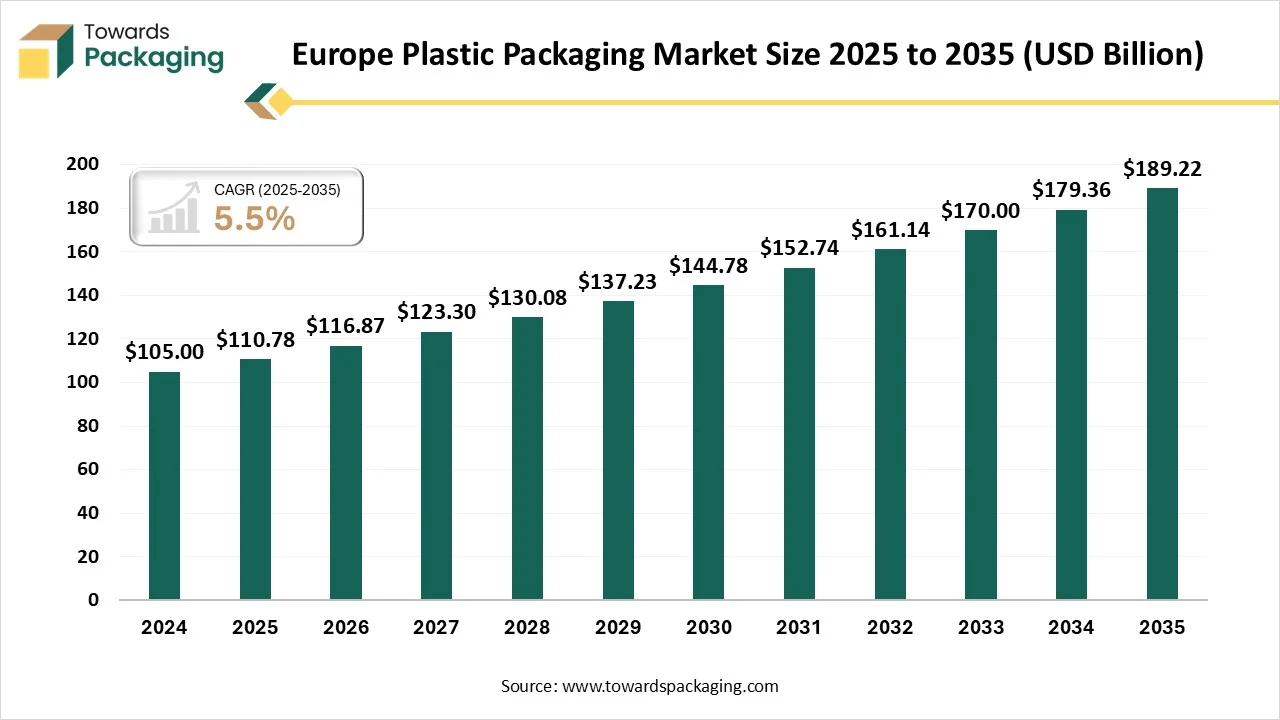

Ottawa, Jan. 07, 2026 (GLOBE NEWSWIRE) -- The Europe plastic packaging market, which stood at USD 110.78 billion in 2025, is projected to grow further to USD 189.22 billion by 2034, according to data published by Towards Packaging, a sister firm of Precedence Research. The European plastic packaging market is driven by strong demand from food, beverage, pharmaceutical, and personal care industries, supported by advanced manufacturing capabilities and high-quality standards.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Plastic Packaging in Europe?

Plastic packaging refers to the use of polymer-based materials to protect, contain, transport, and preserve products, ensuring durability, safety, convenience, and extended shelf life. The European plastic packaging market is driven by strong demand from food and beverage, pharmaceuticals, and personal care sectors, along with innovations in recyclable materials, lightweight packaging, regulatory compliance, and growing adoption of circular-economy and sustainability-focused solutions.

Sustainability initiatives, lightweighting, recyclable materials, and mono-material designs are reshaping product development, while regulatory pressure and circular-economy goals accelerate innovation and adoption of eco-friendly packaging solutions across the region.

Major Europe Initiatives for the Plastic Packaging Industry

- Single-Use Plastics Directive (SUPD) 2025 Milestone: A critical milestone in 2025 requires PET beverage bottles to contain at least 25% recycled plastic and targets a 77% separate collection rate for plastic bottles.

- Plastic Waste Minimization and Compostability Mandate: Starting in 2025, specific items such as very lightweight plastic carrier bags and sticky labels for fruit and vegetables must be industrially compostable, while overall per capita consumption of lightweight bags must not exceed 40 per year.

- EU Plastic Own Resource (Plastic Tax): This fiscal measure encourages member states to reduce waste by applying a uniform call rate on non-recycled plastic packaging waste, effectively acting as an incentive for increased recycling.

- Circular Plastics Alliance (CPA) Relaunch: This industry-led initiative aims to ensure that 10 million tonnes of recycled plastics are used in new products on the EU market annually by 2025, supported by a significant relaunch in 2025 to address current recycling sector challenges.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5904

What Are the Latest Key Trends in the Europe Plastic Packaging Market?

- Sustainability and Recyclability: Companies are increasingly adopting recyclable and bio-based plastics, focusing on circular economy goals. Innovations aim to reduce environmental impact and meet stringent EU regulations, while brands respond to consumer demand for eco-friendly packaging solutions and increased use of recycled content.

- Lightweighting and Material Optimization: Manufacturers are redesigning packaging to use less material without sacrificing performance. Lightweighting reduces transportation costs, energy use, and emissions, improving overall product sustainability and driving cost efficiencies across the supply chain.

- Mono-Material Packaging Solutions: There’s a shift toward mono-material designs that simplify recycling processes and enhance separation efficiency. These solutions maintain product protection while aligning with recycling infrastructure improvements and extended producer responsibility (EPR) initiatives within Europe.

- Smart and Active Packaging: Advanced packaging integrates sensors, QR codes, and antimicrobial coatings to improve product safety, traceability, and consumer engagement. Smart features help reduce food waste, provide real-time information, and enhance supply chain transparency.

- Regulatory Compliance and Extended Producer Responsibility (EPR): European policies push manufacturers to reduce plastic waste and increase recyclability. EPR schemes require producers to manage end-of-life packaging, accelerating sustainable practices and investment in recycling technologies throughout the region.

What is the Potential Growth Rate of the Europe Plastic Packaging Industry?

Innovation in Sustainable Materials and Advancements in Smart & Functional Packaging

Innovation in sustainable materials and advancements in smart and functional packaging drive the European plastic packaging market by addressing regulatory pressures, environmental concerns, and evolving consumer expectations. The development of recyclable, bio-based, and high-performance plastics supports circular-economy goals, while smart features such as QR codes, barrier enhancements, and active protection improve product safety, shelf life, traceability, and brand engagement, encouraging wider adoption across food, pharmaceutical, and personal care applications.

Country-Level Analysis:

Germany Plastic Packaging Market Trends

Germany’s dominance in the European market stems from its status as the continent’s largest plastics producer with a dense value chain, strong R&D networks, and advanced infrastructure. A highly skilled workforce, strategic location for converters and recyclers, and robust manufacturing and export capabilities further reinforce its leading position across packaging applications.

Which Factors Make Eastern European Countries the Fastest Growing in European Market?

Eastern European countries are the fastest-growing region in the European market due to rapid urbanization, rising disposable incomes, and increasing demand for packaged food, beverages and consumer goods. Expanding retail and e-commerce sectors, improved manufacturing capabilities, foreign investments, sustainability awareness, and gradual alignment with EU packaging regulations further accelerate packaging technology adoption and market expansion.

The UK Plastic Packaging Market Trends

The UK’s notable growth in the European market is driven by strong e-commerce expansion demanding durable, lightweight packaging and stringent sustainability regulations like the Plastic Packaging Tax and Extended Producer Responsibility that boost recycled content use. Rising consumer preference for eco-friendly packaging and advancements in recycling technologies further accelerate demand for innovative and sustainable plastic packaging solutions.

More Insights of Towards Packaging:

- Personal Care Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Food Service Packaging Market by Product, End-User, Region, and Key Manufacturers, Competitive Dynamics and Trends

- Luxury Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Recyclable mono-material PE Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Europe Pharmaceutical Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Europe Flexible Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Sustainable Wipe Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Microplastic Recycling Market Size, Trends, Segments and Competitive Analysis, 2025-2035

- Packaging Market Size, Trends, Segments, Competitive Analysis, Regional Dynamics with Manufacturers and Suppliers Data 2035

- Pharmaceutical Plastic Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Single-use Packaging Market Size, Segments, and Regional Dynamics (North America, Europe, APAC, LA, MEA)

- Alcoholic Beverage Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Form-Fill-Seal Packaging Market Size, Segments Data, and Regional Insights (NA, EU, APAC, LA, MEA)

- Pet Care Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Refillable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

Segment Analysis

Material Type Insights

What made the Polyethylene (PE) Segment Dominant in the Europe Plastic Packaging Market in 2024?

The polyethylene (PE) segment dominates the European plastic packaging market due to its excellent flexibility, durability, chemical resistance, and lightweight nature. PE is widely used in films, pouches, and containers for food and consumer goods, supported by cost-effectiveness, strong barrier performance, ease of processing, and high recyclability, aligned with Europe’s circular economy and sustainability initiatives.

The polyethylene terephthalate (PET) segment is the fastest-growing due to its strong recyclability, clarity, and lightweight properties, making it ideal for bottles and food containers. Growing demand for sustainable packaging, improved recycling infrastructure, and consumer preference for high-quality, safe materials boost PET adoption. Its suitability for beverage and personal care applications further accelerates growth across European markets.

Product Type Insights

How did the Bottles and Jars dominate the Europe Plastic Packaging Market in 2024?

The bottles and jars segment dominates the European plastic packaging market due to its widespread use in beverages, food, pharmaceuticals, and personal care products. These formats offer strong protection, convenience, resealability, and compatibility with materials like PET and HDPE. Their recyclability, durability, and suitability for mass production further support strong adoption across Europe.

The pouches segment is the fastest-growing in the European plastic packaging market due to increasing demand for lightweight, flexible, and convenient packaging. Pouches enhance shelf appeal, reduce material use and transportation costs, and support sustainable initiatives. Their versatility across food, pet food, and consumer goods, along with customizable shapes and resealable options, drives strong market adoption.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Application Insights

What made the Food and Beverage Segment Dominant in the Europe Plastic Packaging Market in 2024?

The food and beverages segment dominates the European plastic packaging market due to high consumption of packaged and processed foods, demand for extended shelf life, and strict hygiene requirements. Plastic packaging offers excellent barrier protection, lightweight handling, and convenience. Its compatibility with bottles, pouches, trays, and films supports widespread use across diverse food and beverage applications.

The pharmaceutical segment is the fastest-growing in the European plastic packaging market due to rising healthcare demand, stringent safety and contamination control requirements, and increased use of unit-dose formats. Plastic packaging offers excellent barrier protection, tamper evidence, and lightweight handling. Growth in biologics and specialty medicines further drives demand for advanced, reliable, and compliant packaging solutions across the region.

Recent Breakthroughs in the Europe Plastic Packaging Industry

- In September 2025, at FACHPACK 2025, held in September, Sappi Europe showcased its expanded portfolio of recyclable, high-barrier paper solutions, including Guard Pro OMH and Guard Duo. These innovations offer functional alternatives to multi-material plastics for food packaging, supporting both sustainability goals and efficient production, reflecting strong industry momentum toward recyclable mono-material solutions.

- In October 2025 at K 2025 in Düsseldorf, Braskem spotlighted its next-generation bio-based polyethylene products and circular packaging collaborations with Bottle Up and Eurobottle. Key launches included bio-based MDO films and Medcol LDPE for healthcare, underscoring progress toward bio-derived materials that offer performance and environmental benefits.

- In February 2025, Huhtamaki unveiled its ProDairy recyclable single-coated paper cups tailored for yogurt and dairy packaging, reducing plastic to less than 10% while ensuring strong barrier performance. This innovation meets stringent food safety and sustainability demands, supporting recyclability across Europe and addressing growing consumer and regulatory pressure for lower-plastic food packaging solutions.

- In May 2025, the European Packaging and Packaging Waste Regulation (PPWR) entered into force, harmonizing national packaging rules across the EU, boosting resource efficiency, and incentivizing reuse and recycling. This regulatory milestone is accelerating sustainable packaging innovation, creating business opportunities and supporting circular economy goals by reducing environmental impact from packaging and encouraging eco-design across sectors.

- In July 2025, Huhtamaki expanded its sustainable food packaging portfolio with home and industrial-compostable ice cream cups that also remain recyclable. Made from responsibly sourced paperboard with bio-based coatings, the new cups exemplify the firm’s commitment to reducing environmental footprint while maintaining quality and consumer appeal in frozen dessert packaging.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Europe Plastic Packaging Market & Their Offerings:

- Amcor Group: Flexible and rigid packaging for food, healthcare, and home care, with a focus on recyclable materials.

- ALPLA-Werke: Custom plastic bottles, caps, and injection-molded packaging systems for the beverage and consumer goods sectors.

- Coveris Holdings S.A.: High-performance flexible and sustainable plastic films and trays tailored for food and industrial use.

- Sealed Air Corporation: Specialized protective packaging and high-barrier food films under the CRYOVAC® brand.

- Mondi Group UK: Flexible plastic packaging and high-barrier films for pet food, home care, and personal care products.

- Flexible PE Film Extrusion: An industrial manufacturing process used to create polyethylene films for shrink wraps, bags, and industrial liners.

- RPC Group (Berry Global): A leading supplier of rigid plastic containers and closures through Berry Global’s European operations.

- Constantia Flexibles Holding: High-end flexible packaging and aluminum-based foil solutions for the pharmaceutical and food markets.

- Aptar Group: Precision-engineered plastic dispensing systems, spray pumps, and closures for beauty and pharmaceutical applications.

- Papier Mettler: A diverse range of flexible plastic carrier bags and industrial films for the retail and e-commerce sectors.

Segment Covered in the Report

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Bioplastics / Bio-based plastics

- Others (EVOH, EPS, etc.)

By Product Type

- Bottles & Jars

- Trays & Containers

- Cups & Tubs

- Pouches

- Films & Wraps

- Bags

- Clamshells & Blister Packs

- Caps & Closures

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Household Products

- Industrial Goods

- Chemicals

- Agriculture

By Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5904

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Dairy Product Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Hermetic Packaging Market Size, Segmentation, and Competitive Insights (2024-2034)

- Consumer Packaged Goods (CPG) Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Thin Wall Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Dunnage Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Retail Ready Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Blister Packaging Market Growth, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Cold Chain Packaging Refrigerants Market Size, Segments, Regional Data, and Competitive Landscape Analysis

- Packaging Adhesive Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Stick Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Metalized Flexible Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Thermoform Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Vacuum Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Food Packaging Technology and Equipment Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Automated Bagging Solutions Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035