New York, USA, April 22, 2024 (GLOBE NEWSWIRE) -- EGFR Inhibitor Market to Accelerate Substantially During the Study Period (2020–2034) | DelveInsight

According to DelveInsight’s analysis, the growth of the EGFR inhibitor market is expected to be mainly driven by increasing incidence, a rise in awareness and access to treatment, and robust pipeline activity for cancer indications in the 7MM.

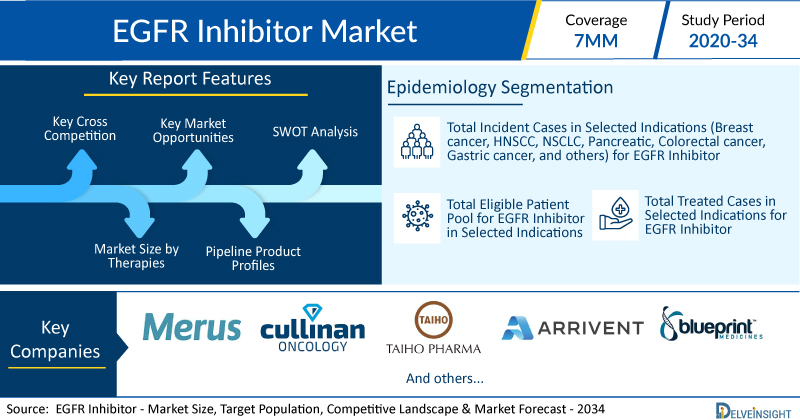

DelveInsight’s EGFR Inhibitor Market Insights report includes a comprehensive understanding of current treatment practices, emerging EGFR inhibitors, market share of individual therapies, and current and forecasted EGFR Inhibitor market size from 2020 to 2034, segmented into 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

Key Takeaways from the EGFR Inhibitor Market Report

- As per DelveInsight’s analysis, the EGFR inhibitor market is anticipated to grow at a significant CAGR by 2034.

- Leading EGFR inhibitor companies such as Merus, Cullinan Oncology, Taiho Pharma, Arrivent Biopharma, Blueprint Medicines Corporation, and others are developing novel EGFR inhibitors that can be available in the EGFR Inhibitor market in the coming years.

- Some of the key EGFR inhibitors include Petosemtamab, MCLA-129, Zipalertinib, Furmonertinib, and BLU-945, among others.

- In February 2024, the FDA approved the combination of TAGRISSO (osimertinib) plus chemotherapy for the treatment of EGFR-mutated non-small cell lung cancer.

- In October 2023, Scorpion Therapeutics presented preclinical data for STX-241, a fourth-generation EGFR Inhibitor, at the AACR-NCI-EORTC Symposium 2023.

- In October 2023, ArriVent received BTD for furmonertinib for First-Line Treatment of Advanced NSCLC with EGFR exon 20 insertion mutations.

Discover which therapies are expected to grab the EGFR inhibitor market share @ EGFR Inhibitor Market Report

EGFR Inhibitor Market Dynamics

The market dynamics of EGFR inhibitors have been a fascinating interplay of scientific advancements, patient needs, and industry competition. These targeted therapies have revolutionized the treatment landscape for various cancers, particularly non-small cell lung cancer (NSCLC). The EGFR inhibitors market has witnessed a steady rise in demand as these inhibitors demonstrate efficacy in patients with specific EGFR mutations. This demand has been a primary driver for pharmaceutical companies to invest heavily in research and development, aiming to bring more effective and less toxic inhibitors to market.

Competition within the EGFR inhibitor market has been fierce, with multiple players vying for market share. Established drugs such as gefitinib and erlotinib have long been staples in treatment protocols, but newer entrants like osimertinib have shaken up the landscape. Osimertinib’s approval as a first-line treatment for NSCLC patients with EGFR mutations has significantly impacted market dynamics, leading to shifts in prescribing patterns and market dominance. Additionally, the emergence of biosimilars and generics has added another layer of complexity, driving down prices and intensifying the battle for market share.

Beyond the competitive landscape, the market dynamics of EGFR inhibitors are intricately linked to evolving treatment paradigms and regulatory developments. Advances in precision medicine, where treatment decisions are tailored to a patient's genetic profile, continue to shape the market. Moreover, ongoing clinical trials exploring combination therapies and new indications promise to expand the market further. Regulatory agencies’ role in approving new indications, ensuring drug safety, and balancing access with affordability will undoubtedly influence the trajectory of the EGFR inhibitor market in the years to come.

EGFR Inhibitor Treatment Market

Inhibiting the activity of EGFR tyrosine kinase is seen as a promising treatment approach for cancer. There are several established methods for this in initial treatments and for patients who have received previous therapies, along with some emerging options. In the first-line treatment, FDA-approved regimens feature the use of first-generation EGFR inhibitors, specifically TARCEVA (erlotinib) and IRESSA (gefitinib), which have shown effectiveness. Additionally, second-generation medications such as GILOTRIF (afatinib) and VIZIMPRO (dacomitinib) have received approval. Among these, the most commonly utilized is the single-agent TAGRISSO (osimertinib).

ERBITUX (cetuximab) is a synthetic, hybrid monoclonal antibody that binds to and hinders the activity of the human epidermal growth factor receptor (EGFR, HER1, c-ErbB-1) found on both normal and cancerous cells. It has been authorized as a therapy for specific cases of advanced colorectal and head and neck cancers. GIOTRIF (afatinib) is an orally administered medication used as an antineoplastic agent to treat locally advanced or metastatic NSCLC. In July 2013, Boehringer Ingelheim obtained approval from the FDA for Afatinib as a first-line treatment option for patients with metastatic NSCLC-carrying EGFR mutations.

TAGRISSO (osimertinib) is a type of EGFR tyrosine kinase inhibitor, created as a treatment for NSCLC patients who have EGFR mutations, especially T790M. It is commonly prescribed when resistance to earlier-generation EGFR inhibitors develops. In April 2018, the FDA approved TAGRISSO to be used as the first-line treatment for patients with metastatic NSCLC whose tumors exhibit EGFR exon 19 deletions or exon 21 L858R mutation, as identified by an FDA-approved test.

NERLYNX (neratinib) is an intracellular kinase inhibitor that binds irreversibly to EGFR, HER2, and HER4. In laboratory studies, neratinib has been shown to decrease EGFR and HER2 autophosphorylation, as well as downstream MAPK and AKT signaling pathways. It has demonstrated anti-tumor effects in carcinoma cell lines expressing EGFR and/or HER2.

Learn more about the FDA-approved EGFR inhibitor @ EGFR Inhibitor Drugs

Key Emerging EGFR Inhibitors and Companies

Some of the drugs in the pipeline include Petosemtamab (Merus), MCLA-129 (Merus), and Zipalertinib (Cullinan Oncology/Taiho Pharma), Furmonertinib (Arrivent Biopharma), BLU-945 (Blueprint Medicines Corporation), and others.

Petosemtamab (Merus), a bispecific biclonics low-fucose human full-length IgG1 antibody, is designed to target both the EGFR and the leucine-rich repeat-containing G-protein-coupled receptor 5 (LGR5). It is currently under development for potential use in treating HNSCC. The ongoing Phase I/II clinical trial of petosemtamab is now in its dose-expansion phase, conducted as an open-label, multicenter study. The trial is actively enrolling patients with HNSCC, exploring the efficacy of petosemtamab alone in those previously treated for HNSCC, as well as in combination with KEYTRUDA (pembrolizumab) for untreated cases of HNSCC.

The company’s presentation outlines plans for a Phase III monotherapy trial set to begin in mid-2024. Updates on the clinical progress of second-line treatment with petosemtamab are slated for 2024, alongside expectations for updates on combination therapy in the first half of that same year.

MCLA-129 another Merus lead asset, is an ADCC-enhanced human IgG1 biclonics, is designed to target EGFR and c-MET. Merus has granted exclusive development and potential commercialization rights of MCLA-129 in China to Betta Pharmaceuticals while retaining complete rights for all other regions. The drug is currently undergoing Phase I/II trials for the treatment of advanced NSCLC and various solid tumors. Patient enrollment for dose expansion cohorts is ongoing, examining the effectiveness of MCLA-129 as monotherapy in MET ex14 NSCLC, in combination with TAGRISSO for treatment-naïve EGFR mutant (m) NSCLC, and for EGFRm NSCLC that has progressed after TAGRISSO. Additionally, trials are assessing MCLA-129 combined with chemotherapy for 2L+ EGFRm NSCLC. The company’s presentation indicates plans to begin combination therapy with chemotherapy in the first quarter of 2024.

Zipalertinib (CLN-081/TAS6417) by Cullinan Oncology/Taiho Pharma is a new type of EGFR inhibitor that can be taken by mouth and works in a way that cannot be reversed. In laboratory studies, it has shown a strong ability to target and affect cells that have EGFRex20ins mutations, while being gentler on cells with the regular EGFR, aiming to prevent the negative effects that can come from inhibiting the normal EGFR function. By 2024, the crucial Phase IIb trial focusing on treating NSCLC after the second line and beyond was completely filled with participants. At the same time, enrollment is actively happening for the Phase III trial which aims to treat NSCLC with exon 20 insertion mutations right from the start of treatment.

The anticipated launch of these emerging therapies are poised to transform the EGFR inhibitors market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the EGFR inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about EGFR inhibitor clinical trials, visit @ EGFR Inhibitor Treatment Drugs

EGFR Inhibitor Overview

EGFR inhibitors, a class of targeted therapy, stand at the forefront of precision medicine for certain types of cancer. Epidermal Growth Factor Receptor (EGFR) plays a crucial role in cell growth and division, and when it becomes overactive due to mutations, it can lead to uncontrolled cell proliferation—a hallmark of cancer. EGFR inhibitors work by blocking this receptor, impeding its signaling pathways that drive cancer growth. This targeted approach often results in fewer side effects compared to traditional chemotherapy, as it focuses on cancer cells while sparing healthy ones. Through personalized medicine, these inhibitors are paving the way for more effective, tailored cancer treatments.

However, challenges persist in the realm of EGFR inhibitors, notably the development of resistance. Despite initial successes, cancer cells can adapt, developing mechanisms to bypass the inhibitory effects of these drugs. Scientists continue to investigate combination therapies and new generations of inhibitors to overcome this hurdle. Additionally, the identification of biomarkers for patient selection is crucial to optimize treatment outcomes. EGFR inhibitors exemplify the promising direction of targeted therapies in oncology, illustrating the ongoing quest to refine treatments for better efficacy, reduced side effects, and improved outcomes in the fight against cancer.

EGFR Inhibitor Epidemiology Segmentation

The EGFR inhibitor report takes into the account of historical, current, and forecasted EGFR inhibitor patient pool. According to the European Society for Medical Oncology (ESMO), NSCLC is the most common type of lung cancer, accounting for 80─90% of all lung cancer cases.

The EGFR inhibitor market report proffers epidemiological analysis for the study period 2019–2032 in the 7MM segmented into:

- Total Incident Cases in Selected Indications (Breast cancer, HNSCC, NSCLC, Pancreatic, Colorectal cancer, Gastric cancer, and others) for EGFR Inhibitor

- Total Eligible Patient Pool for EGFR Inhibitor in Selected Indications

- Total Treated Cases in Selected Indications for EGFR Inhibitor

Download the report to understand what epidemiologists are saying about how EGFR inhibitor patient trends in 7MM @ EGFR Inhibitor Epidemiological Insights

| EGFR Inhibitor Report Metrics | Details |

| Study Period | 2020–2034 |

| EGFR Inhibitor Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Key EGFR Inhibitor Companies | Merus, Cullinan Oncology, Taiho Pharma, Arrivent Biopharma, Blueprint Medicines Corporation, and others |

| Key EGFR Inhibitor | Petosemtamab, MCLA-129, Zipalertinib, Furmonertinib, and BLU-945, among others |

Scope of the EGFR Inhibitor Market Report

- EGFR Inhibitor Therapeutic Assessment: EGFR Inhibitor current marketed and emerging therapies

- EGFR Inhibitor Market Dynamics: Attribute Analysis of Emerging EGFR Inhibitor Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, EGFR Inhibitor Market Access and Reimbursement

Discover more about EGFR inhibitor drugs in development @ EGFR Inhibitor Clinical Trials

Table of Contents

| 1. | EGFR Inhibitor Market Key Insights |

| 2. | EGFR Inhibitor Market Report Introduction |

| 3. | EGFR Inhibitor Market Overview at a Glance |

| 4. | EGFR Inhibitor Market Executive Summary |

| 5. | Disease Background and Overview |

| 6. | EGFR Inhibitor Treatment and Management |

| 7. | EGFR Inhibitor Epidemiology and Patient Population |

| 8. | Patient Journey |

| 9. | EGFR Inhibitor Marketed Drugs |

| 10. | EGFR Inhibitor Emerging Drugs |

| 11. | Seven Major EGFR Inhibitor Market Analysis |

| 12. | EGFR Inhibitor Market Outlook |

| 13. | Potential of Current and Emerging Therapies |

| 14. | KOL Views |

| 15. | Unmet Needs |

| 16. | SWOT Analysis |

| 17. | Appendix |

| 18. | DelveInsight Capabilities |

| 19. | Disclaimer |

| 20. | About DelveInsight |

Related Reports

KRAS Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key KRAS inhibitors companies, including Novartis, Roche, Genentech, Verastem Oncology, Revolution Medicines, Cardiff Oncology, Immuneering Corporation, Jacobio Pharmaceuticals, BridgeBio Pharma, Mirati Therapeutics, Deciphera Pharmaceuticals, Elicio Therapeutics, InventisBio, Gritstone Bio, D3 Bio, among others.

PD/L-1 Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key PD/L-1 inhibitors companies, including Merck, Laekna Therapeutics, Genentech, Tracon Pharmaceuticals Inc., Celgene, MedImmune, Hangzhou Sumgen Biotech, among others.

TROP-2 Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key TROP-2 inhibitors companies, including Daiichi Sankyo, AstraZeneca, Kelun Biotech, Merck, DualityBio, BioNTech, BiOneCure Therapeutics, among others.

HER2+ Market Size, Target Population, Competitive Landscape & Market Forecast – 2034 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key HER2+ companies, including Zymeworks, Jazz Pharmaceuticals, Ambrx, AnBogen Therapeutics, Enliven Therapeutics, Roche, among others.

JAK Inhibitors Competitive Landscape

JAK Inhibitors Competitive Landscape – 2024 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key JAK inhibitors companies, including Pfizer, Sierra Oncology, Theravance Biopharma, Dizal Pharmaceutical, Aclaris Therapeutics, Celon Pharma, Incyte Corporation, AbbVie, Galapagos, among others.

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter