ENDEAVOUR INCREASES ITS STAKE IN THE FETEKRO PROJECT;

PRE-FEASIBILITY STUDY ON TRACK FOR Q1-2021

Increased stake from 65% to 80% · PFS to be based on 3Mtpa · Mining permit process well underway

Abidjan, December 21, 2020 – Endeavour Mining (TSX:EDV) (OTCQX:EDVMF) is pleased to announce that it has increased its stake in the Fetekro Project in Côte d’Ivoire, ahead of a Pre-Feasibility Study (“PFS”) which is due to be published in Q1-2021.

Under the terms of the agreement, once the mining permit is granted, Endeavour will be entitled to an 80% stake in the Fetekro Project, compared to 65% currently, while SODEMI (the state-owned mining company) and the Government of Côte d’Ivoire will each have a 10% stake. Endeavour will retain the full ownership of the Fetekro exploration license until such time as it is converted into a mining license.

Sébastien de Montessus, President and CEO, commented: “We are delighted to have concluded this agreement with our long-standing government partners, in a manner which allows all stakeholders to benefit from the value we expect to continue to unlock at Fetekro.

We believe that we have the opportunity to develop Fetekro into a cornerstone asset for Endeavour, which we define as assets with the potential to produce more than 200,000 ounces per annum over 10 years at low AISC. Fetekro has significant exploration potential, an already defined large-scale deposit with straightforward metallurgy and high gold recovery. It also benefits from being located close to existing infrastructure and requires only minimal relocation. We are eager to complete the PFS, which is expected to build on the PEA we recently published based on only half of the current resource, to demonstrate further the robust economics of the project.”

Endeavour acquired the additional stake from SODEMI for a consideration of $19 million plus contingent payments of $3 per ounce for future Proven and Probable reserves defined outside of the existing Measured and Indicated resource boundary. The contingent payment is based on a gold price of $1,450 per ounce and will be adjusted upwards or downwards in a linear relationship with the gold price.

ABOUT THE FETEKRO PROJECT

Located in north-central Côte d’Ivoire, within the northern end of the Oumé-Fetekro Greenstone Belt, the Fetekro Project is approximately 500km from Abidjan and close to existing infrastructure, including sealed roads and grid power.

Endeavour began exploration at Fetekro in March 2017, with the Lafigué deposit as the primary target. A maiden resource for Lafigué was published on October 29, 2018 and was updated on September 3, 2019 and again on August 18, 2020. As shown in Table 1 below, the latest resource update resulted in a 108% increase in Indicated resources to 2.5Moz at an average grade of 2.40 g/t Au.

Table 1: Lafigué Mineral Resource Estimate Evolution

| AS AT AUGUST 31, 2019 | AS AT JULY 31, 2020 | Δ AU CONTENT | ||||||

| On a 100% basis | Tonnage | Grade | Content | Tonnage | Grade | Content | ||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | |||

| Measured Resource | - | - | - | |||||

| Indicated Resources | 14.6 | 2.54 | 1,190 | 32.0 | 2.40 | 2,471 | +108% | |

| M&I Resources | 14.6 | 2.54 | 1,190 | 32.0 | 2.40 | 2,471 | +108% | |

| Inferred Resources | 0.9 | 2.17 | 60 | 0.8 | 2.52 | 66 | +10% | |

Mineral Reserve Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII Pit Shell and based on a cut-off of 0.5 g/t Au. For further details, please refer to Endeavour’s press release dated August 18, 2020, available on its website and on SEDAR under its profile.

A Preliminary Economic Assessment (“PEA”), based on the previous 1.2Moz Indicated resource, was published on August 18, 2020 and demonstrated robust project economics, as shown in Table 2 below.

Table 2: Initial PEA Highlights

| TOTAL LIFE OF MINE | |

| Gold contained processed | 1.0Moz |

| Average recovery rate | 95% |

| Gold production | 0.95Moz |

| Cash costs | $592/oz |

| AISC | $697/oz |

| Upfront capital cost | $268m |

| Pre-tax NPV5% based $1,500/oz | $372m |

| Pre-tax IRR based $1,500/oz | 37% |

For further information, please refer to Endeavour’s press release dated August 18, 2020, available on its website and on SEDAR under its profile.

A PFS is expected to be published in Q1-2021 and will be based on the updated 2.5Moz Indicated resource and will define a production scenario based on a 3.0Mtpa mill throughput (compared to 1.5Mtpa for the PEA). Given its strong exploration potential, Endeavour believes that Fetekro has the potential to become a cornerstone asset with a production target of +200koz per annum over 10 years at a low AISC.

The mining permitting process is well underway, with the environmental study completed and submitted. Receipt of the environmental permit is expected in early 2021, following which the exploitation license application will be submitted.

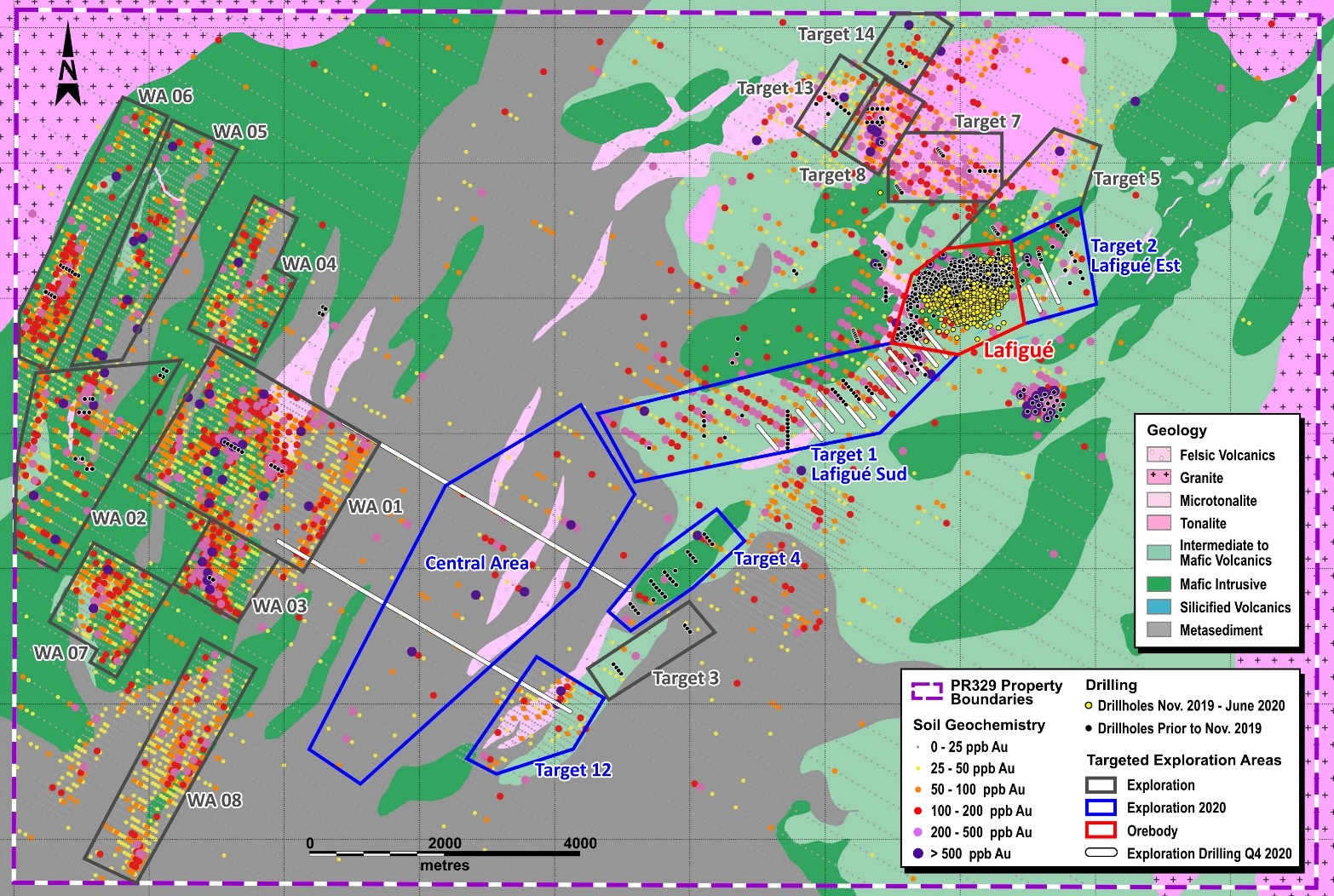

To date, only a small portion of the Fetekro property has been explored, as the priority has been the Lafigué deposit, which remains open at depth and along strike. Several additional exploration targets have been identified within 10km from Lafigué, which have had limited drilling of just 7,050 meters, as shown in Figure 1 below.

Figure 1: Fetekro Map with Exploration Targets

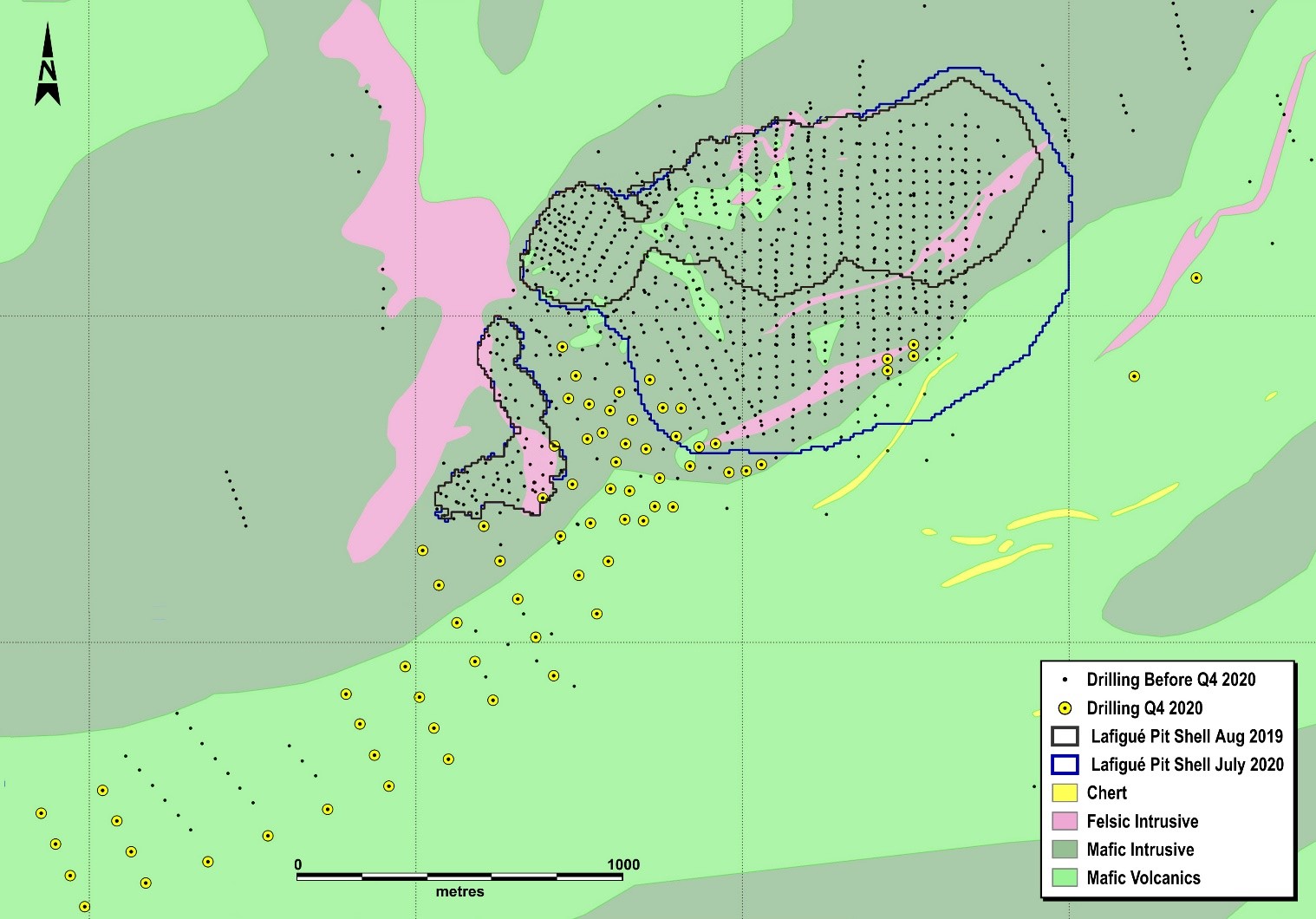

The current 15,000 meter drilling campaign is expected to be completed during Q4-2020, with the aim of further extending the Fetekro resource and testing nearby targets, including Lafigué Sud, as shown in Figure 2 below.

Figure 2: Q4-2020 Fetekro Drilling Campaign

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Silvia Bottero, Professional Natural Scientist, VP Exploration Côte d’Ivoire for Endeavour. Silvia Bottero has more than 18 years of mineral exploration and mining experience and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

| Vincic Advisors in Toronto John Vincic, Principal +1 (647) 402 6375 john@vincicadvisors.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a multi-asset gold producer focused on West Africa, with two mines (Ity and Agbaou) in Côte d’Ivoire, four mines (Houndé, Mana, Karma and Boungou) in Burkina Faso, four potential development projects (Fetekro, Kalana, Bantou and Nabanga) and a strong portfolio of exploration assets on the highly prospective Birimian Greenstone Belt across Burkina Faso, Côte d’Ivoire, Mali and Guinea.

As a leading gold producer, Endeavour Mining is committed to principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the Toronto Stock Exchange, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

Attachment