Austin, Dec. 15, 2025 (GLOBE NEWSWIRE) -- Fiber Optic Preform Market Size & Growth Insights:

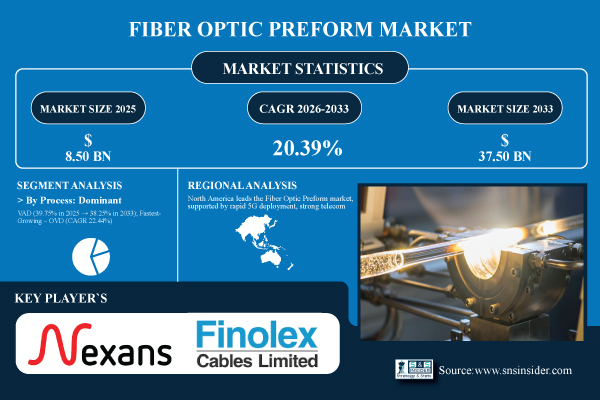

According to the SNS Insider,“The Fiber Optic Preform Market size was valued at USD 8.50 Billion in 2025E and is projected to reach USD 37.50 Billion by 2033, growing at a CAGR of 20.39% during 2026–2033.”

Rising Implementation of Protective Measures to Drive Market Expansion Globally

Strong protective measures that maintain local prices and protect domestic businesses from global overcapacity are driving the market for optical fiber preforms. These elements promote spending on increased production capacity and technological advancements, enabling regional firms to fortify their competitiveness and solidify their market positions. The market can meet growing demand while reducing threats from less expensive alternatives by encouraging innovation, efficiency, and resilience. Protective policies are a major underlying driver of the growth of the optical fiber preform business because they guarantee long-term growth, improve supplier capabilities, and preserve stable market dynamics.

Get a Sample Report of Fiber Optic Preform Market Forecast @ https://www.snsinsider.com/sample-request/9063

Leading Market Players with their Product Listed in this Report are:

Leading Market Players with their Product Listed in this Report are:

- Corning Incorporated

- Optical Cable Corporation

- Sterlite Technologies Limited

- OFS Fitel, LLC

- Prysmian Group

- AFL

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

- HENGTONG GROUP CO., LTD

- Fujikura Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Jiangsu Zhongtian Technology Co., Ltd.

- Nexans S.A.

- Finolex Cables Ltd.

- CommScope, Inc.

- Hitachi Cable, Ltd.

- LS Cable & System Ltd.

- Belden Inc.

- FiberHome Telecommunication Technologies Co., Ltd.

Fiber Optic Preform Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 8.50 Billion |

| Market Size by 2033 | USD 37.50 Billion |

| CAGR | CAGR of 20.39% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Process (OVD, VAD, PCVD and MCVD) • By Product Type (Single-Mode, Multi-Mode and Plastic Optical Fiber) • By End User (Telecom, Oil & Gas, Military & Aerospace, BFSI, Medical, Railway and Others) • By Technology (Fluorine-Doped Silica, Germanium-Doped Silica, Phosphorus-Doped Silica and Pure Silica) |

Purchase Single User PDF of Fiber Optic Preform Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9063

Hurdles Including Cost, Supply, and Innovation Can Hinder Growth Globally

A number of significant obstacles could prevent the fiber optic preform market from expanding. Scalability is restricted by high production costs and intricate manufacturing procedures, and suppliers are vulnerable to supply chain interruptions and price volatility due to their reliance on specialized raw materials. Profit margins are under pressure from fierce competition from low-cost foreign manufacturers, and compliance burdens are increased by strict environmental rules.

Key Industry Segmentation Analysis

By Process

VAD remains the dominant process segment, accounting for the largest share of 39.75% due to its established use in telecom, data communication, and high-quality optical fiber manufacturing. OVD is the fastest-growing segment at a CAGR of 22.44%, driven by rising demand for high-performance fibers, increasing investments in advanced production technologies, and the need for superior optical properties in emerging applications.

By Product Type

Multi-Mode fiber remains the dominant product type holding a share of 44.38%, as it is widely used in telecom and data centers due to its cost-effectiveness and ease of installation. Plastic Optical Fiber is the fastest-growing segment, growing at a CAGR of 23.17%, fueled by increasing adoption in short-distance communication, consumer electronics, and automotive applications.

By End-User

Telecom continues to dominate the end-user segment by holding a share of 34.51%, driven by the global expansion of broadband, 5G networks, and data communication infrastructure. The Others segment is the fastest-growing, expanding at a CAGR of 26.25% supported by rising demand in emerging sectors such as smart cities, IoT, renewable energy, and specialized industrial applications.

By Technology

Germanium-Doped Silica remains the dominant technology, which holds a 38.75% market share, preferred for high-performance fiber with low attenuation and broad bandwidth. Fluorine-Doped Silica is the fastest-growing technology, expanding at a CAGR of 22.90%, benefiting from advances in low-loss fibers, high-speed transmission requirements, and increasing applications in next-generation telecom networks and high-capacity data centers.

Regional Insights:

North America leads the Fiber Optic Preform market with 26.16% share in 2025, supported by rapid 5G deployment, strong telecom infrastructure, and increasing investment in high-speed broadband expansion.

Asia Pacific is the fastest-growing region in the Fiber Optic Preform market at a CAGR of 18.18% globally, propelled by massive telecom expansion, rapid 5G deployments, and rising data consumption.

Do you have any specific queries or need any customized research on Fiber Optic Preform Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9063

Recent Developments:

- In Aug 2024, Corning and Lumen Technologies partnered to supply next-generation AI-ready fiber-optic cables, reserving 10% of Corning’s global fiber capacity to more than double Lumen’s U.S. intercity network miles and support high-bandwidth data center demands.

- In Sept 2025, Sterlite Technologies (STL) launched its Celesta IBR Cable, the world’s slimmest optical fiber packing 864 fibers into just 11.7 mm, delivering ultra-high-density, bend-insensitive performance for data centers and hyperscalers with rapid installation and global deployment capabilities.

Exclusive Sections of the Fiber Optic Preform Market Report (The USPs):

- TECHNOLOGY INNOVATION & ADVANCED PREFORM DESIGN INDEX – helps you track adoption of MCVD, OVD, and VAD fabrication methods, R&D investment in low-loss and specialty preforms, patent activity in doping/core-cladding designs, and advancements in large-diameter, multicore, and eco-friendly low-PMD preforms.

- PERFORMANCE & RELIABILITY BENCHMARK SCORE – helps you evaluate optical attenuation levels, bandwidth performance, refractive index profile uniformity, defect density, thermal stability, and lifetime degradation under stress conditions during fiber drawing and deployment.

- PRODUCTION & SUPPLY CHAIN EFFICIENCY MATRIX – helps you assess manufacturing capacity utilization, production-to-drawing lead times, raw material dependency (silica, dopants, specialty glass), inventory turnover speed, and regional localization ratios across supply chains.

- COST & PRICING STRUCTURE ANALYSIS – helps you understand ASP variations across standard, dispersion-shifted, and specialty preforms, cost distribution in raw material and fabrication stages, dopant price impact, OEM vs aftermarket price gaps, and total cost of ownership across fiber production cycles.

- DEMAND & APPLICATION ADOPTION LANDSCAPE – helps you uncover adoption trends across telecom, data centers, sensing, and defense segments, regional demand share, specialty vs standard preform usage, FTTH-driven growth patterns, and rising demand for high-bandwidth, low-loss, multicore preforms.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.