Dublin, Dec. 11, 2025 (GLOBE NEWSWIRE) -- The "Digital Remittance Market - Global Forecast 2025-2032" report has been added to ResearchAndMarkets.com's offering.

The digital remittance market is swiftly evolving into a core pillar of cross-border payments, driven by higher user expectations, rapid financial technology innovation, and greater regulatory scrutiny. Senior decision-makers now face new opportunities and challenges in optimizing the efficiency, security, and inclusivity of global money movement.

Market Snapshot: Digital Remittance Market Growth Trajectory

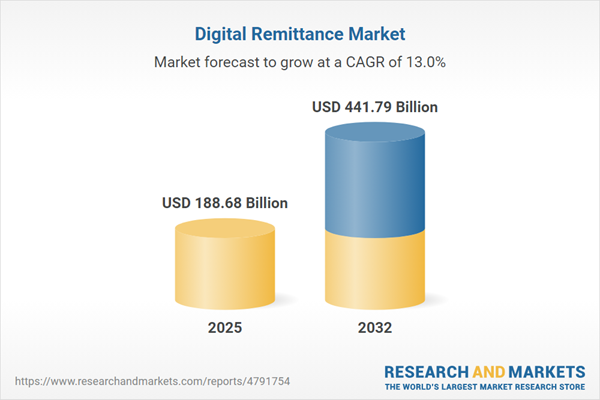

The Digital Remittance Market grew from USD 166.60 billion in 2024 to USD 188.68 billion in 2025. It is expected to continue growing at a CAGR of 12.96%, reaching USD 441.79 billion by 2032.

Scope & Segmentation

- Remittance Types: Inward Remittance, Outward Remittance

- Channels: Agent Network, Mobile Application

- Payment Methods: Bank Account, Credit Card, Debit Card, Mobile Money

- Service Providers: Banks, Fintech Companies

- End-users: Businesses, Individuals

- Regions: Americas, Europe, Middle East & Africa, Asia-Pacific

- Countries and Subregions: United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru, United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya, China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan

Key Takeaways

- Rapid innovation, enabled by partnerships between fintechs and traditional banks, is reshaping competitive dynamics and spurring seamless, real-time fund transfers worldwide.

- Open banking protocols and distributed ledger technologies are strengthening transparency, interoperability, and settlement speed for cross-border remittances.

- Mobile-first approaches, advanced analytics, and biometric security measures are reducing onboarding friction and fraud risks, supporting expanded access in both developed and emerging markets.

- Greater regulatory engagement, such as through sandboxes and adaptive licensing, allows providers to test new solutions, increasing transparency and security for end users.

- Diverse end-user segments, ranging from migrant workers to global businesses, drive the need for tailored service models and multi-channel strategies.

Why This Report Matters

- Deliver strategic foresight for navigating technology disruption, regulatory complexity, and market segmentation in cross-border payments.

- Empower investment, product, and partnership decisions for both established institutions and emerging fintechs across global regions.

- Reveal evolving patterns in remittance channels, payment methods, and customer segments, aiding precise growth and risk strategies..

Key Attributes

| Report Attribute | Details |

| No. of Pages | 191 |

| Forecast Period | 2025-2032 |

| Estimated Market Value (USD) in 2025 | $188.68 Billion |

| Forecasted Market Value (USD) by 2032 | $441.79 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |

Market Insights

- Rapid adoption of blockchain-based peer-to-peer remittance solutions in emerging markets

- Integration of biometric authentication and AI fraud detection in mobile remittance apps for enhanced security

- Launch of voice-enabled digital remittance services targeting unbanked rural populations through USSD

- Strategic partnerships between global neobanks and telecom operators to expand cross-border payment corridors

- Emergence of central bank digital currency pilots facilitating instant low-cost remittance settlement

- Adoption of real-time foreign exchange hedging tools embedded in digital remittance platforms for SMEs

- Leveraging social media messaging platforms for seamless person-to-person remittance transactions

- Implementation of regulatory sandbox frameworks accelerating innovative remittance fintech solutions

The companies profiled in this Digital Remittance market report include:

- American Express Company

- Citigroup, Inc.

- Digital Wallet Corporation

- GoCardless Ltd.

- Mastercard Incorporated

- Mavro Imaging

- Moneygram International, Inc.

- Nium Pte. Ltd.

- The Western Union Company

- WorldRemit Limited

For more information about this report visit https://www.researchandmarkets.com/r/wqrzt3

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment