Dublin, Dec. 23, 2025 (GLOBE NEWSWIRE) -- The "Semaglutide Market Outlook 2026-2034: Market Share, and Growth Analysis" report has been added to ResearchAndMarkets.com's offering.

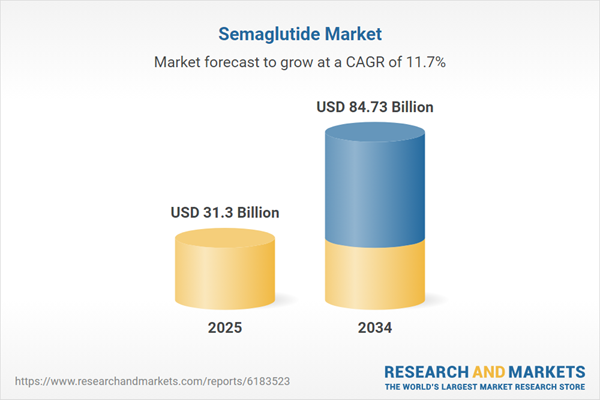

The Semaglutide Market is valued at USD 31.3 billion in 2025 and is projected to grow at a CAGR of 11.7% to reach USD 84.73 billion by 2034.

Demand consistently outpaces supply, pushing upstream investments in peptide synthesis (resin, solvents), sterile fill-finish, device components, and cold-chain logistics; brand owners increasingly ration by indication and geography while scaling capacity.

Payer behavior is the key commercial swing factor: diabetes coverage is entrenched, while obesity coverage varies widely by employer, plan design, and HTA rulings, shaping out-of-pocket exposure and adherence. Real-world data and label expansions continue to enlarge the addressable base beyond early adopters, supporting longer treatment duration and higher persistence with structured dose-escalation and side-effect management.

Competitive intensity rises from next-gen incretin agents (dual/triple agonists) and alternative delivery formats, yet semaglutide retains durable share where continuity of care, supply reliability, and established dosing algorithms matter. Downstream, telehealth, specialty pharmacy, and hub services orchestrate prior authorization, patient onboarding, and injection training; employer programs and cardiometabolic bundles become influential channels.

Over the medium term, manufacturing de-bottlenecking, oral dose innovation, and outcomes-based contracts will determine volume elasticity, while policy scrutiny (advertising, compounding, waste) and safety/contraindication management shape reputation and payer posture. Net-net, semaglutide has transitioned from a high-impact diabetes drug to a multi-indication franchise with ecosystem-level influence on primary care, obesity medicine, and cardiometabolic prevention.

Semaglutide Market Reginal Analysis

North America

Demand is propelled by high diagnosis rates, primary-care adoption, and strong specialist advocacy. Diabetes coverage is broad; obesity coverage remains heterogeneous across commercial plans and public programs, creating a mix of reimbursed and cash-pay cohorts. Telehealth platforms, employer benefits, and specialty pharmacy hubs shape initiation speed and refill reliability. Supply prioritization, copay dynamics, and adherence support (titration, side-effect management) drive real-world persistence.

Europe

HTA decisions and country-level obesity strategies determine pace of uptake. Diabetes indications are embedded in formularies; obesity access depends on BMI/complication criteria and budget impact analyses. Prescribing often sits in specialist clinics with structured follow-up. Pharmacy channels favor audited dispensing and pen return programs; outcomes registries and stewardship on safe use underpin reputation and renewal.

Asia-Pacific

A diverse landscape: advanced markets show strong guideline alignment and rapid specialist adoption; emerging markets balance growing private-pay demand with constrained public budgets. Oral semaglutide supports primary-care reach, while obesity treatment remains concentrated in urban centers. Local device and cold-chain partners are critical to availability; education on dose-escalation and GI management improves continuity.

Middle East & Africa

Rising metabolic disease burden and private insurance penetration support uptake, initially in premium private settings and government employee schemes. Access hinges on negotiated tenders, center-of-excellence models, and reliable cold-chain. Clinician education and patient support programs mitigate discontinuation due to tolerability or stock variability.

South & Central America

Urban private markets lead adoption, with public-sector access evolving via targeted programs. Currency volatility and import logistics influence continuity; distributors with robust inventory and patient hubs gain share. Diabetes indications anchor volume; obesity uptake grows where employer or supplemental plans reimburse and where prescriber training on titration and monitoring is widespread.

Semaglutide Market Key Insights

- Dual-franchise engine: Diabetes scripts provide durable baseline volume; obesity indications add a faster-growing, high-visibility second engine, with distinct payer rules, dose strengths, and service models.

- Supply is strategy: Peptide capacity, lyophilization, and pen component availability remain gating; winners prove reliability via dual sourcing, regional fill-finish, safety stocks, and transparent allocation policies.

- Access is the swing factor: Diabetes coverage is standardized; obesity access depends on employer benefits, step edits, and country HTA outcomes. Copay structures and prior authorization workflows drive initiation and persistence.

- Oral lifecycle matters: Oral semaglutide broadens prescriber reach and patient preference, especially in primary care and needle-averse segments, while higher doses target obesity-adjacent needs.

- Care model redesign: Telehealth plus specialty pharmacy hubs compress time-to-therapy, manage titration and side effects, and improve refill cadence; integrated cardiometabolic clinics emerge as anchor channels.

- Competitive pressure from next-gen incretins: Dual/triple agonists reset efficacy expectations; semaglutide defends share via outcomes evidence, tolerability familiarity, and device/route choice.

- Persistence over initiation: GI tolerability, dose-escalation coaching, nutrition/behavioral support, and clear expectations around plateaus are critical to maintaining therapy beyond early cycles.

- Economics beyond drug price: Employers assess absenteeism, cardiometabolic risk costs, and bariatric deferral; payers trial outcomes-based agreements and utilization caps to balance budgets.

- Policy and reputation management: Advertising scrutiny, compounding controversies, and environmental waste from pens drive stewardship programs (safe disposal, training, controlled messaging).

- Globalization with local nuance: Label scope, obesity recognition in guidelines, and pharmacy channel structure vary widely; success requires country-specific access playbooks and clinician education.

Key Questions Addressed

- What is the current and forecast market size of the Semaglutide industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional "hotspots" and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 160 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value (USD) in 2025 | $31.3 Billion |

| Forecasted Market Value (USD) by 2034 | $84.73 Billion |

| Compound Annual Growth Rate | 11.7% |

| Regions Covered | Global |

Companies Featured

- Novo Nordisk

- Catalent

- Thermo Fisher Scientific

- WuXi AppTec

- Samsung Biologics

- Bachem

- CordenPharma

- PolyPeptide Group

- AmbioPharm

- Lonza

- Piramal Pharma Solutions

- Siegfried

- Recipharm

- Baxter (fill-finish)

- Ajinomoto Bio-Pharma Services

Semaglutide Market Segmentation

By Band

- Wegovy

- Rybelsus

- Ozempic

By Route of Administration

- Oral

- Injection

By End-User

- Hospitals Pharmacies

- Retail Pharmacies

- Online Pharmacies

Countries Covered

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

Middle East and Africa

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

South and Central America

- Brazil

- Argentina

- Chile

- Peru

For more information about this report visit https://www.researchandmarkets.com/r/j7eikc

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment