Austin, April 10, 2025 (GLOBE NEWSWIRE) -- Autoinjectors Market Size & Growth Analysis:

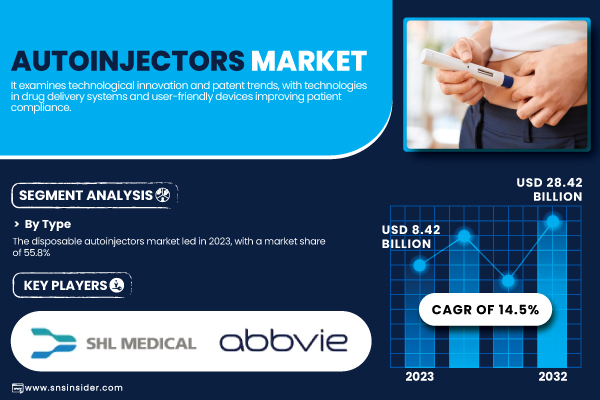

According to the latest report published by SNS Insider, the Autoinjectors Market was valued at USD 8.42 billion in 2023 and is projected to reach USD 28.42 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 14.5% over the forecast period 2024–2032. This rise is brought about mainly by the growing demand for self-injection devices, technological innovations in autoinjector systems, and an increase in the prevalence of chronic diseases such as diabetes and multiple sclerosis. In addition, growing interest in lowering healthcare expenditure while enhancing patient outcomes has contributed to the increased need for easy-to-use autoinjectors across homecare and clinical settings.

In the United States, the autoinjectors market is undergoing significant growth with the support of the healthcare sector's growing demand for injectable drugs to treat diseases. Government healthcare expenditure and insurance coverage by the U.S. government are also driving the widespread use of the devices. A rising trend of patient-friendly options, such as autoinjectors for managing chronic diseases, is fueling growth in North America.

Get a Sample Report of Autoinjectors Market@ https://www.snsinsider.com/sample-request/3648

Key Autoinjectors Companies Profiled in the Report

- Eli Lilly – Humalog KwikPen, Trulicity Pen

- SHL Medical AG – Molly, DAI (Disposable Autoinjector)

- AbbVie, Inc. – Humira Pen

- Amgen – Enbrel SureClick, Repatha SureClick

- Owen Mumford – Autoject, UniSafe

- Ypsomed – YpsoMate, YpsoPen

- Teva Pharmaceutical – Teva’s Epinephrine Auto-Injector

- Biogen Idec – Avonex Pen, Plegridy Pen

- Mylan N.V. – EpiPen, Semglee Autoinjector

- Pfizer, Inc. – Genotropin Pen, Nivestym Autoinjector

- Sanofi – Auvi-Q, SoloStar Pens (Lantus SoloStar, Apidra SoloStar)

- Gerresheimer – SensAir, Gx Inbeneo

Autoinjectors Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.42 billion |

| Market Size by 2032 | US$ 28.42 billion |

| CAGR | CAGR of 14.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East]), Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

Segment Analysis

By Type

The disposable autoinjectors segment dominated the industry in 2023 with a contribution of 55.8%. They are favored due to ease of use and convenience since they need no refilling or maintenance, thus standing out as a first choice for patients requiring single-dose disposable injections. Disposable autoinjectors are applied widely in the administration of biologics, vaccines, and drugs against diseases such as rheumatoid arthritis and diabetes.

Conversely, the reusable autoinjectors segment, predicted to be the fastest-growing segment, has gained considerable momentum. This is driven by the demand for cost-effective and sustainable options. Reusable autoinjectors provide long-term value since one device can be used multiple times, thus serving as a cost-effective option for patients who need frequent injections.

By Indication

The diabetes segment led the market in 2023 with the highest share of 26.4%. As the global incidence of diabetes increases and more patients need to be injected with insulin, the demand for autoinjectors for managing diabetes is strong. Autoinjectors enable patients to take care of themselves without the need for assistance, enhancing medication adherence and patient satisfaction.

Multiple sclerosis, however, is the most rapidly growing segment based on market growth. The rising prevalence of multiple sclerosis and demand for injectable treatments for disease-modifying therapies are major drivers for this segment. Multiple sclerosis autoinjectors provide convenience and better patient compliance, especially for patients who need to self-administer drugs daily.

By End Use

The homecare settings segment accounted for the largest revenue market share of 53.9% in 2023. This dominance is due to increasing at-home healthcare, in which patients prefer the convenience of giving their injections at home in their own surroundings. Autoinjectors are suited to this setting since they are simple to use and need minimal training.

The clinics and hospitals segment, however, is anticipated to be the most rapidly growing segment since more healthcare facilities are adopting these devices to improve patient care. Clinics and hospitals are adopting autoinjectors more and more to simplify the drug delivery process so that patients can receive timely treatment safely and efficiently.

Need Any Customization Research on Autoinjectors Market, Enquire Now@ https://www.snsinsider.com/enquiry/3648

Autoinjectors Market Segmentation

By Type

- Disposable auto-injectors

- Reusable auto-injectors

- Prefilled

- Empty

By Indication

- Rheumatoid Arthritis

- Multiple Sclerosis

- Diabetes

- Anaphylaxis

- Other Therapies

By End Use

- Homecare Settings

- Hospitals & Clinics

- Ambulatory Surgical Centers

Regional Analysis

In 2023, North America dominated the autoinjectors market, with the huge healthcare spending in the region and the growing uptake of sophisticated drug delivery systems. The U.S. is especially responsible for the development of this market, thanks to the high incidence of chronic diseases, including diabetes and autoimmune diseases, that need frequent injections. The increasing popularity of self-medication with treatments administered in homecare is also driving market growth in North America.

The Asia-Pacific is forecast to have the highest growth over the forecast period. China and India are both seeing considerable development in healthcare infrastructure as well as growing levels of awareness for chronic diseases and the imperative for effective drug delivery systems. Increased demand for autoinjectors is anticipated as greater numbers of patients within these markets use self-injection devices for chronic disease management.

Recent Developments

- January 2025: Kindeva Drug Delivery’s Meridian Medical Technologies secured a contract worth up to USD 129 million to supply DuoDote autoinjectors, a chemical nerve agent antidote, to the U.S. Strategic National Stockpile (SNS) under the ASPR, U.S. Department of Health and Human Services.

- November 2024: Amneal Pharmaceuticals resubmitted its NDA to the U.S. FDA for a dihydroergotamine (DHE) prefilled syringe autoinjector for treating migraines and cluster headaches.

- October 2024: Teva Pharmaceuticals launched the Amgen Biosimilar Etanercept (Enbrel) autoinjector for the treatment of autoimmune diseases, offering a more affordable option for patients.

- August 2024: Eli Lilly and Co. introduced a new version of its insulin autoinjector, designed to provide a faster and more convenient insulin delivery system for diabetes patients.

- June 2024: Sandoz launched a new autoinjector device for the treatment of rheumatoid arthritis, which includes an enhanced needle safety feature to minimize needle-stick injuries.

- March 2024: Biogen announced the launch of an improved multiple sclerosis autoinjector, featuring a streamlined injection process and a user-friendly interface designed to increase patient adherence.

Statistical Insights and Trends Reporting

- In 2023, the global prevalence of diabetes was approximately 537 million people, a significant portion of whom rely on insulin injections, driving the demand for autoinjectors.

- In 2023, North America accounted for the highest prescription rates for autoinjectors, with more than 40% of global prescriptions.

- The North American region held the largest market share in device volume, accounting for over 35% of total global autoinjector units in 2023.

- In 2023, North America represented 48% of global healthcare spending, significantly influencing the growth of the autoinjectors market in the region.

- The adoption rate for homecare autoinjectors in Europe and North America was 60%, showing a marked shift toward self-administered injectable therapies.Top of Form

Buy a Single-User PDF of Autoinjectors Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3648

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Regional Pricing Analysis and Cost Trends (2023)

5.2 Technological Innovations and Patent Trends (2023-2032)

5.3 Consumer Preferences and Market Demand Analysis (2023-2032)

5.4 Prescription and Usage Trends for Autoinjectors (2023) by Region

5.5 Regulatory and Compliance Trends Affecting Market Growth (2023-2032)

5.6 Healthcare Spending on Autoinjectors by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

7. Autoinjectors Market by Type

8. Autoinjectors Market by Indication

9. Autoinjectors Market by End Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Autoinjectors Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/autoinjectors-market-3648

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.