- COMPLETED $11,500,000 FULLY ALLOCATED PRIVATE PLACEMENT FINANCING WITH BMO

- COMPLETED ACQUISITION OF QUARTZ MOUNTAIN ADVANCED GOLD PROJECT IN OREGON, UNITED STATES FROM ALAMOS GOLD

- FILED NEW NI 43-101 TECHNICAL REPORT ON MINERAL RESOURCE ESTIMATE FOR QUARTZ MOUNTAIN GOLD PROJECT

- COMMENCED TRADING ON OTCQB® VENTURE MARKET UNDER “QGLDF”

- PRELIMINARY ECONOMIC ASSESSMENT (“PEA”) OF QUARTZ MOUNTAIN GOLD PROJECT STARTED WITH KAPPES CASSIDAY

- INITIATED TWO DRILL CAMPAIGNS AT MINE CENTRE GOLD PROJECT IN CANADA

- ADVANCED PERMITTING AT QUARTZ MOUNTAIN GOLD PROJECT WITH ENGAGEMENT OF SLR INTERNATIONAL

- BOARD OF DIRECTORS STRENGTHENED WITH INDUSTRY LEADERS: SCOTT PARSONS, VP EXPLORATION OF ALAMOS GOLD, AND JAMSHEED MEHTA, FORMER VICE CHAIR AT BMO CAPITAL MARKETS

TORONTO, Dec. 19, 2025 (GLOBE NEWSWIRE) -- Q-Gold Resources Ltd. (TSXV: QGR; OTCQB: QGLDF; Börse Frankfurt: QX9G) (“QGold” or the “Company”) is pleased to provide the following Q4 2025 shareholder overview and 2026 corporate strategies for the Company's flagship Quartz Mountain gold project (the “Quartz Mountain Gold Project”) in southern Oregon, USA, as well as the Mine Centre gold project in Ontario, Canada (the “Mine Centre Gold Project”).

"2025 was a transformational year for QGold," stated Peter Tagliamonte, President and CEO. "We successfully completed the acquisition of the high-quality Quartz Mountain Gold Project, secured $11.5 million in financing, and delivered an updated mineral resource estimate on the Quartz Mountain Gold Project demonstrating the significant scale and potential of this advanced-stage asset. I want to thank our dedicated team, our new board members, and our shareholders and local communities for their support as we achieved these critical milestones. With strong financial backing, a robust mineral resource estimate base, and experienced technical partners now engaged, we are exceptionally well-positioned to advance the Quartz Mountain Gold Project through economic studies and permitting in 2026, bringing us closer to our goal of becoming Oregon's next gold producer."

STRATEGIC FINANCING POSITIONS COMPANY FOR GROWTH

On October 3, 2025, QGold successfully closed a fully subscribed private placement financing for gross proceeds of $11,500,000, including a 15% overallotment, with BMO Capital Markets acting as agent (the “$11.5m Financing”). The financing significantly strengthened the Company's treasury, providing runway to advance multiple work streams across both of the Company’s gold projects, being the Quartz Mountain Gold Project and the Mine Centre Gold Project. Proceeds are being deployed toward the PEA, permitting advancement, exploration activities, and general corporate purposes.

TRANSFORMATIONAL ACQUISITION OF QUARTZ MOUNTAIN GOLD PROJECT

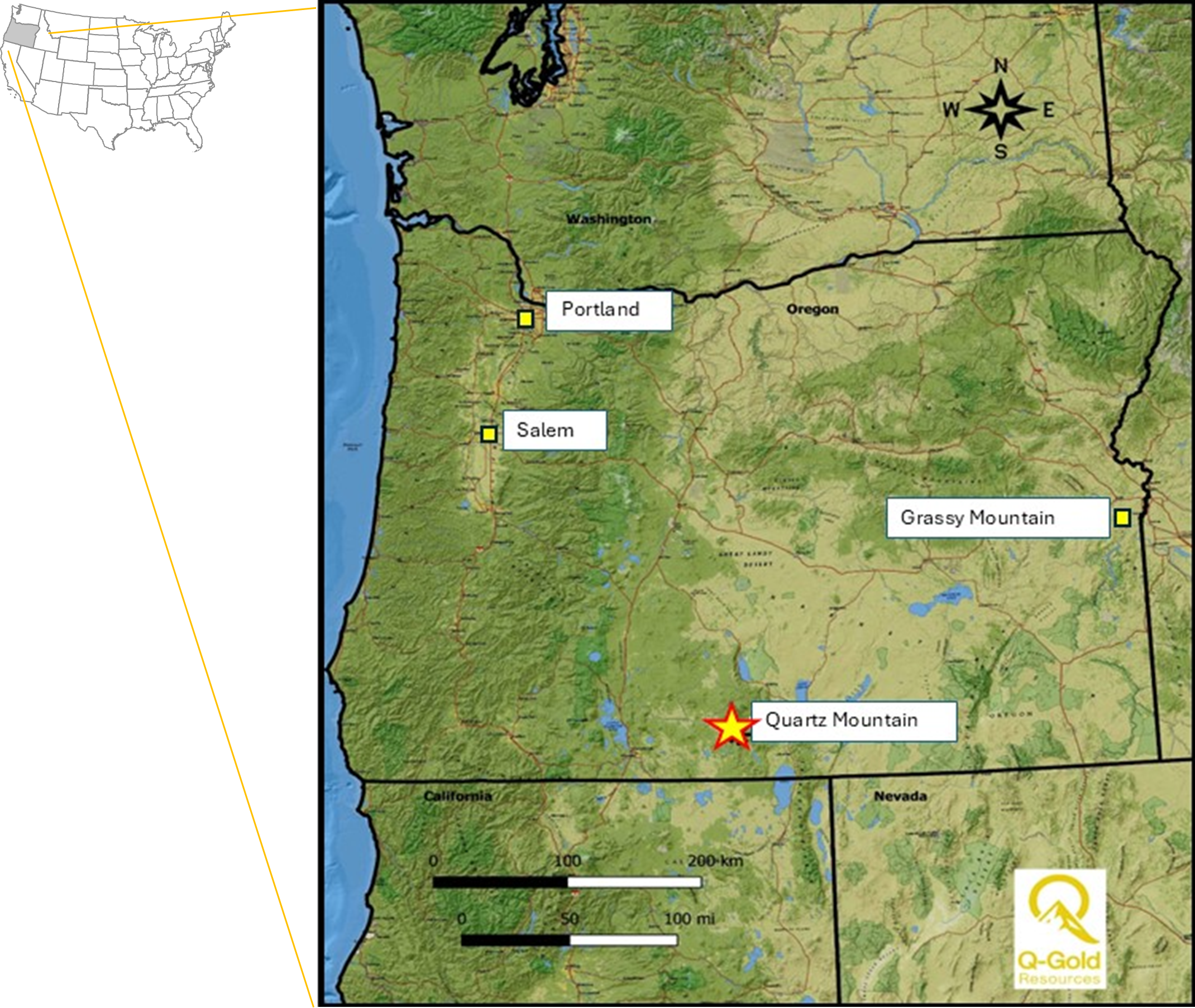

On October 22, 2025, QGold purchased the option to acquire the advanced-stage Quartz Mountain Gold Project from Alamos Gold Inc. (“Alamos Gold”), marking a pivotal moment in the Company's evolution. The project comprises two contiguous properties - Quartz Mountain and Angel's Camp - approximately 4,823 acres in south-central Oregon's prolific gold belt. See Figure I below.

The Quartz Mountain Gold Project benefits from over 90,000 meters of historical drilling, extensive geological data, and proximity to excellent infrastructure, including paved road access, electrical power, and supportive communities. This acquisition immediately elevated QGold's project portfolio, providing shareholders with exposure to a significant, well-defined gold and silver resource in an attractive jurisdiction.

NI 43-101 TECHNICAL REPORT FOR THE QUARTZ MOUNTAIN GOLD PROJECT

On October 23, 2025, QGold announced a significant milestone by disclosing details of an updated mineral resource estimate on the Quartz Mountain Gold Project (the “Mineral Resources Estimate”) following the filing by the Company on October 20, 2025 of a new technical report (the “Technical Report”) prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects. The new Technical Report highlights a relatively large indicated mineral resource estimate and open-pit amenable resource.

Highlights of the Mineral Resource Estimate include:

- An estimated 1,543,000 ounces of gold with a grade of 0.96 g/t and 2,049,000 ounces of silver with a grade of 1.27 g/t within 50,002,000 tonnes in the indicated mineral resource category

- An additional 148,000 ounces of gold with a grade of 0.77 g/t and 135,000 ounces of silver with a grade of 0.70 g/t within 5,992,000 tonnes in the inferred mineral resource category

- The Mineral Resource Estimate is amenable to conventional open-pit mining methods

The completion of the Technical Report enabled QGold to advance its strategy to move the Quartz Mountain Gold Project toward development and production. The Company quickly evaluated engineering firms to initiate mining technical studies, advancing the project toward feasibility and development.

INITIATION OF PRELIMINARY ECONOMIC ASSESSMENT

On November 21, 2025, QGold announced the engagement of Kappes, Cassiday & Associates (“Kappes Cassiday”), a highly respected Reno, Nevada-based engineering firm with extensive experience in gold project development and heap leach operations. Kappes Cassiday is conducting the PEA on the Quartz Mountain Gold Project, which is expected to provide a comprehensive evaluation of the project's economic potential. This will include mining methods, processing options, capital and operating costs, and projected financial returns and overall project economics. Kappes Cassiday brings decades of experience in metallurgical engineering and mine development, making it an ideal partner for this critical phase of advancement.

The PEA represents a critical step in de-risking the project and demonstrating its economic viability to stakeholders. Completion is anticipated in Q2 2026, positioning QGold to advance toward pre-feasibility studies thereafter.

COMMENCES TRADING ON OTCQB® UNDER QGLDF

In 2025, to enhance visibility and access for our U.S. shareholders, QGold expanded its trading presence by commencing quotation on the OTCQB® Venture Market under the symbol “QGLDF”, in addition to its primary listing on the TSXV under the symbol “QGR” and its listing on the Börse Frankfurt under the symbol “QX9G”. This additional trading platform is intended to broaden investor access and enhance liquidity for shareholders.

MINE CENTRE GOLD PROJECT EXPLORATION CONTINUES

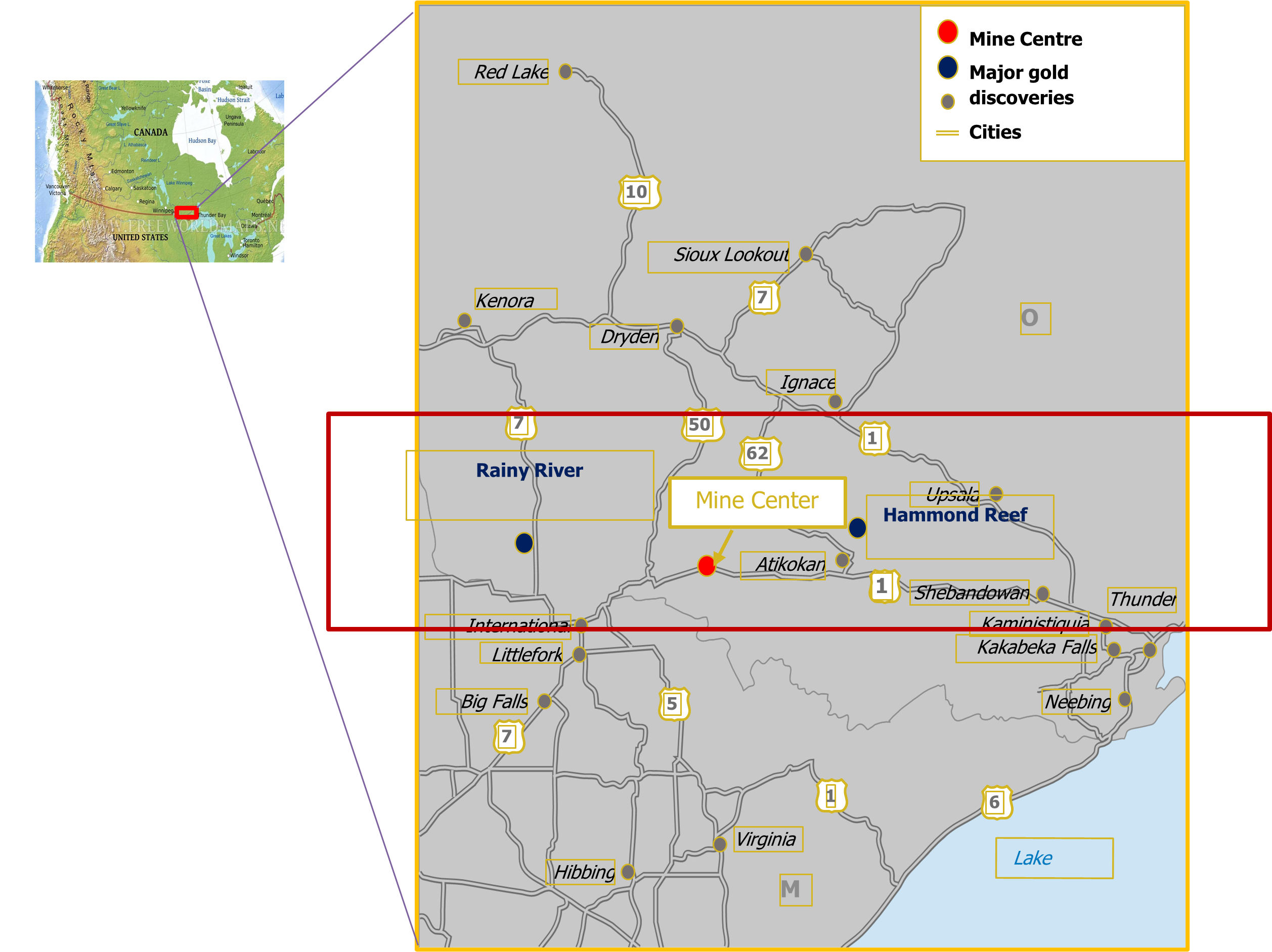

QGold completed two drill campaigns at its Mine Centre Gold Project in Ontario, Canada during 2025, testing high-priority targets and expanding the understanding of the project's gold potential. Drill results from the second program are under evaluation and are expected to inform future exploration strategies at Mine Centre, which remains an important asset in the Company's portfolio. We also have developed a robust exploration program at the project for 2026.

The Mine Centre Gold Project is strategically located in the Quetico region of northwestern Ontario, in proximity to the producing Rainy River Mine (New Gold) and the Hammond Reef Development Project (Agnico Eagle). See Figure II below.

The Company’s work to date has focused on just six veins in an area that is known to host more than 50 gold-bearing structures. This follow-up campaign represents an important step in defining the scale and continuity of mineralization at the historic Foley Mine area for QGold.

PERMITTING ADVANCEMENT WITH SLR INTERNATIONAL

To ensure efficient project development timelines, QGold engaged SLR International Corporation (“SLR International”), a leading international environmental consulting firm with offices in Portland and extensive experience in Oregon, to advance baseline environmental studies and permitting applications for the Quartz Mountain Gold Project. Early-stage permitting work is progressing in parallel with technical studies, positioning the Company to streamline the approval process once economic studies are complete.

Oregon maintains a well-established regulatory framework for mining operations, and QGold is committed to working collaboratively with regulatory agencies, local communities, and stakeholders throughout the permitting process.

The engagement of SLR International represents a significant milestone in advancing the Quartz Mountain Gold Project toward development.

STRENGTHENED BOARD WITH INDUSTRY LEADERS

The Company bolstered its board of directors with two highly accomplished industry professionals:

Scott Parsons, Director: Currently holding the position of VP Exploration at Alamos Gold Inc. A seasoned exploration geologist with decades of experience in gold exploration and resource development, Mr. Parsons brings deep technical expertise that is anticipated to prove invaluable to the QGold board as the Company advances its exploration and development programs, particularly at the Quartz Mountain Gold Project, which was acquired from Alamos Gold in later 2025.

Mr. Parsons holds a Bachelor of Science and a Master of Science in geology from Western University, and a Master of Business Administration from Athabasca University. He is a registered professional geoscientist in Ontario, a fellow of the Australasian Institute of Mining and Metallurgy, and serves as first vice-president and a member of the board of directors of the PDAC (Prospectors & Developers Association of Canada).

Jamsheed Mehta, Director: The former Vice Chair of BMO Capital Markets with extensive experience in capital markets, mining finance, and corporate strategy. During his tenure at BMO Capital Markets, Mr. Mehta held several senior leadership roles, including Head of Canadian Equities, Derivatives, and ETFs, culminating in his appointment as Vice-Chair in 2015, a position he held until his departure in 2023.

Throughout his career, Mr. Mehta has advised mining companies across all stages of growth, from grassroots exploration to production and M&A financing. He played a pivotal role in shaping BMO Capital Market’s equity capital markets strategy. He was a key member of the bank’s Equity Capital Commitments Committee, overseeing equity risk exposures and fostering long-term institutional relationships.

Mr. Mehta's appointment strengthens QGold's strategic guidance and capital markets relationships as the Company transitions toward development.

KEY PRIORITIES AND CATALYSTS FOR 2026:

- Completion of the Preliminary Economic Assessment: Deliver a robust PEA for the Quartz Mountain, providing an independent evaluation of mining methods, processing options, capital and operating costs, and overall project economics—establishing a strong foundation for future feasibility study work.

- Advance Initial Exploration Permits at Quartz Mountain: Secure necessary permits to enable expanded surface and drilling activities, facilitating mineral resource estimate growth and technical optimization.

- Initiate Exploration Activities at Angel’s Camp: Commence targeted fieldwork and drilling on the underexplored Angel’s Camp portion of the Quartz Mountain land package, aiming to identify new mineralization and enhance overall project potential.

- Initiate Exploration Activities at Quartz Mountain: Conduct mineral resource estimate expansion and infill drilling on the core Quartz Mountain project to support mineral resource estimate upgrades and provide material for advanced metallurgical studies.

- Metallurgical Drilling, Test Work, and Feasibility Advancement: Execute dedicated metallurgical drilling programs followed by comprehensive column leach and recovery testing, generating critical data to optimize process flowsheets and support progression toward feasibility studies and the conversion of mineral resource estimates from the indicated category to the measured category.

- Active Marketing and Industry Engagement: Attend and present at major mining conferences and investor events throughout the year to showcase progress, broaden shareholder awareness, and strengthen relationships with institutional and retail investors.

- Strategic Project Assessment: Continue evaluating high-quality North American gold and silver project acquisition opportunities to complement the existing portfolio, with a disciplined approach focused on value-enhancing, jurisdiction-friendly assets.

Peter Tagliamonte, President and CEO, commented: “With momentum from our transformative 2025 achievements, we firmly believe that 2026 is poised to be a year of execution and value creation. By systematically advancing the Quartz Mountain Gold Project through economic studies, permitting, and exploration, we aim to deliver multiple catalysts that highlight the project's compelling potential and position QGold as an emerging North American gold developer committed to responsible exploration and development practices, transparent stakeholder engagement, and creating long-term value for shareholders, communities, and the State of Oregon and Province of Ontario.”

Figure I - Quartz Mountain Gold Project Location Map

Figure II - Mine Centre Gold Project Location Map

Qualified Persons

The scientific and technical information contained in this news release has been reviewed and approved by Fred Brown, P.Geo., an independent consultant of the Company, and Dr. Andreas Rompel, Vice President, Exploration and a director of QGold, Pr.Sci.Nat., each a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About the Quartz Mountain Gold Project

The Quartz Mountain Gold Project is located in southern Oregon and represents QGold's flagship asset. Strategically positioned in a historically productive mining district with excellent infrastructure access, the project is a promising gold development opportunity.

QGold recently published (October 2025) a technical report prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. The report disclosed an estimated 1.543 million ounces of gold at 0.96 g/t and 2.049 million ounces of silver at 1.27 g/t within 50,002 kt of mineral resources in the indicated category, plus an additional 148,000 ounces of gold at 0.77 g/t and 135,000 ounces of silver at 0.70 g/t within 5,992 kt in the inferred category. The project represents a significant opportunity for QGold to advance its portfolio and unlock long-term value for shareholders.

About SLR International

SLR International is a premier environmental consulting firm with offices across North America, with a historical presence in Portland, Oregon, going back 20 years. As global leaders in full-spectrum sustainability solutions, the firm provides support in environmental permitting, baseline studies, and regulatory compliance for mining and natural resource projects, with extensive experience navigating Oregon's regulatory framework.

About Q-Gold Resources Ltd.

Q-Gold Resources Ltd. (TSXV: QGR; OTCQB: QGLDF; Börse Frankfurt: QX9G) is a publicly traded North American-based mineral exploration and development company focused on advancing gold and silver projects in mining-friendly jurisdictions across North America.

The Company’s shares are listed on the TSX Venture Exchange under the symbol “QGR”, the OTCQB® Venture Market in the United States under “QGLDF”, and the Börse Frankfurt exchange under “QX9G”.

QGold is committed to progressing its portfolio of gold and silver assets toward production, with its primary focus on its flagship Quartz Mountain Gold Project in Oregon (USA) and the Mine Centre Gold Project in Ontario (Canada).

QGold focuses on mineral resource estimate expansion or establishment through systematic exploration, disciplined project development backed by rigorous technical work, and responsible environmental stewardship in mining-friendly jurisdictions with established infrastructure.

For further information, contact:

Peter Tagliamonte, P.Eng.

Chief Executive Officer

Email: pwt@qgoldresources.com

Website: https://qgoldresources.com

Cell: +1 (416) 564-2880

Cautionary Notes

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the $11.5m Financing, including the anticipated use of net proceeds, the Company’s beliefs, plans, expectations or intentions for the Quartz Mountain Gold Project and Mine Centre Gold Project, including its plans to develop and progress its portfolio of assets toward pre-feasibility, feasibility, and production, the engagement of Kappes Cassiday and SLR International, including the scope of work for each engagement and the anticipated benefits of each as they relate to the completion of the PEA and permitting, and advancing development, as well as the Company’s business and exploration plans for 2026. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to: receipt of necessary approvals; general business, economic, competitive, political and social uncertainties; future mineral prices and market demand; risks of operating in a non-Canadian jurisdiction; foreign exchange risk, accidents, labour disputes and shortages; and other risks of the mining industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5311f71c-a40c-4bee-aa65-8f38ef384cad

https://www.globenewswire.com/NewsRoom/AttachmentNg/c3c3a640-3c8a-470d-a2e6-e6acdf0ee7ec