Not for distribution to U.S. newswire services or dissemination in the United States

TORONTO, Dec. 19, 2025 (GLOBE NEWSWIRE) -- Galantas Gold Corporation (TSX-V & AIM: GAL; OTCQB: GALKF) (“Galantas” or the “Company”) wishes to provide an update with respect to its previously announced acquisition (the “Transaction”) of all of the issued and outstanding shares of RDL Mining Corp. (“RDL”) and its previously announced private placement (the “Offering”) of units of the Company (each, a “Unit”), for $0.08 per Unit (the “Offering Price”), led by Canaccord Genuity Corp. and Haywood Securities Inc. (together, the “Agents”).

The Company is working diligently to satisfy remaining closing conditions, including obtaining approval of the Transaction from the TSX Venture Exchange (the “TSXV”), and both the Offering and the Transaction are expected to be completed during 2025. Trading in the common shares of Galantas (“Common Shares”) is currently halted in accordance with TSXV Policy 5.3.

Clarification of the RDL Option

Once the Transaction is completed, Galantas (indirectly through RDL) will hold an option (the “Option”) to acquire a 100% interest in the Indiana gold/copper project located in Chile (the “Indiana Project”). In order to exercise the Option, RDL must make payments totaling US$15 million to Minería Indiana Limitada (“Indiana Limitada”), the current owner of the Indiana Project, over a period of five years, with the first payment of US$500,000 paid in the fourth quarter of 2025. The remaining payments consist of US$1 million in years one and two, US$2 million in years three and four and a final payment of US$8.5 million in year five (together, the “Option Payments”).

Until RDL has exercised the Option, RDL will “lease” the Indiana Project from Indiana Limitada in exchange for payments as follows:

- If the Indiana Project is in production, the monthly payment is equivalent to 10% of the net sales of minerals from the mining concessions.

- If the Indiana Project is not in production, the monthly payment based on net sales will not be paid, and the minimum payment below will be paid.

- On an annual basis, the minimum payment required is 25% of the Option Payment due for that year, and the maximum payment required is 50% of the Option Payment due for that year.

- If the Indiana Project is not in production, minimum payments will still be payable on an annual basis. As soon as the Option Payments are paid in full, RDL will no longer need to make any lease payments.

Such payments are made in exchange for access to the Indiana Project and are not credited as Option Payments.

Historical Mineral Resources

The Company would like to clarify and restate certain technical information previously provided in respect of the 2013 Technical Report (as defined below), which was included in the Company’s press release dated November 13, 2025. See below for the corrected information.

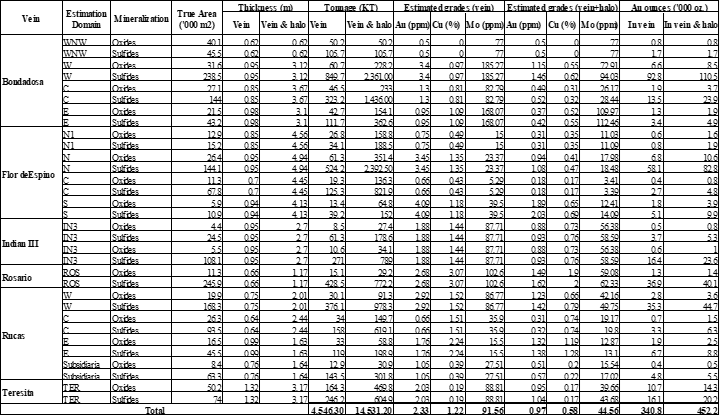

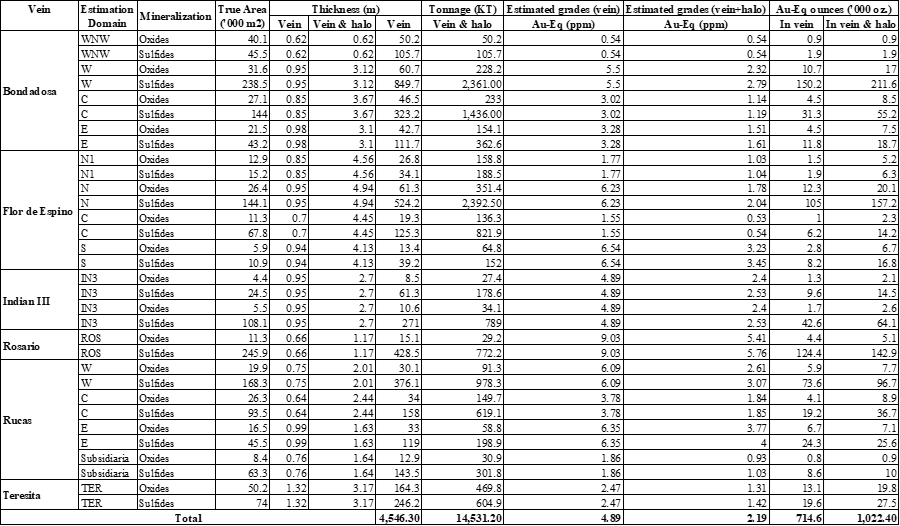

A historical inferred mineral resource estimate for the Indiana Project1 outlines approximately 714,600 ounces of gold equivalent (AuEq)2, consisting of approximately 4,546,300 tonnes, averaging 4.89 parts per million (ppm) AuEq, supported by a technical report (the “2013 Technical Report”) prepared for Minera Activa SpA in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

The historical inferred mineral resource estimate2 for the Indiana Project is contained in the table below.

The below table presents the inferred mineral resource estimate2 in terms of equivalent gold grade.

The Company considers the historical estimate to be relevant as it provides an indication of the mineral potential of the Indiana Project. However, a qualified person of Galantas has not done sufficient work to classify this historical estimate as current mineral resources or mineral reserves, and Galantas is not treating this historical estimate as current mineral resources or mineral reserves. Galantas has not verified this information and is not relying on it. To verify the historical estimate, Galantas will need to prepare an updated mineral resource estimate and NI 43-101 technical report with respect to the Indiana Project (the “New Technical Report”). Galantas is currently preparing the New Technical Report and intends to file it on SEDAR+ upon the completion of the Transaction in accordance with the policies of the TSXV and applicable securities laws.

Since the date of the 2013 Technical Report, additional exploration has been conducted on the Indiana Project. Approximately 1,500 meters of exploitation and exploration drifts have been excavated, mapped and sampled. In addition, approximately 960 meters of core was drilled in 2020.

Offering Update

The Company intends to rely on the “part and parcel pricing exception” provided for in the corporate finance policies of the TSXV in relation to gross proceeds raised that are specifically allocated and necessary for the Transaction, being $10 million (the “Transaction Funds”). The Offering Price for any non-Transaction Funds raised under the Offering may need to be adjusted after the Common Shares resume trading, and therefore closing of the Offering relating to any non-Transaction Funds will occur at least two business days after the Common Shares resume trading. Any adjustments to all or a portion of the Offering will require the approval of the TSXV and will be announced via a subsequent press release.

The securities offered under the Offering have not been registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any State in which such offer, solicitation or sale would be unlawful.

Notes

1 “Technical Report Indiana Gold and Copper Project Region III Chile” dated December 9, 2013, prepared in accordance with NI 43-101 by Dr. Eduardo Magri for Activa.

2 Gold equivalency based on the following prices: gold US$1,100/oz, copper US$2.80/lb, molybdenum US$12/lb, and adjusted for the following recovery rates: gold 75%, copper 88%, molybdenum 60% (e.g., 1 pound copper = (1 x $2.80) / $1,100 x (88% / 75%) AuEq). Areas, tonnages and metal content are rounded to the nearest hundred square metres, tonnes and ounces, respectively; vein thickness is rounded to the nearest centimetre, grades are rounded to two decimal places. Rounding may result in apparent differences between tonnes, grade and metal content. Inferred mineral resources were estimated as a global inferred geological resource using a vein accumulation methodology base on true widths, with grades estimated using Sichel’t estimation due to limited data density. No cut-off grade was applied to the inferred mineral resource estimate.

Qualified Person

Scientific and technical disclosures in this news release have been reviewed and approved by Mr. Gavin Berkenheger, who is considered, by virtue of his education, experience and professional association, a “qualified person” and independent under the terms of NI 43-101.

Neither TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the “UK MAR”) which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company’s obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

About Galantas Gold Corporation

Galantas Gold Corporation is a Canadian public company that trades on the TSX Venture Exchange and the London Stock Exchange AIM market, both under the symbol GAL. It also trades on the OTCQB Exchange under the symbol GALKF. The Company’s strategy is to create shareholder value by expanding gold production and resources at the Omagh Project in Northern Ireland, and exploring the Gairloch Project hosting the Kerry Road gold-bearing VMS deposit in Scotland.

Enquiries

Galantas Gold Corporation

Mario Stifano: Chief Executive Officer

Email: info@galantas.com

Website: www.galantas.com

Telephone: +44(0)28 8224 1100

Grant Thornton UK LLP (AIM Nomad)

Philip Secrett, Harrison Clarke, Elliot Peters

Telephone: +44(0)20 7383 5100

SP Angel Corporate Finance LLP (AIM Broker)

David Hignell, Charlie Bouverat (Corporate Finance)

Grant Barker (Sales & Brokering)

Telephone: +44(0)20 3470 0470

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including the terms of the Transaction and the Offering, the timing of the completion of the Transaction and the Offering, the potential repricing of the Offering, the details of Option Payments and the filing of the New Technical Report. Forward-looking statements are based on estimates and assumptions made by Galantas in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that Galantas believes are appropriate in the circumstances. Many factors could cause Galantas’ actual results, the performance or achievements to differ materially from those expressed or implied by the forward looking statements or strategy, including: gold price volatility; discrepancies between actual and estimated production, actual and estimated metallurgical recoveries and throughputs; mining operational risk, geological uncertainties; regulatory restrictions, including environmental regulatory restrictions and liability; risks of sovereign involvement; speculative nature of gold exploration; dilution; competition; loss of or availability of key employees; additional funding requirements; uncertainties regarding planning and other permitting issues; and defective title to mineral claims or property. These factors and others that could affect Galantas’ forward-looking statements are discussed in greater detail in the section entitled “Risk Factors” in Galantas’ Management Discussion & Analysis of the financial statements of Galantas and elsewhere in documents filed from time to time with the Canadian provincial securities regulators and other regulatory authorities. These factors should be considered carefully, and persons reviewing this news release should not place undue reliance on forward-looking statements. Galantas has no intention and undertakes no obligation to update or revise any forward-looking statements in this news release, except as required by law.

Tables accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/88c77237-c800-4cdd-aea0-69a6a9fcd310

https://www.globenewswire.com/NewsRoom/AttachmentNg/5c7c51b7-5e9a-4d0e-a53e-d9ab4a00505d