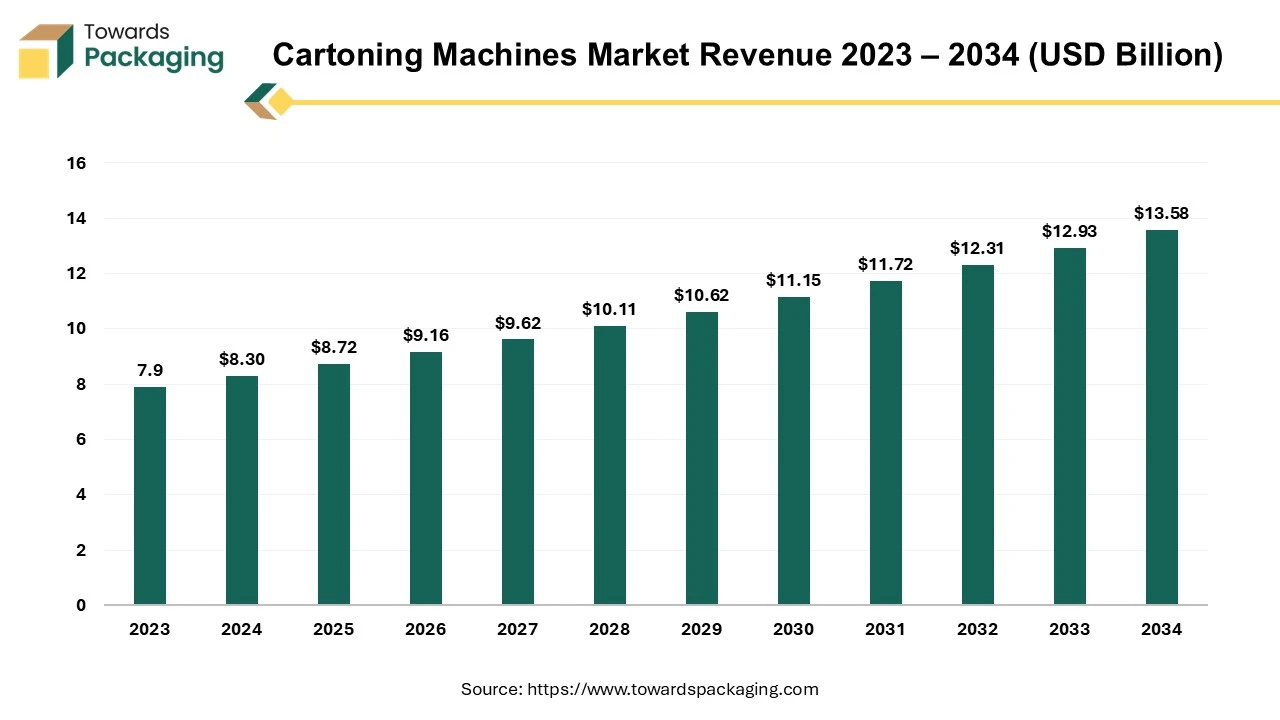

Ottawa, Dec. 16, 2025 (GLOBE NEWSWIRE) -- The global cartoning machines market size was recorded at USD 8.72 billion in 2025 and is forecast to increase to USD 13.58 billion in 2034, as per findings from a study published by Towards Packaging. The cartoning machines market is growing steadily as manufacturers seek faster, automated, and more reliable packaging solutions across the food, beverage, pharmaceutical, and personal care sectors. The demand for flexible and compact machines is rising, driven by increasing product variety and stringent quality standards.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What are Cartoning Machines?

The cartoning machines market is being driven by rising automation across packaging lines, growing demand for high-speed operations, and the need for consistent, secure, and visually appealing carton packaging across industries. Manufacturers are increasingly adopting these systems to reduce labor dependency and improve efficiency. Cartoning machines are automated equipment designed to form, fill, and seal cartons in either end-load or top-load formats.

They handle various product types ranging from food items and pharmaceuticals to consumer goods, ensuring accurate placement, uniform sealing, and enhanced protection during transport. Their ability to work with different carton styles and integrate seamlessly with upstream processes makes them essential in modern packaging environments. Asia Pacific will dominate the market due to rapid industrialization, expanding manufacturing bases, and heightened investment in automated packaging lines.

Private Industry Investments for Cartoning Machines:

- PAG's acquisition of Manjushree Technopack: In one of the key deals in the industrial sector, PAG acquired Manjushree Technopack for $1 billion, which represents a major private equity (PE) buyout in the packaging space.

- Blackstone's acquisition of Piramal Glass: Blackstone made a $1 billion acquisition of Piramal Glass, another significant buyout that highlights strong private investment interest in the packaging industry.

- SIG's investment in plant expansion: SIG is investing an additional €40 million in the second phase of its plant expansion in India, increasing total investment there to €130 million to meet the growing demand for packaging and filling solutions.

- Industrifonden's investment in Yangi: Industrifonden and other investors participated in a $11.7 million Series A funding round for Yangi, a company focused on sustainable packaging solutions.

- Massman's acquisition of ADCO Manufacturing: Massman acquired ADCO Manufacturing in March 2025, a strategic business acquisition to expand product offerings in automated packaging solutions, including cartoning.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5362

What are the Latest Key Trends in the Cartoning Machines Market?

1. Industry 4.0 and Smart Automation:

Cartoning machines are increasingly integrated with IoT sensors, AI analytics, and real-time monitoring systems. These technologies enable predictive maintenance, minimize downtime, and improve operational efficiency by providing actionable insights, remote diagnostics, and autonomous adjustments during production.

2. Sustainability and Eco-Friendly Packaging:

Manufacturers are adapting cartoning systems to handle recyclable, biodegradable, and reduced-material cartons in response to environmental regulations and consumer demand for greener packaging. These machines enhance energy efficiency and reduce waste throughout the packaging lifecycle.

3. Customization and Turnkey Solutions:

There is a growing preference for turnkey and customizable cartoning solutions that streamline production flow, support OEE enhancements, and allow rapid changeovers between formats. This trend helps manufacturers optimize efficiency, reduce errors, and tailor equipment to specific product needs.

4. Robotics and Advanced Automation:

Robotics integration, such as vision-guided pick-and-place systems and collaborative robots, boosts speed, precision, and flexibility. These automated components reduce reliance on manual labour, improve handling of diverse products, and support complex packaging requirements.

5. Flexible and Multi-Format Machines:

Demand is rising for cartoning machines that can quickly adapt to varied carton sizes, shapes, and SKUs. Machines with modular designs, fast changeover capabilities, and support for diverse packaging formats help manufacturers respond to SKU proliferation and dynamic market needs.

6. Compact and Space-Efficient Designs:

Compact cartoning machines are being developed to fit smaller production spaces while delivering high performance. These designs appeal to manufacturers focused on optimizing floor space without sacrificing output, especially in fast-growing e-commerce and FMCG sectors.

What is the Potential Growth Rate of the Cartoning Machines Industry?

The market is driven by increasing demand for automation and high-speed packaging across food, beverage, pharmaceutical, and personal care industries. Rising need for product safety, consistent quality, and attractive packaging, combined with labor cost reduction and efficiency improvements, encourages adoption. Additionally, growing e-commerce, regulatory compliance, and emphasis on sustainable, recyclable cartons further propel the market’s expansion and technological advancements.

More Insights of Towards Packaging:

- Rigid Sleeve Boxes Market Size, Segments, Regions, Competition & Value Chain 2025-2035

- Bubble Wrap Packaging Market Size, Segments, Regional Outlook, and Competitive Landscape 2024-2035

- Reclosable Zipper Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive and Trade Analysis, 2025-2035

- Cornstarch Packaging Market Size, Share, Trends, and Forecast 2025-2035

- Micro Perforated Films for Packaging Market Size, Segments, Regional Insights, and Competitive Landscape Report 2025-2035

- Industrial Electronics Packaging Market Size, Segments, and Regional Outlook Report (2025-2035)

- Tinplate Packaging Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape Analysis to 2034

- Topical Drugs Packaging Market Size, Segmentation, Regional Insights, and Competitive Landscape 2025-2035

- Corrugated Plastic Tray Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Analysis, 2025-2035

- Boxboard Packaging Market Size, Share, Segments, Regional Outlook, and Competitive Landscape, 2025-2035

- Cider Packaging Market Size, Share, Trends, Regional Insights, Segments, Competitive Landscape and Forecast 2025-2035

- Rigid Tray Market Size, Segments, and Regional Outlook (2025-2035), Competitive Landscape, Value Chain, and Trade Analysis

- Panel Level Packaging Market Size, Segmentation, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape, 2025-2035

- Clinical Trial Packaging Market Size, Segments, Regional Outlook, and Competitive Landscape 2025-2035

- High Impact Corrugated Boxes Market Size, Share, Segments, and Global Outlook 2025-2035

Regional Analysis:

Who is the leader in the Cartoning Machines Market?

Asia-Pacific dominates the market due to its rapidly expanding manufacturing base, strong growth in food, beverage, pharmaceutical, and consumer goods industries, and increasing adoption of automated packaging technologies. Rising investments in industrial automation, availability of cost-effective production facilities, and supportive government initiatives for manufacturing modernization further strengthen the region’s leadership in advanced cartoning solutions.

China Cartoning Machines Market Trends

China leads the Asia-Pacific market due to its extensive manufacturing ecosystem, strong presence of packaging machinery producers, and continuous investments in automation across food, pharmaceutical, and consumer goods sectors. Its large-scale production capacity, competitive labor and component costs, and government support for industrial upgrading further enhance China’s dominance in adopting and exporting advanced cartoning technologies.

How is the opportunity in the Rise of Europe in the Cartoning Machines Industry?

Europe is the fastest-growing region due to strong advancements in packaging automation, rising demand for sustainable carton solutions, and rapid modernization of food, beverage, and pharmaceutical manufacturing lines. The region’s strict quality standards and increasing investments in smart, flexible cartoning technologies further accelerate adoption across diverse industrial sectors.

The UK Cartoning Machines Market Trends

The UK dominates the Europe market due to its advanced packaging industry, strong presence of pharmaceutical and FMCG manufacturers, and rapid adoption of automated, high-efficiency equipment. The country’s strict packaging standards, focus on sustainable carton solutions, and continuous investments in modernizing production lines further strengthen its leadership within the regional market.

How Big is the Success of the North America Cartoning Machines Industry?

North America is growing at a notable rate in the market due to rising demand for advanced, automated packaging systems across pharmaceuticals, food, beverages, and personal care industries. Strong regulatory focus on packaging quality, rapid adoption of smart and robotic technologies, and continuous investments in modernizing production lines accelerate growth. Additionally, the region’s thriving e-commerce sector boosts the need for efficient, high-speed cartoning solutions.

U.S. Cartoning Machines Market Trends

The U.S. dominates the North America market due to its advanced manufacturing infrastructure, strong presence of leading packaging technology providers, and high adoption of automation across food, pharmaceutical, and consumer goods sectors. Strict regulatory standards, continuous investment in production modernization, and a robust e-commerce ecosystem further drive demand for efficient and high-precision cartoning solutions in the country.

How Crucial is the Role of Latin America in the Cartoning Machines Industry?

Latin America is growing at a considerable rate in the market due to expanding food, beverage, and pharmaceutical production, alongside increasing adoption of automated packaging to enhance efficiency and product safety. Rising investments in manufacturing modernization, growing consumer goods demand, and improving industrial infrastructure further support the region’s steady shift toward advanced cartoning technologies.

How Big is the Opportunity for the Growth of the Middle East and Africa Cartoning Machines Industry?

The Middle East and Africa present strong growth opportunities in the market due to expanding food, beverage, and pharmaceutical manufacturing, supported by rising urbanization and consumer demand for packaged goods. Ongoing investments in industrial automation, improvements in production infrastructure, and government initiatives to develop local manufacturing capacity further enhance the region’s potential for advanced cartoning solutions.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Machine Type Insights

What made the Vertical Segment Dominant in the Cartoning Machines Market in 2024?

The vertical segment dominates the market because it efficiently handles lightweight, free-flowing, or fragile products such as powders, sachets, and small food items. Its compact footprint, faster changeover capability, and smooth product feeding make it ideal for high-speed operations. Additionally, strong adoption in food and pharmaceutical packaging strengthens its leadership due to reliability, hygiene, and cost-effective performance.

The horizontal segment is the fastest-growing machine type as it excels in packaging larger, rigid, or uniquely shaped products across food, personal care, and pharmaceutical sectors. Its ability to support high-speed end-load operations, seamless integration with robotic pick-and-place systems, and flexibility for diverse carton styles drives strong adoption. Growing demand for premium, secure packaging further accelerates its rapid market expansion.

Packaging Material Insights

How the Paperboard Dominated the Cartoning Machines Market in 2024?

The paperboard segment dominates the packaging material category because it is lightweight, cost-effective, and easily customizable for branding, making it ideal for high-volume consumer goods packaging. Its recyclability and alignment with global sustainability goals strengthen its preference across industries. Additionally, paperboard offers excellent printability, product protection, and compatibility with both vertical and horizontal cartoning machines, driving widespread adoption.

The corrugated fiberboard segment is the fastest-growing because it offers superior strength, durability, and shock resistance, making it ideal for heavier or fragile products and for shipping-ready packaging. Its rising use in e-commerce, logistics, and bulk packaging boosts demand. Additionally, corrugated fiberboard supports sustainable packaging goals and works efficiently with advanced cartoning machines designed for larger, protective carton formats.

End User Insights

What made the Food & Beverages Segment Dominant in the Cartoning Machines Market in 2024?

The food and beverages segment dominates the market due to high demand for automated, hygienic, and efficient packaging of products like snacks, confectionery, dairy, and beverages. Rapid product diversification, strict safety and quality regulations, and the need for attractive, durable packaging drive adoption. Cartoning machines ensure speed, consistency, and minimal product damage, making them essential in this sector.

The pharmaceuticals segment is the fastest-growing end-user segment after food and beverages in the market. Growth is driven by rising demand for safe, tamper-evident, and compliant packaging, increasing production of prescription and over-the-counter medicines, and the need for precise, high-speed cartoning of tablets, capsules, vials, and syringes to meet regulatory standards and ensure patient safety.

Recent Breakthroughs in the Cartoning Machines Industry

- In July 2025, Omori showcased its latest cartoning and packaging systems at JAPAN PACK 2025, focusing on productivity enhancement and digital transformation tailored for the food and pharmaceutical sectors, reinforcing high-efficiency automated solutions.

- In July 2025, Romaco launched the Noack N 760 at PACK EXPO Las Vegas and PPMA Birmingham. This machine supports eco-friendly PET mono-material blister packaging with reduced carbon footprint, highlighting sustainability trends in cartoning for pharmaceuticals.

- In February 2025, Syntegon unveiled the Kliklok ACC (Advanced Carton Closer) at PACK EXPO Southeast (March 10–12). This high-speed carton sealing machine handles up to 200 cartons per minute with servo-driven alignment, tool-free changeovers, and flexible format handling for diverse packaging needs.

Top Companies in the Global Cartoning Machines Market & Their Offerings:

Tier 1:

- Warade PackTech Private Limited: Offers vertical and horizontal motion cartoning solutions for diverse industries like food and pharma.

- Creative Packaging System: Provides cartoning machines tailored to meet various industrial packaging requirements.

- Harikrushna Machines Private Limited: Manufactures customized cartoning solutions designed to meet specific customer needs and international standards.

- Aarvee PHARMA Machinery: Specializes in manufacturing high-speed, automatic horizontal cartoning machines for pharmaceutical applications.

- Durva Machinery: A manufacturer of various packaging equipment, including general cartoning machines for different sectors.

- Jet Pack Machines Private Limited: Produces automatic horizontal cartoning machines suitable for packaging food, cosmetics, and pharma products at high speeds.

- Marchesini Group: Offers advanced cartoning systems as part of complete packaging lines for pharmaceutical and cosmetic industries internationally.

- PAC Machinery Group: Provides packaging equipment and solutions that cover various cartoning applications for different product types.

Tier 2:

- Pactech Machinery LLP

- SATV Industries

- Unisource Packaging Private Limited

- Barvaya Packaging Industries

- Orpac Systems Private Limited

- Sonus Pharma Machines

- Parth Engineers & Consultant

Segment Covered in the Report

By Machine Type

- Vertical

- Horizontal

By Packaging Material

- Paperboard

- Corrugated Fiberboard

By End User

- Food & Beverages

- Personal Care

- Cosmetics

- Pharmaceutical

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5362

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Highly Visible Packaging Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA)

- Cosmetic Packaging Machinery Market Size, Share, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), and Competitive Landscape

- Wine Packaging Market Size, Share, Trends, Segments, Regional Insights (NA, EU, APAC, LA, MEA), and Competitive Landscape to 2034

- Ethical Label Market Size, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape & Value Chain Analysis, 2025-2035

- Polystyrene Packaging Market Size, Segments, Regions, Competition & Trade (2025-2035)

- Adherence Packaging Market Size (2025-2035), Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies, Competitive Landscape, Value Chain, Trade, and Manufacturers & Suppliers

- Transit Packaging Market Size (2025-2035), Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain Analysis, Trade & Supplier Intelligence

- Green Packaging Film Market Size, Segments, Regional (NA, EU, APAC, LA, MEA), Companies, Competitive Landscape, Value Chain, Trade, and Manufacturers & Suppliers Database

- Corrugated Mailers Market Size (2025-2035), Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain, Trade, Manufacturers/Suppliers Data

- Pre-made Pouch Packaging Market Size, Segments, Regional Insights, and Competitive Landscape 2025-2035

- Heavy Duty Corrugated Packaging Market Size (2025–2034), Segments, Regional Outlook (NA/EU/APAC/LA/MEA)

- Inflatable Bags Packaging Market Size, Segments, Regional Insights (NA, EU, APAC, LA, MEA), Competitive Landscape, and Value Chain Outlook, 2025-2035

- Multi Depth Corrugated Box Market Size, Segments, Regional Data (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain Analysis, Trade, Manufacturers & Suppliers

- Industrial Drums Market Size, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Companies, Competitive & Value Chain, Trade and Supplier Analysis, 2025-2035

- Hazardous Goods Packaging Market Size, Share, Trends, and Segment Forecast (2025-2035)