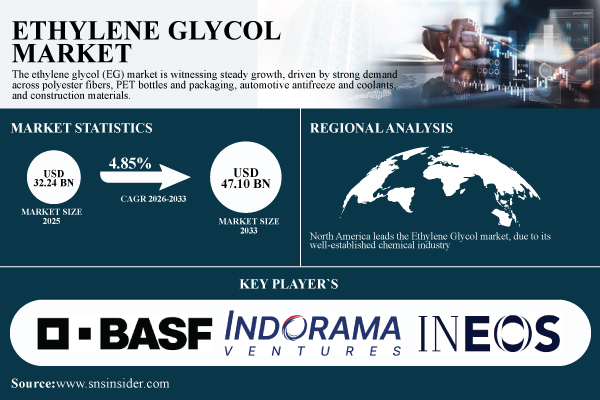

Austin, Dec. 13, 2025 (GLOBE NEWSWIRE) -- According to SNS Insider, The Ethylene Glycol Market size is estimated at USD 32.24 Billion in 2025 and is expected to reach USD 47.10 Billion by 2033, growing at a CAGR of 4.85% during 2026–2033. Increasing industrialization, expanding textile and packaging sectors, and rising demand for sustainable materials are fueling market expansion.

The increased demand for polyester fibers, PET packaging, and automotive applications is expected to propel the U.S. ethylene glycol market, which is estimated at USD 9.36 billion in 2025, to reach USD 12.44 billion by 2033, with a compound annual growth rate (CAGR) of 3.61% from 2026 to 2033.

Instantly Access the Sample Report of Ethylene Glycol Market Forecast @ https://www.snsinsider.com/sample-request/8774

Rising Demand and Production Innovation is Driving the Ethylene Glycol Market Growth Globally

Growing demand from a variety of industries, including polymers, antifreeze, and industrial solvents, is propelling the ethylene glycol market by pushing producers to improve production efficiency and look into alternative feedstock choices. In order to guarantee constant output and cost-effectiveness, investments in technology advancements and process optimization are being prompted by supply-side constraints in strategic regions. Players are also being encouraged to use modern production processes by the focus on sustainability and energy-efficient production methods. The requirement for dependable and varied sourcing, growing end-use applications, and growing industrialization all contribute to market expansion. Together, these elements provide a stable environment for the steady growth of the worldwide ethylene glycol market.

Major Players Analysis Listed in the Ethylene Glycol Market Report

- BASF

- China Petrochemical Corporation

- EQUATE Petrochemical

- Indorama Ventures

- INEOS

- LG Chem

- Mitsubishi Chemical Corporation

- Reliance Industries Limited

- SABIC

- Shell Chemicals

- LOTTE Chemical Corporation

- Kuwait Petroleum Corporation

- Akzo Nobel N.V.

- Clariant International Ltd

- Formosa Plastics Corporation

- Exxon Mobil Corporation

- Huntsman International LLC

- Dow Inc.

- LyondellBasell Industries Holdings B.V.

- SABIC Innovative Plastics

Ethylene Glycol Market Segmentation Analysis

By Type

Triethylene Glycol leads the market with the largest share of 53.19% in 2025, due to its established applications and widespread usage. Monoethylene Glycol is the fastest-growing segment at a CAGR of 8.28%, experiencing strong demand growth across various industries due to its versatility and expanding applications, signaling a significant shift in market dynamics over the coming years.

By Application

PET dominates the market with a share of 39.00% in 2025, reflecting its widespread use and established demand. Polyester Fibers are the fastest-growing segment at a CAGR of 7.04%, driven by rising industrial and textile applications and increasing adoption across diverse sectors.

By End-User

Packaging dominates the market with a share of 43.25% in 2025, reflecting its widespread adoption across industries. Automotive is the fastest-growing segment at a CAGR of 9.81%, driven by increasing demand and expanding applications in vehicle manufacturing and related sectors.

By Manufacturing Process

Ethylene Oxide is the dominating segment with a share of 69.25% in 2025, reflecting its established role and extensive industrial adoption. Biological Route is the fastest-growing process at a CAGR of 15.04%, driven by increasing demand for sustainable and eco-friendly production methods, technological advancements, and rising awareness of environmentally conscious practices, signaling a significant shift in industry manufacturing trends.

On the Basis of Region, North America Leads the Market in 2025; Asia Pacific is Projected to Grow with the Fastest CAGR Globally

North America leads the Ethylene Glycol market with a share of 43.82% in 2025E, due to its well-established chemical industry, strong demand from automotive and packaging sectors, and advanced manufacturing infrastructure. Asia Pacific is the fastest-growing region with a CAGR of 5.60% in the Ethylene Glycol market, fueled by rapid industrialization, expanding automotive and packaging sectors, rising urbanization, and increasing investments in chemical manufacturing.

For a Custom Market Outlook Discussion with Our Analysts, Connect Now @ https://www.snsinsider.com/request-analyst/8774

Ethylene Glycol Market Recent Developments

- June 13, 2024 – Indorama Ventures will shut its Botany Bay ethylene oxide and derivatives plants in Australia due to Qenos Olefins ceasing ethylene production, reducing its Australian presence to an office and technical center.

- August 20, 2025 – South Korea plans restructuring for 10 major petrochemical companies, including significant cuts to naphtha-cracking capacity, as top producers, such as LG Chem, Lotte Chemical, and Yeochun NCC face losses from oversupply and weak demand.

Exclusive Sections of the Report (The USPs):

- TECHNOLOGICAL INNOVATION INDEX – helps you assess the industry’s progress through adoption of advanced MEG and DEG production technologies, R&D investments, and patent trends for bio-based and sustainable ethylene glycol processes.

- OPERATIONAL EFFICIENCY METRICS – helps you evaluate yield performance, energy efficiency, and purity benchmarks across global manufacturers, revealing process optimization opportunities and cost-saving potential.

- ENVIRONMENTAL PERFORMANCE BENCHMARKS – helps you measure emission control, wastewater treatment efficiency, and carbon footprint reduction per ton produced, supporting sustainability and ESG alignment.

- CAPACITY UTILIZATION & SUPPLY CHAIN DYNAMICS – helps you understand production capacity trends, raw material dependencies, and logistics efficiency in delivering glycol products to PET, polyester, and antifreeze sectors.

- PRICING & COST STRUCTURE ANALYSIS – helps you analyze cost per ton of production, feedstock price impact, and ASP trends across grades (MEG, DEG, TEG) to support pricing strategy and margin optimization.

- REGULATORY COMPLIANCE INSIGHTS – helps you track adherence to global environmental and safety standards (EPA, REACH, ISO) and monitor certification rates for eco-friendly glycol production initiatives.

Ethylene Glycol Market Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 32.24 Billion |

| Market Size by 2033 | USD 47.10 Billion |

| CAGR | CAGR of 4.85% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Key Segments | • By Type (Monoethylene Glycol (MEG), Diethylene Glycol (DEG) and Triethylene Glycol (TEG)) • By Application (Polyester Fibers, PET, Antifreeze and Coolants, Films and Others) • By End Use (Textile, Automotive, Packaging and Others) • By Manufacturing Process (Ethylene Oxide, Coal, Biological Route and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

Purchase Single User PDF of Global Ethylene Glycol Market Intelligence Report @ https://www.snsinsider.com/checkout/8774

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.