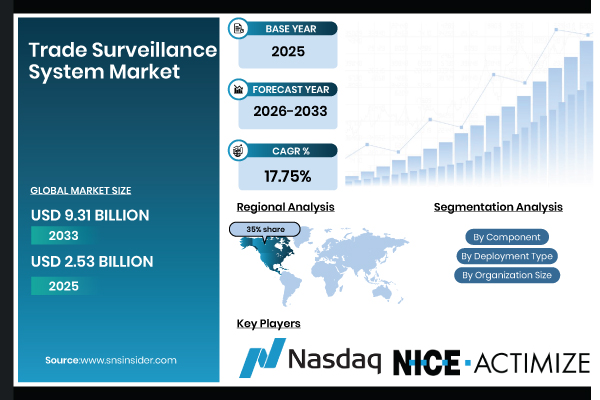

Austin, Dec. 20, 2025 (GLOBE NEWSWIRE) -- The Trade Surveillance System Market size is valued at USD 2.53 billion in 2025E and is expected to reach USD 9.31 billion by 2033, growing at a CAGR of 17.75% over 2026-2033.

As financial institutions come under more regulatory pressure to identify market abuse, insider trading, and fraudulent activity in real time, the market for trade surveillance systems is growing rapidly. The need for sophisticated surveillance techniques is being driven by the complexity of multi-asset markets, the quick expansion of electronic trading, and increasing transaction volumes.

Download PDF Sample of Trade Surveillance System Market @ https://www.snsinsider.com/sample-request/9050

The U.S. Trade Surveillance System Market size is valued at USD 0.76 billion in 2025E and is expected to reach USD 2.73 billion by 2033, growing at a CAGR of 17.40% from 2026-2033.

The U.S. Trade Surveillance System market is growing due to stricter regulatory enforcement, the rise of high-frequency and algorithmic trading, and increasing pressure on financial institutions to detect market manipulation in real time.

Segmentation Analysis:

By Component

Solutions led with 41.8% share as organizations rely heavily on advanced, integrated platforms for detecting market manipulation, insider trading, and regulatory violations. Analytics & Reporting Tools is the fastest-growing segment with a CAGR of 21.4% due to the rising need for deep trade behavior insights, anomaly detection, and automated compliance reporting.

By Deployment Type

Cloud-Based led with 47.6% share as financial institutions prioritize scalability, lower infrastructure costs, and faster deployment timelines. Hybrid Deployment is the fastest-growing segment with a CAGR of 20.2% as organizations seek a balance between on-premise security and cloud scalability.

By Organization Size

Large Enterprises led with 45.2% share as they manage massive trade volumes across multiple platforms, asset classes, and geographies. SMEs are the fastest-growing segment with a CAGR of 18.7% due to increasing regulatory expectations, expanding digital trading activity, and rising adoption of cloud surveillance solutions.

By End-User Industry

BFSI led with 38.9% share as banks, brokers, and financial institutions conduct high-value, high-frequency trades that demand stringent surveillance. Capital Markets & Trading Firms is the fastest-growing segment with a CAGR of 20.9% as these organizations require sophisticated tools to monitor high-speed trades, algorithmic activity, and cross-platform transactions.

If You Need Any Customization on Trade Surveillance System Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/9050

Regional Insights:

North America dominated the Trade Surveillance System Market with about 35% revenue share in 2025 due to its highly regulated financial ecosystem, strict compliance obligations, and early adoption of advanced monitoring technologies by major exchanges and investment firms. Asia Pacific is projected to grow at the fastest CAGR of about 19.56% from 2026–2033, driven by rapid expansion of digital trading platforms, increasing cross-border investment flows, and tightening regulatory requirements across emerging markets.

Growing Regulatory Pressure to Detect Abuse and Ensure Compliance Augment Market Expansion Globally

Global financial regulators are enforcing stricter laws to prevent spoofing, market manipulation, insider trading, and other illegal actions. Banks, brokerage houses, and trading platforms are forced to use advanced surveillance technology with automated reporting and real-time monitoring due to the increased regulatory scrutiny. Businesses are depending more and more on AI-enabled solutions to guarantee adherence, lower fines, and preserve open trade environments. The need for reliable, scalable trade surveillance solutions keeps growing as international markets change and regulatory agencies tighten compliance, hastening industry expansion throughout significant financial centers.

Key Players:

- Nasdaq Inc.

- NICE Actimize

- Aquis Technologies

- IPC Systems Inc.

- SIA S.p.A.

- SteelEye

- BAE Systems

- FIS

- Cinnober Financial Technology

- Trapets AB

- Bloomberg L.P.

- OneMarketData LLC

- ACA Group

- Scila AB

- Trading Technologies International

- Refinitiv

- Software AG

- CCL Compliance

- Eventus Systems

- Behavox

Buy Full Research Report on Trade Surveillance System Market 2026-2033 @ https://www.snsinsider.com/checkout/9050

Recent Developments:

2024, Nasdaq launched Surveillance AI, an advanced trade surveillance platform powered by generative AI and behavioral analytics to detect complex market manipulation (e.g., layering, spoofing, wash trades) across equities, fixed income, and crypto.

2025, NICE Actimize introduced X-Sight, a unified surveillance platform that correlates trading activity across equities, FX, derivatives, and crypto to identify cross-asset manipulation schemes.

Exclusive Sections of the Report (The USPs):

- AI / ML Detection Efficiency Metrics – helps you understand the effectiveness of AI- and ML-driven surveillance by comparing alert generation from AI/ML models versus rule-based systems, model precision, recall, false-positive rates, anomaly detection speed, and post-retraining performance gains.

- Algorithmic Manipulation Coverage Analysis – helps you assess how comprehensively surveillance systems detect complex abuse patterns, including spoofing, wash trades, cross-market manipulation, and advanced pattern-recognition algorithms.

- Data Management & Scalability Benchmarks – helps you evaluate system readiness for high-volume trading environments by analyzing structured vs. unstructured data handling, real-time ingestion speed, data retention requirements, and system load capacity during high-volatility periods.

- Deployment & Infrastructure Mix Insights – helps you understand adoption trends between cloud-based and on-premise trade surveillance deployments and their impact on scalability, compliance, and operational flexibility.

- Alert Generation & Case Management Efficiency – helps you measure surveillance workload and operational efficiency through alerts per trader or desk, alert classification distribution, investigation time, automated resolution share, and case closure rates.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.