for the manufacturing of skincare and haircare products. Hence, the rising use of cocoa fiber in the cosmetics industry is a major opportunity for the cocoa fiber market. The ingredient is also widely used in the manufacturing of personal care products such as face scrubs, exfoliators, and other similar products that help remove dead skin and give an individual’s skin a smooth texture.

Product Survey of the Cocoa Fiber Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or End Use Segments | Representative Producers or Suppliers |

| Cocoa Shell Fiber | Dietary fiber derived from cocoa bean shells, offering high insoluble fiber content and cocoa flavor notes. | Fine cocoa shell powder, granulated cocoa shell fiber | Bakery, cereal, snacks, fiber fortification | Olam Cocoa, Barry Callebaut byproduct streams |

| Cocoa Powder Fiber Ingredients | Cocoa powders optimized for higher fiber and lower fat content. | Reduced fat cocoa powder, high fiber cocoa powder | Bakery, beverages, chocolate flavored foods | Cargill Cocoa, Barry Callebaut |

| Insoluble Cocoa Fiber | Fiber fractions rich in lignin and cellulose for bulking and texture. | Insoluble cocoa fiber powder | Bakery, meat analogs, calorie reduction | Cocoa processors and ingredient suppliers |

| Soluble Cocoa Fiber | Cocoa derived fibers containing soluble polysaccharides for digestive benefits. | Soluble cocoa fiber concentrates | Functional foods, beverages, supplements | Specialty fiber ingredient developers |

| Cocoa Fiber for Sugar Reduction | Fiber ingredients used to replace bulk and mouthfeel lost during sugar reduction. | Cocoa fiber bulking agents | Reduced sugar bakery, confectionery | Functional ingredient suppliers |

| Cocoa Fiber for Fat Reduction | Cocoa fiber used to improve texture and mouthfeel in reduced fat products. | Fat mimetic cocoa fiber powders | Low fat bakery, dairy alternatives | Cocoa ingredient manufacturers |

| Cocoa Fiber for Bakery Applications | Fiber optimized for dough stability and moisture retention. | Heat stable cocoa fiber powders | Bread, cakes, biscuits | Industrial bakery ingredient suppliers |

| Cocoa Fiber for Confectionery | Cocoa fiber used to enhance fiber content without strong bitterness. | Fine particle cocoa fiber | Chocolate fillings, bars, coatings | Chocolate ingredient suppliers |

| Cocoa Fiber for Snacks and Extruded Products | Fiber suitable for extrusion and puffing processes. | Extrusion grade cocoa fiber | Snack pellets, high fiber extrudates | Snack ingredient manufacturers |

| Organic Cocoa Fiber | Fiber sourced from certified organic cocoa processing streams. | Organic cocoa shell fiber powder | Organic bakery, clean label foods | Organic cocoa processors |

| Clean Label Cocoa Fiber | Minimally processed cocoa fiber with simple ingredient declaration. | Natural cocoa fiber | Clean label food formulations | Clean label ingredient suppliers |

| Cocoa Fiber for Nutraceuticals | Cocoa fiber positioned for digestive health and prebiotic support. | Standardized fiber powders | Supplements, functional nutrition | Nutraceutical ingredient suppliers |

| Upcycled Cocoa Fiber Ingredients | Fiber ingredients produced from cocoa processing byproducts as part of sustainability initiatives. | Upcycled cocoa shell fiber | Sustainable foods, circular economy products | Cocoa processors with upcycling programs |

| Cocoa Fiber for Dairy and Dairy Alternatives | Fiber used to improve viscosity and cocoa flavor in dairy systems. | Dairy stable cocoa fiber | Chocolate milk, plant based dairy | Beverage ingredient suppliers |

| Cocoa Fiber for Beverage Applications | Fine fiber dispersions designed for liquid systems. | Micronized cocoa fiber | Smoothies, functional drinks | Specialty fiber technology providers |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5962

Cocoa Fiber Market Regional Analysis

North America Dominated the Cocoa Fiber Market in 2025

North America dominated the cocoa fiber market due to factors including rising disposable income, higher demand for fiber-enriched and organic options, and the growing popularity of fiber-enriched and organic options. The cocoa fiber market also sees growth due to higher demand for functional options that support gut health, improve digestion, and provide other similar benefits. Higher demand for plant-based diets and a growing base of health-conscious consumers are other major factors driving market growth. The US plays a major role in the region's market growth due to factors such as urbanization, rising disposable income, higher demand for healthier options, and similar factors.

Europe Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Europe is expected to be the fastest-growing region over the forecast period due to the growth of the food and beverage and bakery industries. The market also observes growth due to the growing population of health-conscious consumers, leading to higher demand for healthier snacks, foods, and beverage options that are low in calories, low in sugar, and high in fiber. Countries such as Germany, France, and the UK have made a major contribution to the market's growth due to higher demand for healthier, high-fiber options in the region, driven by a health-conscious population.

Asia Pacific is observed to have a Notable Growth in the Foreseen Period

Asia Pacific is expected to show notable growth over the forecast period due to higher demand for healthier food and beverage and bakery options in the region. The region also observes growth driven by rising disposable income, rapid urbanization, and higher demand for healthier options compared to traditional bakery and confectionery items. India has made a major contribution to the region's market growth due to rising disposable income and the use of cocoa fiber across various industries.

Trade Analysis for the Cocoa Fiber Market

What Is Actually Traded (Product Forms and HS Proxies)

- Food-grade cocoa fiber powders and granulates are produced from cocoa shells, typically declared under HS 1805 or HS 2106, depending on the degree of processing and intended use.

- Cocoa shell powders marketed as fiber-rich ingredients for bakery and cereal applications are often declared under HS 1801 or HS 1805 based on national customs practice.

- Blended cocoa fiber systems combined with cocoa powder or flavour carriers, commonly cleared under HS 2106 as food preparations.

Top Exporters (Supply Hubs)

- Netherlands: Major exporter of cocoa fiber ingredients due to its role as a global cocoa grinding hub and concentration of cocoa by-product processing facilities.

- Germany: Exporter of functional cocoa-derived fibers and ingredient systems supplied to bakery and cereal manufacturers.

- France: Supplier of cocoa fiber ingredients integrated into clean-label and fibre-enriched food formulations.

- Côte d’Ivoire and Ghana: Emerging exporters of semi-processed cocoa by-products as local grinding capacity expands, although most value-added fiber processing remains in Europe.

Top Importers (Demand Centres)

- European Union: Largest demand centre for cocoa fiber, driven by fiber-enrichment mandates, clean-label reformulation, and upcycled-ingredient adoption in bakery and cereals.

- United States: Importer of cocoa fiber for use in snacks, nutrition bars, and meat-alternative formulations.

- Japan: Imports high-purity cocoa fiber ingredients for functional foods and specialty nutrition products.

- South Korea: A growing importer linked to the expansion of functional and better-for-you packaged foods.

Typical Trade Flows and Logistics Patterns

- Cocoa shells are generated at grinding locations and processed locally into stabilized fiber powders before export.

- Bulk cocoa fiber is shipped in multi-layer paper bags or big bags via containerised sea freight.

- EU ports act as consolidation hubs, exporting cocoa fiber ingredients to North America and East Asia.

- Minimal cold-chain requirements exist, but moisture control is critical to prevent microbial growth and caking.

Trade Drivers and Structural Factors

- Fiber fortification demand: Regulatory and voluntary nutrition targets drive inclusion of dietary fiber in processed foods.

- Circular economy and upcycling: Use of cocoa shells as food ingredients aligns with waste-reduction policies and brand sustainability goals.

- Cocoa grinding concentration: Locations with high cocoa processing volumes generate consistent raw material for fiber production.

- Clean-label formulation trends: Cocoa fiber provides fibre content with neutral flavour and colour compatibility in chocolate-flavoured products.

- Price sensitivity: Cocoa fiber pricing is influenced by cocoa processing economics rather than agricultural cycles alone.

Regulatory, Quality and Market-Access Considerations

- Cocoa fiber must comply with food-safety regulations covering contaminants such as heavy metals and polycyclic aromatic hydrocarbons.

- Microbiological limits apply because cocoa shells have an agricultural origin.

- Ingredient approval under novel food or traditional food frameworks may be required in some markets, depending on the processing method.

- Documentation typically includes certificates of analysis, allergen statements, origin declaration, and fibre-content validation.

Government Initiatives and Public-Policy Influences

- EU circular-economy and food-waste reduction strategies encourage the valorisation of food-processing by-products.

(Source: https://environment.ec.europa.eu/topics/waste-and-recycling/food-waste_en) - Public funding for sustainable food innovation supports the development of upcycled ingredients, including cocoa fiber.

- Importing-country nutrition policies promoting fibre intake indirectly support demand for cocoa-derived fibres.

Cocoa Fiber Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 6.3% |

| Market Size in 2026 | USD 474.86 Million |

| Market Size in 2027 | USD 504.78 Million |

| Market Size by 2035 | USD 822.94 Million |

| Dominated Region | North America |

| Fastest Growing Region | Europe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Cocoa Fiber Market Segmental Analysis

Nature Analysis

The conventional segment led the cocoa fiber market in 2025, as it is readily available in nearby stores, allowing consumers to purchase it, further fueling market growth. It is an affordable option, has lower manufacturing costs, and is highly preferred by the food and beverage industry, further fueling the market's growth. Hence, these factors collectively help fuel the market's growth.

The organic segment is expected to grow over the forecast period, as the fiber content in organic cocoa fiber is high, which is essential for the manufacturing of various health and digestive supplements. It enhances the nutritional quotient and taste profile of various foods and beverages, which is beneficial for the market's growth in the foreseeable period. Organic cocoa fiber also helps to manage blood sugar levels and cholesterol levels, further fueling the growth of the cocoa fiber market.

Application Analysis

The food and beverage segment led the cocoa fiber market in 2025, driven by rising demand for healthier food and beverage options among health-conscious consumers. Hence, consumers are increasingly demanding organic, plant-based, functional, and healthier options that are easy to digest, further fueling market growth. The growing population of vegans and their increasing adoption of plant-based options are other major factors fueling the growth of the cocoa fiber market.

The pharmaceutical segment is expected to grow over the foreseeable period due to its multiple health and skin benefits, making it an ideal ingredient for supplement manufacturing, including capsules, pills, and tablets. Cocoa fiber is enriched with high fiber, vitamins, minerals, digestive properties, anti-aging properties, antimicrobial agents, and pectin properties. Hence, such factors are essential for manufacturing healthy skincare products and healthcare supplements, thereby fueling the growth of the cocoa fiber market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Dietary Supplements Market: The dietary supplements market size is projected to reach USD 464.58 billion by 2034, growing from USD 192.68 billion in 2025, at a CAGR of 9.2% from 2025 to 2034.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 214.32 billion in 2025 to reach around USD 347.01 billion by 2034, at a CAGR of 5.5% over the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is evaluated at USD 22.38 billion in 2025 and is expected to reach USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Sugar-Free Food Market: The global sugar-free food market size is expected to grow from USD 48.14 billion in 2025 to USD 83.2 billion by 2034, growing at a CAGR of 6.27% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Ethnic Food Market: The global ethnic food market size is forecasted to expand from USD 93.47 billion in 2025 to reach around USD 179.21 billion by 2034, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Meal Kits Market: The global meal kits market size is projected to rise from USD 17.11 billion in 2025 to approximately USD 58.8 billion by 2034, registering a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Baking Ingredients Market: The global baking ingredients market size is projected to grow from USD 18 billion in 2025 to around USD 31.72 billion by 2034, at a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Cocoa Fiber Market

- Healy Group: A diversified multinational ingredient supplier, Healy Group offers specialty fibers, cocoa derivatives, and functional food ingredients. The company focuses on sustainable sourcing and innovation to support food manufacturers in delivering health-forward products.

- Greenfield: Greenfield is known for its high-quality natural food ingredients and plant-based solutions. With a strong emphasis on research and development, the company supports fiber enrichment and clean-label trends across the food and beverage sector.

- Interfiber: Interfiber specializes in advanced dietary fiber solutions for food, nutrition, and health applications. The company’s expertise in customization and functional ingredient formulation makes it a key player for brands seeking tailored cocoa fiber solutions.

- Omya / FutureCeuticals Inc.: Omya, through its subsidiary FutureCeuticals Inc., delivers premium nutritional and functional ingredients, including plant-based fibers. Their global reach, scientific expertise, and focus on evidence-based solutions support product differentiation in healthy foods and supplements.

- Nestlé S.A.: As a global leader in food and beverage, Nestlé integrates functional fibers like cocoa derivatives into product portfolios that span nutrition, confectionery, and wellness categories. Nestlé’s strong R&D and sustainability commitments help drive broader acceptance of fiber-rich ingredients.

- Guan Chong Berhad: One of the world’s largest cocoa processors, Guan Chong Berhad provides a range of cocoa products and by-products, including fiber-rich ingredients. The company’s production scale and regional influence support stable supply chains for cocoa fiber manufacturers.

- Euroduna Food Ingredients: Euroduna specializes in plant-based and functional food ingredients tailored to the bakery, confectionery, and health food industries. With a focus on innovation and clean label formulations, Euroduna meets rising demand for fiber-enriched solutions.

- Barry Callebaut AG: A global leader in chocolate and cocoa product manufacturing, Barry Callebaut leverages its extensive cocoa processing capabilities to supply high-quality cocoa fiber and related ingredients. The company’s sustainability initiatives and wide customer base strengthen its position in the functional ingredient market.

Segments Covered in the Report

By Nature

- Conventional

- Organic

By Application

- Food & Beverage

- Pharmaceuticals

- Personal Care & Cosmetics

- Animal Feed

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5962

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Coffee Beans Market: https://www.towardsfnb.com/insights/coffee-beans-market

➡️Soybean Market: https://www.towardsfnb.com/insights/soybean-market

➡️Beef Market: https://www.towardsfnb.com/insights/beef-market

➡️Cheese Market: https://www.towardsfnb.com/insights/cheese-market