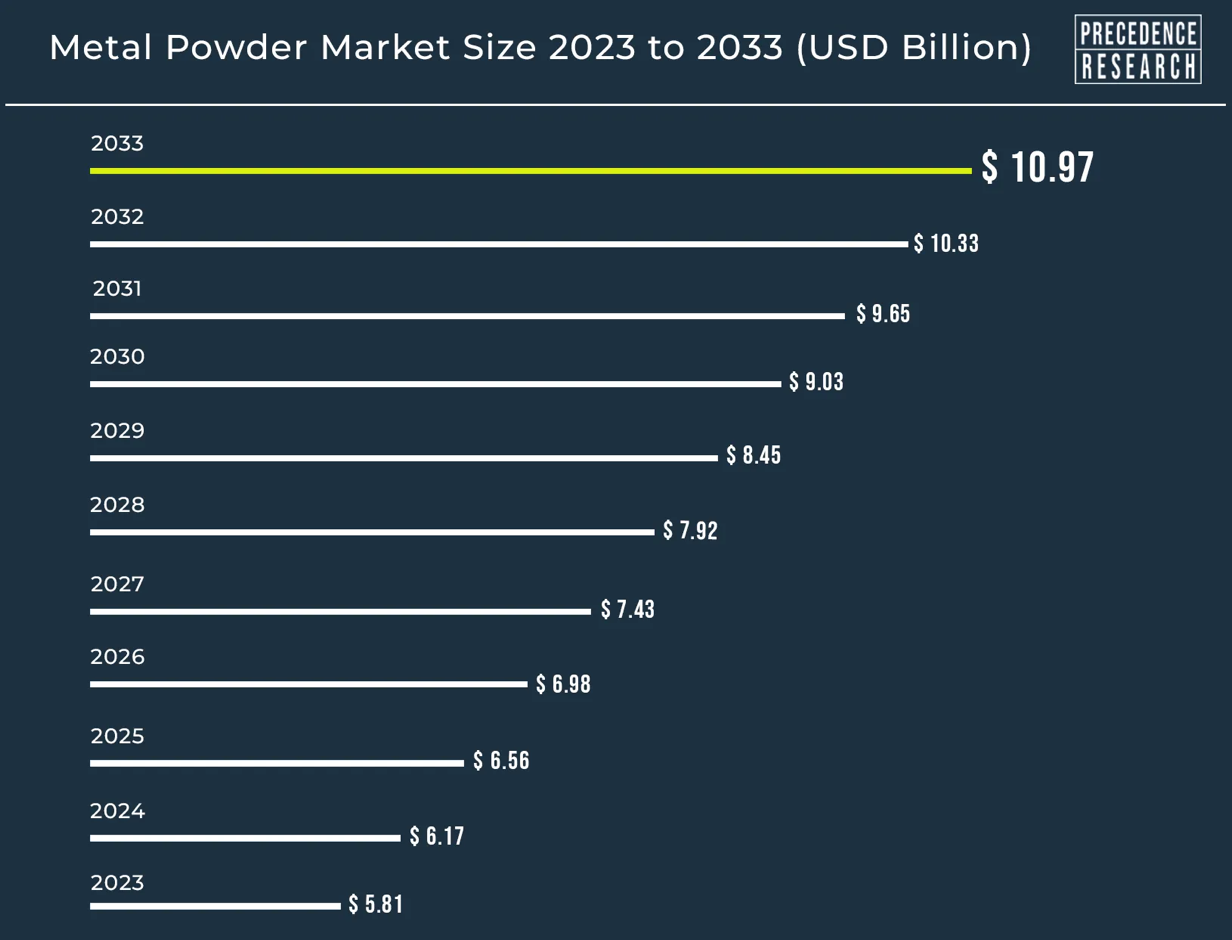

Beijing, April 17, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global metal powder market size is expected to reach around US$ 10.33 billion by 2032, increasing from US$ 5.81 billion in 2023. The metal powder market is driven by the evolving electronics sector, increasing R&D initiatives, and advanced technologies.

Market Overview

The metal powder market refers to the industry involved in the production, distribution, and sale of finely powdered metals, alloys, and metal compounds. Powder forging, metal injection, hot isostatic pressing, electro-current-assisted sintering, and additive manufacturing are some of the procedures used to produce metal powders. These goods are utilized in precise production for automobiles, gears, airplanes, turbine discs, and medical equipment.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1181

Metal powders include aluminum powder, cadmium oxide powder, bismuth powder, iron powder, manganese powder, granular copper, nickel powder, nickel and nickel-chromium alloys, red and black cupric oxide, tin powder, and zinc powder. These powders are used to lubricate, resist corrosion, and create alloys. Common metal powders include aluminum powder for fireworks, bismuth powder for batteries, and cadmium oxide powder for silver alloys and ceramic glazes.

Key Insights

- By region, Asia-Pacific dominated the metal powder market in 2023 and accounted 34.12% revenue share.

- Asia Pacific metal powder market size was estimated at USD 1.39 billion in 2023

- Asia Pacific metal powder market size is expected to be worth around USD 2.76 billion by 2033 and growing at a CAGR of 7.16% from 2024 to 2033.

- By type insight, the ferrous powder segment dominated the market in 2023.

- By application insight, the aerospace and defense sector segment dominated the market in 2023.

- By technology insight, the press and sinter technology segment dominated the market in 2023.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1181

Regional Stance

Asia-Pacific dominated the metal powder market in 2023 due to the rapid growth of emerging countries in this region. Furthermore, the expansion of the market in this area is anticipated to be fueled by increased demand from the industrial sector and rising disposable income. China, the world's second-largest economy, has contributed to the growth of the market due to the concentration of high-end industries. China is a worldwide manufacturing powerhouse with significant end-use industries for powdered metal in electronics, automotive, infrastructure, and manufacturing.

- In March 2024, the 16th China International Exhibition for Powder Metallurgy and Cemented Carbides (PM China 2024) opened at the Shanghai World Expo Exhibition Centre. The largest show for PM and allied businesses, it covers over 45,000 m2 and is projected to draw over 65,000 visitors. The event, which coincides with IACE China, MMIC China, AM China, and POWDEX China, runs till March 8.

- In November 2023, ArcelorMittal, an Indian steel and mining company, officially entered the additive manufacturing (AM) market as a steel powder supplier. This marks the company's first official business in 3D printing, and its existing role in AM could have significant implications for the industry and India's position as a growing superpower.

Metal Powder Market in the Asia Pacific 2024 To 2033

| Year | Market Size (USD Billion) |

| 2024 | 1.48 |

| 2025 | 1.59 |

| 2026 | 1.70 |

| 2027 | 1.82 |

| 2028 | 1.95 |

| 2029 | 2.09 |

| 2030 | 2.24 |

| 2032 | 2.41 |

| 2032 | 2.59 |

| 2033 | 2.76 |

Report Highlights

Type Insights

The ferrous segment dominated the metal powder market in 2023. Ferrous metals are iron-based materials with magnetic properties, except for the 300 series of stainless steels. Examples include pure iron, carbon steel, cast iron, and wrought iron. Ferrous powdered metals offer the highest level of mechanical properties, including durability, hardness, tensile strength, lower costs, magnetic function, and broad flexibility. They are widely used in various industries, including auto, power tools, construction, piping, shipping containers, and industrial piping. Ferrous powdered auto components include connecting rods, bearing caps, pulleys, and VVT parts, all of which are different alloys and heat-treated differently.

Application Insights

The aerospace and defense sector segment dominated the metal powder market in 2023. Metal powder like titanium, nickel, and cobalt powders are used in a variety of aerospace components, including turbine disks, compressor blades, heat exchangers, combustion chambers, aerospace fasteners, structural components such as wing spars and fuselage frames, thermal barrier coatings such as zirconia and yttria, electrical contacts for switches and relays, high-strength alloys such as cobalt and nickel, and rocket engine parts. Compressor blades, turbine disks, aerospace fasteners, combustion chambers, heat exchangers, structural components such as wing spars and fuselage frames, thermal barrier coatings, electrical contacts, high-strength alloys, and rocket engine parts are all made with these materials to withstand high temperatures and pressures. These materials are critical to the safety and performance of aircraft systems.

Technology Insights

The press and sinter technology segment dominated the metal powder market in 2023. Press-ready flex bags filled with metal powder for pressing and sintering provide component makers with powder solutions that are ready to be transported and emptied straight onto presses for maximum efficiency. Benefits include access to a press-ready workshop, characteristics that are specifically designed for cost, performance, and productivity, availability of a wide range of alloys and additives, and global support and service.

Personalized your customization here: https://www.precedenceresearch.com/customization/1181

Market Dynamics

Driver

Rise in the automotive industry

Metal powders are widely used in the automotive industry, particularly for the manufacture of engine components such as pistons, connecting rods, cylinder heads, transmission gears, brakes, suspension systems, and structural parts, due to their high strength-to-weight ratio, wear resistance, and excellent machinability. The rising demand of the automotive industry is a key driver of the metal powder market. The automotive industry is undergoing tremendous transformation because of growing market development, new technology, environmental legislation, and shifting consumer tastes. Digitization, automation, and new business models propel four disruptive trends: diversified mobility, autonomous driving, electrification, and connection.

Connectivity and autonomous technology will allow automobiles to serve as platforms for drivers and passengers to consume media and services, while upgradeability will be critical. As shared mobility solutions with shorter life cycles become more widespread, consumers will be increasingly aware of technology improvements, raising the demand for upgradability in privately owned vehicles. Individual mobility behavior is being influenced by shifting consumer demands, stronger regulation, and technological developments. Individuals increasingly employ several modes of transportation, with products and services being brought to them rather than fetched by consumers.

Restraint

Limited and cost ineffective in small quantity

Powder metallurgy is a cost-effective way to make complicated, sophisticated parts because it can produce exact parts. However, it is limited in size and shape, with the final component size restricted by the press's capacity. This makes it unsuitable for small batches since the initial expenses of equipment such as presses, sintering furnaces, and powder mixing machines often outweigh the profits. Furthermore, tooling, labor, and material costs can quickly pile up when made in lower quantities.

Opportunity

Adoption of new technologies in metal additive manufacturing

Metal additive manufacturing (MAM) is a method that involves layering metal powder materials on a platform to provide mass customization, creative freedom, and sustainable products. This technique is entirely digitized and can be viewed as an open-loop system in which basic settings are constantly adopted for each layer. However, genuine fabrication stages can produce unexpected flaws because of differences in layer conditions. Real-time monitoring via smart devices and sensors is required for defect-free AM parts. A closed-loop system called a 'Digital Twin' (DT) is emerging as the next stage in AM.

Artificial intelligence (AI) technology can serve as the foundation for creating DT to make real-time decisions during MAM manufacture. However, a powerful database is necessary for the proper deployment of DT. MAM technology researchers or machine developers have a large amount of data that must be correctly AI-trained before application. Most of the data collected is machine- or material-specific, making it impossible to use as a global metric. These evolving advanced technologies create great opportunities for the growth of the metal powder market.

Related Reports

- Bearing Market - The global market size was accounted at USD 133.99 billion in 2023 and it is increasing around USD 279.83 billion by 2032 with a CAGR of 8% from 2023 to 2032.

- Metal Fiber Market - The global market size was accounted for USD 5.31 billion in 2022 and is increasing around USD 8.77 billion by 2032, with a CAGR of 5.2% from 2023 to 2032.

- Metal Recycling Market - The global market size was accounted for USD 119.3 billion in 2022, and it is increasing around USD 249.4 billion by 2032 with a CAGR of 7.7% from 2023 to 2032.

Recent Development

- In April 2024, Volkmann USA introduced the vHub 250 metal powder storage system, which is a versatile buffer for pre-and post-processing. It has an integrated container for consistent powder feed and excess powder collection from a construction box. The recovered powder can be sieved, stored, or returned for further processing.

- In March 2024, Qualloy, a metal powder marketplace based in Düsseldorf, introduced a new online platform aimed at revolutionizing metal powder procurement for additive manufacturing and associated applications. The platform provides price and delivery transparency, allowing consumers to make quick, informed decisions. Yannik Wilkens, Qualloy's co-founder, wants to drive innovation in the additive manufacturing industry by allowing firms to easily and efficiently acquire a varied choice of high-quality metal powders.

- In November 2023, 6K Additive, a branch of 6K Inc., teamed up with Metal Powder Works to manufacture pure copper, copper alloys, and bronze alloy powders for additive manufacturing.

- In October 2023, 3D Lab released the ATO Induction Melting System (IMS) module, which is compatible with their AT Lab Plus atomizer. This module enables the atomization of a larger range of alloys, including those with lower melting points, such as aluminum. This increase in the machine's application for additive manufacturing allows for the creation of small to medium batches of metal powders, making it more appropriate for metal powder production.

Leading Companies in the Metal Powder Market

- Advanced Technology & Materials Co., Ltd

- MolyWorks Materials Corporation

- GKN PLC

- Rio Tinto Metal Powders

- Hoganas AB

- POLEMA

- Rusal

- Liberty House Group

- Sandvik AB

Major Market Segments Covered

By Type

- Ferrous

- Non-ferrous

By Technology

- Press & Sinter

- Additive Manufacturing

- Metal Injection Molding

- Others

By Application

- Healthcare

- Automotive

- Aerospace & Defense

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1181

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us:

Linkedin | Facebook | Twitter