Dublin, April 18, 2024 (GLOBE NEWSWIRE) -- The "Indonesia Cement Industry Research Report 2024-2033" report has been added to ResearchAndMarkets.com's offering.

Indonesia is the largest economy in Southeast Asia with a population of about 280 million at the end of 2023. Indonesia is also the largest producer and consumer of cement in Southeast Asia.

Indonesia has emerged as the sixth-largest cement producer globally, with an estimated production of 66 million metric tons in 2023. Despite the challenges posed by the pandemic, its impact on the country's cement industry has been relatively moderate. Infrastructure and residential-commercial projects have played a crucial role in sustaining domestic demand during this period.

However, cement consumption remains low in Indonesia, with per capita annual production at no more than 300 kilograms, significantly lower than that of its peers like Malaysia (over 600 kilograms per capita) or Vietnam. According to the publisher, this suggests that infrastructure development is still lacking in Southeast Asia's largest economy. The insufficient quality and quantity of infrastructure hinder connectivity, raise logistics costs, reduce business competitiveness, and contribute to social issues, such as limited access to healthcare in rural regions.

The ongoing development of Indonesia's new capital city, IKN, particularly in Sumatra and Eastern Indonesia, has stimulated demand for cement. Leading companies like Semen Indonesia have shifted their focus to the domestic market, capitalizing on improved coal supplies availability in the first half of 2022.

Looking ahead, the cement sector expects significant growth driven by demand from developers undertaking numerous new construction projects, including the construction of a new capital in Borneo Island's jungles. Moreover, Indonesia's ambitious plans for sustained economic growth, with numerous seaports and harbor projects in the pipeline, alongside increasing urbanization, indicate Indonesia will remain a construction hub for years.

However, concerns loom over the industry, including rising production costs, particularly energy-related issues, and worries about the environmental impact of cement production, with instances of local unrest around provincial plants. Furthermore, Indonesia is still grappling with overcapacity in the cement sector, with a utilization level of 54% in 2022 and no expected increase beyond 57% by 2025.

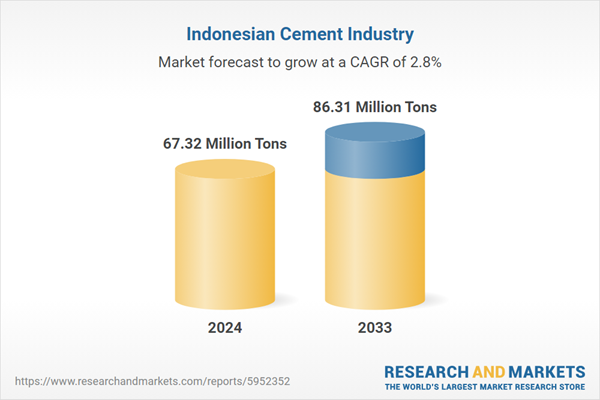

In conclusion, Indonesia's cement industry is expected to have a moderate expansion despite encountering challenges such as fluctuating energy prices, environmental concerns and overcapacity. The publisher projects that the production volume of Indonesia's cement industry will rise from 67.32 million metric tons in 2024 to approximately 86.31 million metric tons by 2033, exhibiting a compound annual growth rate (CAGR) of 2.8%.

Topics covered:

- Indonesia Cement Industry Overview

- Economic environment and policy environment of cements in Indonesia

- Indonesian cement market size from 2019 to 2023

- Analysis of major Indonesian cement manufacturers

- Key Drivers and Market Opportunities of Indonesia's Cement Industry

Key Questions Answered

- What are the key drivers, challenges and opportunities for the Indonesian cement industry during the forecast period 2024-2033?

- What is the expected revenue of the Indonesia Cement market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesian Cement Market is expected to dominate the market in 2033?

- Indonesia Cement Market Forecast from 2024 to 2033

- What are the main headwinds facing Indonesia's cement industry?

Companies Featured

- Semen Indonesia

- Indocement Tunggal Prakarsa

- Holcim Indonesia

- Holcim-Apasco

- Conch

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 60 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 67.32 Million Tons |

| Forecasted Market Value by 2033 | 86.31 Million Tons |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Indonesia |

Key Topics Covered:

1 Overview of Indonesia

1.1 Geographical conditions

1.2 Indonesia's demographic structure

1.3 Indonesia's economy

1.4 Indonesian minimum wage from 2014 to 2024

1.5 Impact of COVID-19 on Indonesia's Cement Industry

2. Development Environment of Indonesia Cement Industry

2.1 Economic Environment

2.1.1 Indonesia's GDP

2.1.2 Minimum Wage in Indonesia, 2014-2023

2.2 FDI in Indonesia Cement Industry

2.3 Policy Environment of Indonesia Cement Industry

2.3.1 Preferential Policies on Foreign Investment of Cement Industry in Indonesia

2.3.2 Policies Related to Imports and Exports of Cement Industry in Indonesia

3. Analysis on Market Status of Indonesia Cement Industry

3.1 Supply of Indonesia Cement Industry

3.1.1 Production Volume of Indonesia Cement Industry

3.1.2 Production volume of Indonesia Cement products by types

3.2 Demand of Indonesia Cement Industry

3.2.1 Domestic Sales Volume of Cement

3.2.2 Market size of Cement

3.2.3 Demand structure and key clients of cement industry in Indonesia

4. Analysis on Import and Export of Cement in Indonesia

4.1 Indonesia Cement Industry Import Situation

4.2 Indonesia Cement Industry Export Situation

5. Cost and Price Analysis of the Indonesia Cement Industry

5.1 Cost

5.1.1 Raw Material Cost

5.1.2 Energy Cost

5.1.3 Human Resources Cost

5.2 Price trend of cement in Indonesia 2020-2024

6. Market Competition Analysis of Indonesia's Cement Industry

6.1 Barriers to entry in Indonesia's cement industry

6.1.1 Brand barriers

6.1.2 Quality barriers

6.1.3 Capital barriers

6.2 Competitive Structure of Indonesia's Cement Industry

7. Top 5 Cement Manufacturers in Indonesia

7.1 Semen Indonesia

7.2 Indocement Tunggal Prakarsa

7.3 Holcim Indonesia

7.4 Holcim-Apasco

7.5 Anhui Conch

8. Indonesia Cement Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Indonesia Cement Industry

8.2 Supply Forecast of Indonesia Cement Industry, 2024-2033

8.3 Demand Forecast of Indonesia Cement Industry, 2024-2033

8.4 Import and Export Forecast of Indonesia Cement Industry, 2024-2033

For more information about this report visit https://www.researchandmarkets.com/r/lb8puu

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment