SAN ANTONIO, May 09, 2024 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold mining to airlines, today reported operating revenues of $2.6 million in the quarter ended March 31, 2024. Net income was mostly flat as the Company saw a decrease in advisory fees, lower investment income and lower assets under management (AUM) compared to the previous quarter and the same quarter a year earlier.

For the three-month period ended March 31, 2024, average AUM was $1.8 billion, while AUM as of March 31, 2024, were $1.7 billion.

The Company’s shareholder yield at the end of the period was 8.32%,1 which exceeded the yields on the five-year and 10-year Treasury. This represents the Board of Directors’ commitment to returning value to shareholders through a combination of monthly dividends and share repurchases.

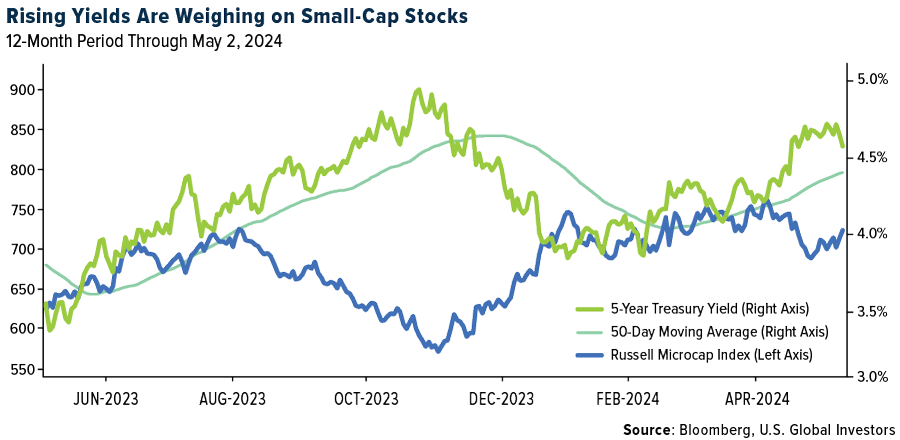

“We consider GROW a deep-value stock, especially with the Federal Reserve keeping rates higher for longer,” says Frank Holmes, the Company’s CEO and Chief Investment Officer. “Higher borrowing costs affect companies of all sizes, but they put substantial pressure on small and microcap stocks, which are generally more sensitive to economic shifts and smaller financial cushions.”

Quarterly Share Repurchases

The Company repurchased a total of 211,282 of its own shares during the quarter ended March 31, 2024, at a net cost of approximately $577,000. This marks a 9.4% increase from the same period a year earlier and represents the most shares that the Company has bought back in a single quarter in the past few years.

London-Listed JETS Merges with TRIP, Increasing AUM Fivefold

As was covered in a previous press release,2 the Company announced that its Europe-domiciled airlines ETF, the U.S. Global Jets UCITS ETF (JETS), merged into the Travel UCITS ETF (TRIP), effective April 19, 2024. This move is expected to increase JETS’ AUM fivefold, providing a larger base to grow assets and further solidifying the Company’s position as a leader in thematic investing.

“We’re pleased and extremely excited about the recent merger of our smart beta 2.0 JETS ETF, listed on the London Stock Exchange, into TRIP,” says Mr. Holmes. “TRIP presents a unique opportunity for the company to increase assets from around $5 million to $20 million. We’re confident that our expertise in the quantamental investment space has unlocked new avenues for shareholders, both domestically and internationally, as evidenced in this merger.”

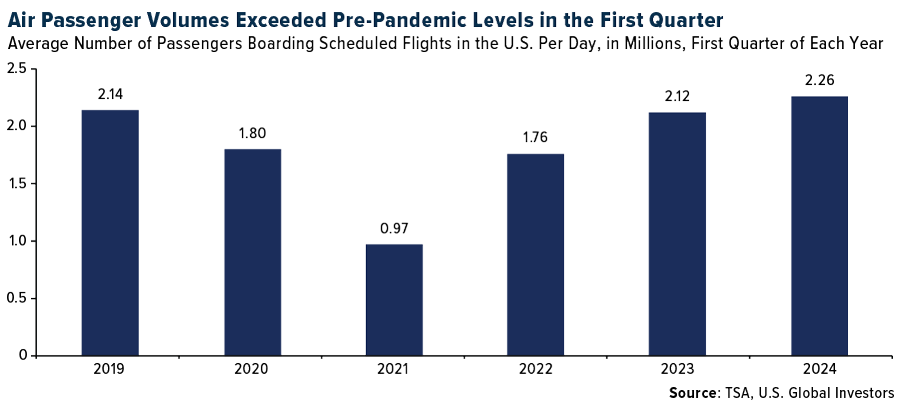

The Company maintains its bullishness on the travel industry as airline executives predict that a record number of passengers will fly this summer.3 Checkpoint volumes provided by the Transportation Security Administration (TSA) are off to a record start in 2024, with carriers in the U.S. handling an average of 2.26 million passengers each day, a 5.6% increase over the same period in 2019, before the pandemic.

GOAU Responding Well to ATH Gold Prices as Central Bank Demand Perseveres

The price of gold recently hit a record high on geopolitical uncertainty and fears that persistently sticky inflation will convince the Federal Reserve to keep rates higher for longer. The metal traded above $2,400 per ounce for the first time ever on Friday, April 12. Meanwhile, the first quarter of 2024 saw central banks purchase a net 290 tons of gold, a record amount for the start to a year.4

“Gold’s recent surge isn’t just a U.S. dollar story. The precious metal is also making historic breakouts in various currencies around the world, from the Japanese yen to the Chinese yuan and Indian rupee,” says Mr. Holmes. “This global phenomenon underscores gold’s broad appeal as a store of value and a means of preserving purchasing power. It’s also constructive for our U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU), which takes a quantitative approach to picking gold mining stocks. We’re happy to see that the smart-beta 2.0 ETF has been performing as expected with gold near all-time highs.”

Healthy Liquidity and Capital Resources

As of March 31, 2024, the Company had net working capital of approximately $38.6 million, an increase of $1.2 million from June 30, 2023. With approximately $27.5 million in cash and cash equivalents, plus investments in our funds and other securities, the Company has adequate liquidity to meet its current obligations.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Friday, May 10, 2024, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | |||||

| 3/31/2024 | 3/31/2023 | ||||

| Operating Revenues | $ | 2,593 | $ | 3,624 | |

| Operating Expenses | 3,081 | 2,894 | |||

| Operating Income (Loss) | (488 | ) | 730 | ||

| Total Other Income | 528 | 1,216 | |||

| Income Before Income Taxes | 40 | 1,946 | |||

| Income Tax Expense | 75 | 326 | |||

| Net Income (Loss) | $ | (35 | ) | $ | 1,620 |

| Net Income Per Share (Basic and Diluted) | $ | 0.00 | $ | 0.11 | |

| Avg. Common Shares Outstanding (Basic) | 14,077,042 | 14,747,537 | |||

| Avg. Common Shares Outstanding (Diluted) | 14,077,042 | 14,747,637 | |||

| Avg. Assets Under Management (Billions) | $ | 1.8 | $ | 2.5 | |

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here, GOAU here and for SEA here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS and GOAU.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and GOAU.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market.

_____________________________

1 The Company calculates shareholder yield by adding the percentage of change in shares outstanding to the dividend yield for the 12 months ending March 31, 2024. The Company did not have debt; therefore, no debt reduction was included.

2 U.S. Global Investors announces merger of Europe-Domiciled Airlines ETF into the Travel UCITS ETF (TRIP), expanding and diversifying investment opportunities in global travel industry. USGI. (2024, April 23). https://www.usfunds.com/resource/u-s-global-investors-announces-merger-of-europe-domiciled-airlines-etf-into-the-travel-ucits-etf-trip-expanding-and-diversifying-investment-opportunities-in-global-travel-industry/

3 Josephs, L. (2024, April 18). Airline executives predict a record summer and even more demand for First class. CNBC. https://www.cnbc.com/2024/04/17/airline-execs-predict-record-summer-even-more-demand-for-first-class.html

4 Gold demand trends Q1 2024. World Gold Council. (2024, April 30). https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2024

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/af421562-6bd8-45e7-8c43-08983c981e94

https://www.globenewswire.com/NewsRoom/AttachmentNg/06b1720e-a52a-4db9-987e-637fc6b1dc91