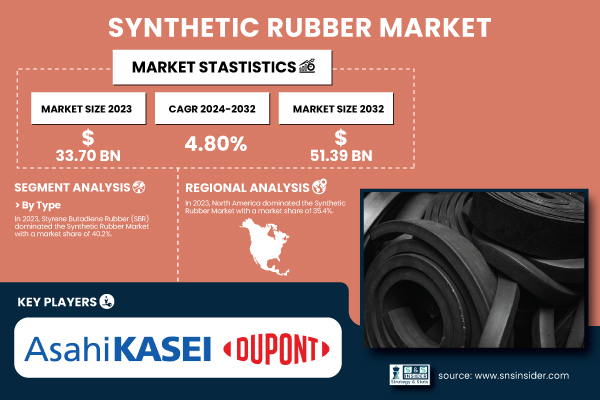

Austin, April 17, 2025 (GLOBE NEWSWIRE) -- The Synthetic Rubber Market Size was valued at USD 33.70 Billion in 2023 and is expected to reach USD 51.39 Billion by 2032, growing at a CAGR of 4.80% over the forecast period of 2024-2032.

Download PDF Sample of Synthetic Rubber Market @ https://www.snsinsider.com/sample-request/6484

Driving Growth in the Synthetic Rubber Market: Innovations and Sustainability Shape the Future

The synthetic rubber market is experiencing robust expansion, primarily fueled by rising demands in the automotive and construction sectors. Renowned for its exceptional durability, flexibility, and resistance to heat and chemicals, synthetic rubber plays a pivotal role in tire production and various industrial applications. As reported by the American Chemistry Council, U.S. production reached approximately 4.5 million tons in 2022, reflecting steady growth amidst technological advancements. The increasing prevalence of electric and hybrid vehicles drives manufacturers to seek high-performance materials for improved efficiency and safety. Furthermore, an emphasis on sustainable practices is reshaping the market, with companies investing in innovative solutions to align with environmental standards, ensuring a progressive and eco-conscious approach to synthetic rubber manufacturing.

The US Synthetic Rubber Market Size was valued at USD 9.59 Billion in 2023 and is expected to reach USD 13.56 Billion by 2032, growing at a CAGR of 3.93% over the forecast period of 2024-2032.

The U.S. synthetic rubber market is projected to grow significantly, supported by robust consumer spending and industrial growth. In 2023, the tire industry accounted for over 60% of synthetic rubber demand, driven by the increasing vehicle production and a shift towards electric vehicles. The International Rubber Study Group reported that global synthetic rubber consumption reached approximately 15.5 million tons in 2023, highlighting the material's critical role in modern manufacturing. Companies like Goodyear and Continental are investing in advanced synthetic rubber technologies to enhance tire performance and longevity, while regulatory bodies are encouraging sustainable practices to reduce environmental impact.

Key Players:

- Apcotex Industries Limited (Nitrile Rubber, Styrene Butadiene Rubber)

- Asahi Kasei Corporation (Butadiene Rubber, Styrene-Butadiene Rubber)

- China National Petroleum Corporation (CNPC) (Buna-S Rubber, Ethylene Propylene Diene Monomer Rubber)

- China Petroleum & Chemical Corporation (Sinopec Corporation) (Buna-N Rubber, Styrene Butadiene Rubber)

- Denka Company Ltd. (Nitrile Rubber, Styrene Butadiene Rubber)

- DuPont (Hytrel, Crude Butadiene)

- Dynasol Elastomers S.A. (SBR, SBC)

- ExxonMobil (Butyl Rubber, EPDM)

- Goodyear Tire and Rubber Company (SBR, Natural Rubber)

- Indian Synthetic Rubber Private Limited (Butadiene Rubber, Styrene Butadiene Rubber)

- JSR Corporation (SBR, Polybutadiene Rubber)

- Kumho Petrochemical Company Ltd (Buna-N Rubber, EPDM)

- LANXESS AG (Buna-S Rubber, Butyl Rubber)

- Mitsui Chemical Inc. (EPDM, Hydrogenated Nitrile Rubber)

- Nizhnekamskneftekhim (Butyl Rubber, Styrene-Butadiene Rubber)

- Reliance Industries Limited (Ethylene Propylene Diene Monomer Rubber, Nitrile Rubber)

- Sinopec (Buna-N Rubber, Styrene Butadiene Rubber)

- Sumitomo Chemical Co., Ltd. (Butadiene Rubber, Polybutadiene Rubber)

- TSRC Corporation (Styrene Butadiene Rubber, Butyl Rubber)

- Versalis S.p.A. (SBR, EPDM)

Synthetic Rubber Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 33.70 Billion |

| Market Size by 2032 | USD 51.39 Billion |

| CAGR | CAGR of 4.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Styrene butadiene rubber (SBR), Polybutadiene Rubber (BR), Styrene block copolymer (SBC), Ethylene-propylene-diene rubber (EPDM), Butyl rubber (IIR), Others) • By Application (Tire, Automotive (Non-tire), Footwear, Industrial Goods, Consumer Goods, Textiles, Others) |

| Key Drivers | • Increasing Demand for High-Performance Synthetic Rubber in Automotive and Tire Industries Drives Market Expansion. |

Driving Sustainability: Key Environmental Initiatives in the Synthetic Rubber Market

- Closed-loop systems are being used to recycle materials and reduce emissions in synthetic rubber production.

- Investment in bio-based alternatives helps lower greenhouse gas emissions and reliance on fossil fuels.

- Adoption of sustainable certifications, like ISO 14001, showcases commitment to environmental performance.

- R&D focuses on improving the recyclability of synthetic rubber products to minimize waste.

- Collaborations with environmental groups promote sustainable practices and knowledge sharing in the industry.

By Type, Styrene Butadiene Rubber (SBR) Dominated the Synthetic Rubber Market with A Market Share Of 40.2%.

SBR is widely utilized in tire manufacturing due to its excellent abrasion resistance, aging stability, and low-temperature flexibility. The rise in global automobile production and increasing demand for high-performance tires have significantly contributed to the dominance of SBR in the market. According to the Tire and Rubber Association, around 70% of the SBR produced is used in tires, underscoring its vital role in the automotive sector. Companies like ExxonMobil and Lanxess have invested in R&D to enhance SBR formulations, focusing on improving tire performance and reducing rolling resistance. As the automotive industry shifts toward electric vehicles, the demand for high-quality synthetic rubber compounds like SBR is expected to continue growing, reinforcing its market leadership.

By Application, Tire Segment Dominated The Synthetic Rubber Market With A Market Share Of 60.8% Market Share

This dominance is primarily due to the burgeoning automotive sector and the increasing need for high-performance tires. The rise in vehicle ownership and advancements in tire technology, such as the development of fuel-efficient and durable tires, are propelling the demand for synthetic rubber in this application. According to the Rubber Manufacturers Association, the tire industry accounted for nearly 65% of all synthetic rubber consumption in the U.S. in 2023. Major tire manufacturers, including Michelin and Bridgestone, are focusing on innovation and sustainability, producing tires that utilize advanced synthetic rubber compounds to improve safety and performance. The growing trend of electric vehicles further fuels this segment, as manufacturers seek high-quality materials to enhance efficiency and reduce environmental impact.

If You Need Any Customization on Synthetic Rubber Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/6484

North America Dominated the Synthetic Rubber Market In 2023, Holding a 35.4% Market Share.

North America held a significant share of the synthetic rubber market in 2023, driven by the robust automotive industry and increasing demand for high-performance tires. The U.S. automotive sector, one of the largest globally, is a major consumer of synthetic rubber, with companies investing heavily in research and development to enhance tire performance and sustainability. According to the U.S. Department of Commerce, the automotive industry contributes over $500 billion to the U.S. economy annually, further fueling the demand for synthetic rubber products. Additionally, stringent regulations regarding vehicle emissions and performance are pushing manufacturers to adopt advanced synthetic rubber technologies that meet evolving standards. The presence of key players like Goodyear, Michelin, and Continental in North America supports the growth of the synthetic rubber market in the region, as these companies continuously innovate to meet consumer needs and environmental requirements.

Asia Pacific Emerged as the Fastest Growing Region in Synthetic Rubber Market with A Significant Growth Rate in The Forecast Period

This growth is primarily attributed to the booming manufacturing sector and rising automotive production in countries like China, India, and Japan. The region's demand for synthetic rubber is propelled by the increasing production of tires and automotive components, driven by a growing middle-class population and rising disposable incomes. According to the Asian Development Bank, Asia's automotive market is expected to expand by 5% annually through 2025, significantly impacting synthetic rubber consumption. Furthermore, government initiatives aimed at promoting electric vehicles and sustainable manufacturing practices are fostering market growth. Companies such as Bridgestone and Yokohama Rubber are expanding their production capabilities in the region to cater to the growing demand, reinforcing Asia Pacific's position as a key player in the global synthetic rubber market.

Recent Developments

- November 2024: Bridgestone researchers in Akron explored creating synthetic rubber from plant-based ethanol to promote sustainability.

- October 2024: South Korea's synthetic rubber market was projected to reach USD 2.9 billion by 2028, driven by eco-friendly tire demand.

- August 2024: Michelin invested in reducing CO2 emissions at its U.S. synthetic rubber plant to improve energy efficiency and sustainability.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Synthetic Rubber Market Segmentation, By Type

8. Synthetic Rubber Market Segmentation, By End-use Industry

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Related Reports:

Elastomers Market Growth & Forecast to 2032

Construction Elastomers Market Size & Share by 2032

Advanced Elastomers Market Research Report 2024-2032

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.