Dublin, May 24, 2024 (GLOBE NEWSWIRE) -- The "Southeast Asia Data Center Market Landscape 2024-2029" report has been added to ResearchAndMarkets.com's offering.

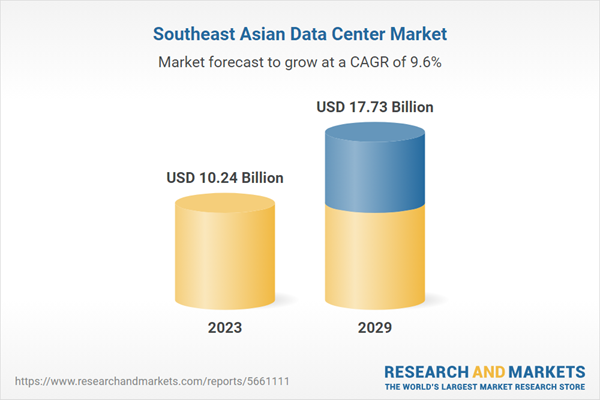

The Southeast Asia data center market is expected to grow from $10.24 Billion in 2023 to reach $17.73 Billion in 2029, at a CAGR of 9.59%.

AirTrunk, Digital Edge, ST Telemedia Global Data Centers, Chindata Group, DCI Indonesia, Digital Realty, Equinix, GDS Services, Keppel Data Centres, NTT DATA, Viettel IDC, and others are among the current major investors in the Southeast Asia data center market.

ABB, Airedale, Schneider Electric, Cummins, Legrand, Siemens, Eaton, Rittal, Vertiv are among the major support infrastructure vendors in the Southeast Asia data center market. These companies have a strong global presence and have been operating across Southeast Asia for many years. They operate directly in some prominent countries with numerous existing and ongoing ventures. In other countries, they operate through channel partners and distributors, competing with local vendors.

Prominent investors such as CtrlS Data Centres, EdgeConneX, Yondr, YTL Data Center, i-Berhad, Gaw Capital, Evolution Data Centres are entering the Southeast Asia data center market, bringing with them a significant presence in other countries. These companies can potentially disrupt the existing market by competing with current players and their customer base.

KEY TRENDS

Digitalization Gaining Momentum

- Prominent Southeast Asian countries such as Singapore, Malaysia, Indonesia, Thailand, and the Philippines are prioritizing digitalization initiatives. Local governments in many of these countries are offering incentives to encourage ongoing digitalization efforts, leading to an increased demand for cloud services. These factors, among others, have become key drivers for the growth and development of the Southeast Asia data center market.

- The adoption and expansion of 5G services and connectivity is rapidly spreading in the countries. Almost every Southeast Asian country now has 5G connectivity, and many of them have set targets to establish nationwide coverage shortly.

- The countries in this region share a common goal of advancing activities that lead to long-term digital progress, supported by their respective governments. For example, Malaysia's Digital initiative plays a crucial role in driving the growth of the country's ecosystem across various essential and non-essential sectors. This initiative creates opportunities in the digital economy by leveraging programs such as the Malaysia Digital Catalytic Programs (PEMANGKIN) and others, positioning the country at the forefront of global digital progress.

Increasing Adoption of Cloud-based Services

- Global cloud services providers like Amazon Web Services, Google, Microsoft, Tencent Cloud, and others have made many investments and set up their dedicated cloud regions in the past in countries like Singapore and Indonesia. They are now actively expanding their presence with planned upcoming cloud regions in Malaysia and Thailand, among other Southeast Asian countries. The companies are also expanding their self-built data center facilities in countries like Singapore.

- The rising popularity of technologies such as Artificial Intelligence (AI) and machine learning workloads has the potential for significant growth. This is mainly due to the contributions of global cloud service providers like Amazon Web Services, Google, Microsoft, and others. Data center operators are redesigning their facilities to be compatible with AI workloads with the help of liquid-based cooling technologies.

- Cloud services are continuing to grow and expand in Southeast Asia. Local enterprises increasingly embrace digitalization to gain a competitive edge, acting as a positive catalyst. The demand for cloud services in this region notably rose during the COVID-19 pandemic and continues to surge. This is primarily due to the crucial need for business continuity and the drive to remain relevant and irreplaceable within their specific industries.

SEGMENTATION INSIGHTS

- The launch of numerous innovative power and cooling systems has emphasized sustainability. Infrastructure providers are increasingly focusing on developing products that minimize environmental impact. In recent years, data center operators have been implementing new and energy-efficient cooling systems intending to reduce power consumption by up to 50%. This trend is expected to continue in the forecast period as market vendors continually invest in developing more efficient products.

- Countries in this region, such as Indonesia, Malaysia, the Philippines, Singapore, and Thailand, have tropical climatic conditions. As a result, the preferred method for cooling data centers in these countries is mostly water-based, chosen for its cost-effectiveness and ease of implementation. This choice is influenced by the fact that almost all these countries are surrounded by oceans. However, alternative cooling methods like liquid cooling are also viable options to increase energy efficiency and decrease consumption.

- The Southeast Asia data center market has seen a rise in establishing data centers, particularly those with Uptime Tier III and IV certifications in either the design or construction phases. Many public and private entities, including those in banking, financial services and insurance (BFSI), education, and government sectors, are obtaining the Uptime Institute's Tier III/IV certification either during the design phase or after the facility's completion.

GEOGRAPHICAL ANALYSIS

- The Southeast Asia data center market is heavily influenced by the development of colocation facilities, which attract significant investment. The market continues to expand as new players actively participate in establishing colocation data centers. At the same time, hyperscale data center operators are expanding their presence in the market by making substantial investments in cloud regions. In 2023, countries such as Malaysia, Indonesia, and the Philippines also saw significant investments in enterprise data centers.

- Despite the moratorium being lifted, Singapore's status as the top location for regional data centers may experience a slowdown due to other detrimental factors. In 2023, the Infocomm Media Development Authority (IMDA) and the Singapore Economic Development Board (EDB) selected four data center operators - Microsoft, AirTrunk, Equinix, and GDS Services - to build new data center facilities with a combined power capacity of about 80 MW.

- Malaysia's recent investments, particularly in its capital cities of Kuala Lumpur and Johor, have significantly increased over the past two years. As a result, Malaysia's power capacity is expected to exceed 2 GW, with numerous new facilities set to operational in 2024 and 2025. Artificial intelligence has played a significant role in advancing and strengthening Malaysia in recent years.

- Batam is becoming an important location for data centers in Indonesia, with promising opportunities due to the overflow of demand from Singapore. The construction of new data centers in Singapore slowed after a moratorium on construction was lifted in 2022. Batam's proximity to Singapore means that enterprises in Singapore are considering storing their data in Batam due to cross-border data transfer implications

- Thailand and the Philippines have also witnessed several new investments during the past few years. A cumulative capacity addition of over 600 MW is in the pipeline, and it will most likely go online during the forecast period.

- Vietnam's local data center operators, such as VNPT and Viettel IDC, are expected to attract new investments. Additionally, we anticipate that investments from global operators will continue to increase in Vietnam. Potential investments from Gaw Capital and NTT DATA are also seen as positive possibilities.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 110 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $10.24 Billion |

| Forecasted Market Value (USD) by 2029 | $17.73 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Asia Pacific |

Key IT Infrastructure Providers

- Arista Networks

- Broadcom

- Cisco Systems

- Dell Technologies

- Extreme Networks

- Fujitsu

- Hewlett Packard Enterprise

- Huawei Technologies

- Intel

- IBM

- Inspur

- Lenovo

- NEC

- NetApp

- Oracle

- Quantum

- Supermicro

- Seagate Technology

- Toshiba

- Western Digital

- Wiwynn

Prominent Support Infrastructure

- ABB

- Airedale

- Alfa Laval

- Canovate

- Caterpillar

- Cisco Systems

- Cummins

- Cyber Power

- Dell Technologies

- Delta Electronics

- EAE Group

- EATON

- Envicool

- Fuji Electric

- Fujitsu

- Green Revolution Cooling

- Hewlett Packard Enterprise

- HITEC Power Protection

- Huawei Technologies

- Kohler

- Legrand

- Lenovo

- Mitsubishi Electric

- Narada Power

- Nortek Air Solutions

- Piller Power Systems

- Rittal

- Rolls-Royce

- Schneider Electric

- Siemens

- Socomec

- STULZ

- Trane

- Vertiv

Prominent Construction Contractors

- Arup

- AtkinsRealis

- Aurecon

- AWP Architects

- Corgan

- CSF Group

- DPR Construction

- DSCO Group

- First Balfour

- Fortis Construction

- Gammon Construction

- ISG

- Kienta Engineering Construction

- Linesight

- LSK Engineering

- M+W Group (Exyte)

- Nakano Corporation

- NTT Facilities

- Obayashi Corporation

- PM Group

- Powerware Systems

- Red Engineering

- Sato Kogyo

- Studio One Design

Prominent Data Center Investors

- AirTrunk

- Amazon Web Services

- Beeinfotech

- Big Data Exchange

- Chindata Group

- Converge ICT Solutions

- DCI Indonesia

- Digital Edge

- Digital Realty

- ePLDT

- Equinix

- FPT Telecom

- GDS Services

- Keppel Data Centres

- MettaDC

- Microsoft

- Meta

- NTT DATA

- OneAsia Network

- Open DC

- Princeton Digital Group

- Singtel

- ST Telemedia Global Data Centres

- Telkom Indonesia

- VADS (Telekom Malaysia)

- Vantage Data Centers

- Viettel IDC

New Entrants

- CtrlS Datacenters

- Digital Halo

- EdgeConneX

- Evolution Data Centres

- Flow Digital Infrastructure

- FutureData

- Gaw Capital

- i-Berhad

- Infinaxis Data Centre

- Infracrowd Capital

- K2 Data Centres

- Minoro Energi Indonesia

- Nautilus Data Technologies

- Pure Data Centres Group

- YCO Cloud

- YTL Data Center

- Yondr

For more information about this report visit https://www.researchandmarkets.com/r/7p2ri3

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment