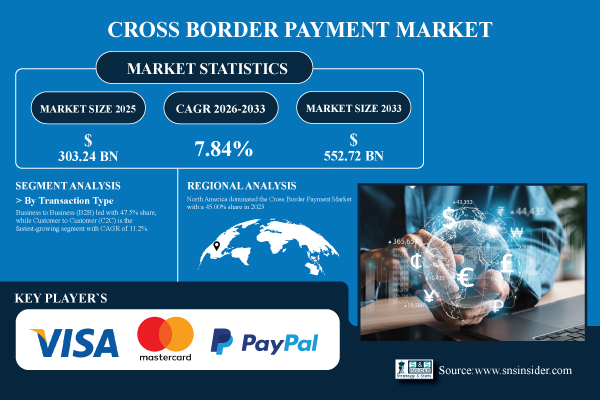

Austin, Jan. 07, 2026 (GLOBE NEWSWIRE) -- The global Cross Border Payment Market is valued at USD 303.24 billion in 2025E and is expected to reach USD 552.72 billion by 2033, growing at a CAGR of 7.84% over 2026-2033.

The market for cross-border payments is expanding gradually as a result of rising consumer demand for cutting-edge goods and services, industry-wide digital transformation, and technology breakthroughs. Efficiency and customer experiences are being improved by growing e-commerce, increasing consumer awareness, and using automation and AI-driven solutions.

Download PDF Sample of Cross Border Payment Market @ https://www.snsinsider.com/sample-request/9131

The U.S. Cross Border Payment Market is valued at USD 109.16 billion in 2025E and is expected to reach USD 195.16 billion by 2033, growing at a CAGR of 7.63% from 2026 to 2033.

Growth in the U.S. Cross Border Payment Market growth is driven by increasing adoption of advanced technologies, digital transformation, and demand for innovative solutions across industries.

Segmentation Analysis:

By Transaction Type

Business to Business (B2B) led with 47.5% share due to high transaction volumes, large monetary value transfers, and long-standing business relationships between international companies. Customer to Customer (C2C) is the fastest-growing segment with CAGR of 11.2% as peer-to-peer transfers gain traction through mobile apps, social platforms, and fintech solutions.

By Channel

Bank Transfer led with 42.8% share due to trust, security, and regulatory compliance, particularly for large-value corporate and institutional transactions. Card Payment is the fastest-growing segment with CAGR of 12.0% fueled by online commerce, consumer convenience, and instant settlement features.

By Payment Type

Bank Transfers led with 44.3% share as it is the most widely used payment type for B2B and institutional cross-border transactions. Digital Wallets is the fastest-growing segment with CAGR of 13.5% due to the rise of mobile-first users, fintech solutions, and e-commerce expansion.

By End-User

Large Enterprises led with 48.1% share as they handle high transaction volumes for global trade, supplier settlements, and payroll. SMEs are the fastest-growing segment with CAGR of 12.7% driven by globalization, cross-border e-commerce, and trade expansion.

If You Need Any Customization on Cross Border Payment Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/9131

Regional Insights:

Due to its sophisticated financial infrastructure, widespread use of digital payment methods, and robust presence of international banks and fintech firms, North America held a 45.00% market share in 2025, dominating the cross-border payment market. The region's market leadership was further strengthened by the extensive usage of e-commerce, B2B trading, and favorable regulatory frameworks.

Asia Pacific is expected to grow at the fastest CAGR of about 10.04% over 2026–2033, driven by rapid digital payment adoption, increasing international trade, and growing smartphone and internet penetration. Rising e-commerce activities, expanding cross-border remittance flows, and government initiatives promoting financial inclusion and digital banking accelerate the region’s rapid market growth.

Rapid Growth in Global Trade, E-commerce, and International Remittances is Boosting Market Expansion Globally

The number of cross-border transactions globally has increased due to the ongoing growth of international trade and the rise in e-commerce activity. To enable trade and remittance movements, both individuals and businesses need quick, dependable, and secure payment mechanisms. The need for smooth financial transfers is further fueled by an increase in international remittances, particularly in emerging markets. Digital payment solutions are being embraced by businesses more and more in an effort to boost customer happiness, decrease transaction delays, and increase operational efficiency. Together, these elements drive the expansion of international payment services and promote global investment in cutting-edge payment infrastructure.

Key Players:

- Visa Inc.

- Mastercard Incorporated

- PayPal Holdings Inc.

- Western Union Company

- MoneyGram International Inc.

- Wise Plc

- Stripe Inc.

- Adyen N.V.

- Payoneer Global Inc.

- Worldpay Inc.

- FIS Global

- Fiserv Inc.

- JPMorgan Chase & Co.

- Citigroup Inc.

- HSBC Holdings Plc

- SWIFT

- Ripple Labs Inc.

- Ant Group

- Tencent Holdings Ltd.

- Remitly Global Inc.

Buy Full Research Report on Cross Border Payment Market 2026-2033 @ https://www.snsinsider.com/checkout/9131

Recent Developments:

May 2024, Visa expanded Visa Direct, its real-time push payments network, to support instant cross-border disbursements in 100+ currencies with transparent, upfront foreign exchange (FX) rates.

January 2025, Mastercard launched Mastercard Move, a wallet-to-wallet cross-border payment service enabling consumers and small businesses to send money globally in seconds via mobile apps.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.