Austin, Dec. 10, 2025 (GLOBE NEWSWIRE) -- Order Consolidation Robots Market Size & Growth Insights:

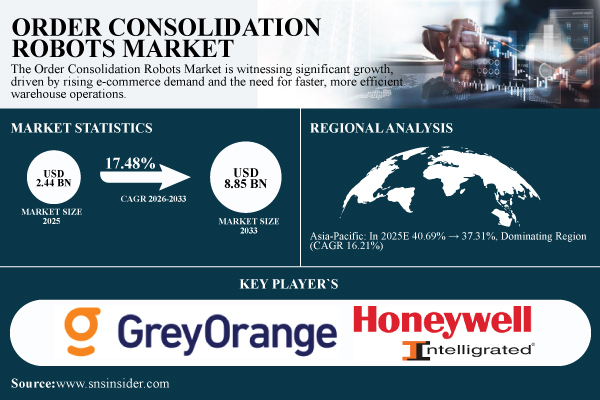

According to the SNS Insider,“The Order Consolidation Robots Market size was valued at USD 2.44 Billion in 2025E and is projected to reach USD 8.85 Billion by 2033, growing at a CAGR of 17.48% during 2026–2033.”

Rising Labor Shortages is Augmenting the Demand for Order Consolidation Robots Globally

Businesses are investing in order consolidation robots due to the increasing scarcity of competent warehouse labor. Manual order picking becomes labor-intensive and prone to errors as warehouses are under growing pressure to complete orders promptly and precisely. The consolidation of goods on pallets or carriers is automated by autonomous robots with sophisticated multi-axis grippers and cognitive navigation, which minimizes mistakes and lessens the physical strain on workers. As a result, businesses benefit from increased operational efficiency, quicker throughput, and less dependence on human labor, which makes these robots an essential part of contemporary warehouse automation.

Get a Sample Report of Order Consolidation Robots Market Forecast @ https://www.snsinsider.com/sample-request/9013

Leading Market Players with their Product Listed in this Report are:

- GreyOrange

- Geek+

- Locus Robotics

- 6 River Systems (Shopify)

- Fetch Robotics (Zebra Technologies)

- KUKA AG

- ABB Ltd.

- Honeywell Intelligrated

- Dematic (KION Group)

- Knapp AG

- Swisslog (KUKA Group)

- Vecna Robotics

- IAM Robotics

- Magazino GmbH

- inVia Robotics

- RightHand Robotics

- Boston Dynamics

- Quicktron Robotics

- Hikrobot

- Mobile Industrial Robots (MiR)

Order Consolidation Robots Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 2.44 Billion |

| Market Size by 2033 | USD 8.85 Billion |

| CAGR | CAGR of 17.48% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Product Type(Autonomous Mobile Robots, Collaborative Robots, Automated Guided Vehicles and Others) • By Application (E-commerce, Retail, Warehousing, Logistics, Manufacturing and Others) • By Payload Capacity(Low, Medium and High) • By End User(Retailers, Third-Party Logistics Providers, Manufacturers and Others) |

Purchase Single User PDF of Order Consolidation Robots Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9013

Key Industry Segmentation:

By Product Type

Autonomous Mobile Robots continue to lead the market with a share of 46.75% due to their versatility, reliability, and ability to handle diverse warehouse operations with minimal human intervention. The collaborative robots are the fastest-growing segment at a CAGR of 19.93%, driven by increasing demand for flexible, AI-enabled, human-robot integrated solutions that enhance efficiency, safety, and real-time responsiveness in dynamic operational environments.

By Application

E-commerce continues to lead the market with 38.88% in 2025 and is also expected to grow with the Fastest at a CAGR of 19.34% due to its widespread adoption and critical role in driving demand for efficient and reliable logistics solutions.

By Payload Capacity

Medium-capacity solutions dominate the market holding a share of 37.88% in 2025 due to their versatility and suitability for a wide range of warehouse operations. High-capacity solutions segment is the fastest-growing segment at a CAGR of 18.95%, driven by the need for robust handling capabilities in large-scale and complex logistics operations.

By End-User

Third-party logistics providers hold a leading position among end-users by holding a share of 41.63% in 2025, supported by their extensive adoption of automation and advanced operational solutions. This segment is also the fastest-growing at a CAGR of 18.74%, fueled by the increasing demand for efficient, scalable, and flexible logistics services.

Regional Insights:

Asia Pacific leads the Order Consolidation Robots Market with a share of 40.69% in 2025E, driven by rapid e-commerce growth, rising warehouse automation, and advanced logistics infrastructure. High adoption of smart technologies in countries, such as China, Japan, and South Korea boosts operational efficiency and reduces labor costs, reinforcing the region’s dominance in the global market landscape.

North America is the fastest-growing region in the Order Consolidation Robots market at a CAGR of 19.61%, driven by increasing e-commerce demand, technological advancements in robotics, and investments in smart warehouses.

Do you have any specific queries or need any customized research on Order Consolidation Robots Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9013

Recent Developments:

- In August 2025, Swisslog launched its IntraMove series of AMRs for pallet transport, capable of carrying up to 3,000 kg, featuring AI-powered fleet management, SLAM navigation, and flexible deployment for dynamic warehouse operations.

- In August 2025 — GreyOrange, in collaboration with Google Cloud, launched GreyMatter DeepNav, an AI-powered orchestration platform that dynamically manages and optimizes large autonomous robot fleets for scalable warehouse operations.

Exclusive Sections of the Order Consolidation Robots Market Report (The USPs):

- TECHNOLOGY & INNOVATION METRICS – helps you evaluate advancements in automation technologies through metrics such as AI-driven picking accuracy, adoption of AMRs and AS/RS systems, and innovation in vision recognition and machine learning algorithms. These indicators highlight how robotics and AI are revolutionizing warehouse efficiency and SKU management.

- OPERATIONAL & PERFORMANCE BENCHMARKS – helps you understand the real-world efficiency of consolidation robots by analyzing key parameters like order processing speed, uptime availability, latency, and accuracy in high-volume environments—crucial for assessing system reliability and scalability in fulfillment operations.

- PRODUCTION, DEPLOYMENT & SUPPLY CHAIN METRICS – helps you identify manufacturing and rollout capabilities of robotics OEMs, including production capacity utilization, component localization rates, and integration lead times. This section provides insights into supply chain readiness and maintenance ecosystem maturity.

- COST & PRICING METRICS – helps you analyze affordability and investment potential by reviewing average selling prices, ROI periods, and total cost of ownership (TCO) across 3PL, retail, and e-commerce operations—shedding light on how semiconductor and sensor pricing trends affect automation costs.

- DEMAND, VOLUME & ADOPTION METRICS – helps you uncover demand dynamics by evaluating robot deployment across sectors, automation growth in micro-fulfillment centers, and order surge handling capacities. These insights correlate with labor shortages and booming e-commerce activity driving market expansion.

- REGULATORY & SAFETY COMPLIANCE METRICS – helps you understand adherence to global safety, data privacy, and cybersecurity frameworks such as OSHA, ISO 10218, GDPR, and NIST, ensuring compliance and sustainability across robotic warehouse operations.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.