Hamilton Square, April 16, 2024 (GLOBE NEWSWIRE) -- Overview:

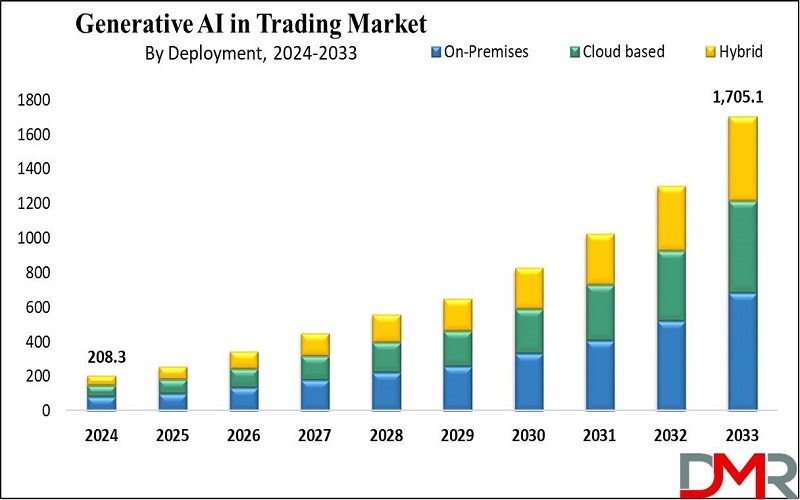

The Global Generative AI in Trading Market size is expected to reach USD 208.3 million by 2024 and is further anticipated to reach USD 1,705.1 million by 2033, according to Dimension Market Research. The market is anticipated to register a CAGR of 26.3% from 2024 to 2033.

Generative AI, uses neural networks, produces realistic content, and proves valuable in trading by adapting to market changes. Analyzing historical data, it identifies complex patterns, providing actionable insights. It complements human judgment, improving decision-making. The future entails adaptive algorithms responding quickly to real-time market shifts, creating the way for autonomous trading systems, and shaping a dynamic future in financial markets.

The global generative AI in trading market is segmented into on-premises, cloud-based, and hybrid deployments, where the on-premises deployment is anticipated to lead in revenue by 2024, providing traders control & regulatory compliance. Further, Cloud-based deployment is expected to be the fastest-growing segment, provides scalability & accessibility, enabling traders to manage AI solutions remotely and reduce infrastructure costs.

Elevate Your Strategy with Our Exclusive Report: Request Your Sample Now at https://dimensionmarketresearch.com/report/generative-ai-in-trading-market/request-sample/

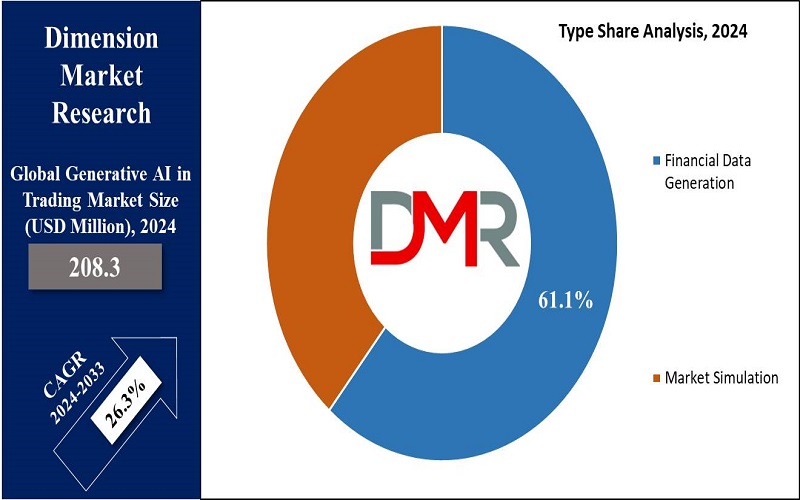

In the generative AI in the trading market, the financial data generation segment is set to lead market revenue in 2024, by revolutionizing trading processes. Using specialized algorithms, generative AI systems produce accurate financial data, making traders to refine strategies and manage risks effectively. In addition, the market simulation segment is expected to emerge as the fastest-growing, allowing risk-free experimentation and enhancing trading performance through realistic virtual environments.

In the global generative AI in trading market, applications include portfolio optimization, trading strategy development, and risk assessment. Portfolio optimization is anticipated to dominate in 2024, enabling traders to evaluate portfolios across various conditions. Trading strategy development is critical, with generative AI replicating market data for strategy testing, which allows traders to explore markets and refine strategies, gaining a competitive edge in dynamic trading environments.

Important Insights

- The Generative AI in Trading Market is expected to grow by USD 1,447.6 million by 2033 from 2025 with a CAGR of 26.3%.

- On-premises deployment is predicted to lead in revenue in 2024, providing control and compliance, while cloud-based deployment is set to grow fastest.

- The financial data generation segment will lead revenue by 2024, revolutionizing trading with accurate data. Also, Market simulation emerges fastest, enhancing performance.

- Portfolio optimization leads in 2024, allowing traders to assess portfolios in diverse conditions. Trading strategy development is pivotal, leveraging generative AI for competitive advantages.

- North America will lead the Generative AI in the trading market with 48.0% in 2024, while the Asia-Pacific region shows the fastest growth.

Global Generative AI in Trading Market: Trends

- Increased Adoption: Global adoption of generative AI in trading is rising, due to its ability to analyze high-volume datasets, identify patterns, and execute trades autonomously, creating better efficiency and profitability for financial institutions.

- Advanced Algorithm Development: Recent trends show an aim to develop more specialized generative AI algorithms capable of handling complex market dynamics, allowing better decision-making and risk management.

- Ethical Considerations: There's a major focus on addressing ethical concerns surrounding generative AI in trading, like algorithmic bias, transparency, and accountability, as regulators and industry stakeholders look to ensure fair and responsible use of these technologies.

- Integration with Other Technologies: Integration with complementary technologies like blockchain and decentralized finance (DeFi) is coming out as a trend, improving the dependency and scalability of generative AI trading systems while exploring new avenues for innovation & disruption in financial markets.

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today : https://dimensionmarketresearch.com/report/generative-ai-in-trading-market/download-reports-excerpt/

Generative AI in Trading Market: Competitive Landscape

In the dynamic generative AI in trading market, firms compete for dominance, using advanced technologies and new strategies. Competition depends on factors like technological advancements, R&D efforts, and strategic alliances in finance & tech sectors. Companies look for differentiation through customized generative AI tools catering to changing trader demands in portfolio optimization, strategy development, and risk assessment, focused on enhancing data accuracy, processing speed, and model interpretability to secure and satisfy clients.

Some of the major players in the market include Kavout Inc, Numerai LLC, OpenAI AP, Aidyia Holding Ltd, and more.

Some of the prominent market players:

- Sentient Technologies Holdings Ltd.

- Other Key Players

Generative AI in Trading Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 208.3 Mn |

| Forecast Value (2033) | USD 1,705.1 Mn |

| CAGR (2024-2033) | 26.3 % |

| North America Revenue | 48.0% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Deployment, By Type, By Application |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Recent Developments in the Generative AI in Trading Market

- February 2024: Birlasoft Ltd launched Cogito, a Generative AI platform, set to drive innovation, optimization, and automation in enterprises, and improve decision-making and performance.

- February 2024: TradeAlgo introduced TradeGPT, a leading generative AI product tailored for retail traders, marking a culmination of extensive engineering efforts to democratize investing.

- January 2024: The Federal Trade Commission ordered five companies to disclose recent investments and partnerships, aiming at those involving generative AI and major cloud providers.

- January 2024: India's SEBI regulator announced plans to deploy an internally developed generative AI tool to expedite the timely clearance of IPO applications.

- March 2023: Roundhill Investments launched the Roundhill Generative AI & Technology ETF for trading on NYSE Arca, providing exposure to leading AI technology companies.

Segment Analysis:

In Global Generative AI in Trading, the financial data generation segment is expected to dominate revenue in 2024, promising to transform trading data creation. Through specialized algorithms and neural networks, these systems create highly accurate financial data replicating real market conditions. Drawing on historical market information, they look into patterns, predict future scenarios, and empower investors and traders with higher reliable data, which allows them to refine trading strategies, implement strong risk management practices, and gain deeper market insights, ultimately improving decision-making. In addition, the market simulation segment comes out as the fastest-growing, providing accurate mock data for risk-free strategy experimentation, further strengthening traders' capabilities and performance.

Drive Your Business Growth Strategy: Purchase the Report for Key Insights at https://dimensionmarketresearch.com/checkout/generative-ai-in-trading-market/

Generative AI in Trading Market Segmentation

By Type

- Financial Data Generation

- Market Simulation

By Deployment

- Cloud-based

- On-Premises

- Hybrid

By Application

- Portfolio Optimization

- Trading Strategy Development

- Risk Assessment and Management

Global Generative AI in Trading Market: Driver

- Data Availability and Quality: The higher availability of a variety and high-quality financial data, along with development in data processing and storage technologies, is driving growth in the generative AI trading market by enabling more accurate modeling and prediction.

- Demand for Automation: The need for automation in trading processes to minimize human error, improve efficiency, and capitalize on fast market movements is a significant growth driver, with generative AI providing the ability to automate trading strategies at scale.

- Competitive Advantage: Financial firms are largely recognizing the competitive advantage provided by generative AI in trading, creating higher investment in research, development, and deployment of these technologies to stay in front of the highly competitive financial markets.

- Regulatory Environment: Regulatory frameworks promoting innovation and adoption of AI technologies in trading, while making sure compliance and risk management, are acting as growth drivers by providing a conducive environment for the growth of generative AI applications in the financial sector.

Global Generative AI in Trading Market: Restraints

- Regulatory Uncertainty: Changing regulatory landscapes and concerns about algorithmic trading oversight create a restraint, as strict regulations may hinder the adoption & development of generative AI in trading due to compliance challenges and legal uncertainties.

- Data Privacy and Security: Worrying regarding data privacy, security breaches, and potential misuse of sensitive financial information reduces the growth of generative AI in trading, as firms deal with ensuring strong security measures and compliance with data protection regulations.

- Ethical Concerns: Ethical considerations regarding the fairness, transparency, and accountability of AI-driven trading systems restrict market growth, as stakeholders look to address issues like algorithmic bias, discriminatory outcomes, and the ethical implications of autonomous decision-making in financial markets.

- Complexity and Interpretability: The complexity of generative AI models & the lack of interpretability in their decision-making processes create challenges for adoption, as traders and regulators need transparency and explainability to trust & validate the outputs of AI-driven trading systems, causing hesitation and doubt in their deployment.

Global Generative AI in Trading Market: Opportunities

- Enhanced Trading Strategies: Generative AI provides opportunities for developing more specialized and adaptive trading strategies by using advanced algorithms to analyze broad datasets, identify patterns, and execute trades on the spot, thereby improving trading performance and profitability.

- Risk Management: Generative AI allows more accurate risk assessment and management by giving predictive analytics, scenario analysis, and automated decision-making capabilities, enabling financial institutions to reduce risks, optimize portfolio diversification, and navigate volatile market conditions more effectively.

- Market Prediction and Forecasting: Generative AI supports more accurate market prediction and forecasting by generating synthetic data, replicating market scenarios, and identifying trends and anomalies, providing traders and investors with actionable insights to make well-made decisions and capitalize on market opportunities.

- Algorithmic Trading Innovation: Generative AI drives innovation in algorithmic trading by allowing the development of novel trading algorithms, adaptive trading systems, and dynamic portfolio optimization strategies, causing better trade execution, reduced transaction costs, and increased liquidity in financial markets.

Elevate Your Strategy with Our Exclusive Report: Request Your Sample Now at https://dimensionmarketresearch.com/report/generative-ai-in-trading-market/request-sample/

Regional Analysis

North America is expected to lead the global Generative AI in trading market in 2024, capturing a major 48.0% share. The United States, particularly, is a key player, using generative AI extensively in trading. With a strong financial services sector and a thriving tech ecosystem, mainly in cities like New York and Chicago, North America supports innovation in generative AI tools for trading. Further, the Asia-Pacific region emerges as the fastest-growing market, driven by countries like Japan, China, and Singapore. Their investments in technology and adoption of generative AI underscore their commitment to trading automation, risk management, & market analysis, shaping the global landscape of AI-driven trading strategies.

By Region

North America

- The U.S.

- Canada

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Browse More Related Reports

- Generative AI in Architecture Market is expected to reach a value of USD 1.0 billion by the end of 2024, and it is further anticipated to reach a market value of USD 18.1 billion by 2033 at a CAGR of 38.3%

- Generative AI in Audit Market is expected to reach a value of USD 111.7 million by the end of 2024, and it is further anticipated to reach a market value of USD 2,708.5 million by 2033 at a CAGR of 42.5%

- Generative AI in Computer Vision Market is expected to reach a value of USD 7.8 billion by the end of 2024, and it is further anticipated to reach a market value of USD 118.1 billion by 2033 at a CAGR of 35.3%

- Generative AI in FMCG Market is expected to reach a value of USD 10.2 billion by the end of 2024, and it is further anticipated to reach a market value of USD 67.7 billion by 2033 at a CAGR of 23.4%

- Generative Al in Biology Market is expected to reach a value of USD 92.1 million in 2023, and it is further anticipated to reach a market value of USD 406.6 million by 2032 at a CAGR of 17.9%

- Generative AI in Cyber Security Held a Market value of USD 17.8 billion in 2023 and is expected to show promising growth as the market is projected to have a USD 146.9 billion market value at a CAGR of 26.4% in the forthcoming years

- Generative AI Market is expected to reach a value of USD 14.9 billion in 2023, and it is further anticipated to reach a market value of USD 266.0 billion by 2032 at a CAGR of 37.8%

- Generative AI in Financial Services Market is expected to reach a value of USD 1,156.9 million in 2023, and it is further anticipated to reach a market value of USD 11,527.4 million by 2032 at a CAGR of 29.1%

- Generative AI in E-Commerce Market is expected to reach a value of USD 760.9 million in 2023, and it is further anticipated to reach a market value of USD 2,796.4 million by 2032 at a CAGR of 15.6%

About Dimension Market Research (DMR):

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts into work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world. We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.