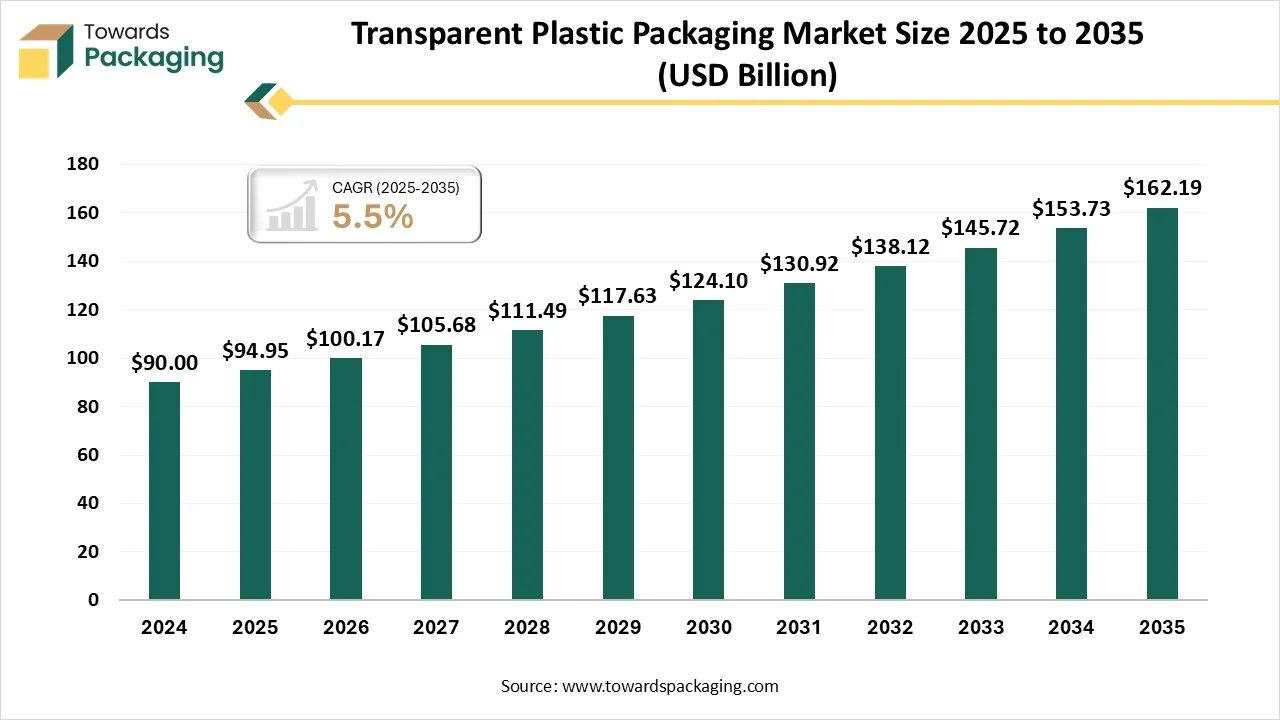

Ottawa, Dec. 09, 2025 (GLOBE NEWSWIRE) -- The global transparent plastic packaging market was assessed at USD 94.95 billion in 2025, with projections indicating an increase to USD 162.19 billion by 2034, based on insights from Towards Packaging, a sister firm of Precedence Research.

This market is growing due to rising demand for lightweight, durable, and visually appealing packaging that enhances product visibility and shelf appeal across the food, beverage, and personal care sectors.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Insights

- By region, the Asia Pacific region has dominated the market, having the biggest share in 2024.

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By material type, the polyethylene terephthalate (PET) segment has contributed the largest market share in 2024.

- By material type, the polypropylene (PP) segment will grow at a notable CAGR between 2025 and 2034.

- By product type, the bottles & jars segment contributed the largest share in 2024.

- By product type, the pouches & bags segment will grow at a notable CAGR between 2025 and 2034.

- By end-use industry, the food & beverage segment contributed the largest share in 2024.

- By end-use industry, the personal care & cosmetics segment will grow at a notable CAGR between 2025 and 2034.

- By thickness/form factor, the thick/rigid sheets segment contributed the largest share in 2024.

- By thickness/form factor, the thin-gauge films segment will grow at a notable CAGR between 2025 and 2034.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5883

Key Technological Shifts

| Technological Shifts | Description |

| High-clarity barrier films | Advanced films maintain transparency while protecting against oxygen, moisture, and UV, extending shelf life. |

| Bio-based and compostable plastics | Use of plant-derived materials reduces carbon footprint without compromising strength or clarity. |

| Lightweighting and downgauging | Thinner yet stronger films reduce material usage and transportation costs. |

| Smart and interactive packaging | Integration of QR codes, sensors, and tracking technologies enhances consumer engagement and supply chain visibility. |

| Advanced recycling technologies | Chemical recycling and closed-loop systems convert used plastics back into high-quality transparent resins. |

Market Overview

The transparent plastic packaging market is witnessing a steady growth driven by consumers growing desire for convenient and aesthetically pleasing packaging. Adoption is being accelerated by growing demand from the food, beverage, and personal care sectors, and manufacturers are concentrating on creating lightweight long long-lasting, and sustainable solutions. Technological advancements in barrier films, recycling, and biobased plastics are further enhancing market expansion. Overall, transparency, convenience, and sustainability are key factors shaping market dynamics.

Key Trends

- Sustainability Focus: Growing shift toward biodegradable, compostable, and recyclable plastics to meet environmental regulations and consumer demand.

- E-commerce Packaging Demand: Rising online retail drives demand for lightweight, protective, and visually appealing packaging solutions.

- Premiumization of Packaging: Transparent packaging is increasingly used to showcase product quality, especially in food, beverages, and cosmetics.

- Smart Packaging Integration: Adoption of QR codes, NFC tags, and sensors for traceability, consumer engagement, and anti-counterfeiting.

- Lightweighting & Material Efficiency: Manufacturers are developing thinner, stronger films to reduce material use and transportation costs.

Opportunities

| Opportunity Area | Why it Matters |

| Eco-Friendly Packaging | Rising consumer & regulatory pressure for sustainable solutions fuels demand for biodegradable, compostable, and recyclable plastics. |

| E-Commerce & Retail Boom | Surge in online shopping increases the need for lightweight, protective, and attractive packaging that ensures safe delivery. |

| Premium & Brand-Focused Packaging | Transparent packaging enhances product visibility, enabling brands to showcase quality and stand out on shelves. |

| Smart & Interactive Packaging | QR codes, NFC tags, and embedded sensors offer traceability, engagement, and anti-counterfeiting, creating high-tech packaging opportunities. |

| Lightweighting & Material Efficiency | Advanced thin yet strong films reduce material costs, lower shipping expenses, and improve sustainability credentials. |

More Insights of Towards Packaging:

- Gift Wrapping Paper Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Ovenable Paperboard Trays Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Decor Paper Market Size, Trends, Segmentation & Global Opportunity Analysis (2025-2035)

- Plant-Based Plastics Market Size, Trends, Segments, and Regional Outlook 2025-2035

- Custom Sustainable Boxes for E-Commerce Market Size, Trends, Segmentation, and Regional Analysis 2025-2034

- Carbon-Negative Packaging Market Size, Trends, and Global Industry Analysis 2025-2035

- Blockchain-Integrated Smart Packaging Market Size, Growth Trends, and Industry Segmentation 2025-2035

- PHA Bioplastics Market Size, Trends, Segments, and Regional Insights 2025-2035

- Closed-Loop Packaging Systems Market Size, Share, Trends, Segments, and Regional Analysis 2025-2035

- Recycled Packaging for Apparel Market Size, Share, Trends, Segments, and Regional Analysis 2025-2035

- PFAS-Free Food Packaging Market Size, Share, Trends, Segmentation, and Regional Analysis 2025-2035

- Polyhydroxyalkanoates Films Market Size, Trends, Segmentation, and Global Regional Analysis 2025-2035

- Circular Packaging Market Size, Share, Trends, Segmentation, and Regional Analysis 2025-2035

- Plastic Blister Packs Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- North America High-Barrier Packaging Films Market Size, Global Trends Segments, Companies & Competitive Landscape Analysis

- Single-Use Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Smart Packaging for D2C Market Size, Trends, Segments, Regional Insights, and Competitive Landscape Analysis 2025-2035

- 3D Printed Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Analysis Report

- Packaging-as-a-Service (PaaS) Market Size, Trends, Segments, Regional Insights, and Competitive Landscape Report 2025-2035

- Smart Packaging for Retail & E-Commerce Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA) and Competitive Landscape Analysis

Segmental Insights

By Material Type

The polyethylene terephthalate (PET) segment is dominating the market due to its excellent clarity, durability, barrier protection, and recyclability, making it ideal for high-volume applications in beverages, food, and personal care. Brands prefer PET because it enhances shelf appeal while maintaining product safety and extending shelf life. PET's competitive advantage is being strengthened by the growing use of recycled PET and laws that encourage environmentally friendly packaging. Its suitability for lightweight packaging formats contributes to reduced logistics expenses and increased productivity.

The polypropylene (PP) segment is the fastest-growing as producers move toward options that support both flexible and rigid packaging formats and are lightweight, economical, and chemically resistant because of its high heat resistance and transparency. PP is a good choice for microwaveable food packs, pharmaceutical containers, and high-end cosmetics. PP adoption is being accelerated by the growing need for mono-material packaging to facilitate recycling.

By Product Type

Bottles & jars segments are dominating the transparent plastic packaging market as it remains the primary format for beverages, sauces, condiments, oils, pharmaceuticals, and personal care products. Brands rely on transparent rigid containers to communicate product quality and enable easy visibility for consumers, boosting purchase intent. Bottles made for PET, PP, and HDPPE offer advantages for lightweight, transparent durability, and leak-proof performance.

The pouches & bags segment is the fastest-growing, driven by rapid adoption across snacks, dairy, frozen foods, and personal care due to its convenience, portability, and cost-effectiveness. Flexible packaging formats support reduced material usage, lower packaging waste, and extended shelf life through advanced barrier films. Growing preference for resealable stand-up and spoouted pouches is also fueling demand.

By End Use Industry

The food & beverage segments are dominating the transparent plastic packaging market since clarity is crucial for manufacturers to guarantee product visibility, quality control, and branding impact. Transparent packaging is widely used across bottled beverages, dairy products, snacks, sauces, and ready-to-eat meals due to stringent hygiene and safety requirements. Demand is further supported by urbanization, increasing packaged food consumption, and the rise of retail-ready packaging. Innovations in recyclable and lightweight formats continue to sustain dominance in this sector.

The personal care & cosmetics segment is the fastest-growing as brands increasingly adopt transparent packaging to highlight the texture, color, and premium aesthetics of products like lotions, serums, and gels. Transparent containers enhance brand storytelling and support premiumization trends, especially in emerging markets. Growth is being further accelerated by consumers interest in beauty and self-care products and rising disposable incomes. Additionally, demand for travel-size refillable and sustainable transparent packaging formats is boosting adoption in this industry.

By Thickness/ Form Factor

The thick/rigid sheets segment is dominating the transparent plastic packaging market due to its extensive use in bottles, jars, trays, and containers, offering superior strength, stability, and shelf appeal. Rigid plastic packaging is appropriate for food, drinks, medications, and cosmetics because it offers better defense against contamination, breakage, and tampering. Advanced thermoforming and lightweighting technologies that increase cost effectiveness also benefit manufacturers. The demand for stiff transparent packaging is further supported by its recyclability and compatibility with PET and PP materials

Thin-gauge films segment is the fastest-growing as brands shift toward flexible, lightweight, and cost-efficient packaging solutions for snacks, frozen foods, confectionery, and personal care. Transparent films offer high clarity, barrier protection, and heat-sealability, supporting diverse printing and branding requirements. The rise of sustainable mono-material films and compostable alternatives is expanding market traction. Additionally, growth in e-commerce, single-serve packaging, and smart packaging designs continues to accelerate the adoption of thin-gauge transparent films.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

By Geography

Asia Pacific continues to dominate the transparent plastic packaging market, driven by the growing demand for packaged goods from consumers and the quickening pace of industrialization. Countries are witnessing substantial growth in the food and beverage and personal care sectors, which heavily rely on transparent packaging for product visibility. Additionally, the area gains from a robust manufacturing base, reasonably priced raw materials, and government initiatives that promote environmentally friendly packaging options.

India Transparent Plastic Packaging Market Trends

India is a key driver of the transparent plastic packaging market in the Asia Pacific, supported by rapid urbanization, rising disposable incomes, and a booming food and beverage sector. Growing e-commerce and organized retail are increasing the demand for convenient, visually appealing packaging solutions. Furthermore, government programs that support manufacturing and ease of doing business are drawing in both local and foreign competitors, solidifying India's leading position in the regional market.

North America is emerging as the fastest growing market, driven by growing consumer preferences for premium product presentation, eco-friendly packaging, and ease of use. The U.S. is seeing rapid adoption of innovative packaging designs and recyclable materials, particularly in the food, beverage, and healthcare segments. Stricter laws governing sustainability and packaging quality are also encouraging businesses to make investments in cutting-edge technologies, which is accelerating market growth.

U.S. Transparent Plastic Packaging Market Trends

The U.S. leads the growth of transparent plastic packaging in North America, driven by the food, beverage, and healthcare industries strong demand for high-quality quality sustainable packaging. Market adoption is accelerated by innovation in bio-based and recyclable plastics. Packaging design is being impacted by consumers growing awareness of eco-friendly options. Strong R&D efforts and stringent regulations are driving technological progress.

Europe holds a notable position in the market due to its focus on high-quality standards, environmental sustainability, and premium packaging demand. To comply with the EU's stringent environmental regulations, important markets like Germany, France are investing in bio-based and recyclable plastics. The region's emphasis on aesthetics and product differentiation in sectors like cosmetics, pharmaceuticals, and food and beverages further contributes to its significant market share.

Recent Developments

- In December 2025, Aduro Clean Technologies collaborates with ECOCE, A.C. to evaluate its Hydro hemolytic chemical recycling process for flexible and mixed plastic packaging in Mexico. the multi year agreement is intended to test post consumer flexible packaging from ECOCE waste collection streams with HCT processing planned from lab through pilot scale.

- In December 2025, DS Smith announces collaboration with Mondelez internation to trial 300000 paper tubs and expanded fibre based packaging solutions for retail and industrial shipping replacing plastic packaging and improving circularity.

Market Companies

- BASF SE (Germany): A major global chemical company producing various high-performance plastics, including transparent options.

- Dow (U.S.): Produces a wide range of plastic materials used in packaging applications.

- DuPont (U.S.): Focuses on specialty materials and has a significant presence in healthcare and medical device components through acquisitions.

- INEOS (U.K.): A leading chemical company with a large polymers business that serves the packaging market.

- SABIC (Saudi Arabia): One of the largest suppliers of plastics globally, with offerings in transparent polymers.

- LyondellBasell (U.S./Netherlands): A prominent producer of polyolefin and other transparent plastic materials.

Segments Covered in the Report

By Material Type

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polystyrene (PS)

- Others (PLA, EVOH, etc.)

By Product Type

- Bottles & Jars

- Trays & Containers

- Pouches & Bags

- Clamshells & Blisters

- Films & Wraps

- Others (Lids, Tubes)

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Household Products

- Electronics & Industrial Goods

By Thickness / Form Factor

- Thin-gauge Films (<50 microns)

- Medium-gauge Films (50–200 microns)

- Thick / Rigid Sheets (>200 microns)

By Geography

North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5883

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Single-Use Packaging Alternatives Market Size, Trends, Segmentation, Regional Outlook, and Competitive Landscape Analysis

- Circular Economy in Packaging Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Global Value Chain Analysis

- Logistics-Optimized Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Global Trade Analysis

- Low-Carbon Footprint Packaging Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Trade Analysis

- Glass-to-Plastic Packaging Market Size, Trends, Segments, Regional Analysis, Trade Insights & Competitive Landscape

- Leak-Proof Flexible Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis 2025-2035

- Single-Use Plastic Water Bottles Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

- Polyethylene Films Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis, 2025–2035

- Recycled Polypropylene in Packaging Market Size, Trends, Segments, Regional Insights, Competitive Landscape, Value Chain & Trade Data Analysis (2025–2035)

- Europe Packaging Market Size, Trends, Segments, Competitive Landscape & Trade Analysis

- Contract Packaging and Fulfilment Services Market Size, Trends, Segmentation, Regional Overview, Competitive Analysis & Trade Insights 2025–2034

- Recycled Materials Packaging Solutions Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis

- Connected Food Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Next-Generation Packaging Market Outlook 2025-2035 Size, Share, Trends, and Growth Opportunities

- Biopolymer Packaging Market Global Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Value Chain Analysis

- Paper-Based Sustainable Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis Report

- North America Plastic Packaging Market Size, Trends, Segments, Companies, Value Chain & Trade Analysis Report

- Non-Recyclable Polystyrene Packaging Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, Value Chain & Trade Analysis

- North America Packaging Market Size, Trends, Share, Trends, Segments 2025-2034

- PET Packaging in Pharmaceutical Market Size, Trends, Segments, Regional Outlook, Value Chain and Competitive Landscape Analysis