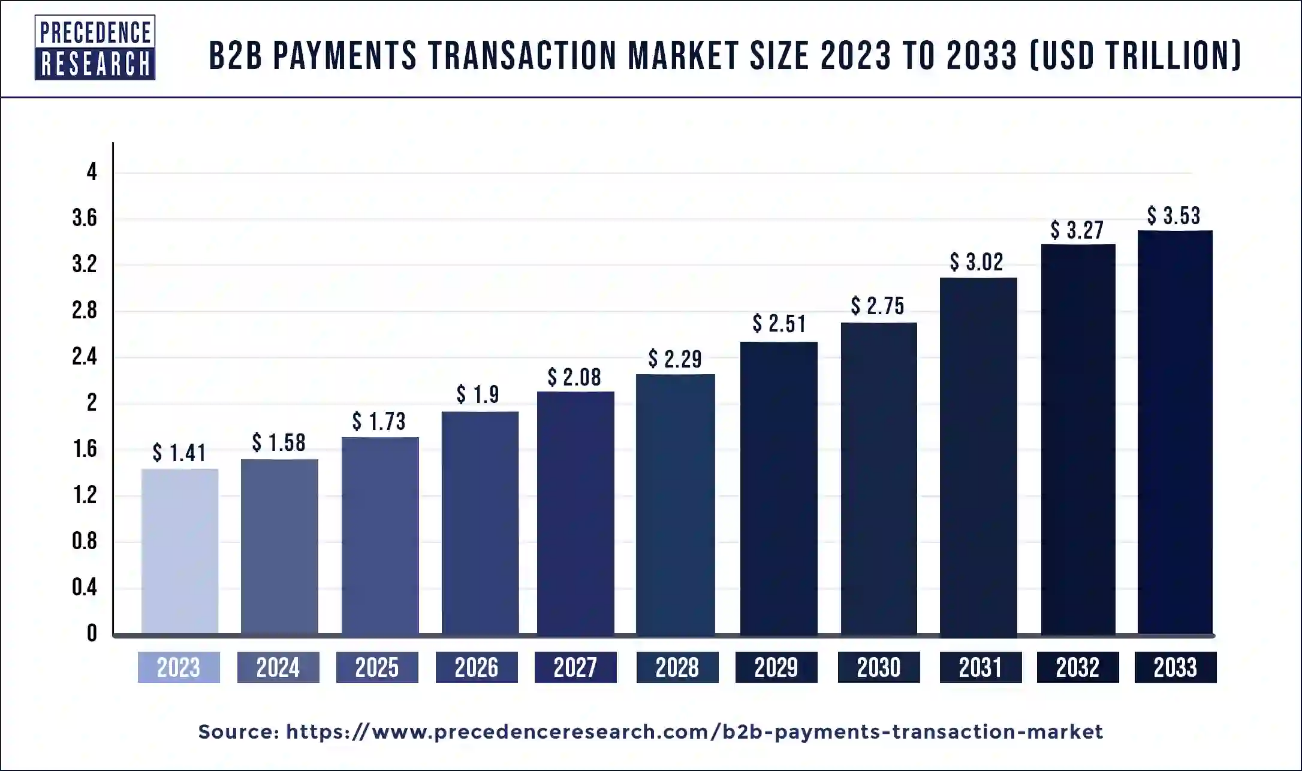

Ottawa, May 24, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global B2B payments transaction market size surpassed USD 1.41 trillion in 2023 and is predicted to hit around USD 3.27 trillion by 2032. Increased e-commerce usage, less time consumption, and advanced technologies drive the B2B transaction market.

The B2B payments transaction market is growing due to the continuous need for transaction systems and the increased number of businesses. Business-to-business (B2B) payment systems, including those used by acquisition, payroll, accounts payable, and receivable departments, provide safer transactions for merchants and end users. Because they take longer to process, they are more complicated than B2C payments.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1274

The growing digitization and automation of business-to-business payment systems have raised the need for business owners to network with global suppliers, distributors, and retailers. The growth of international trade and cross-border transactions power the world market. However, the COVID-19 pandemic and increased commercial payment fraud could impede industry expansion. However, partnerships between FinTech giants and B2B payment operators and advancements in transparency are expected to present the market with appealing growth opportunities.

B2B Payments Transaction Market Key Insights

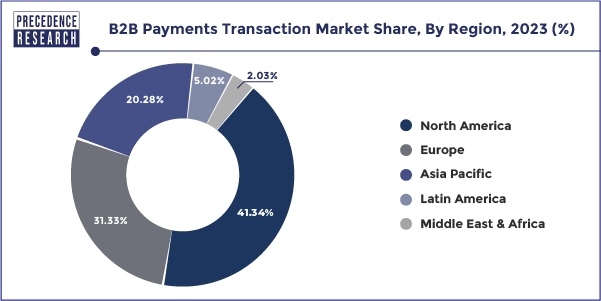

- North America has held the largest revenue share of 41.34% in 2023.

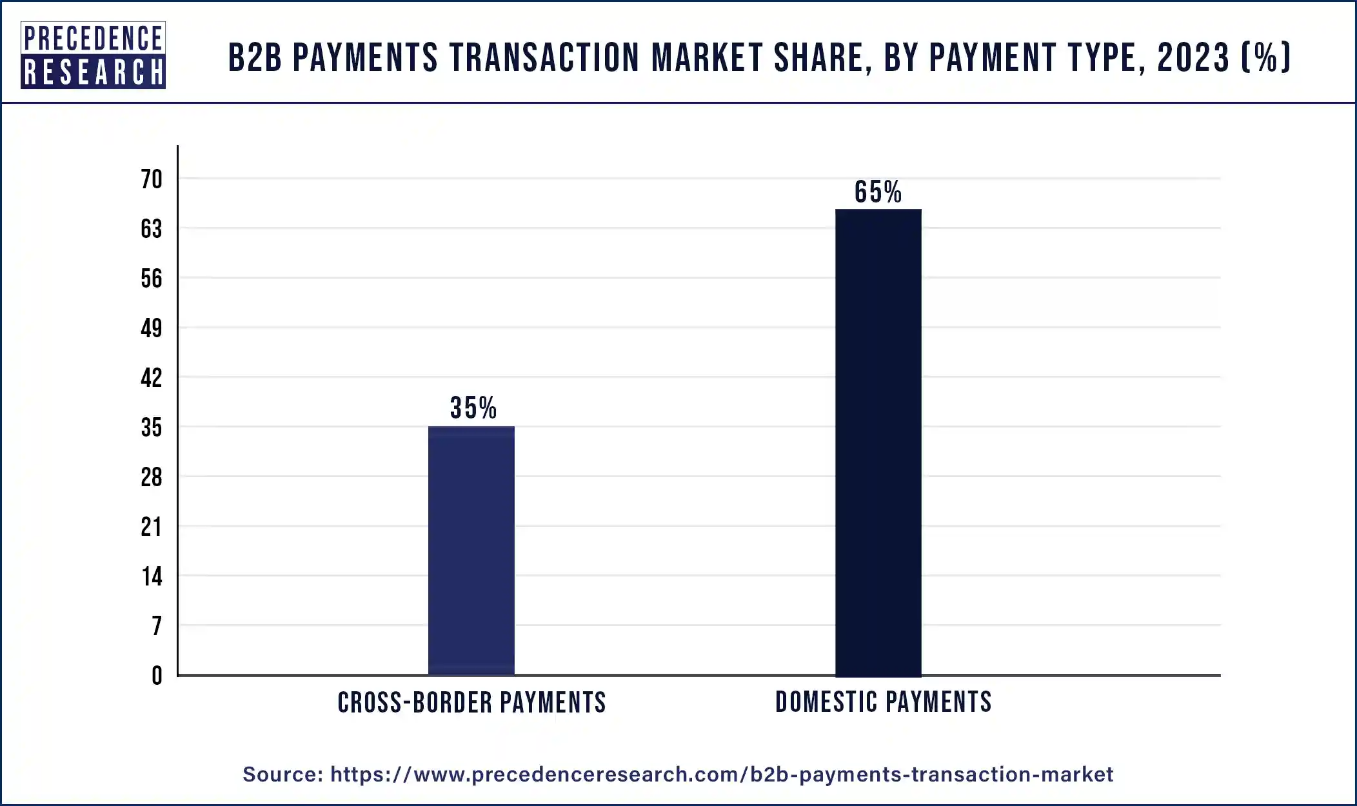

- By Payment Type, the domestic payments segment has contributed the largest revenue share of 65% in 2023.

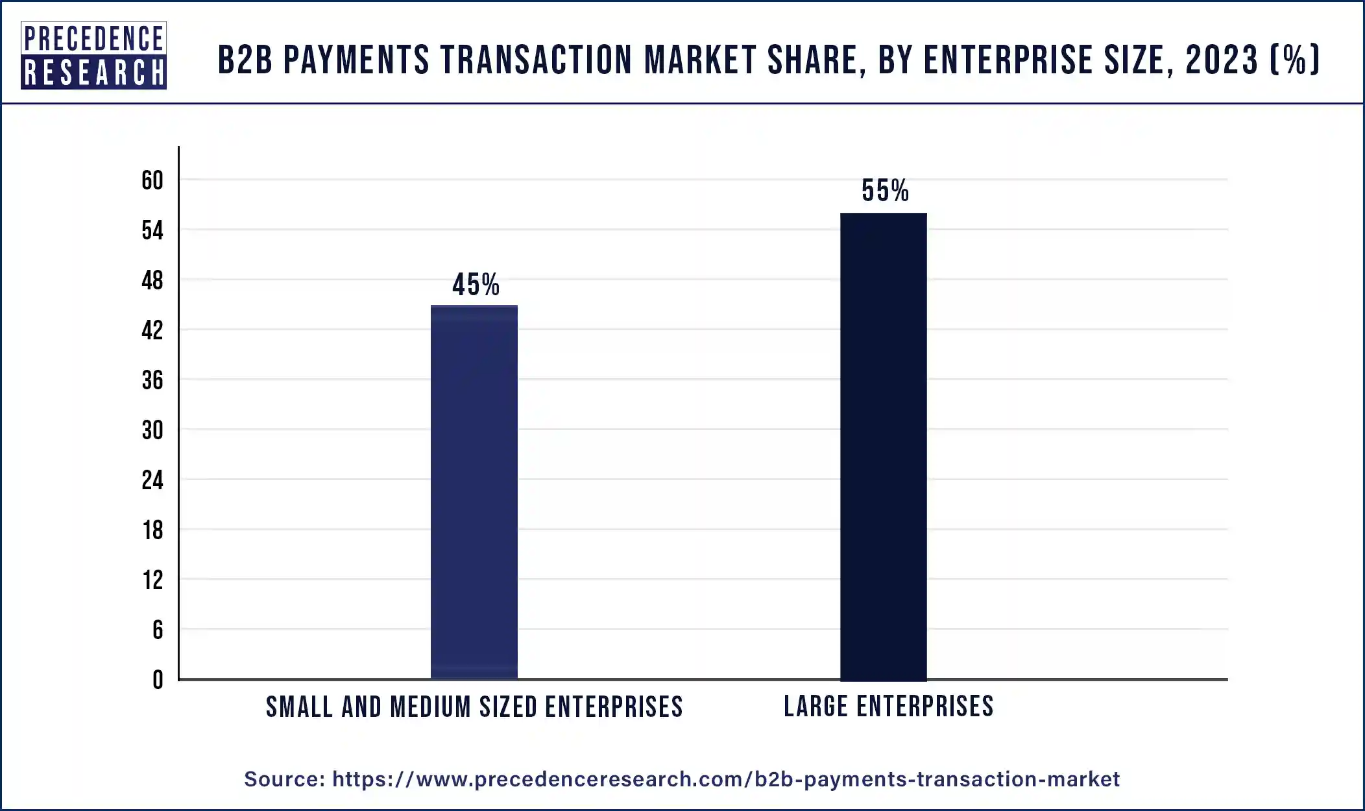

- By Enterprise Size, the large enterprises segment has generated more than 55% of revenue share in 2023.

- By Payment Mode, the traditional segment is estimated to hold the highest market share of 66% in 2023.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Scope of B2B Payments Transaction Market

| Report Attribute | Key Statistics | |

| CAGR from 2024 to 2033 | 9.39% | |

| B2B Payments Transaction Market Size in 2023 | USD 1.41 Trillion | |

| B2B Payments Transaction Market Size in 2024 | USD 1.58 Trillion | |

| B2B Payments Transaction Market Size by 2033 | USD 3.53 Trillion | |

| Largest Market | North America | |

| Base Year | 2023 | |

| Forecast Period | 2024 to 2033 | |

| Segments Covered | Payment Type, Enterprise Size, Payment Mode, Industry Vertical, and Regions | |

| Regional Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America | |

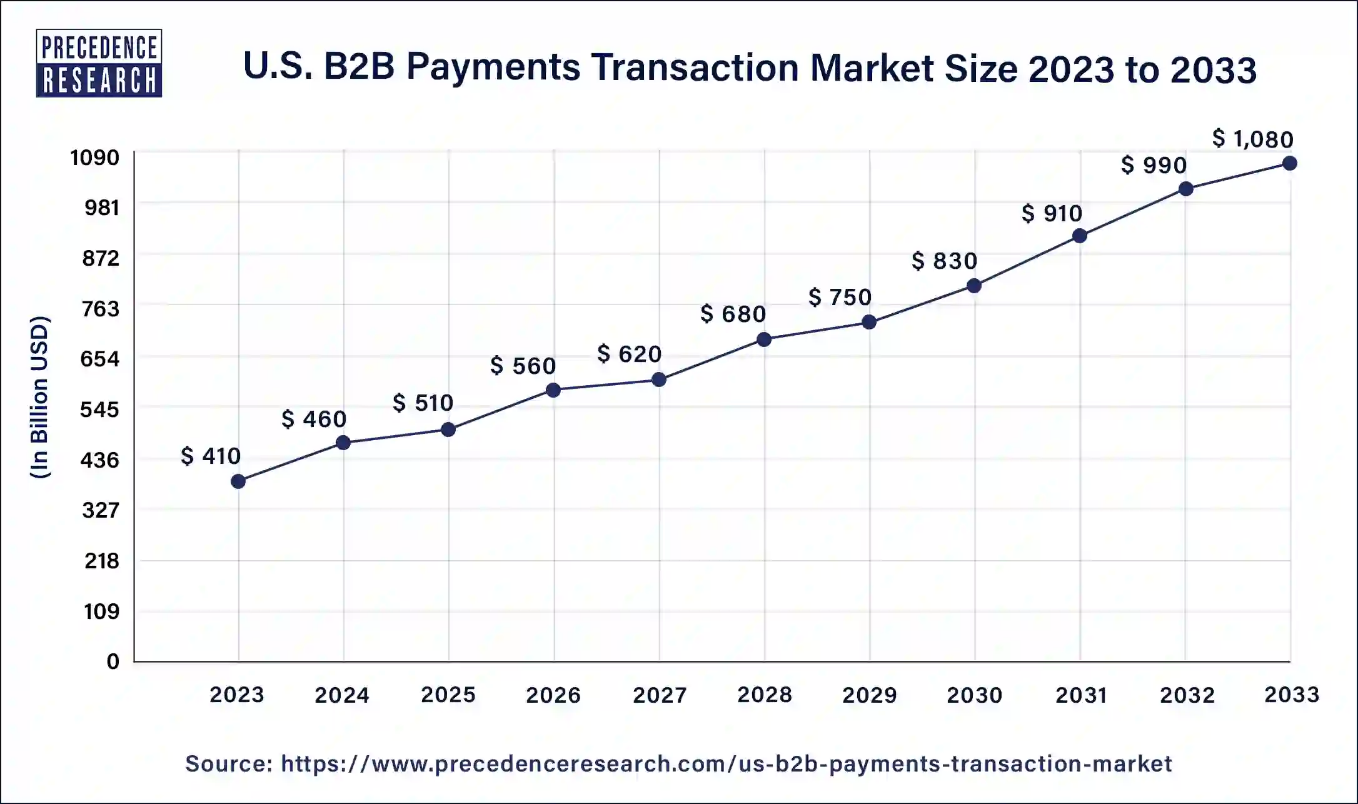

U.S. B2B Payments Transaction Market Size and Growth 2024 to 2033

The U.S. B2B payments transaction market size accounted for USD 460 billion in 2024 and is projected to reach around USD 1,080 billion by 2033, expanding at a solid CAGR of 9.95% from 2024 to 2033.

North America dominates the B2B payments transaction market due to advanced infrastructure, high government spending on transaction network security, and standard rules and regulations. The growth of this region is expected to be driven by the availability of online payment services and the securing of the transaction network. Major payment solutions providers, such as Eedenbull, a business credit card supplier, are expanding to offer comprehensive payment services to small and medium-sized businesses in North America. Eedenbull provides banks with commercial payment technologies and a commercial payments-as-a-service portfolio to enhance the US market. Paypal Holdings Inc., Square Inc., Stripe, TransferWise Ltd., and Visa Inc. are important market participants.

Asia Pacific is expected to show the fastest growth rate due to the proliferation of the e-commerce market, financial technology adoption, increased smartphone and internet penetration, and high customer spending capacity. China, Japan, and India's financial technology enterprises offer advanced payment technologies to businesses. At the same time, traditional commercial methods like cheques, bank transfers, and third-party gateways are widely accepted in Asia-Pacific.

Europe B2B Payments Transaction Market Size and Growth 2024 to 2033

The Europe B2B payments transaction market size is estimated at USD 500 billion in 2024 and is anticipated to expand to around USD 1,160 billion by 2033. The market is poised to grow at a solid compound annual growth rate of 10.17% during the forecast period.

| Forecast Years | Market Size ($ Billion) |

| 2023 | USD 440 Bn |

| 2024 | USD 500 Bn |

| 2025 | USD 550 Bn |

| 2026 | USD 600 Bn |

| 2027 | USD 660 Bn |

| 2028 | USD 730 Bn |

| 2029 | USD 810 Bn |

| 2030 | USD 890 Bn |

| 2031 | USD 980 Bn |

| 2032 | USD 1,070 Bn |

| 2033 | USD 1,160 Bn |

Unlock the potential for future growth by requesting your personalized custom report Now! https://www.precedenceresearch.com/customization/1274

B2B Payments Transaction Market Highlights:

By Payment Outlook

The domestic payment segment dominated the B2B payments transaction market with the largest revenue share of 65% in 2023. Domestic payment serves many clients by charging minimal fees for inward and outbound payments. The DMT money transfer facility offers round-the-clock assistance, facilitating seamless and rapid transactions. Because the service guarantees immediate funding, it is practical for unexpected expenses like medical crises. Bank holiday transactions are possible, enabling speedy transfers on weekends or during festival seasons. Customers may be guaranteed that their transactions are safe and secure since end-to-end encryption and verification technologies provide total security.

The cross-border payments segment is expected to grow at the fastest rate. Cross-border payments offer numerous benefits for businesses, including increased control over international transactions, facilitated remittances, diversification of risks, expanded customer base, better exchange rate management, cross-border e-commerce opportunities, and access to international financial services.

By Enterprise Size Insights

The market is divided into small & medium enterprises and large enterprises, with the large enterprise segment dominating the B2B payments transaction market due to increased spending and adoption of digital technologies for extensive transactions between suppliers and buyers. Some of the large enterprises that are responsible for the domination are Apple Inc, Samsung, Microsoft, Intel, Panasonic, and so on.

The small & medium enterprises segment is expected to experience the highest growth rate due to cost-effective B2B payment solutions that optimize operational performance through transparent transactions and cross-border payments. An increase in the number of people opting for business over a job has led to the growth of the segment.

By Payment Mode Insights

The traditional payment segment dominated the market in the year 2023. Traditional payment systems offer stability, widespread acceptance, and consumer protection backed by central banks and governments while also providing fraud protection and chargeback rights.

The digital payment segment is the fastest growing. Digital payment systems provide businesses with efficiency, speed, cost reduction, security, and cost reduction. They break geographical barriers, facilitate international trade, and promote financial inclusion. They also generate valuable data for strategic decision-making and streamline operations, reducing manual errors and improving efficiency and productivity.

Browse More Insights:

- Business-to-Business E-commerce Market: The global business-to-business e-commerce market size reached USD 9.74 trillion in 2023 and is expected to hit around USD 44.88 trillion by 2032, poised to grow at a CAGR of 18.50% from 2023 to 2032.

- B2B Sports Nutrition Market: The global B2B sports nutrition market size reached USD 3.78 billion in 2022 and it is expected to hit around USD 7.68 billion by 2032, poised to grow at a CAGR of 7.35% between 2023 and 2032.

- Generative AI in E-Commerce Market: The global generative AI in e-commerce market size was valued at USD 624.51 million in 2022 and it is expected to reach around USD 2,530.89 million by 2032, poised to grow at a CAGR of 15.02% from 2023 to 2032.

- Digital Commerce Market: The global digital commerce market size was estimated at USD 4.5 trillion in 2022 and it is expected to reach around USD 19.43 trillion by 2032, poised to grow at a CAGR of 15.8% from 2023 to 2032.

- E-commerce Market: The global E-commerce market size is projected to hit around USD 57.22 trillion by 2032 from USD 14.14 trillion in 2022, expanding at a CAGR of 15% during the forecast period 2023 to 2032.

- Contactless Payment Market: The global contactless payment market size was valued at USD 29.89 billion in 2022 and is expected to reach over USD 132.42 billion by 2032, projected to register a CAGR of around 16.1% from 2023 to 2032.

- Proximity Payment Market: The global proximity payment market size is expected to reach over US$ 56.02 billion by 2032 from US$ 16 billion in 2022, poised to grow at a noteworthy CAGR of 13.40% from 2023 to 2032.

- P2P Payment Market: The global P2P payment market size was valued at USD 2.21 trillion in 2022 and is expected to hit around USD 11.62 trillion by 2032, growing at a CAGR of 18.10% during the forecast period 2023 to 2032.

Market Dynamics

Drivers

Rising collaboration among FinTech and B2B payment companies

Banks and fintech startups are working to expand their operations. This enables established financial institutions to incorporate technologies for their clients without creating new solutions. Nationwide, a UK building society, has invested in Future Technologies, a start-up that aims to improve banking experiences. This investment offers Nationwide minority ownership in the company and allows them to work together to establish a digital business banking platform.

Rise in e-commerce usage

The E-commerce segment boosted the growth of the B2B payments transaction market as it provides numerous advantages to the consumer. E-commerce is still expanding for several reasons, such as social media's popularity and brand advocates' impact. These factors include the convenience of internet purchasing, the proliferation of mobile phones, more retail selections, and personalized, tailored experiences. Businesses may target a wider market with personalized purchasing experiences, which reduces waste and increases return on investment.

Reaching a wider audience, customers value the option to shop in their language and currency. Because mobile phones are so widely available, businesses can target customers who have the means to purchase goods or services, which is fueling the expansion of the eCommerce sector. People may now access a wide range of brands and options because of eCommerce's global expansion, making it possible for consumers to compare costs and find better offers.

Restraints

Payment delays

Payment delays can lead to strained company relationships and cash flow problems. Businesses should set up explicit payment conditions and procedures with clients and vendors to prevent problems. Automated payment solutions can streamline the payment process and decrease the chance of late payments. Automated payment reconciliation solutions can help with the tedious and prone-to-error payment reconciliation process. These solutions can decrease errors, expedite reconciliation, and free up resources for other crucial company duties.

Payment Security

The B2B payments transaction market faces significant challenges in payment security due to the rise of cyberattacks and fraud. Businesses must implement secure payment solutions like two-factor authentication and encryption, regularly review and update their security protocols, and stay ahead of emerging threats. Additionally, a lack of payment visibility is another major issue. Without real-time tracking and reporting, businesses may struggle to identify and address issues before they escalate. To address these issues, businesses should use payment solutions that provide real-time monitoring and reporting, enabling them to effectively manage their payment processes.

Opportunity

Leveraging autonomous AI for B2B payment processing

In B2B payment processing, the idea of "AP autonomy"—where AI is utilized to operate independently alongside the AP team—is becoming increasingly popular. This is a major change compared to basic automation, which uses template-driven software to carry out specified tasks manually. In contrast, autonomous technology can be flexible and use reason to eliminate human intervention.

Autonomous AI systems can process invoices without human intervention, resulting in an autonomous workflow from start to finish. AP teams can collaborate with a single vendor for optimal efficiency and accuracy thanks to Vic.ai's AI-powered AP platform. Using real-time AI data lowers the risk of fraud, permits early payment reductions, and improves cash flow. Payment options for invoices include checks, ACH transfers, and virtual cards. This allows more time to focus on vendor relationships, negotiate better terms, and focus on strategic initiatives for the finance team.

Recent Developments

- In February 2024, Card Schemes Visa, Mastercard, and banks have been advised to prohibit vendor and supplier payments made with commercial credit cards handled by fintech startups such as EnKash and Paymate.

- In January 2024, Balance Payments Inc. launched an integrated software suite to help B2B vendors manage their sales processes from order placing to payment. The company strives to address inefficiencies and expenses associated with business payments, affecting profit margins, by improving the full transaction lifecycle, from order placing to payment settlement.

- In January 2024, The National Bank of Oman (NBO) has teamed up with PayMate India SPC to modernize and streamline business-to-business payment procedures utilizing Visa Business Credit Cards. The alliance intends to create a more efficient transaction mechanism for corporate and SME clients, thereby altering the B2B payment landscape.

- In November 2023, Neobank Brighty launched a new platform for business payments in the European Union, targeting institutions interested in joining the crypto trend. The platform aims to serve both traditional and cryptocurrency investors, tapping into the rapidly growing B2B payment market, which is expected to exceed $2 trillion in value.

B2B Payments Transaction Market Top Companies

- Citigroup Inc.

- American Express

- Capital One

- TransferWise Ltd.

- Payoneer Inc.

- PayPal Holdings Inc.

- Bank of America Corporation

- Mastercard

- Square Inc.

- Visa Inc.

Market Segmentation

By Payment Type

- Domestic Payments

- Cross-Border Payments

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Payment Mode

- Traditional

- Digital

By Industry Vertical

- BFSI

- Manufacturing

- Metals & Mining

- IT & Telecom

- Energy & Utilities

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1274

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: