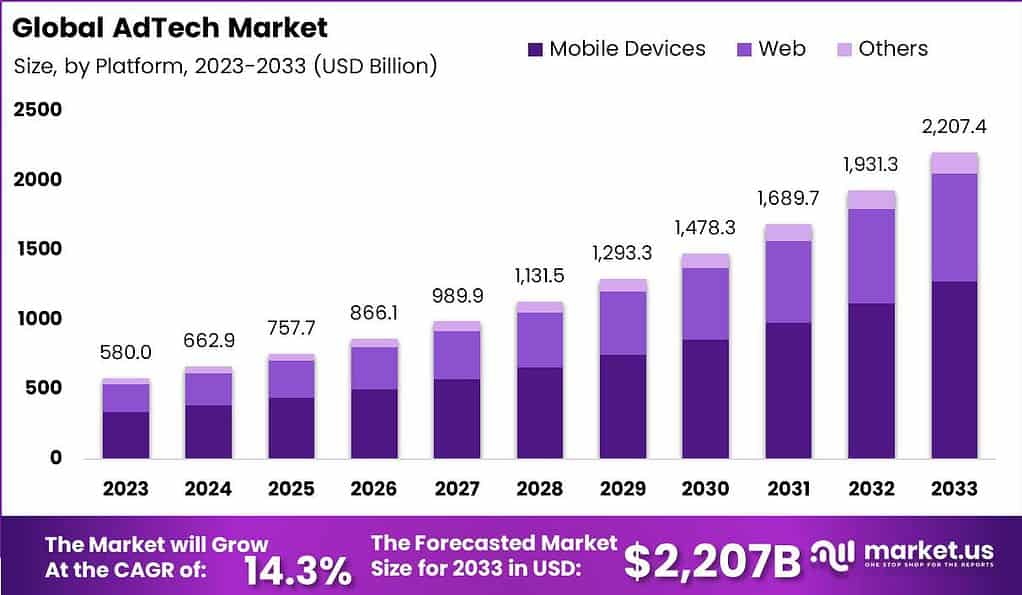

New York, Jan. 18, 2024 (GLOBE NEWSWIRE) -- According to a Market.us report, "The Global AdTech Market size is expected to be worth around USD 2,207.4 Billion by 2033 from USD 580.0 Billion in 2023, growing at a CAGR of 14.3% during the forecast period from 2024 to 2033."

AdTech, short for Advertising Technology, refers to the use of technology and data-driven solutions to optimize and automate advertising processes. It encompasses a range of tools, platforms, and strategies that enable advertisers to target, deliver, and measure their ad campaigns more effectively. AdTech solutions are designed to enhance the efficiency, precision, and impact of advertising efforts in today's digital landscape.

The AdTech market has witnessed substantial growth in recent years, driven by various factors. Firstly, the increasing digitalization of media consumption has led to a shift in advertising budgets from traditional channels to digital platforms. Advertisers are leveraging AdTech solutions to reach their target audiences across multiple digital touchpoints, including websites, social media, mobile apps, and streaming services.

Get deeper insights into the market size, current market scenario, future growth opportunities, major growth driving factors, the latest trends, and much more. Buy the full report here

Another driving force behind the AdTech market's growth is the availability and accessibility of vast amounts of data. AdTech platforms harness data from various sources, such as audience demographics, browsing behavior, and purchase history, to create detailed consumer profiles and enable precise targeting. This data-driven approach allows advertisers to deliver personalized and relevant ads, resulting in improved engagement and conversion rates.

Key Takeaways

- The AdTech market is expected to reach a valuation of USD 2,207.4 billion by 2033, with a projected CAGR of 14.3% from 2024 to 2033.

- The exponential increase in digital advertising spending, with 73% of individuals aged 10 and above having access to smartphones by 2022, has significantly contributed to the AdTech market’s growth.

- In 2023, Demand-side Platforms (DSPs) dominated the market with a 33% share, followed by Supply-side Platforms (SSPs), Ad Networks, and Data Management Platforms (DMPs), each serving specific advertising needs.

- Search Advertising held a dominant market position in 2023, capturing over 23% of the market share, followed by Programmatic Advertising, Display Advertising, Mobile Advertising, Email Marketing, and Native Advertising.

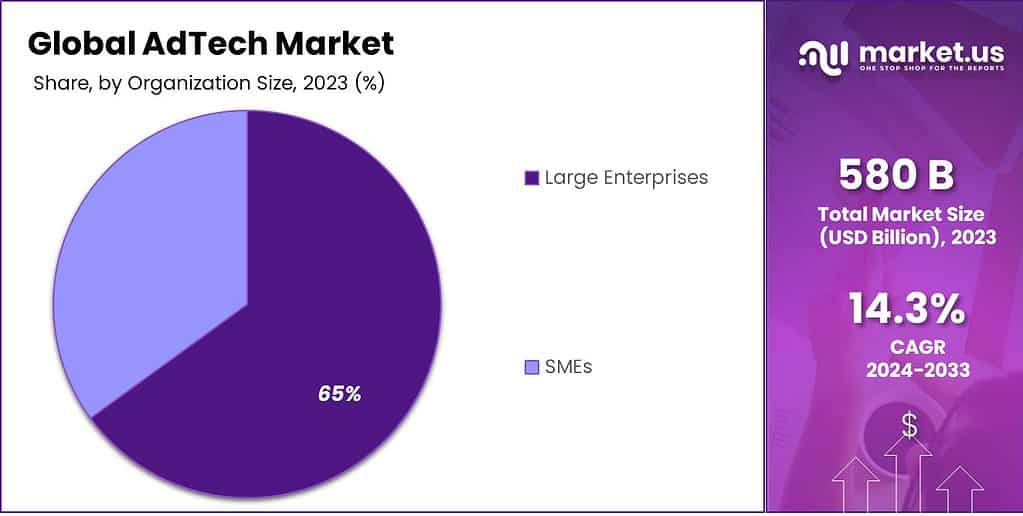

- Large Enterprises led the AdTech market in 2023 with a 65% share due to their extensive resources and the need for comprehensive advertising strategies. However, SMEs are rapidly gaining influence with user-friendly AdTech platforms.

- Mobile devices were the dominant platform in 2023, capturing over 58% of the market share, followed by Web. Emerging platforms like connected TVs and wearable devices are also gaining traction.

- Retail & Consumer Goods held the largest market share in 2023 (28%), driven by digital transformation and e-commerce growth. Other sectors such as BFSI, Media & Entertainment, Education, IT & Telecom, Healthcare, and more also contribute to the market diversity.

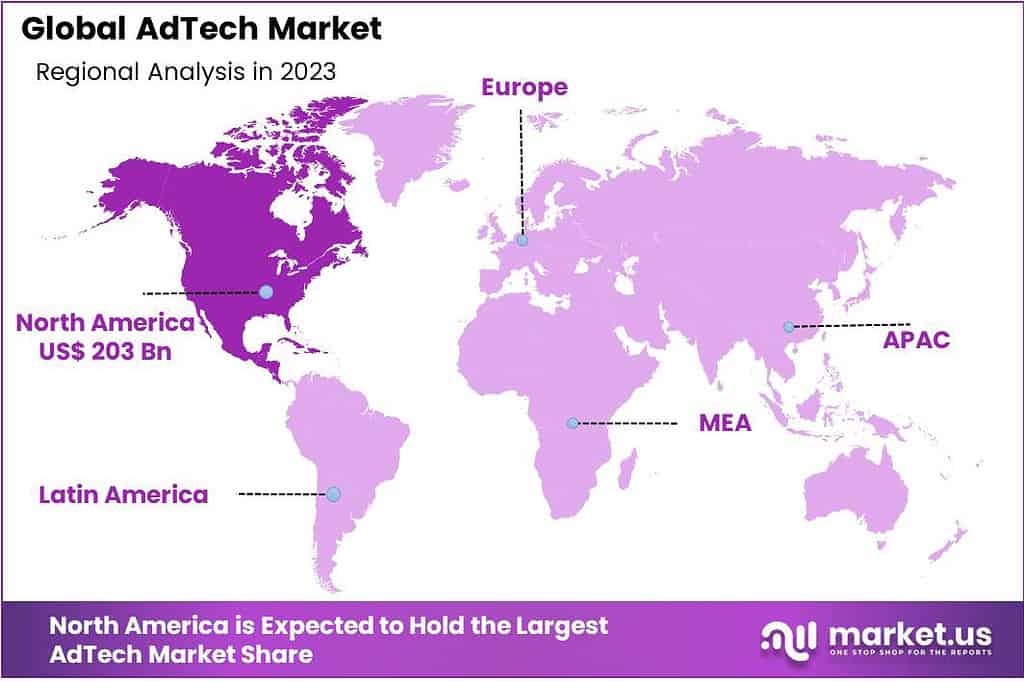

- North America led the AdTech market in 2023 with a 35% share, followed by Europe, APAC, Latin America, and MEA. Each region has its unique growth drivers, such as digital infrastructure and data protection regulations in Europe.

The report provides a full list of key companies, their strategies, and the latest developments. Download a PDF Sample before buying

Factors Affecting the Growth of the AdTech Market

- Digital Transformation: The ongoing digital transformation across industries has significantly impacted the AdTech market. As businesses shift their focus and advertising budgets towards digital channels, there is a growing demand for AdTech solutions that can effectively target and engage audiences in these digital environments.

- Data Availability and Advancements: The availability of vast amounts of data has revolutionized the AdTech landscape. Advertisers can now access detailed insights into consumer behavior, preferences, and demographics, enabling them to deliver more personalized and targeted ads. Advancements in data analytics and machine learning have further enhanced the ability to leverage data for precise ad targeting and optimization.

- Programmatic Advertising: Programmatic advertising has gained significant momentum in recent years. It enables automated buying and selling of ad inventory in real-time through sophisticated algorithms and bidding systems. Programmatic advertising offers efficiency, scalability, and precise targeting capabilities, driving its adoption and fueling the growth of the AdTech market. As an illustration, a significant portion, at least 25%, of Spotify's revenue is generated by its exclusive programmatic platform.

- Mobile Advertising: The proliferation of smartphones and mobile devices has led to a surge in mobile advertising. Advertisers are increasingly investing in mobile-centric AdTech solutions to reach consumers on-the-go and capitalize on the popularity of mobile apps, mobile websites, and location-based targeting.

- Artificial Intelligence and Automation: The integration of artificial intelligence (AI) and automation technologies has transformed the AdTech market. AI-powered algorithms analyze vast amounts of data to optimize ad targeting, creative optimization, and campaign management. Automation streamlines workflows, reduces manual tasks, and enables real-time optimization, enhancing efficiency and effectiveness.

Report Segmentation

By Solution Analysis

In 2023, the Demand-side Platforms (DSPs) segment held a dominant market position, capturing more than a 33.0% share of the global Advertising Technology (AdTech) market. This segment's preeminence can be attributed to several key factors. Firstly, DSPs have revolutionized the way advertisers access and bid for ad inventory, enabling real-time purchasing across a multitude of publishers. This efficiency in ad buying has significantly reduced the time and resources required for advertisers, fostering a more dynamic and responsive approach to ad placement.

Secondly, the integration of advanced analytics and data management capabilities within DSPs has empowered advertisers to target audiences more accurately and effectively. By leveraging data insights, advertisers can create more personalized and relevant ad experiences, leading to higher engagement rates and better campaign performance. This data-driven approach has been instrumental in enhancing the return on investment for advertising campaigns.

Furthermore, the increasing complexity of the digital advertising landscape has necessitated more sophisticated and automated tools for advertisers. DSPs, with their programmatic bidding capabilities, have provided a solution to this complexity, making them an indispensable tool for advertisers seeking efficiency and effectiveness in their digital campaigns.

By Advertising Type Analysis

In 2023, the Search Advertising segment held a dominant market position in the AdTech market, capturing more than a 23.0% share. This prominence can be primarily attributed to the fundamental role that search engines play in the daily online activities of consumers. Search Advertising, which involves placing ads within search engine results, capitalizes on the user's active search behavior, making it highly effective for targeting relevant audiences.

One of the key reasons for the segment's dominance is the high intent of users who engage with search ads. When consumers search for specific products or services, they exhibit a readiness to purchase or learn more, thereby increasing the likelihood of conversion from these ads. This high conversion potential makes Search Advertising a preferred choice for many advertisers, as it often leads to a better return on investment compared to other forms of digital advertising.

Moreover, the granularity of targeting in Search Advertising allows for a more tailored approach. Advertisers can use keywords and search terms that align closely with their products or services, reaching audiences who are more likely to be interested in what they offer. This precision targeting is not only cost-effective but also enhances the relevance of ads for users, contributing to a more positive user experience.

Don’t miss out on business opportunities in Market. Speak to our analyst and gain crucial industry insights that will help your business grow: https://market.us/book-appointment/?report_id=112188

By Organization Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the AdTech market, capturing more than a 65% share. This significant dominance can be attributed to several factors that align with the operational scale and strategic capabilities of large enterprises.

Firstly, large enterprises typically have more substantial marketing budgets compared to Small and Medium-sized Enterprises (SMEs). This financial prowess allows them to invest heavily in advanced advertising technologies and platforms, including programmatic advertising, sophisticated data analytics tools, and cross-channel marketing solutions. The ability to leverage these technologies not only enhances the reach and effectiveness of their advertising campaigns but also allows for more refined targeting and personalization, which are crucial in today's competitive market.

Additionally, large enterprises often have access to a broader range of data resources, including comprehensive customer databases and market research. This wealth of data enables them to develop more informed and strategic advertising campaigns. By utilizing data analytics and consumer insights, these companies can optimize their ad spend, improve campaign performance, and achieve a higher return on investment

By Platform Analysis

In 2023, the AdTech market witnessed the Mobile devices segment securing a commanding market position, encompassing over 58% of the market share. This dominance can be attributed to several key factors. Firstly, the exponential growth in mobile device usage, including smartphones and tablets, has substantially increased the target audience for advertisers. Mobile devices offer a personalized and convenient platform for users, allowing advertisers to deliver highly targeted and location-specific advertisements, enhancing their reach and impact.

Moreover, the availability of mobile apps and the integration of social media platforms on mobile devices have enabled seamless ad placements and interactions. The ability to track user behavior and gather valuable data for precise ad targeting has further amplified the appeal of mobile AdTech solutions. This, in turn, has attracted a substantial portion of advertising investments towards the Mobile devices segment. With the increasing reliance on mobile technology in daily life, this segment is poised to maintain its dominance, with continuous innovations and enhanced user experiences driving its growth in the AdTech market.

By Industry Verticals Analysis

In 2023, the Retail & Consumer Goods segment held a dominant market position in the AdTech market, capturing more than a 28% share. This significant market share is primarily attributed to the extensive use of digital advertising platforms by retailers and consumer goods companies to engage with a diverse and widespread consumer base. The retail industry, in particular, has been at the forefront of leveraging digital marketing strategies to drive sales and brand awareness. The integration of data analytics and personalized advertising approaches has enabled retailers to target specific demographics with tailored advertisements, resulting in higher conversion rates and customer retention.

The rise of e-commerce has further bolstered this trend, as online retailers utilize AdTech to gain insights into consumer behavior, preferences, and purchasing patterns. Additionally, the increased investment in digital advertising by consumer goods companies, aimed at boosting brand visibility and product promotions, has contributed to the growth of this segment. The Retail & Consumer Goods sector's reliance on digital advertising is also driven by the need to compete in a highly saturated market, where capturing consumer attention is crucial for success.

Gain expert insights and supercharge your growth strategies. Request our market overview sample now: https://market.us/report/adtech-market/request-sample/

Key Market Players

The sector faces robust competition, with numerous companies relentlessly pursuing maximum market share. Leading players direct their efforts towards providing advertising platforms, facilitating marketers in the buying, selling, and delivery processes of digital ads. The competitive landscape of the advertising technology market is in a perpetual state of change, primarily influenced by shifts in consumer behaviors, technology trends, and regulatory developments.

Top Key Players

- InMobi Technology Services Private Limited

- Twitter Inc.

- Meta Platforms Inc.

- Oracle Corporation

- Amazon.com Inc.

- Alibaba Group Holding Limited

- Microsoft Corporation

- Adobe Inc.

- Google LLC

- Verizon Communications Inc.

- Other key players

Recent Developments

- Meta completed the acquisition of Kustomer, a customer relationship management (CRM) platform, for USD 1 billion in August 2023. This strategic move is aimed at broadening Meta's advertising business by incorporating additional customer data.

- Launching in August 2023, Amazon Ads introduced a reporting feature for Household Reach and Frequency measurement, providing Streaming TV (STV) advertisers with enhanced tools for assessing campaign effectiveness. This release allows advertisers to plan and optimize campaigns more effectively, offering insights into reach and frequency at both the viewer and household levels.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 580 Billion |

| Forecast Revenue 2032 | US$ 2,207.4 Billion |

| CAGR (2023 to 2032) | 14.3% |

| North America Revenue Share | 35% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Key Market segments

By Solution

- Demand-side Platforms (DSPs)

- Supply-side Platforms (SSPs)

- Ad Networks

- Data Management Platforms (DMPs)

- Others

By Advertising Type

- Programmatic Advertising

- Search Advertising

- Display Advertising

- Mobile Advertising

- Email Marketing

- Native Advertising

- Others

By Organization Size

- Large Enterprises

- SMEs

By Platform

- Mobile devices

- Web

- Others

By Industry Verticals

- BFSI

- Retail & Consumer Goods

- Media & Entertainment

- Education

- IT & Telecom

- Healthcare

- Others

Market Dynamics

Driver: Proliferation of Smartphones for Greater Mobile Optimization and In-App Advertising

The widespread adoption of smartphones has been a significant driver for the AdTech industry. The increasing usage of mobile devices has led to a surge in mobile optimization and in-app advertising. Advertisers are capitalizing on the extensive reach and engagement opportunities offered by mobile platforms. Mobile optimization allows for more personalized, location-based advertising that can reach consumers directly on their devices. In-app advertising, in particular, benefits from the high engagement levels of app users, providing a lucrative channel for digital advertising.

Restraints: Stringent Privacy Regulations and Security Concerns

One of the primary restraints facing the AdTech market is the increasing stringency of privacy regulations, such as the GDPR in Europe and CCPA in California. These regulations impose limitations on data collection and usage, compelling AdTech providers to modify their approaches to comply with privacy standards. Additionally, security concerns related to data breaches and the unauthorized use of consumer data pose significant challenges, impacting consumer trust and advertiser confidence.

Opportunity: Widespread Adoption of AR and VR Technologies for More Interactive and Immersive Ad Experiences

The integration of Augmented Reality (AR) and Virtual Reality (VR) technologies presents a substantial opportunity in the AdTech market. These technologies offer new, immersive ways for brands to engage with consumers, creating interactive and engaging ad experiences. According to Market.us, worldwide spending on AR is likely to total USD 29.6 billion in 2024., reflecting the significant market potential. AR and VR enable advertisers to innovate beyond traditional ad formats, offering unique and memorable experiences that can enhance brand recognition and consumer engagement.

Challenge: Presence of Ad-Blocking Bypass Solutions

A notable challenge in the AdTech market is the prevalence of ad-blocking technologies. These solutions allow users to bypass traditional advertising, posing a significant hurdle for advertisers and publishers. The growing use of ad-blockers reflects consumer preferences for ad-free experiences, forcing the AdTech industry to seek alternative strategies, such as native advertising and content marketing, to effectively reach their target audiences.

Regional Analysis

In 2023, North America held a dominant market position in the AdTech sector, capturing more than a 35% share. This notable market dominance can be largely attributed to the region's advanced digital infrastructure, high internet penetration, and the presence of leading technology companies, many of which are pioneers in the AdTech space. The United States, in particular, is a significant contributor to this dominance, with its large and diverse advertising market driven by substantial investments in digital advertising. The region's openness to adopting new technologies, such as AI and machine learning for programmatic advertising, has further propelled its market leadership.

Europe follows closely, with a substantial market share, driven by its robust digital economy and stringent data privacy regulations like GDPR. These regulations have led to innovations in privacy-centric advertising technologies, positioning Europe as a key player in the global AdTech landscape. The United Kingdom, Germany, and France are notable contributors within the European market, leveraging their strong digital infrastructure and mature advertising sectors.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Browse More Related Reports

- Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032, growing at a CAGR of 12.00%.

- By 2032, the Satellite Communication market is anticipated to grow at a 9.4% CAGR, having reached USD 182.7 billion.

- Data Center Construction Market size is projected to reach a valuation of USD 453.5 Billion by 2033 at a CAGR of 6.7%.

- Cybersecurity Insurance Market is set to reach USD 62.7 billion by 2032, predicted to expand at a CAGR of 18.8% till 2032.

- Digital identity solutions market was valued at US$ 28 Bn and is projected to reach US$ 131.6 Bn by 2032, with the highest CAGR of 17.2%.

- Retail Analytics Market size is expected to be worth around USD 39.6 Bn by 2032 from USD 5.7 Bn in 2022, growing at a CAGR of 22%.

- Data catalog market accounted for USD 718.1 Mn in 2022. It is estimated to reach USD 5,235.2 Mn at a CAGR of 22.6% between 2023 and 2032.

- Game-Based Learning Market is expected to reach USD 77.4 bn between 2023 and 2032; register the highest CAGR of 21.6%.

- API Management Market will reach USD 49.9 Billion in 2032, from USD 4.5 Billion in 2022; at a CAGR of 28% during forecast period.

- Electric Vehicle (EV) Charging Infrastructure Market is Set to Attain USD 224.8 Billion by 2032, Expands Steadily at a CAGR of 27.5%.

- Farm management software market was USD 2.60 bn in 2022. It is estimated to reach USD 8.94 bn in 2032, CAGR of 13.5% from 2023-32.

- AI Training Dataset Market was valued at USD 1.9 Billion in 2022. This market is estimated to register the highest CAGR of 20.5%.

- Neuromorphic computing market reached USD 4.2 Bn in 2022 and is projected to reach US$ 29.2 Bn by 2032, growing at a CAGR of 22%

- Speech and voice recognition market size is expected to be worth around USD 83 bn by 2032 from USD 14 bn in 2022, grow at a CAGR of 20%

- Telecom Cloud Market is estimated to reach USD 127.6 billion by 2032, growing at a impressive CAGR of 18.9%.

- Dental Practice Management Software Market size is projected to surpass at USD 6.88 Billion by 2032; growing at a CAGR of 11.89%.

- Payment gateway market is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5%.

- Digital content creation market size is expected to be worth around US$ 181.4 Bn by 2032 from US$ 24.5 Bn in 2023, at a CAGR of 25.7%.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: