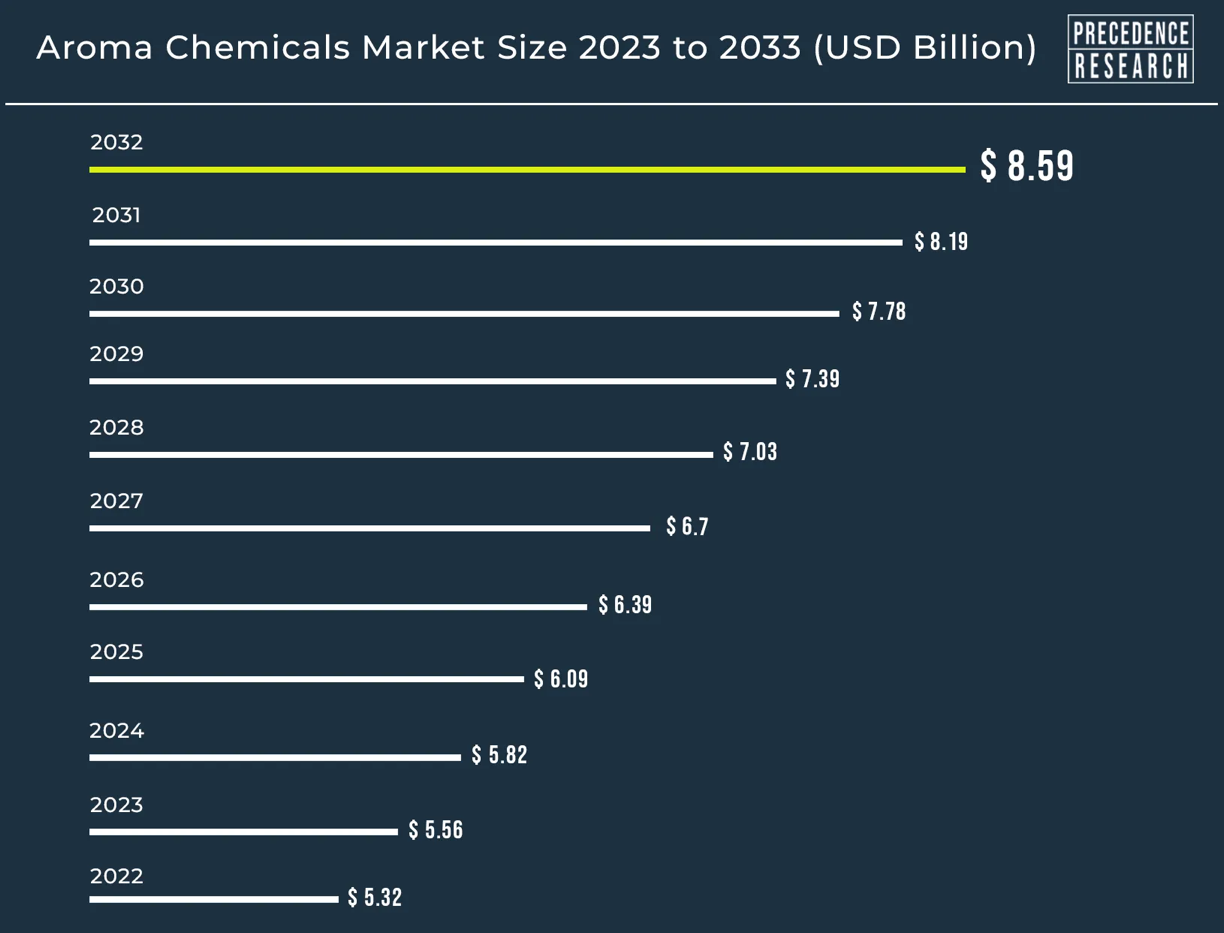

Ottawa, April 18, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global aroma chemicals market size was valued at US$ 5.32 billion in 2023 and it is expanding over US$ 8.19 billion by 2032. The aroma chemicals market is driven by consumer awareness, changing lifestyles, increasing R&D initiatives, and advanced technologies.

Market Overview

The aroma chemicals market encompasses the production, distribution, and sale of synthetic or natural compounds used primarily for their scent or flavoring properties. Aroma chemicals are substances with complex fragrances that improve the fragrance of compositions. They are highly volatile and may easily diffuse smells, resulting in long-lasting fragrances. Natural aroma chemicals are extracted from plant parts and purified by fermentation and separation. Synthetic aroma chemicals are developed in a laboratory, providing clarity about the aromatic signature and chemical ingredients. These compounds can be added to skincare, haircare, personal care, household cleaning supplies, and detergents to improve their fragrance.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2287

Key Insights

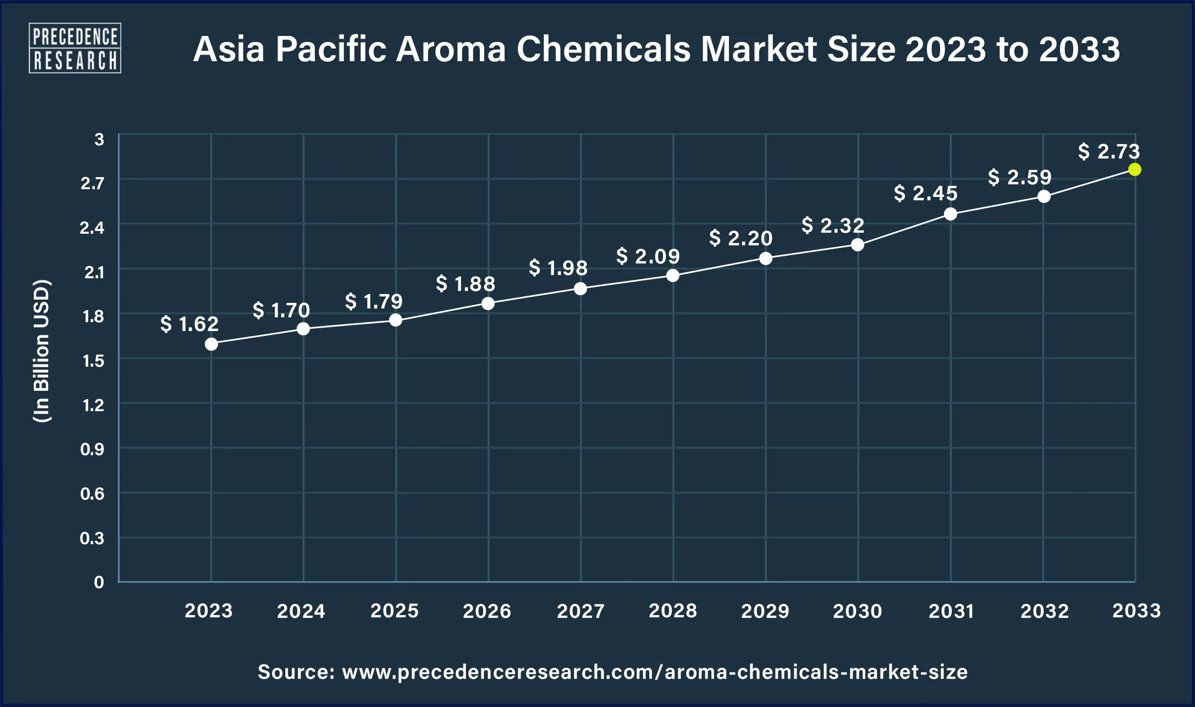

- The Asia Pacific aroma chemicals market size was valued around USD 1.62 billion in 2023

- The Asia Pacific aroma chemicals market size is expected to reach around USD 2.73 billion by 2033 and growing at a CAGR of 5.38% from 2024 to 2033.

- The natural source segment is expanding at a CAGR of 3.8% from 2024 to 2033.

- The terpenes & terpenoids segment is expanding at a CAGR of 4.7% from 2024 to 2033.

- The natural aroma chemicals market is growing at a CAGR of 6.8% from 2024 to 2033.

Regional Stance

Asia-Pacific dominated the aroma chemicals market in 2023. The Asia-Pacific market is being driven by rising demand for tastes and fragrances in the food and beverage industry, as well as increased consumption of packaged and processed goods. Advances in technology for extracting aroma compounds present prospects for industry expansion. China is leading the market because of its strong presence and expansion in key end-user industries.

According to a USDA report, the Indian food sector, the world's third largest, is expanding rapidly, making it the second-largest food producer behind China. Food processors, importers, distributors, retailers, and service providers are likely to expand. According to Risabh Kothari, president of the Fragrances and Flavours Association of India (FAFAI), the fragrance and flavor sector in India is predicted to develop by approximately 12% per year and reach more than USD 5.2 billion in three to four years. Rising disposable incomes and shifting consumer tastes are propelling the industry forward.

- In April 2024, Takasago International Corporation, a Japanese company that manufactures and markets flavors, fragrances, aroma chemicals, and fine chemicals, opened the Takasago International India Fragrance Centre in Mumbai. The center will focus on fragrance research, creation, development, and sensory evaluation. To maintain its position in India's dynamic market, the company is devoted to investing in R&D, creative staff, and disruptive innovation.

- In March 2023, BASF invested in a citral factory in Zhanjiang, China, as well as downstream menthol and linalool factories in Ludwigshafen, Germany, in response to increased global flavor and fragrance market demand and the company's commitment to sustainability transformation.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2287

Report Highlights

Source Insight

The synthetic source segment dominated the aroma chemicals market. Synthetic aroma chemicals are long-lasting, complex scents created at a low cost from petroleum and aromatic molecules. They provide a diverse selection of scents and are evaluated to forecast composition, odor, price, and market availability. They provide a continuous supply to meet expanding market demand while maintaining quality. They also provide a solution for those who are allergic to natural scents because they do not employ genuine plant extract.

The natural source segment is also growing in the market. Natural aroma chemicals derived from plants are thought to improve mood and are gentler on sensitive skin. However, their particular aroma can be influenced by ambient circumstances and plant growth conditions. These small modifications may necessitate formulation adjustments by perfumers. Natural aroma compounds provide high-quality perfumes despite their high cost and scarcity.

Application Insights

The fragrance application segment dominated the aroma chemicals market in 2023. Aroma chemicals are used in a wide range of sectors, including perfumery, food processing, cosmetics, candles, soaps, detergents, fabric softeners, cleaning goods, and pharmaceuticals. They are used to provoke emotions, cover bad odors, and align with brand identity, thus increasing brand loyalty. They are also used in consumer products such as air fresheners, potpourri, and car interiors. Aroma compounds have an important role in creating aromatic experiences that improve our daily lives, influencing all aspects of our sensory interactions with the world.

Chemical Used Insights

The terpenes chemical segment dominated the aroma chemicals market in 2023. Terpenes are a natural flavoring and aroma agent found in food and cosmetics, providing a wide range of flavors and aromas. They are commonly used in the production of essential oils, beverages, flavorings for baked goods, and other products, while in cosmetics, they are used in the production of lotions, perfumes, and other products.

Personalized your customization here: https://www.precedenceresearch.com/customization/2287

Market Dynamics

Driver

Rise in demand for aroma chemicals in the fragrance and flavor industry

Rising demand for different fragrances and flavors is a key driver for the growth of the aroma chemicals market. Rising disposable incomes and shifting consumer tastes are propelling the fragrance and flavor industry forward. Food and beverage, personal care, home care, medicines, and cosmetics are the most common user industries, with huge multinational corporations, domestic companies, and small businesses all participating. The increased demand for natural and organic products creates an opportunity for the fragrance and flavor business. Natural essential oils, a crucial element, have a higher import duty than fragrances. The industry has sent many requests to the government to remedy this issue by raising the VAT on finished fragrance compounds to protect the domestic industry.

Restraint

Health challenges

Fragrances are a prominent allergen, causing allergy responses in 1-2% of individuals. More than half of shampoos, conditioners, and styling treatments include fragrance as a component. The EWG discovered fourteen compounds on average in seventeen well-known brands, all of which were labeled "fragrance." Essential oils, which can be duplicated in a lab, also provide benefits that no lab can match. Synthetic fragrances, on the other hand, use over 3000 different chemical compounds to achieve the same scent. Over 1,200 of these chemicals have been classified as "chemicals of concern," with seven of them being cancer-causing agents and fifteen being banned from use in cosmetics in the EU. Endocrine disruptors, which mimic human hormones and cause aberrant cell reproduction, can have a minor impact at the smallest dosages.

Opportunity

AI in fragrance

AI is gaining popularity in the fragrance sector, with uses ranging from studying customer behavior in e-commerce transactions to creating AI models for scent design and formulation. This has resulted in a greater willingness to use risk resources to advance the sector. AI integration into fundamental fragrance capabilities includes formula-to-brief recommendations, formulation, sensing, and novel chemical design. Formula-to-brief recommendation enables fragrance houses to match current formulations to new briefs, which benefits and monetizes non-exclusive formulas. AI formulation, which creates scent formulations and reformulations using software that predicts their perceptual influence, is difficult due to nonlinear arithmetic and the requirement for interdisciplinary knowledge. However, if operational, AI formulation can result in cost reductions and new revenue streams, such as effective malodor control formulae, near-identical odor profile reformulation, and individualized fragrance. From a perfumer's standpoint, AI formulation empowers and facilitates through decision support rather than replacing the perfumer.

Related Reports

- Pharmaceutical Chemicals Market - The global pharmaceutical chemicals market size was valued at USD 114.70 billion in 2023 and is expanding over USD 205.6 billion by 2032 with a CAGR of 6.7% from 2023 to 2032.

- Specialty Chemicals Market - The global specialty chemicals market size was valued at USD 869.88 billion in 2023 and is expanding over USD 1,244.13 billion by 2032 with a CAGR of 4.06% from 2023 to 2032.

- Agrochemicals Market - The global agrochemicals market size was estimated at USD 229.53 billion in 2023 and is expected to hit USD 280.87 billion by 2030, poised to grow at a CAGR of 2.7% from 2022 to 2030.

- Oleochemicals Market - The global oleochemicals market size was estimated at USD 24.27 billion in 2023 and is expected to hit around USD 46.26 billion by 2032 with a CAGR of 7.4% from 2023 to 2032.

Recent Development

- In August 2023, Harmony Organics was funded Rs 225 crore from Piramal Alternatives, the Piramal Group's fund management arm, to pursue worldwide possibilities in the fragrance and flavor industry. The money comes in the form of convertible securities. Harmony Organics intends to invest in establishing and expanding facilities at both existing and new locations in the future quarters to become one of India's major fragrance chemical players.

- In June 2023, Solvay, a Belgian chemical corporation, was broken into two independent entities: EssentialCo and SpecialCo. EssentialCo will keep the Solvay name and include industries such as soda ash, silica, peroxides, Coatis, and Special Chem. SpecialCo will be renamed Syensqo and will offer specialty polymers, technology solutions, composites, aroma, Novecare, oil and gas, and growth platforms in batteries, thermoplastic composites, renewable materials, and biotechnology.

Key Players in the Aroma Chemicals Market

- Takasgo International Corporation

- Bell Flowers and Fragrances

- Eternis Fine Chemicals Ltd

- Privi Speciality Chemicals

- Kao Corporation

- S H Kelkar and Company Limited

- Henkel AG, BASF SE

- Symrise

- Givaudan

Segments Covered in the Report

By Source

- Synthetic

- Natural

By Products

- Benzoids

- Terpenes

- Musk Chemicals

- others

By Application

- Flavors

- Confectionery

- Convenience Food

- Bakery Food

- Dairy Products

- Beverages

- Others

- Fragrances

- Fine Fragrance

- Cosmetics and Toiletries

- Soaps and Detergents

- Others

By Aroma Node

- Floral

- Woody

- Citrus

- Fruity

- Herbal

- Tropical

- Others

By Color

- Colorless

- White

- Yellowish

- Others

By Form

- Liquid

- Dry

By Distribution Channel

- Indirect

- Direct

By Product Type

- Vainilla Vainas Madagascar

- Tixosil 38 x

- Vainillin

- Carvacrol

- Propilenglicol USP

- Dipropilenglicol

- Dipropilenglicol Metil Eter

- Dihidromircenol

- Cis-3-Hexenol

- Aldehide c-18

- Linalool

- Lysmeral

- Cinnamic Aldehyde

- Citronelol

- Galaxolide

- Iso E Super

- Geraniol

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2287

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

Access our Premium Real Time Data Intelligence Tool, Visit: www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us:

Linkedin | Facebook | Twitter