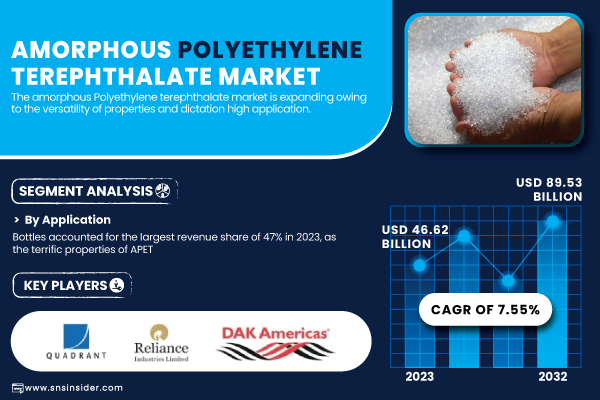

Austin, Jan. 31, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Amorphous Polyethylene Terephthalate Market was valued at USD 46.62 billion in 2023 and is expected to reach USD 89.53 billion by 2032, growing at a CAGR of 7.55% over the forecast period from 2024 to 2032.”

Rising Demand for Sustainable Packaging: The Growth and Trends of Amorphous Polyethylene Terephthalate (APET)

Amorphous Polyethylene Terephthalate (APET) is a type of polyester widely used in the packaging industry due to its excellent properties, such as high clarity, durability, and resistance to impact and heat. It is commonly used for food and beverage packaging, including trays, containers, and films, as well as in the production of medical packaging and consumer goods. APET’s appeal lies in its non-toxic nature, recyclability, and its ability to be molded into various shapes and sizes, making it ideal for packaging solutions that require both strength and transparency.

The APET market has seen significant growth, driven by increasing demand for sustainable and eco-friendly packaging materials. Consumers' preference for recyclable and lightweight packaging has boosted its usage in industries such as food, pharmaceuticals, and cosmetics. Additionally, the rise in e-commerce and demand for high-quality, transparent packaging is propelling its adoption. Trends in the APET market also indicate a shift towards incorporating renewable resources and improving the recycling process, addressing both environmental concerns and the need for innovation in packaging technologies.

Download PDF Sample of Amorphous Polyethylene Terephthalate Market @ https://www.snsinsider.com/sample-request/1685

Key Companies:

- Indorama Ventures (PET resin, ClearGuard™)

- Reliance Industries Limited (PET resins, PET films)

- Covestro AG (APET sheets, high-performance films)

- M&G Chemicals (PET resins, APET films)

- LOTTE Chemical Corporation (APET, PET sheets)

- JBF Industries Ltd. (PET resins, packaging materials)

- PolyQuest (APET films, food-grade PET resins)

- Daiwa Can Company (APET, shrink films)

- Shijiazhuang Sicong Technology Co. Ltd. (APET resin, recycled PET)

- Quadrant AG (APET sheets, PET plastic packaging)

- Polisan Holding (PET resins, PET sheets)

- Teijin Limited (PET films, automotive materials)

- Jiangsu Sanfangxiang (APET resin, packaging materials)

- Alpek Polyester (PET resin, APET products)

- Evergreen Plastics (APET sheets, PET recycling)

- Toray Industries (APET films, plastic sheets)

- Jiangsu Zhongtai International (PET resin, APET products)

- SABIC (Recycled PET, APET resin)

- OCTAL (PET resin, food-grade packaging)

- MPI Polyester Industries (APET resin, films for packaging)

Amorphous Polyethylene Terephthalate Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 46.62 Billion |

| Market Size by 2032 | USD 89.53 Billion |

| CAGR | CAGR of 7.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Bottles, Films/Sheets, Food Packaging, Others) • By End Use (Food & Beverage, Pharmaceuticals, Others) |

| Key Drivers | • Rising Demand for Convenient Food Packaging and E-Commerce Drives APET Adoption in Global Markets • Advancements in APET Film Extrusion and Coating Technologies Drive Market Growth and Industry Adoption |

If You Need Any Customization on Amorphous Polyethylene Terephthalate Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/1685

APET is a 100% recyclable packaging material that is gaining popularity due to its eco-friendly benefits and sustainability.

As global awareness of environmental concerns increases, the demand for sustainable packaging solutions has become crucial. APET (Amorphous Polyethylene Terephthalate) meets this need by being 100% recyclable, offering a significant environmental advantage. This characteristic makes APET an attractive option for industries committed to reducing their ecological footprint. Its recyclability helps minimize waste, reduce resource consumption, and promote a circular economy. As companies and consumers alike prioritize eco-friendly practices, APET’s adoption is growing, especially in sectors like food and beverage, cosmetics, and consumer goods. The material's durability and versatility further contribute to its appeal, reinforcing its role in meeting sustainability goals while maintaining product protection and quality.

Market Dominance of Bottles and Food & Beverage Sector in Amorphous Polyethylene Terephthalate (APET)

By Application: Bottles segment dominated with the market share over 47% in 2023. The material's clarity, strength, and versatility make it ideal for packaging a wide range of products. The growing demand for sustainable and recyclable packaging in industries like food & beverage, cosmetics, and household goods has bolstered its use in bottles. APET’s lightweight, durable, and cost-effective properties make it especially popular in beverages and personal care products. Its recyclability also enhances its market position, as eco-conscious consumers and companies increasingly prioritize sustainable packaging.

By End Use: The food & beverage sector accounted for 59% of the APET market share in 2023. The material’s high transparency, moisture resistance, and durability make it an ideal choice for food packaging, ensuring product quality is preserved. As demand for convenient, ready-to-eat food grows, APET has become the preferred material for manufacturers. Its recyclability further appeals to food and beverage companies seeking environmentally friendly packaging options.

Market Leadership and Growth Trends in APET Packaging: Asia Pacific's Dominance and North America's Rapid Expansion

Asia Pacific region dominated with the market share over 46% in 2023, driven by rapid industrialization, growing consumer demand, and the packaging sector's expansion in emerging markets such as China and India. APET is widely used for packaging bottled beverages, snacks, and instant meals due to its transparency and durability. Notably, companies like Nongfu Spring increasingly favor APET for these characteristics. The rise of e-commerce and home delivery services further boosts the demand for efficient and reliable packaging solutions, making APET a top choice for businesses in the region.

North America is expected to experience the fastest growth in the APET market between 2024 and 2032. This growth is fueled by the increasing demand for sustainable packaging materials and efforts to reduce plastic usage. The U.S. food and beverage sector is adopting APET for its eco-friendly qualities, with companies like Coca-Cola leading the charge. Sustainability and recycling initiatives are key drivers of the market's growth, alongside the surge in online grocery shopping and meal kit delivery services, which are boosting the demand for APET packaging.

Buy Full Research Report on Amorphous Polyethylene Terephthalate Market 2024-2032 @ https://www.snsinsider.com/checkout/1685

Recent Development

In January 27, 2025: Toray Industries announced the development of a high-efficiency separation membrane module for biopharmaceutical manufacturing, offering more than double the filtration performance of conventional systems. This innovation enhances gene therapy yields and improves purification efficiency.

In September 27, 2023: Alpek announced that Corpus Christi Polymers had temporarily halted construction of its integrated PTA-PET plant in Corpus Christi, Texas, due to inflationary pressures and higher-than-anticipated construction costs. The project will undergo a reassessment to optimize both costs and the timeline, with plans to resume construction at a later date.

Table of Contents – Major Key Points

1. Introduction

- Market Definition

- Scope (Inclusion and Exclusions)

- Research Assumptions

2. Executive Summary

- Market Overview

- Regional Synopsis

- Competitive Summary

3. Research Methodology

- Top-Down Approach

- Bottom-up Approach

- Data Validation

- Primary Interviews

4. Market Dynamics Impact Analysis

- Market Driving Factors Analysis

- PESTLE Analysis

- Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

- Amorphous Polyethylene Terephthalate Innovation and Technology Adoption (2023)

- Amorphous Polyethylene Terephthalate Recycling and Sustainability Rates (2023)

- Amorphous Polyethylene Terephthalate Supply Chain Metrics

- Amorphous Polyethylene Terephthalate Environmental Impact

6. Competitive Landscape

- List of Major Companies, By Region

- Market Share Analysis, By Region

- Product Benchmarking

- Strategic Initiatives

- Technological Advancements

- Market Positioning and Branding

7. Amorphous Polyethylene Terephthalate Market Segmentation, By Application

8. Amorphous Polyethylene Terephthalate Market Segmentation, By End Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/1685

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.