Ottawa, May 02, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global silicon carbide market size was valued at USD 3.72 billion in 2023 and is projected to surpass around USD 10.1 billion by 2031. The silicon carbide market is driven by increased industrial use, R&D projects, and advanced technology.

The silicon carbide market refers to the industry involved in the production, distribution, and sale of silicon carbide (SiC) materials and products. Silicon carbide, or carborundum, is a silicon-carbon compound found in moissanite. It is abundant in space and has numerous applications, including military ballistic armor, abrasives, electric cars, semiconductors, jewelry, fuel, and LEDs. Its hardness makes it appropriate for bulletproof armor, which is resistant to bullets and other dangerous items. Silicon carbide can be transformed into p-type or n-type semiconductors by including dopants such as boron and aluminum. It is also used in abrasives; therefore, it is less expensive and more durable than other materials. It is also utilized as a fuel in steel production, which results in purer steel and is more environmentally friendly. Silicon carbide technology was used to produce red, blue, and yellow LEDs, which are used in display boards, TVs, and computers.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4059

Key Insights

- Asia-Pacific dominated the market with the largest market share of 60% in 2023.

- North America is expected to grow at the fastest rate during the forecast period.

- By product, the black SiC segment has held a major market share of 55% in 2023.

- By product, the green SiC segment is projected to grow at a CAGR of 12.84% during the forecast period.

- By application, the electrical and electronics segment has generated more than 27% of the market share in 2023.

- By application, the automotive segment is expected to expand at the fastest rate during the forecast period.

Regional Stance

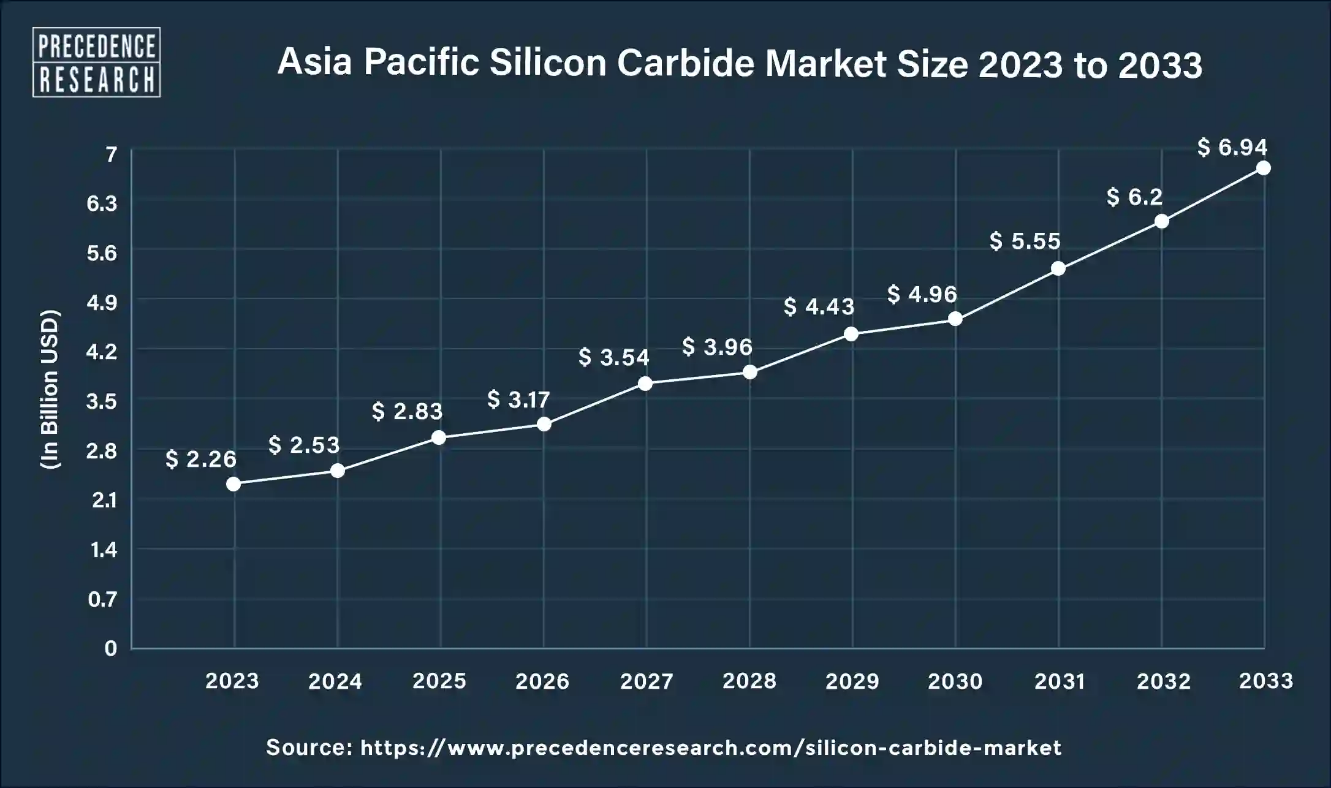

The Asia Pacific silicon carbide market size was valued at USD 2.26 billion in 2023 and is anticipated to reach around USD 6.94 billion by 2033, expanding at a CAGR of 11.82% from 2024 to 2033.

The SiC device industry is predicted to grow to $10 billion in the future years, led by applications in EVs and the industrial sector. Major industry players are increasing their footprint, and cooperation and consolidation are altering the supply chain. The Asia-Pacific Conference on Silicon Carbide and Related Materials (APCSCRM) is a top-tier event for the Asia Pacific-wide bandgap semiconductor industry and academia. Since its start in 2018, it has drawn representatives from over ten nations, with an average annual attendance of over 500. The conference will include interdisciplinary themes such as crystal and epitaxial growth, material characteristics, power and RF devices, packaging modules, system solutions, and applications.

North America is expected to grow at the fastest rate during the forecast period. The growing demand for silicon carbide in industrial applications has prompted businesses, governments, and research institutions to invest in expanding manufacturing capacity and regional presence. Opportunities exist in both the upstream and downstream sectors, with growth tactics such as product innovation, expansion, collaborations, and acquisitions providing profitable growth for future market participants.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Scope of Silicon Carbide Market

| Report Coverage | Details |

| CAGR | 11.74% from 2024 to 2033 |

| Market Size in 2023 | USD 3.72 Billion |

| Market Size in 2024 | USD 4.16 Billion |

| Market Size by 2033 | USD 11.29 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

| Historical Year | 2021-2022 |

| Segments Covered | By Product and By Application and By Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

Product Insights

The black SiC segment dominated the silicon carbide market in 2023. Black silicone is a versatile sealer that provides excellent performance in protecting surfaces from stains, moisture, and damage. Its low reflectivity and strong light absorption make it ideal for a variety of applications. The features of black silicone include flexibility, chemical resistance, temperature resistance, weather resistance, water repellency, electrical insulation, and durability. It can tolerate both high and low temperatures, making it ideal for harsh environments. Its flexibility and elasticity make it perfect for applications involving material movement and bending. Its chemical resistance makes it appropriate for exposure to a variety of chemicals.

Moisture does not penetrate the surface of black silicone due to its natural water-repellent properties. Its resilience makes it a dependable and long-lasting sealer. Its uses include glass and automobile sealing, image sensor fabrication, solar cells, thermal imaging cameras, and photodetectors.

The green SiC segment is expected to grow at the fastest rate during the projected period. Green silicon carbide is a durable, wear-resistant substance that ranks second only to diamond. It is suitable for use in ore hopper linings, wear-resistant pipelines, impeller pump chambers, rocket nozzles, and gas turbine blades. It is purer than black silicon carbide and ideal for fine grinding of materials such as carbide and diamond products.

Personalized your customization here: https://www.precedenceresearch.com/customization/4059

Application Insights

The electrical and electronics segment dominated the silicon carbide market share in 2023. Silicon carbide (SiC) is emerging as a viable alternative to silicon in the electronics and EV charging industries. SiC, which has a hardness of 9.5, outperforms silicon in terms of power handling capacity and performance at high temperatures. Its excellent thermal conductivity and hardness make it appropriate for heat-intensive processes in sectors such as foundries, steel, and ceramics. SiC's unique properties offer system-level benefits in high-power device applications.

The automotive segment is anticipated to witness the fastest growth rate during the projected period. Silicon carbide (SiC) is a lightweight material suitable for usage in vehicle parts due to its low weight, high strength, and hardness. It works well for structural parts like suspension systems, brakes, and engine elements, as well as wear-resistant components like bearings and gears. SiC's strong thermal conductivity and chemical inertness make it ideal for high-temperature applications. It is used in braking discs, engine components including pistons and cylinder liners, and suspension systems like shock absorbers and springs. These materials can enhance fuel efficiency and handling, lower greenhouse gas emissions, and reduce automotive weight.

Market Dynamics

Drivers

Increased use of silicon carbide in EV

The usage of SiC in electronic vehicles has boosted the growth of the silicon carbide market. Electric vehicles (EVs) have an average battery capacity of 40 kWh, allowing them to provide energy to a standard home for the full day. This alternative "vehicle-to-home" (V2H) technique will likely disrupt the market and modify energy use in the future. When demand is high, EVs can save money on power, reduce grid demand, and return energy to the grid (V2G).

Manufacturers are developing bi-directional onboard chargers (OBCs) for V2H, V2G, and V2L applications. These next-generation power solutions rely more on SiC power devices, such as GeneSiC MOSFETs, which offer high temperature, high-speed performance, and low leakage while supporting high surge currents with little forward-voltage drop and fast switching.

Silicon carbide-based components in solar devices

Emerging solar technology has become a significant growth factor for the silicon carbide market. SiC technology is propelling advancements in energy management, particularly solar conversion, wind energy, heat pumps, and energy storage. Customers increasingly turn to solar power and battery storage technology with escalating power disruptions due to weather and climate change. In the United States, the 'attach rate' for battery storage capabilities sold with solar panels has risen from 9.5% to 17.1% in 18 months.

GeneSiC's trench-assisted planar-gate technology enables high-yielding manufacturing while maintaining leading-edge performance. The KATEK Steca coolcept fleX series transforms DC power from solar panels into 4.6 kW AC power for home usage, grid return, or local storage. The inverters utilize sixteen GeneSiC 1200 V, 75 mΩ-rated SiC MOSFETs, resulting in a two-level converter with bi-directional boost converters and an H4-topology for AC voltage output. The increased switching frequency lowers the size and weight of passive components, making the KATEK unit more efficient than traditional silicon-based inverters.

Restraint

Fabrication challenges

SiC, a material with well-known characteristics, has been employed in power devices since the early 2000s. The move to 200-mm wafers has been difficult due to the material's hardness, high temperatures, energy requirements, and processing time. The most common crystalline structure (4H-SiC) has a high transparency and refractive index, making it difficult to detect faults. Crystalline stacking faults, micropipes, pits, scratches, stains, and surface particles are examples of defects found during the manufacture of SiC substrates. These faults can have a severe impact on SiC device performance and present complicated issues in terms of cycle time, cost, and dicing performance. Even upgrading to 200-mm wafers will present substantial challenges in ensuring substrate quality and dealing with a larger density of faults.

Browse More Insights:

- Silicon Tetrachloride Market: The global silicon tetrachloride market size was valued at USD 2.40 billion in 2022 and is expected to hit USD 3.40 billion by 2032, exhibiting growth at a CAGR of 3.60% during the forecast period 2023 to 2032.

- Honeycomb Core Materials Market: The global honeycomb core materials market size was valued at USD 3.26 billion in 2023 and is anticipated to reach around USD 7.07 billion by 2033, growing at a CAGR of 8.04% from 2024 to 2033.

- Synthetic Gypsum Market: The global synthetic gypsum market size was valued at USD 1.63 billion in 2023 and is anticipated to reach around USD 2.29 billion by 2033, growing at a CAGR of 3.42% from 2024 to 2033.

- Polyester Film Market: The global polyester film market size was valued at USD 33.06 billion in 2023 and is anticipated to reach around USD 60.50 billion by 2033, growing at a CAGR of 6.23% from 2024 to 2033.

- Rosin Resin Market: The global rosin resin market size was valued at USD 2.48 billion in 2023 and is anticipated to reach around USD 4.05 billion by 2033, growing at a CAGR of 5.03% from 2024 to 2033.

- Precious Metal Catalysts Market: The global precious metal catalysts market size was valued at USD 50.08 billion in 2023 and is anticipated to reach around USD 131.80 billion by 2033, expanding at a CAGR of 10.16% from 2024 to 2033.

Opportunity

SiC detectors

SiC detectors are interesting alternatives for UHDR beam dosimetry and monitoring due to their high radiation hardness, rapid response, sensitivity, and dose rate independence. The 4H-SiC detector, which has a hexagonal crystal structure of SiC, combines the sensitivity of Si with the durability of diamond. ST-Lab developed ultra-thin SiC detectors with various active areas and thicknesses in partnership with INFN's Catania division as part of the FRIDA (Flash Radiotherapy with High Dose Rate Particle Beams) project. The detector has a variety of active regions and thicknesses, with the first dosimetric evaluation performed using UHDR electron beams.

Recent Developments

- In April 2024, Aixtron, a German chip systems manufacturer, announced first-quarter revenue that was above market estimates and confirmed its 2024 outlook. The company, which provides deposition equipment to chipmakers, praised its accomplishments on the G10-SiC system and in the larger market, citing a contract with a top-five SiC producer and a large order from China. The quarterly sales came in at 118.3 million euros ($126.59 million), which was better than the company's projection range of 100 million to 120 million euros. The SiC and GaN segments accounted for over half of the top line.

- In April 2024, ROHM and STMicroelectronics expanded their long-term supply agreement with SiCrystal, a German business, to accommodate higher volumes of 150mm silicon carbide substrate wafers. The new $230 million arrangement will help STMicroelectronics boost its device manufacturing capacity for automotive and industrial customers around the world. The increased agreement increases STMicroelectronics' supply chain resilience for future expansion.

- In March 2024, Wolfspeed finished building its largest and most advanced John Palmour Manufacturing Center for Silicon Carbide, which cost USD 5 billion and covers 445 acres. The first phase is scheduled to be finished by the end of 2024. The facility will primarily manufacture 200mm silicon carbide wafers, which are 1.7 times larger than 150mm wafers, to address the need for next-generation semiconductors for energy transformation and artificial intelligence.

- In September 2023, Continental Device India Private Limited (CDIL) developed the country's first silicon carbide device manufacturing line at its Mohali facility, with an investment of approximately Rs.30 crore. The development will raise CDIL's total capacity to 600 million units annually. Due to the increased demand for electric vehicles, power management systems, and solar-powered panels, the company concentrates on Silicon Carbide products.

Silicon Carbide Market Key Players

- Infineon Technologies AG

- Cree, Inc.

- Toshiba Corporation

- General Electric Company

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- ROHM Co., Ltd.

- Microsemi Corporation (Microchip Technology Inc.)

- United Silicon Carbide, Inc.

- Fuji Electric Co., Ltd.

- Monolithic Power Systems, Inc.

- Littelfuse, Inc.

- Northrop Grumman Corporation

- Fairchild Semiconductor International, Inc.

Segments Covered in the Report

By Product

- Black Silicon Carbide

- Green Silicon Carbide

By Application

- Steel

- Automotive

- Aerospace

- Military & Defense

- Electrical & Electronics

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4059

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: