Selbyville, Delaware, Jan. 10, 2024 (GLOBE NEWSWIRE) --

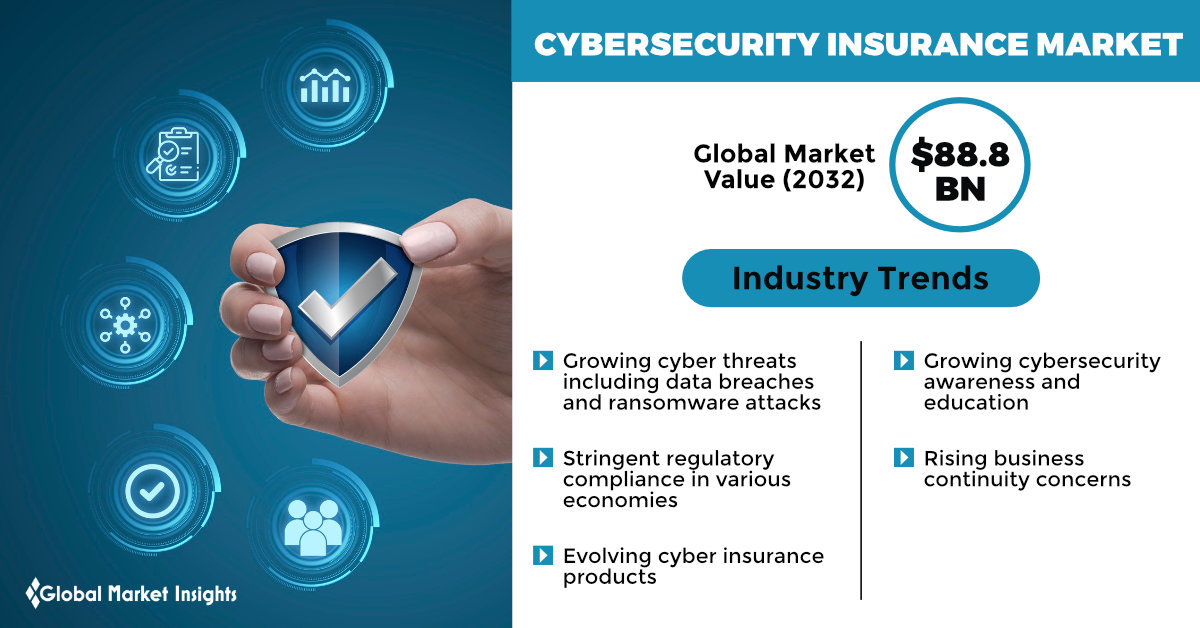

The cybersecurity insurance market valuation is expected to cross USD 88.8 billion by 2032, as reported in a research study by Global Market Insights Inc.

The markets witnesses soaring demand as industries and companies delve deeper into cybersecurity. In December 2023, The United India Insurance Company Limited, a public sector entity, announced that it is venturing into the retail cybersecurity insurance sector. Introducing three distinct products, they aimed to safeguard laptops and personal computers (PCs) from cyber-attacks. Satyajit Tripathy, the company's chairman and managing director, stated that these policies will debut before March 2024. Tripathy emphasized the surging demand for retail insurance due to escalating cybersecurity threats. Stringent data protection regulations worldwide (such as GDPR in Europe and CCPA in the U.S.) mandate organizations to adhere to specific cybersecurity standards, further propelling the market expansion.

Cybersecurity insurance market from the large enterprises segment will exhibit a decent growth rate over 2024-2032, claims the study. Large companies with expansive digital footprints face heightened risks of cyber-attacks and data breaches. To shield against potential financial losses and reputational damage, these organizations invest in comprehensive cyber insurance. This demand arises from the imperative to fortify defenses and mitigate the impact of sophisticated cyber incidents. Cyber insurance serves as a vital component in their risk management strategy, ensuring resilience in an increasingly interconnected business landscape. These factors collectively fuel the growing contribution of large enterprises in the market share.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/6407

Cybersecurity insurance market from the IT & telecom segment is projected to register a noteworthy CAGR from 2024 to 2032, according to the report. With rapid technological advancements and increased reliance on interconnected networks, these industries face amplified cyber risks. To fortify against threats like data breaches and system compromises, IT & Telecom companies are increasingly seeking specialized cyber insurance. This surge in demand reflects the necessity to safeguard critical infrastructure, ensuring continuity and resilience in the face of evolving cyber threats.

Asia Pacific cybersecurity insurance market will witness remarkable growth between 2024 and 2032, owing to burgeoning digital expansion and technological adoption leading to businesses in Asia Pacific grappling with amplified cyber risks. This surge in demand for cyber insurance stems from the imperative to fortify against sophisticated threats like data breaches and ransomware attacks. Companies in the region recognize the need to bolster their defenses, seeking comprehensive insurance solutions to mitigate potential financial losses and ensure resilience in an increasingly interconnected digital landscape. Therefore, the rising need for security systems in the Asia Pacific region is helping bolster the revenue share.

Make an inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/6407

Major players involved in cybersecurity insurance market include Aon PLC, BitSight Corporation, Munich RE, The Hanover Insurance Inc., Zurich Insurance Co. Ltd., Axis Capital, The Chubb Corporation, American International Group Inc., Liberty Mutual, Lockton Companies Inc. Companies in the cybersecurity insurance industry are employing various strategies to enhance their market presence, by participating in launching products at several expos and events that are aimed at showcasing potential in the construction industry.

For instance, in November 2023, AXIS Capital Holdings Limited, an insurer and reinsurer based in Bermuda, revealed the completion of the market's inaugural 144A cyber catastrophe bond. This transaction, through Long Walk Reinsurance Ltd., amounts to $75 million, offering the company's subsidiaries indemnity reinsurance for systemic cyber events on a per-occurrence basis, fully collateralized. The Series 2024-1 Class A notes, totaling $75 million, are set to mature in January 2026.

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Cybersecurity insurance market 360º synopsis, 2018 - 2032

2.2 Business trends

2.2.1 Total Addressable Market (TAM), 2024-2032

2.3 Regional trends

2.4 Component trends

2.5 Enterprise size trends

2.6 Insurance type trends

2.7 Coverage type trends

2.8 End use trends

Chapter 3 Cybersecurity Insurance Industry Insights

3.1 Industry ecosystem analysis

3.2 Supplier Landscape

3.3 Profit margin analysis

3.4 Technology innovation landscape

3.5 Patent analysis

3.6 Key news and initiatives

3.7 Regulatory landscape

3.8 Impact forces

3.8.1 Growth drivers

3.8.1.1 Growing cyber threats including data breaches and ransomware attacks

3.8.1.2 Stringent regulatory compliance in various economies

3.8.1.3 Evolving cyber insurance products

3.8.1.4 Growing cybersecurity awareness and education

3.8.1.5 Rising business continuity concerns

3.8.2 Industry pitfalls & challenges

3.8.2.1 Increasing complexity of cyber risks

3.8.2.2 High cost of claims

3.9 Growth potential analysis

3.10 Porter’s analysis

3.11 PESTEL analysis

Browse our Reports Store - GMIPulse @ https://www.gminsights.com/gmipulse

Browse Related Reports:

Commercial Insurance Market Size, By Type (Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance), By Enterprise Size (Large Enterprises, SMEs), By Distribution Channel (Agents & Brokers, Direct Response), By Industry Vertical, Forecast 2024 – 2032

https://www.gminsights.com/industry-analysis/commercial-insurance-market

Trade Credit Insurance Market - By Organization Size (SMEs, Large Enterprise), By Coverage (Whole Turnover, Single Buyer), By Application (Domestic, International), By End Use (Healthcare, Automotive, F&B, IT & Telecom, Manufacturing) & Forecast, 2023 – 2032

https://www.gminsights.com/industry-analysis/trade-credit-insurance-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.