Austin, May 22, 2025 (GLOBE NEWSWIRE) -- Retail Automation Market Size & Growth Insights:

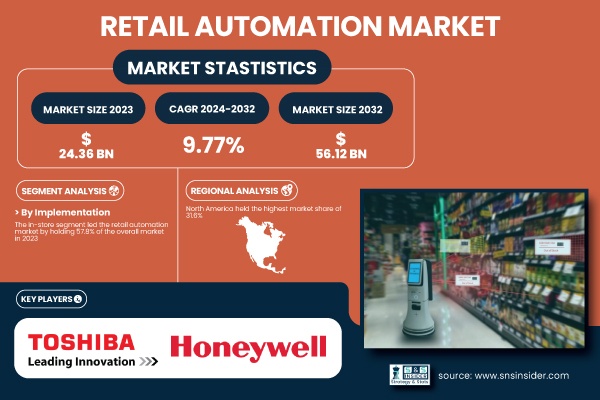

According to the SNS Insider Report, “The Retail Automation Market was valued at USD 24.36 billion in 2023 and is expected to reach USD 56.12 billion by 2032, growing at a CAGR of 9.77% over the forecast period 2024-2032.”

Retail Automation Market Growth Driven by AI, Robotics, and Contactless Solutions

The retail automation market is rapidly expanding, driven by smart store technologies that enhance operational efficiency and customer experience. enabled by smart store technologies that are designed to improve both shopper experience and retail operations. AI and machine learning make hyper personalized shopping and real-time inventory management possible, while robotics are used to simplify and optimize fulfillment and delivery, alleviating logistics obstacles.

In the U.S. market is worth USD 5.96 billion in 2023, and will witness a CAGR of 9.81% to meet the need for faster transactions, lower expenditure on labor, and offering contactless services.

Get a Sample Report of Retail Automation Market @ https://www.snsinsider.com/sample-request/6841

Leading Market Players with their Product Listed in this Report are:

- Toshiba Global Commerce Solutions (TCx™ Elevate Platform)

- NCR Corporation (NCR FastLane SelfServ Checkout)

- Diebold Nixdorf (Vynamic™ Retail Platform)

- Fujitsu (U-Scan® Genesis II)

- Honeywell (Voyager XP 1470g Barcode Scanner)

- Zebra Technologies (DS9900 Series Scanner)

- Panasonic (JS970 Point-of-Sale Terminal)

- First Data (now part of Fiserv) (Clover POS System)

- Oracle Corporation (Oracle Retail Xstore POS)

- SAP SE (SAP Customer Activity Repository)

- Posiflex Technology Inc. (RT-5016 POS Terminal)

- ECR Software Corporation (ECRS) (CATAPULT Retail Automation Suite)

- Blue Yonder (formerly JDA Software) (Luminate Platform)

- Wincor Nixdorf (merged with Diebold) (BEETLE /iPOS plus Advanced)

- Square Inc. (Square POS System).

Retail Automation Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 24.36 Billion |

| Market Size by 2032 | USD 56.12 Billion |

| CAGR | CAGR of 9.77% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Implementation (In-store, Warehouse) • By Product (Point-of-Sale (POS), RFID & Barcode, Camera, Electronic Shelf Label, Warehouse Robotics, Others) • By End-Use (Hypermarkets, Single Item Stores, Supermarkets, Fuel Stations, Retail Pharmacies, Others) |

| Key Drivers | • Boosting Retail Automation Market Growth with AI Machine Learning and Contactless Solutions for Enhanced Efficiency. • Unlocking Retail Automation Growth in Emerging Economies through IoT, Robotics, AI, and Smart Solutions. |

POS systems, ESL, RFID, and cameras are widely installed in retail store to minimize human intervention. The continued evolution of digital, underpinned by IoT and automation, drives seamless and data-driven customer experiences. Given the demand for self-checkout and cashless payments on the rise, it is accelerating the growth of the market retail automation that is laying the foundation for the efficiency, and even the innovation, of the retail market today and in the future.

Purchase Single User PDF of Retail Automation Market Report (20% Discount) @ https://www.snsinsider.com/checkout/6841

Key Industry Segmentation

By Implementation

In 2023, the in-store segment led the retail automation market with 57.8% share, owing to self-checkout systems, electronic shelf labeling, interactive kiosks, and intelligent video analysis. These new solutions, which present themselves as boosting customer experience, accelerating checkout or securing inventory accuracy, target retailers who are primarily focused on improving the front of the store.

The warehouse segment is expected to grow fastest from 2024 to 2032, owing to the rise in demand for supply chain efficiency, fast order fulfillment, and real-time tracking of inventory. Robotic automation, AI-based sortation and automated guided vehicles (AGVs) are transforming the warehouse through elimination of manual labor and driving improved accuracy and scalability in the face of e-commerce and Omni channel retail growth.

By Product

In 2023, the Point-of-Sale (POS) segment dominated the retail automation market with a 37.6% share owing to the crucial role it plays in sales, inventory, customer information, and analytics control among retail formats. Today’s POS solutions, with mobile options and cloud capabilities that provide real-time data for a seamless checkout process and improved customer experience, even integrate with loyalty and CRM platforms.

The camera segment is expected to grow fastest from 2024 to 2032. In addition to surveillance, cameras are capable of customer behavioral analysis, heat mapping and AI-based computer vision automated checkout, which are equally important for real-time data analysis and for smart retail environment operations.

By End-Use

In 2023, supermarkets held the largest share of 36.3% in the retail automation market, due to adoption of self-checkout kiosks, electronic shelf labels, barcode scanners, and POS system to improve operational efficiency and train the customer experience. With high traffic and multiple SKUs, automation is must for inventory management and faster checkouts. The increasing demand for contactless shopping and real-time inventory management have also driven automation in supermarkets.

Hypermarkets led the market in 2024 and are expected to grow fastest by 2032, also using AI for advanced analysis, clever trolleys navigation and automatic checkouts with reduced reliance on labor and optimised complexity for big operations.

North America Leads While Asia Pacific Shows Fastest Growth in Retail Automation

North America retail automation industry accounted for a share of 31.6% in 2023, as the requirement for advanced retail structure and early adoption of technology in the U.S. has made it the largest market in the region. And major chains such as Walmart, Kroger and Costco have been pouring resources into self-checkout systems, smart shelves, AI analytics and robotic automation. SmartCity Shoppers The area uses data mining and consumer observation to improve the shopping experience and logistics. The drive to enable contactless shopping and better customer experience, especially in a post-pandemic era, has also sped the adoption of automation.

Asia Pacific is projected to be the fastest-growing region from 2024 to 2032, owing to increasing urbanization, high disposable income levels, and a growing organized retail sector, especially in countries such as China, Japan, South Korea, and India. The rise of things like Alibaba’s fully automated checkouts and robotic kitchens, and Japan’s cashier-less stores and electronic shelf labels, illustrate the region’s rise. Favourable government support and tech savvy customers is generating ample retail automation opportunity in Asia Pacific.

Do you have any specific queries or need any customized research on Retail Automation Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/6841

Recent Developments:

- In Jan 2025, Fujitsu will unveil next-gen unified commerce solutions that leverage Data & AI across online, in-store, and back-office touchpoints to enhance customer satisfaction and loyalty.

- In Jan 2025, Honeywell’s AI in Retail Survey reveals that over 80% of U.S. retailers plan to expand AI adoption to enhance operational efficiency, improve customer experience, and upskill employees.

Table of Contents - Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Smart Store Solutions and IoT

5.2 Adoption of AI and Machine Learning in Customer Engagement

5.3 Expansion of Robotics in Fulfillment and Delivery

5.4 Integration with Digital Transformation Initiatives

6. Competitive Landscape

7. Retail Automation Market, by Implementation

8. Retail Automation Market, by Product

9. Retail Automation Market, by End-Use

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Other Related Reports:

The U.S. Smart Home Automation Market is projected to grow at a CAGR of 20.08% by 2032