Ottawa, Feb. 06, 2026 (GLOBE NEWSWIRE) -- Human-centric AI is becoming integral to modern automation, particularly in industries such as IT, HR, and customer service. As highlighted by data from Precedence Research, investments in AI and automation systems are growing, with companies embracing solutions that allow for collaborative human-AI interactions. With a focus on explainable AI, collaborative robots (cobots), and AI-driven workflows, organizations are striving to ensure that AI augments human decision-making rather than replacing it. This trend is expected to continue growing, with significant financial investments and adoption rates expected in the coming years.

Invest in Our Premium Strategic Solution: https://www.precedenceresearch.com/request-consultation/44

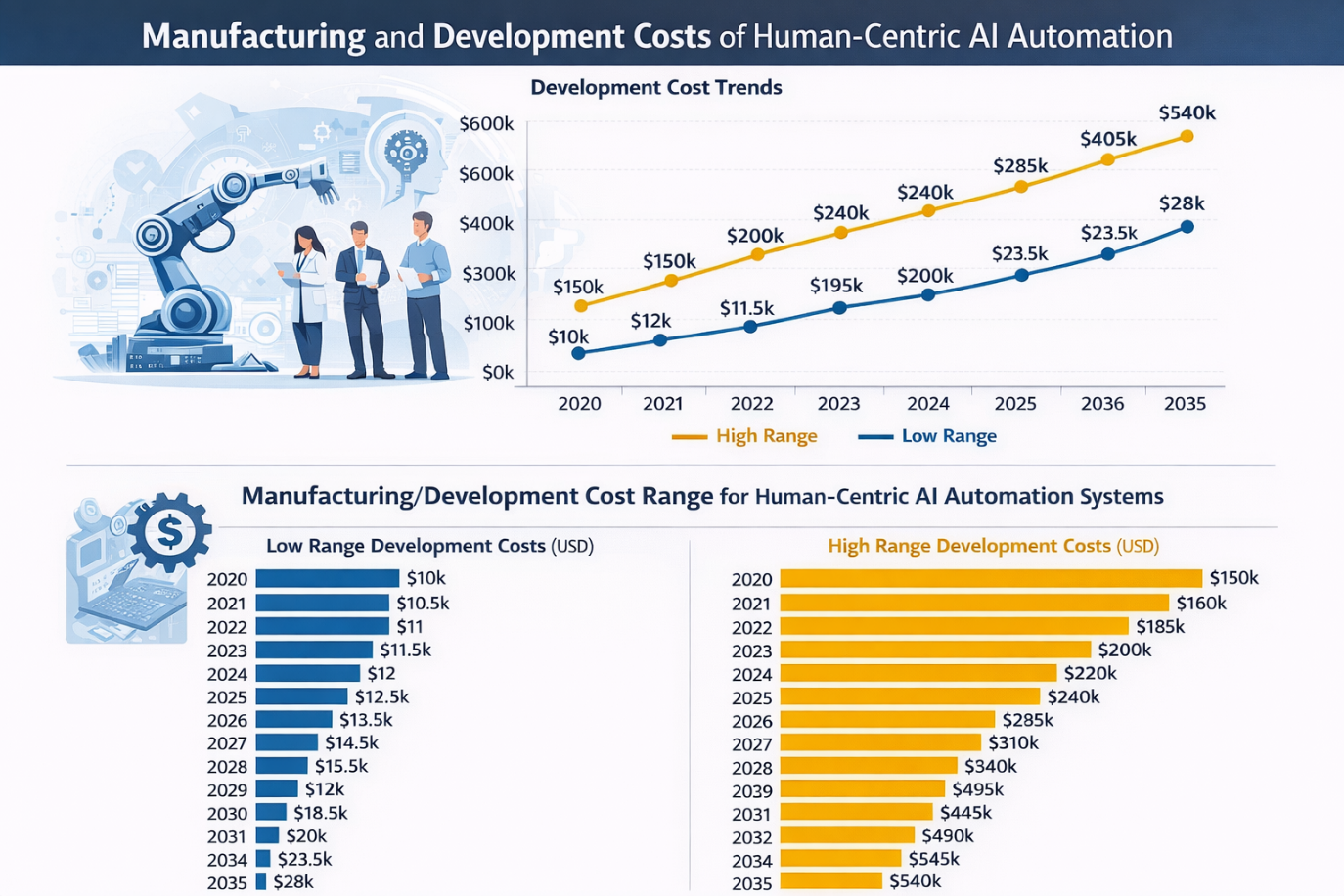

Manufacturing and Development Costs of Human-Centric AI Automation

The development costs for human-centric AI automation systems (software and integration) can vary significantly depending on the complexity, customization, and integration needed. The following table outlines the typical development costs over recent years:

Manufacturing/Development Cost Range for Human-Centric AI Automation Systems

| Year | Low Range (USD) | High Range (USD) | ||

| 2020 | $ | 10,000 | $ | 150,000 |

| 2021 | $ | 10,500 | $ | 160,000 |

| 2022 | $ | 11,000 | $ | 170,000 |

| 2023 | $ | 11,500 | $ | 185,000 |

| 2024 | $ | 12,000 | $ | 200,000 |

| 2025 | $ | 12,500 | $ | 220,000 |

| 2026 | $ | 13,500 | $ | 240,000 |

| 2027 | $ | 14,500 | $ | 260,000 |

| 2028 | $ | 15,500 | $ | 285,000 |

| 2029 | $ | 17,000 | $ | 310,000 |

| 2030 | $ | 18,500 | $ | 340,000 |

| 2031 | $ | 20,000 | $ | 370,000 |

| 2032 | $ | 21,500 | $ | 405,000 |

| 2033 | $ | 23,500 | $ | 445,000 |

| 2034 | $ | 25,500 | $ | 490,000 |

| 2035 | $ | 28,000 | $ | 540,000 |

Key Insights:

- Low-end costs (~$10k–$28k) reflect simpler automation solutions, often for smaller-scale implementations or more straightforward tasks.

- High-end costs (~$150k–$540k) are for more complex systems that involve large models, advanced integration, and human-centric explainable AI, often used in enterprise settings or for highly sophisticated automation tasks.

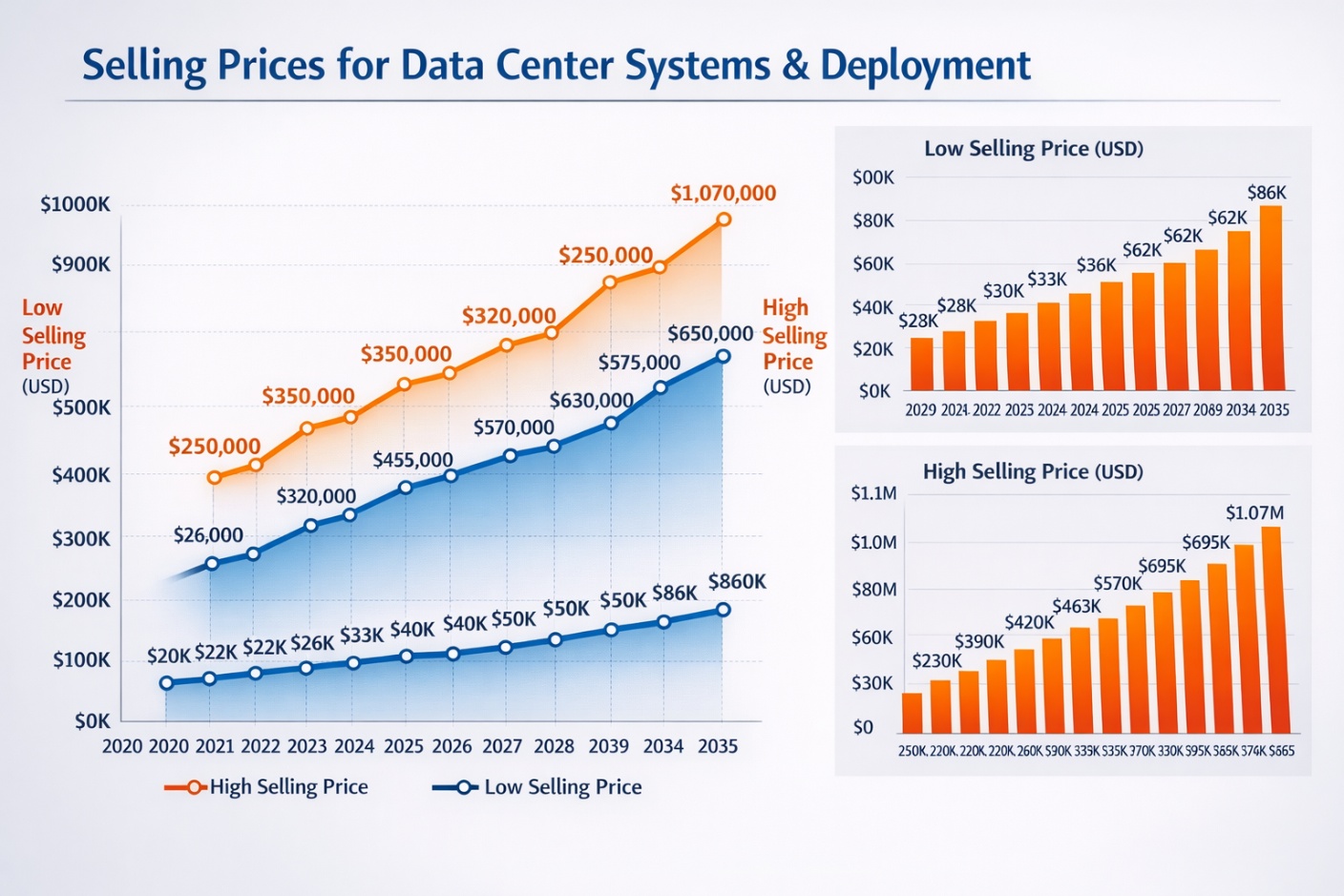

Selling Price Range for Human-Centric AI Automation Solutions

Once developed, these AI systems are sold to enterprises, with costs typically covering the license, subscription, and professional services for integration, support, and updates. The following table shows the estimated selling prices for human-centric AI automation solutions.

| Year | Low Selling Price (USD) | High Selling Price (USD) | ||

| 2020 | $ | 20,000 | $ | 250,000 |

| 2021 | $ | 22,000 | $ | 270,000 |

| 2022 | $ | 24,000 | $ | 295,000 |

| 2023 | $ | 26,000 | $ | 320,000 |

| 2024 | $ | 28,000 | $ | 350,000 |

| 2025 | $ | 30,000 | $ | 380,000 |

| 2026 | $ | 33,000 | $ | 420,000 |

| 2027 | $ | 36,000 | $ | 465,000 |

| 2028 | $ | 40,000 | $ | 515,000 |

| 2029 | $ | 45,000 | $ | 570,000 |

| 2030 | $ | 50,000 | $ | 630,000 |

| 2031 | $ | 56,000 | $ | 695,000 |

| 2032 | $ | 62,000 | $ | 770,000 |

| 2033 | $ | 69,000 | $ | 860,000 |

| 2034 | $ | 77,000 | $ | 960,000 |

| 2035 | $ | 86,000 | $ | 1,070,000 |

Key Insights:

- Low-end selling prices reflect small or edge deployments where the solution is less complex and often used by small to medium enterprises (SMEs).

- High-end prices correspond to large enterprise deployments, where the system is highly customized and includes ongoing support, professional services, and integration with complex IT systems.

Leading Human-Centric AI Automation Companies

Several companies are leading the charge in the human-centric AI automation space, with their systems augmenting human roles and improving operational efficiency. Below is a list of prominent companies in this field:

| Company | Revenue / Financials | Employees / Size | Core Human-Centric AI Focus | Additional Notes / Metrics |

| Nexthink | $294.9M (2024) | ~1,200 employees (2024) | Digital Employee Experience (DEX) with real-time analytics & IT workflow automation | Serves enterprise IT teams for productivity and helpdesk optimization |

| Verint Systems | Operating income $106M (2025) | ~3,800 employees | AI-powered CX automation & workflow analytics | Offers conversational AI, bots, and analytics for contact centers |

| Leena AI | (Financials not public) | ~250 employees | Autonomous conversational AI for HR, IT, and finance workflows | Used by 300+ enterprises globally, supports 3M+ employees |

| Synerise | $9.2M revenue (2023) | ~160 employees (2022) | AI, analytics, and automation platform for business insights and workflow optimization | Focused on enterprise data-driven automation |

| Tungsten Automation | ~$500M revenue (2020) | ~2,200 employees (2024) | Intelligent automation software (RPA, cognitive capture) | Focus on streamlining business processes across multiple sectors |

| Kore.ai | (Revenue not public) | Hundreds of employees | Enterprise AI agents for workflow and service automation | Recognized as a leader in conversational AI platforms |

Key Insights:

- Nexthink and Verint Systems are pioneers in digital employee experience (DEX) automation, improving IT productivity and customer experience through AI.

- Leena AI focuses on HR, IT, and finance workflows, making it a key player in the human-centric automation of internal business processes.

- Tungsten Automation provides enterprise automation solutions, specifically for business processes, helping organizations automate repetitive tasks and optimize workflows.

Real Data on Human-Centric AI Adoption

Data from real-world adoption surveys and reports shows that companies are increasingly prioritizing AI investments, especially in areas where AI enhances human roles and augments workflows. Below are key statistics on AI adoption and its impact on businesses:

| Category | Real Data / Statistics | Context / Tech Focus | Source |

| Enterprise AI Adoption | 92% of companies plan to increase AI investments in the next three years | Broad organizational commitment to AI automation | McKinsey report (AI in workplace study) |

| AI Maturity in Firms | Only ~1% of companies consider themselves mature in AI deployment | Most investments in AI are still in early stages | McKinsey report |

| AI Usage in Workforce | 87% of executives use AI at work vs. 27% of employees | Significant adoption gap between leadership and general workforce | Business Insider survey |

| Organizational Piloting | 79% of organizations report some level of AI agent adoption; 19% deployed at scale | AI agents reflect automation tied to human processes | Enterprise adoption trend data |

| AI ROI Expectations | 62% of companies expect >100% ROI from agentic AI investments | Positive business case expectation for automation | Enterprise adoption trend data |

| Human-AI Collaboration | Adoption of human-in-the-loop systems central to human-centric automation | Collaborative robots, explainable AI, and edge AI as part of Industry 5.0 | Industry review on human-centric AI in manufacturing |

Key Insights:

- AI adoption is broad, with 92% of companies planning to increase AI investments. However, only 1% of companies consider themselves fully mature in AI deployment, indicating that the integration of AI into day-to-day workflows is still in its early stages.

- There is a significant adoption gap between executives (87%) and employees (27%), which highlights the importance of leadership-driven change management strategies to facilitate broader AI integration.

- Companies are increasingly focused on human-in-the-loop systems, which allow AI to work alongside humans to optimize workflows, rather than replace them.

The Future of Human-Centric AI Automation

The future of human-centric AI automation lies in enhancing human productivity and decision-making, not replacing human roles. As AI solutions become more advanced and widespread, the focus will continue to be on collaborative AI, workflow optimization, and predictive insights. While AI adoption rates are rising, true integration into business processes is still maturing, creating a need for strategic implementation and human-centric frameworks to ensure success. With growing investments in AI and automation systems, the next decade will likely see significant advancements in how businesses leverage AI to improve operations and empower workers.

Request Research Report Built Around Your Goals: sales@precedenceresearch.com

About Us: Precedence Research

Our Legacy: Rooted in Research, Focused on the Future

Looking for research that drives real results? Precedence Research delivers strategic, actionable insights, not just data and charts. Based in Canada and India, our team specializes in customized market analysis, executive-level consulting, and tailored research solutions that go beyond traditional survey methodologies to support business growth with precision and confidence.

Insight-Driven

We turn complex data into clear, strategic insights that power confident business decisions.

Innovation-Led

We continuously refine our methods to stay ahead of trends and emerging market forces.

Industry-Agnostic

From tech to healthcare, we serve clients across sectors with tailored, actionable intelligence.

Customer-Centric, Future-Focused, Result-Oriented

We work as strategic partners, engaging deeply with clients to co-create impactful solutions.

Our Commitment: Delivering Intelligence That Drives Transformational Growth

What do we do? We turn data noise into clarity. Through sharp research, agile thinking, and tech-enabled tools, we fuel brands, disrupt markets, and lead with insight that drives unstoppable growth.

Contact Us

USA: +1 8044 419344

APAC: +61 4859 81310 or +91 87933 22019 or +6531051271

Europe: +44 7383 092 044

Email: sales@precedenceresearch.com