London, UK, Feb. 03, 2026 (GLOBE NEWSWIRE) -- Against a backdrop of persistent inflation uncertainty, geopolitical fragmentation, policy divergence, and sharp cross-asset swings, leading AI-driven market intelligence provider Permutable AI today announced the launch of its country-level macro signals data feeds - designed to help investors detect macro inflection points earlier and manage risk more confidently.

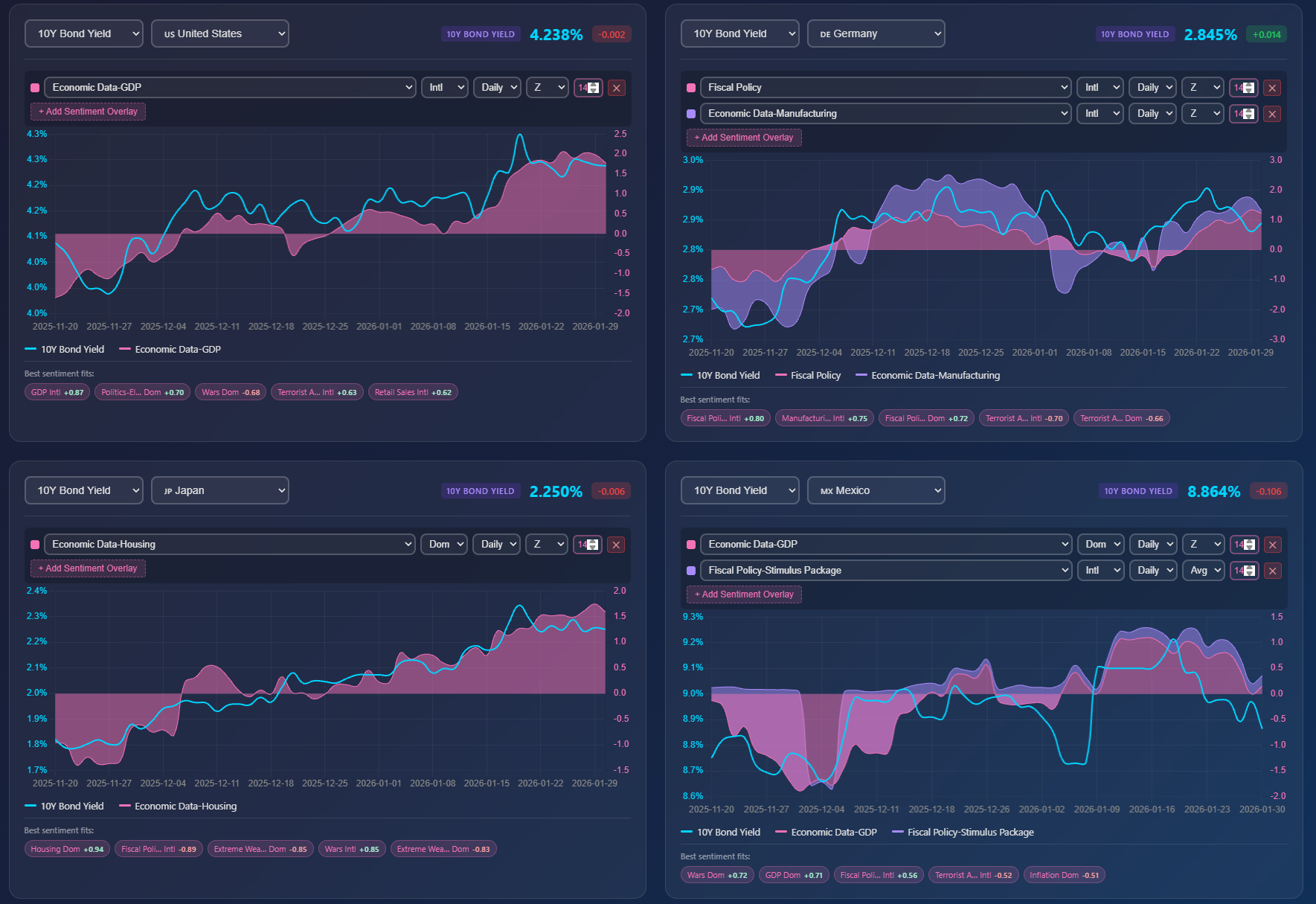

Dashboard showing Permutable AI country-level macro sentiment signals overlaid on 10-year government bond yields for the US, Germany, Japan and Mexico

The new suite delivers structured economic, policy, and sentiment indicators at national level for more than 40 economies, enabling traders, analysts, and portfolio managers to see shifts in growth, sovereign risk, and policy credibility before they are reflected in traditional data or prices.

In today’s markets, waiting for lagging indicators such as CPI, GDP releases, or central bank decisions can mean reacting too late. Permutable AI’s signals instead track changes in real-world and narrative momentum as they happen - providing early warning when risks are building beneath the surface.

Intelligence for a More Fragile Market Regime

From rate shocks and commodity spikes to elections, trade tensions, and supply chain disruption, global markets are increasingly driven by fast-moving narratives rather than slow-moving statistics.

Yet most macro investors still rely on backward-looking datasets.

Permutable AI closes this gap by analysing millions of local and international sources in real time, transforming unstructured information into systematic, tradable signals that highlight:

- Policy pressure before central bank pivots

- Inflation stress before official releases

- Political and implementation risks before markets reprice

- Divergences between perception and on-the-ground reality

The result: investors gain earlier context to adjust FX, rates, credit, and sovereign exposure - reducing drawdowns and improving timing.

Seeing the Cycle First

Backtested data demonstrates the platform’s predictive power across major economies.

In the United States, Permutable AI’s inflation sentiment flagged the 2021–22 price surge months ahead of core CPI, while rates sentiment turned before the 10Y Treasury yield during the Fed’s hiking cycle. In Japan, the system signaled Bank of Japan normalisation risk and the end of ultra-loose policy ahead of rate changes, providing early positioning signals for JPY and duration trades.

“What we are now offering is the most comprehensive on-the-ground macro sentiment across every country, updated every minute. We still maintain that market sentiment moves markets,” said Wilson Chan, CEO and Founder of Permutable AI. “In volatile environments, investors can’t afford to react after the fact. By analysing local-language sources alongside international coverage from across 180+ countries, we’re giving traders the ability to see policy pressure, growth momentum, and market risk as it builds - not after prices have already moved. This is intelligence that supports better decisions in real time.”

Domestic vs International: Two Lenses, Better Risk Control

The platform’s dual-lens approach captures both ground-level domestic sentiment and international “from the outside” perception.

- Domestic sentiment reveals street-level stress, policy execution risk, and coalition dynamics

- International sentiment reflects institutional narratives, geopolitical themes, and cross-border capital flows

This distinction is critical in volatile markets where mispricings often emerge from narrative disconnects.

For example, domestic housing sentiment in China has remained more constructive than international coverage, while UK domestic inflation sentiment highlights household strain earlier than policy-focused headlines. These divergences can signal when markets are over- or under-pricing risk.

“The biggest alpha opportunities often emerge when domestic reality diverges from international perception,” said Michael Brisley, Chief Commercial Officer at Permutable AI. “If local sentiment is deteriorating but global headlines remain calm, risk is building quietly. If the opposite is true, markets may be overreacting. That gap is where mispricings live. Our country-level intelligence makes those disconnects visible and actionable.”

Built for Real-World Decision-Making

Permutable AI’s country intelligence datasets are designed to directly support trading and risk management workflows, helping investors act earlier and with greater confidence in volatile markets. The intelligence enables cycle and risk monitoring by surfacing signs of domestic stress before they reach mainstream headlines, flagging early indicators of FX repricing, curve steepening, or spread widening.

It helps distinguish perception from fundamentals, revealing when markets are trading narrative rather than underlying reality, and uses local-language sources to detect policy and political risks such as execution slippage, street pushback, and credibility concerns.

These signals can be integrated into systematic models across FX, rates, credit, and sovereign strategies to inform cross-asset allocation, reduce surprise events, and improve positioning ahead of key catalysts.

Expanded Coverage, Local-Language Intelligence

The platform covers developed and emerging markets with deep local-language analysis, including the United States, United Kingdom, Eurozone economies, Japan, China, Brazil, Mexico, India, and over 170 additional countries. Each market includes multiple sentiment indices tracking inflation, rates, GDP, consumers, housing, and policy themes.

Availability

Permutable AI’s country-level macro signals are available now via API and integrate seamlessly into existing market data infrastructure for discretionary and systematic strategies alike.

For more information, to request a walkthrough, or to discuss an institutional trial, visit www.permutable.ai.

About Permutable AI

At Permutable AI, we deliver next-generation intelligence to decode the world’s most complex markets. Our plug-and-play LLM solutions cut through global macro, geopolitical, and financial noise – transforming overwhelming information into real-time, actionable signal. We exist to automate how capital markets process insight, fast-tracking decision-making through intelligent workflows that adapt as quickly as the markets move. Our mission is simple: turn complexity into clarity, and empower trading professionals to act with confidence, speed, and precision. We’re building the future of market intelligence – one where AI doesn’t just inform decisions, it enables them. Our vision is to set a new standard for speed, transparency, and strategic edge in global finance. By fusing explainable generative AI with capital markets expertise, we’re redefining what it means to stay ahead of the curve. Our flagship Trading Co-Pilot delivering real-time, LLM-powered signals for commodities, currencies, macro traders with fixed income and equities coming soon. Designed to save 90% of the time typically spent parsing global news and data, it transforms high-volume input into precision insight so you can focus on strategy, not searching. We’re powering the next era of trading intelligence: plug-and-play, explainable, and engineered for performance in today’s fast-moving markets.

Press Inquiries

Michael Brisley

enquiries [at] permutable.ai

https://www.permutable.ai

V123, Vox Studios, 1-45 Durham Street, SE11 5JH