- Third consecutive month of strong growth in sales, with levels returning to historical averages for this period of the year.

- The number of properties for sale on the market is experiencing an upward adjustment, leading to increased market fluidity, especially in the higher price ranges.

- Despite everything, market conditions continue to favour sellers with signs of overheating, particularly on Montreal’s South and North Shores.

- The more affordable and mid-price properties are the most exposed to overheating.

L’ÎLE-DES-SŒURS, Quebec, May 06, 2024 (GLOBE NEWSWIRE) -- The Quebec Professional Association of Real Estate Brokers (QPAREB) has just released its residential real estate market statistics for the month of April 2024. The most recent market statistics for the Montreal Census Metropolitan Area (CMA) are based on the real estate brokers’ Centris provincial database.

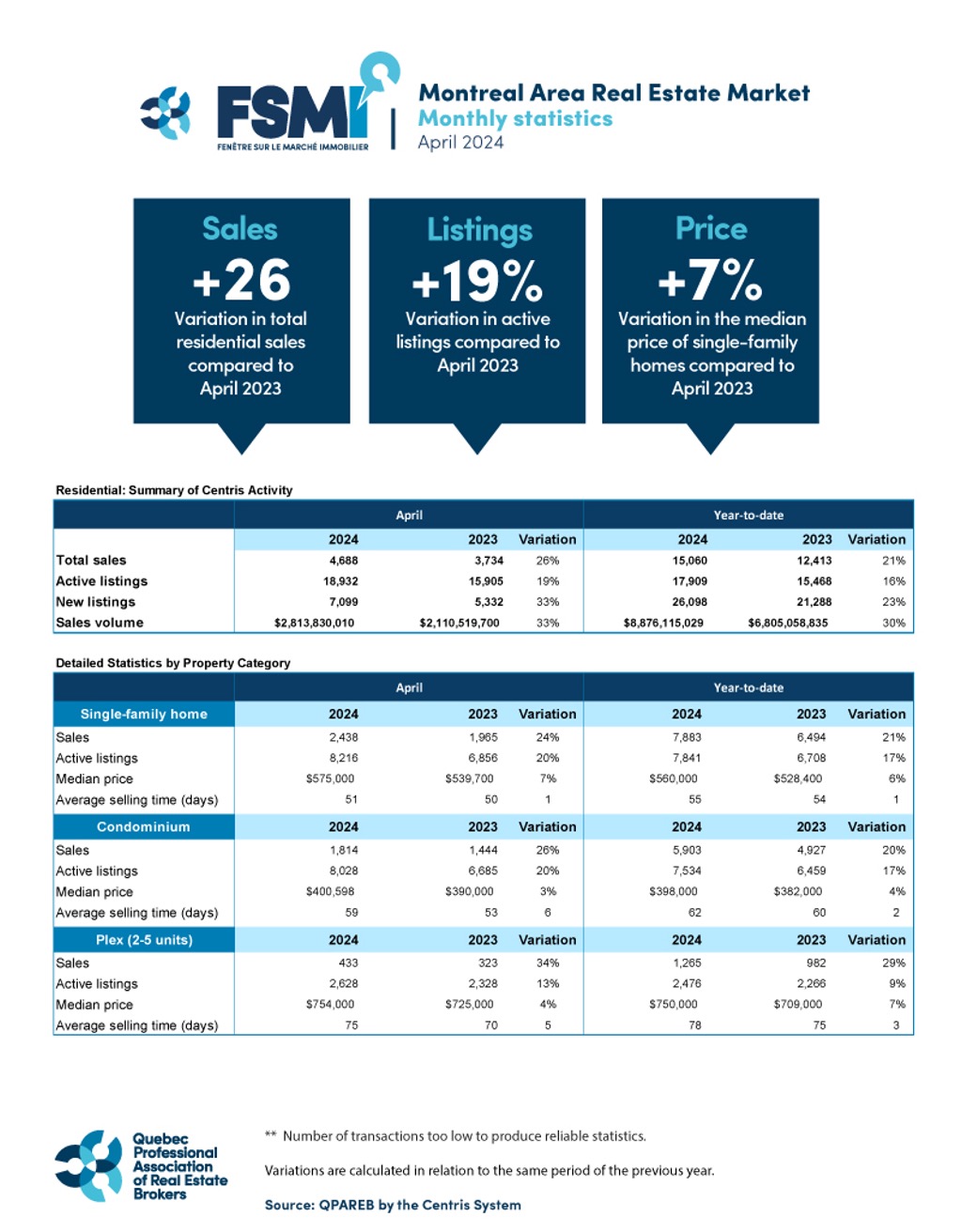

Residential sales in the Montreal CMA territory stood at 4,688 in April 2024, a marked increase of 26 per cent, or 954 transactions, compared to the same period last year. It should be noted, however, that this level of transactional activity is slightly under the historical average recorded for this time of year since the Centris system began compiling market data in 2000.

“Following an early rebound in activity in February, a very reactive recovery of the market took place in April due to two clear factors: an increasingly obvious and imminent return to a downward cycle in interest rates, in addition to a resumption of price growth that this drop in rates may suggest. Despite a persistently weak consumer confidence index marked by job cuts, this nevertheless indicates that more and more consumers believe that this is a good time to make a major purchase, such as a property,” notes Charles Brant, QPAREB Market Analysis Director.

“However, even if purchasing intentions are tangible, the ability to take action belongs to repeat buyers as prices in the Montreal region have reached the highs of 2022 for the same time of year. Helped by better market fluidity, the wealthiest are particularly active in single-family homes and condominiums in price ranges above $700,000 with sales up by 48 per cent in this price segment, compared to 25 per cent for all price ranges combined,” he adds.

April highlights

- Residential property sales are up in all of the Montreal CMA’s main metropolitan areas. Laval, with 438 transactions, stands out with a jump of 35 per cent compared to April of last year. The Island of Montreal (1,713 sales, +27 per cent), the North Shore of Montreal (1,095 sales, +26 per cent), the South Shore of Montreal (1,109 sales, +23 per cent) and Saint-Jean-sur-Richelieu (133 sales, +22 per cent) follow with increases all above 20 per cent compared to April 2023. Vaudreuil-Soulanges (200 sales) posted a 13 per cent increase.

- Transactional activity by property category varied between 24 per cent and 34 per cent for the period. With 2,438 sales, the number of single-family homes sold was up 24 per cent compared to the same period last year. Condominium sales, reaching 1,814 transactions, increased by 26 per cent. Small income properties jumped sharply by 34 per cent to 433 sales.

- Active listings posted a marked increase of 19 per cent during the month of April 2024 from a year ago to reach 18,932 listings in the Montreal CMA. This increase in listings was observed across all property categories. Note that the inventory of available properties is slightly under the historical average recorded for this time of year since the Centris system began compiling market data in 2000.

- The average selling time for small income properties was 75 days, 5 days longer than the same period a year ago. Condominiums and single-family homes follow at 59 days and 51 days, respectively. This is 6 days more for condominiums and 1 day more for single-family homes.

- All median prices were up when compared to those in effect at the same period last year. Single-family homes sold at a median price of $575,000, an increase of 7 per cent compared to last year. The median price of condominiums stood at $400,598, a slight increase of 3 per cent. With a median price of $754,000, plexes recorded an increase of 4 per cent for the period.

- On a consecutive monthly basis, median prices were relatively stable compared to March 2024. Single-family homes saw their median price increase by 2 per cent, that of small income properties by 1 per cent, while that of condominiums remained stable (0 per cent).

- On an annual basis, variations in median prices for single-family homes in the main metropolitan areas of the Montreal CMA varied between +3 per cent and +9 per cent. Substantial median price increases were reported for the South Shore of Montreal (+9 per cent), Laval (+7 per cent) and Vaudreuil-Soulanges (+6 per cent). The North Shore of Montreal, the Island of Montreal and Saint-Jean-sur-Richelieu followed with respective increases of 5 per cent, 4 per cent and 3 per cent.

Additional information:

Detailed and cumulative monthly statistics for the province and regions

If you would like additional information from the Market Analysis Department, such as specific data or regional details on the real estate market, please write to us.

About the Quebec Professional Association of Real Estate Brokers

The Quebec Professional Association of Real Estate Brokers (QPAREB) is a non-profit association that brings together more than 14,000 real estate brokers and agencies. It is responsible for promoting and defending their interests while taking into account the issues facing the profession and the various professional and regional realities of its members. The QPAREB is also a major player in many real estate dossiers, including the implementation of measures that promote homeownership. The Association reports on Québec’s residential real estate market statistics, provides training, tools and services relating to real estate, and facilitates the collection, dissemination and exchange of information. The QPAREB has its head office in Quebec City, administrative offices in Montreal and a regional office in Saguenay. It has two subsidiaries: Société Centris inc. and the Collège de l’immobilier du Québec. Follow its activities at qpareb.ca or via its social media pages: Facebook, LinkedIn, Twitter and Instagram..

For more information:

Ariane Boulé

Morin Relations Publiques

media@qpareb.ca

Image bank (credit QPAREB) available free of charge.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/954b9ce1-3386-4831-bede-eefae116ebba