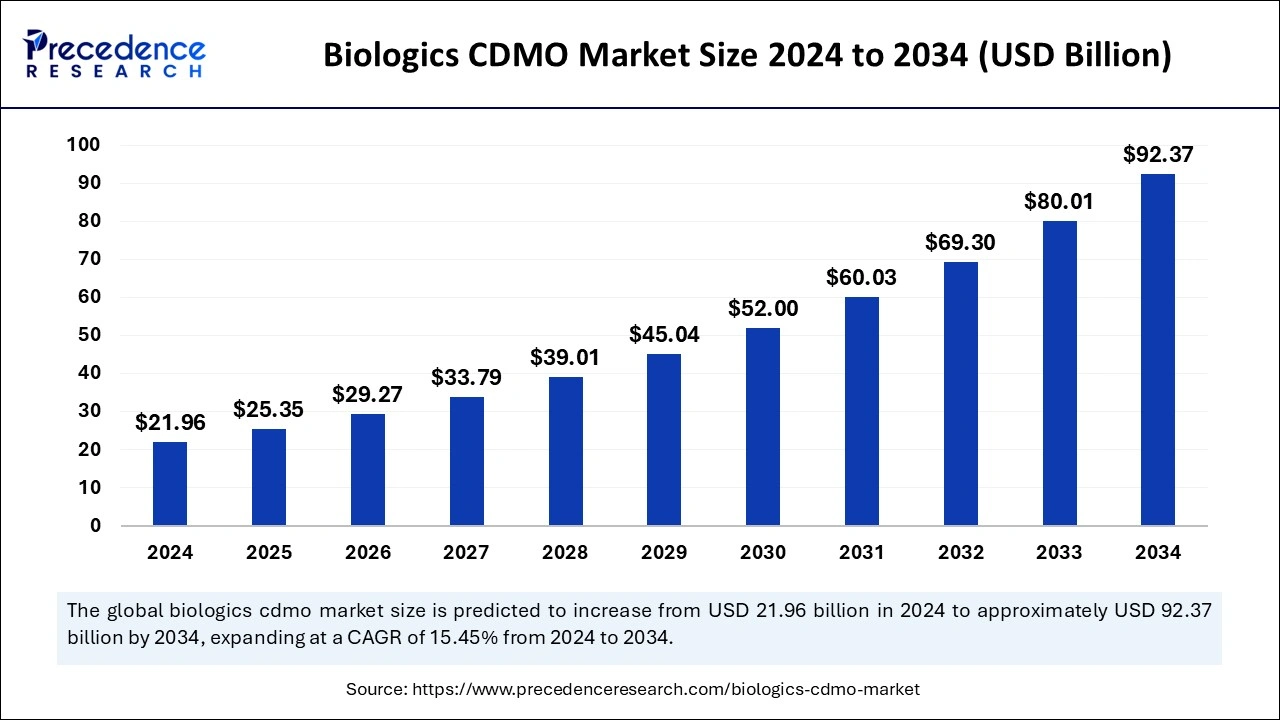

Ottawa, Dec. 15, 2025 (GLOBE NEWSWIRE) -- The global biologics CDMO market size is expected to hit nearly USD 92.37 billion by 2034, increasing from USD 29.27 billion in 2026, growing at a strong CAGR of 15.45% between 2025 and 2034. Driven by rising demand for monoclonal antibodies and biosimilars, increasing biologics outsourcing, and rapid growth in oncology and autoimmune therapies.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4943

Biologics CDMO Market Highlights:

- The global biologics CDMO market was valued at USD 21.96 billion in 2024 and is projected to reach USD 92.37 billion by 2034, growing at a strong CAGR of 15.45%.

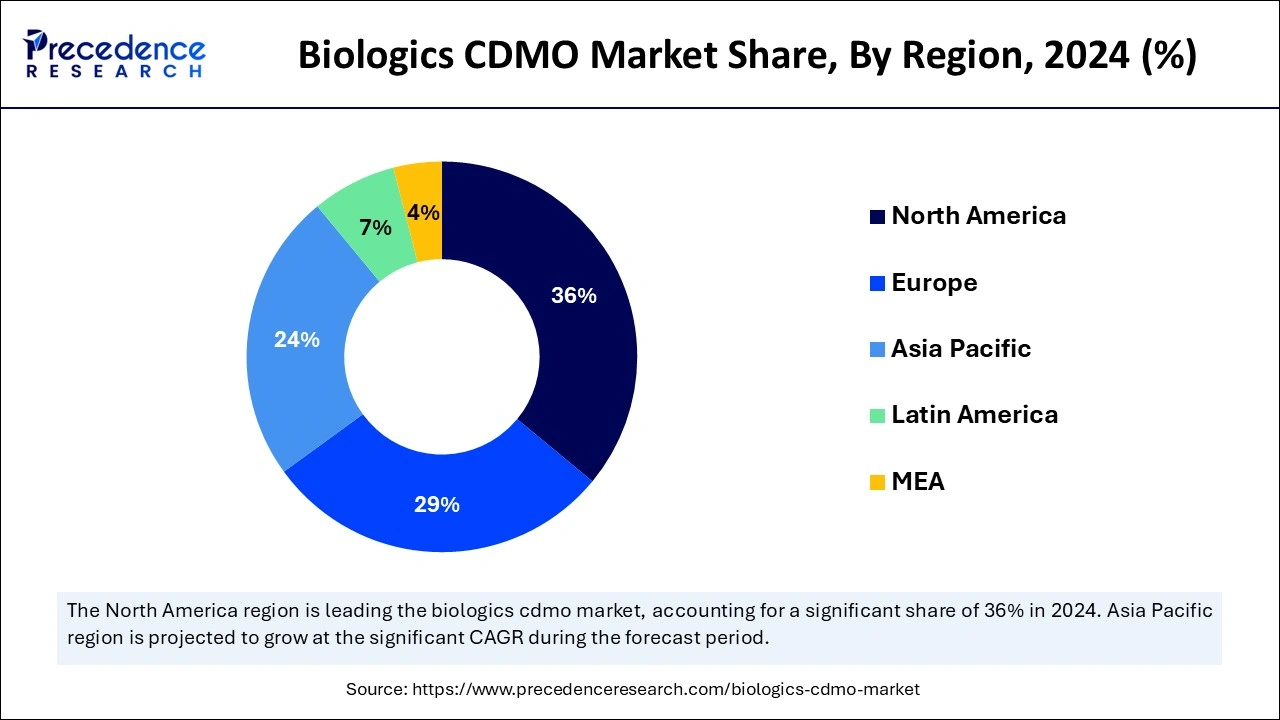

- North America led with a 36% market share in 2024, while Asia-Pacific is set to grow the fastest during the forecast period.

- Mammalian manufacturing and monoclonal antibodies dominated the market in 2024, driven by rising demand for complex biologics.

- Microbial systems and recombinant proteins are expected to register the fastest growth due to scalability and cost efficiency.

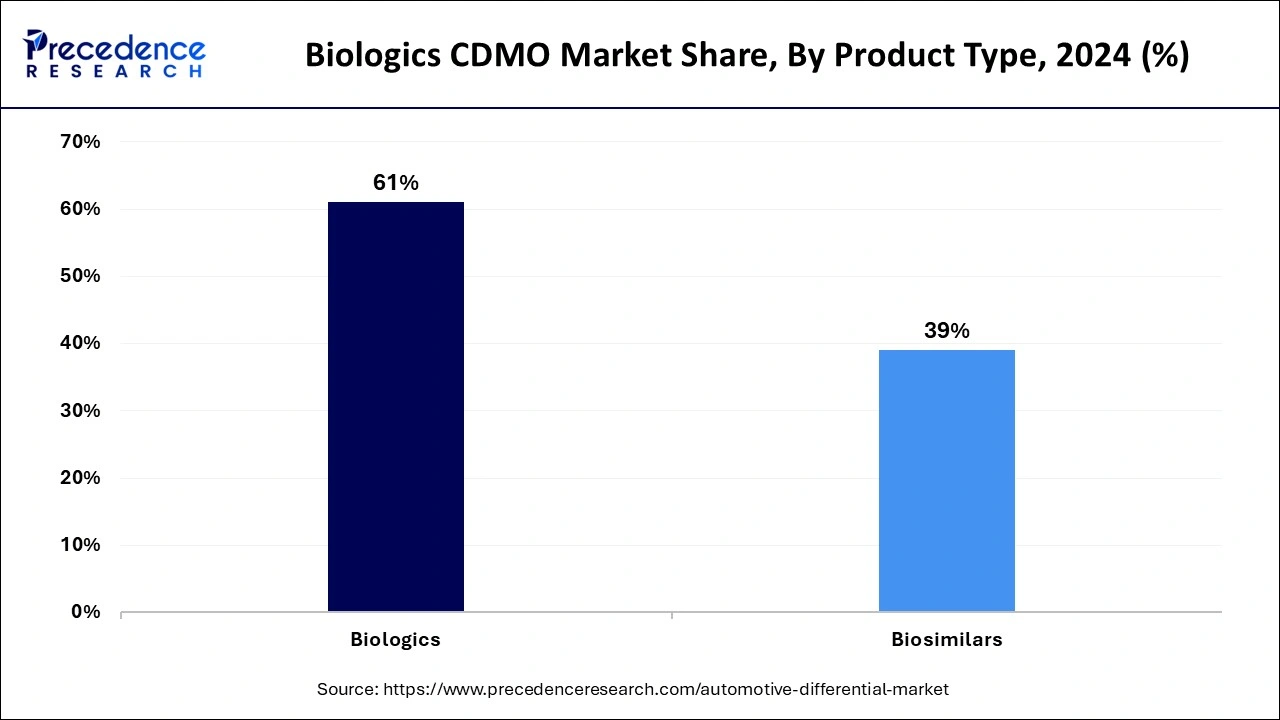

- Biologics accounted for 61% of total revenue, with oncology leading indications, while autoimmune therapies emerge as a high-growth area.

Biologics CDMO Market Overview and Industry Potential

CDMO Sector Heats Up as Complex Biologics Redefine Modern Medicine

The biologics CDMO market is expected to see steady growth owing to the increased need for the production of complex biologic drugs across the globe. Moreover, the technological advancement in science and research has severely contributed to the industry's growth in recent years. Also, the increased demand for specialized treatment for major diseases such as cancer and autoimmune diseases, the CDMO serves has gained traction over the past few years, as per recent industry observations.

Cell and Gene Therapies Create Long-Term Growth Momentum

The expansion of cell and gene therapy pipelines is reshaping the biologics CDMO landscape. These therapies require highly specialized manufacturing environments, viral vector capabilities, and advanced quality controls—capabilities increasingly centralized within leading CDMOs.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Patient Expiration Drive Surge in Biosimilar Development

The production of biosimilars is expected to create lucrative opportunities for the manufacturers in the coming years, as several biologic drugs are seen losing their patients, which has produced high demand for biosimilars in recent times. Moreover, the increased demand for the cheaper version of the drug can contribute to grief if the biosimilar sales in the coming years, as per future industry predictions.

Cost and Complexity Restrain Innovation in Biologics Manufacturing

The high initial cost for the research and development activities and biologics production is expected to hinder the industry's potential in the coming years. The requirement of advanced technologies with a highly controlled environment can create cost challenges for the new entrants and medium-sized businesses during the forecast period. Also, the small can create batch failures, which is expected to hamper the industry's growth in the upcoming years.

Regulatory Expertise Strengthens the CDMO Value Proposition

Biologics CDMOs provide critical regulatory support, including GMP compliance, process validation, comparability studies, and global regulatory filings. This expertise reduces approval risks and accelerates commercialization for both innovator biologics and biosimilars.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Why the Biologics CDMO Market Is Entering a High-Growth Phase

Increasing biologics complexity, rising development costs, and stringent regulatory requirements are accelerating the shift toward outsourced manufacturing. CDMOs enable faster time-to-market, lower capital investment, and access to specialized expertise, positioning them as strategic partners across the biologics value chain.

Top 10 Companies in Biologics CDMO Market & Their Contribution:

- 3P BIOPHARMACEUTICALS S.L.U – Specializes in process development and GMP manufacturing of biologics, especially monoclonal antibodies and recombinant proteins, with strong expertise in microbial and mammalian systems.

- AGC Biologics – A global CDMO offering end-to-end biologics development and manufacturing services, recently expanding cell and gene therapy capabilities across its U.S. and EU sites.

- Binex Co. Ltd. – A South Korea-based CDMO focused on monoclonal antibody production, biosimilars, and clinical manufacturing services for domestic and global biotech firms.

- Boehringer Ingelheim International GmbH – Operates one of the largest biologics manufacturing networks globally, offering commercial-scale CDMO services for mAbs, cell and gene therapies, and vaccines.

- Bora Pharmaceuticals Co. Ltd. – Known for its growing biologics pipeline support, Bora recently expanded into biologics CDMO services with a focus on late-stage clinical and commercial manufacturing in Asia.

- Catalent Inc. – A leading CDMO offering full-spectrum biologics development and production, especially in cell and gene therapies, with recent investments in biologics fill-finish and viral vector technologies.

- Evonik Industries AG – Provides advanced delivery systems and bioprocessing technologies for biologics, including lipid nanoparticles (LNPs) critical to mRNA and gene therapies.

- FUJIFILM Corporation – Through Fujifilm Diosynth Biotechnologies, the company is a major CDMO for biologics, with large-scale investments in cell culture, microbial fermentation, and gene therapy production capacity.

- Rentschler Biopharma SE – A Germany-based, family-owned CDMO focused on complex biologics manufacturing, including mAbs and fusion proteins, with strong regulatory and client-focused support.

- Samsung Electronics Co. Ltd. – Via Samsung Biologics, it is a dominant global CDMO with state-of-the-art biomanufacturing capacity, offering large-scale biologics production and end-to-end services.

➤ Get the Full Report @ https://www.precedenceresearch.com/biologics-cdmo-market

“The biologics CDMO market is undergoing a structural shift as pharmaceutical and biotech companies increasingly outsource complex biologics manufacturing to specialized partners,” said Rohan Patil - Principal Consultant at Precedence Research. “The growing dominance of monoclonal antibodies, rapid biosimilar development, and expansion of cell and gene therapies are accelerating long-term demand for advanced CDMO capabilities worldwide.”

Biologics CDMO Market Report Coverage

| Report Attributes | Details |

| Market Size in 2025 | USD 25.35 Billion |

| Market Size in 2026 | USD 29.27 Billion |

| Market Size by 2034 | Market Size by 2034 |

| Growth Rate (2024–2034) | CAGR of 15.45% |

| Largest Regional Market | North America |

| Fastest-Growing Region | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Molecule Type, Product Type, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Market Drivers | Rising biologics demand, Outsourcing trends, AI and automation in manufacturing |

| Emerging Trends | Adoption of AI for quality control and supply chain optimization, Expansion of CDMO facilities globally |

| Strategic Opportunities | Expansion into adjacent services (comparability studies, regulatory support), Modular facility deployment |

| Industry Dynamics | Increasing small-molecule and biologic drug pipelines, IoT-enabled production efficiency |

✚ Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Will North America Stay Ahead in the Race for Cell and Gene Therapies?

North America held the dominant share of the biologics CDMO market in 2024, owing to having a capable and advanced research base with higher investment in the current period. Moreover, the region has the presence of huge biotech companies, which have provided a significant advantage to the market in recent years.

Furthermore, these major biotechnology companies and the organizations are seen as relying on biologics such as vaccines, cell therapies, and others. Also, the early adoption of high-end technologies by healthcare professionals is anticipated to create huge potential for the market in the coming years.

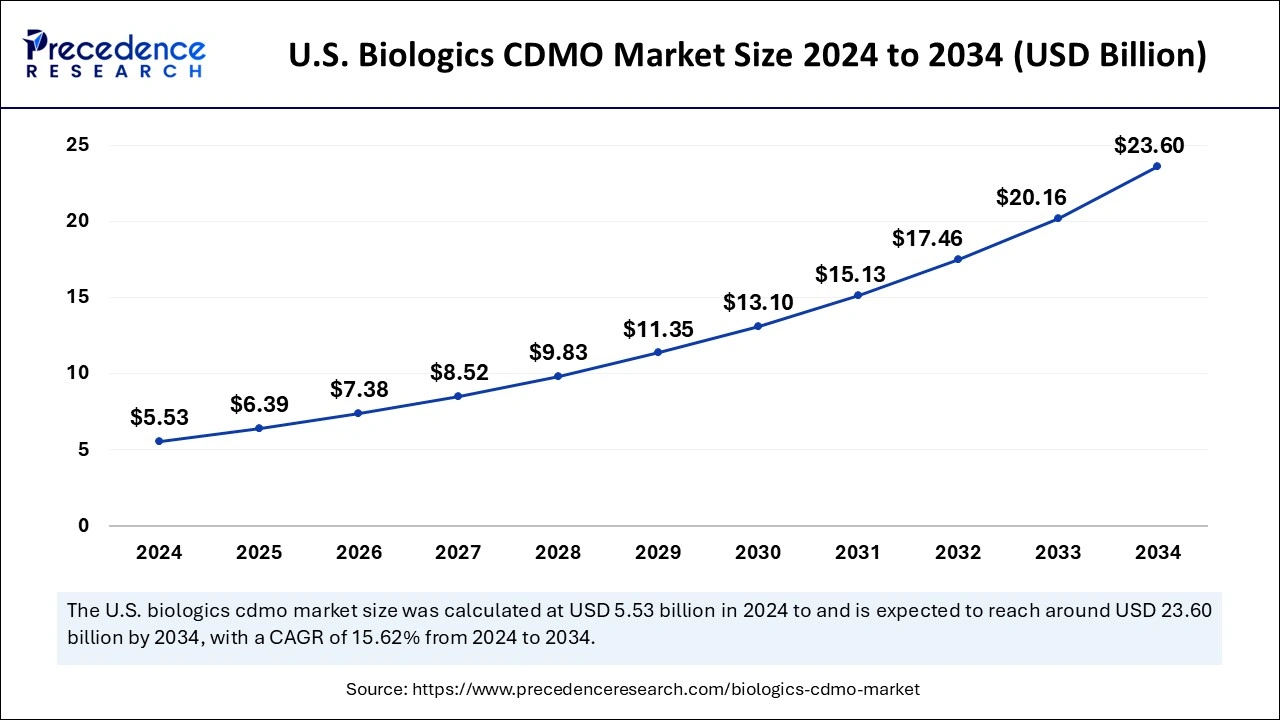

What is the U.S. Biologics CDMO Market Size?

The U.S. biologics CDMO market size is valued at USD 6.39 billion in 2025 and is projected to be exceed over USD 23.60 billion by 2034, expanding at a double-digit CAGR of 15.62% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/4943

Is the World Turning to Asia Pacific for Affordable, Quality Biologics?

Asia Pacific is expected to expand notably during the forecast period, owing to ongoing technology advancements and lower manufacturing costs in the current period. Moreover, the regional countries such as India, China, and others have seen heavy investment for the development of the biotechnology parks while pushing the CDMO growth in recent years. Furthermore, the high-quality biologics manufacturing services are increasingly attracting the major brands towards the region in recent years, as per current industry observations.

Biologics CDMO Market Segmentation Analysis:

By Type Analysis:

Why Did the Mammalian Segment Dominate the Market in 2024?

The mammalian segment held the largest share of the biologics CDMO market in 2024, owing to its suitability for the production of complex biologics in the current period. As the mammalian cells are crucial for this production, as per the recent observation. Moreover, the need for monoclonal antibodies and therapeutic proteins has contributed to the segment's growth in the current period. Furthermore, having the ability to express proteins with human-like modifications, the mammalian segment has gained immense popularity in recent years, as per the recent observation of the current market environment.

On the other hand, the microbial segment is expected to grow significantly during the forecast period due the faster production while lowering the cost. Also, having easy handling, such as the microbial system, like E. coli, is easy to handle as compared to the mammalian cells, which is likely to contribute to the segment growth during the forecast period. Moreover, as more biosimilars and protein-based therapeutic market entrants are expected to provide minor industry attention ot the microbial system during the forecast period.

By Molecule Type Analysis:

How Monoclonal Antibodies Segment Maintain Their Dominance in the Current Industry?

The monoclonal antibodies segment held the largest share of the biologics CDMO market in 2024, akin to they are widely used in treating cancers, autoimmune diseases, and infectious conditions. These drugs are highly specific and effective, making them a preferred choice for many targeted therapies. Due to strong demand, pharmaceutical companies are heavily investing in monoclonal antibody development, and many rely on CDMOs to handle the complex production process. Most CDMOs have dedicated infrastructure for monoclonal antibody manufacturing, which further supports this segment's growth.

On the other hand, the recombinant protein segment is expected to grow at a notable rate. They are increasingly used in new treatments, especially for chronic diseases, rare disorders, and metabolic conditions. These proteins can be engineered to improve therapeutic performance, offering new ways to treat conditions that traditional drugs cannot. With advancements in protein design and expression systems, recombinant proteins are becoming easier to produce at scale. As demand grows for safer and more personalized therapies, recombinant proteins will become a key focus. CDMOs are expanding capabilities to support this shift, making this segment a strong growth area in the coming years.

By Product Type Analysis:

Why Did the Biologics Segment Dominate the Market in 2024?

The biologics dominated the market with the largest share in 2024, owing to the increasing demand for innovative treatments like monoclonal antibodies, vaccines, and cell therapies. These drugs offer more precise targeting of diseases and have become essential in treating cancers and autoimmune disorders. Biologics are complex to manufacture, requiring specialized facilities, which is why pharma companies outsource to CDMOs with advanced capabilities. Biology also commands high market value, making it the largest revenue generator in the industry.

On the other hand, the biosimilars segment is expected to grow at a notable rate, as many original biologics are losing patent protection, opening doors for more affordable alternatives. Biosimilars offer similar therapeutic effects at lower costs, which appeals to healthcare systems and patients.

As more biosimilars are approved globally, CDMOs are seeing rising demand for their development and production. The push for cost-effective healthcare and broader access to treatments is driving biosimilar adoption, especially in emerging markets. CDMOs that specialize in biosimilar scale-up and regulatory support are poised to benefit, making this a high-growth segment in the coming years.

By Indication Type Analysis:

Why is Oncology Segment Dominating the Industry?

The oncology segment held the largest share of the market in 2024. Cancer treatments are a top priority for global healthcare systems and pharmaceutical companies. Monoclonal antibodies, antibody-drug conjugates, and other biologics have revolutionized cancer therapy by offering targeted, effective treatments. Since these drugs are complex to manufacture, pharma companies outsource production to CDMOs with specialized capabilities. The high cost and strong market demand for biologic cancer drugs make oncology a lucrative segment.

The autoimmune diseases segment is observed to grow at the fastest rate during the forecast period, due to the increasing prevalence of conditions like rheumatoid arthritis, lupus, and Crohn's disease. Biologics are proving highly effective in controlling immune responses, offering better outcomes than traditional drugs. With rising awareness and diagnosis, the demand for targeted therapies is growing. Many companies are now focusing R&D on autoimmune biologics, driving the need for CDMO support.

✚ Related Topics You May Find Useful:

➡️ Checkpoint Inhibitor Biologics CDMO Market: Explore how immuno-oncology breakthroughs are accelerating demand for specialized biologics manufacturing

➡️ Oncology CDMO Market: Understand how rising cancer pipelines are driving outsourcing across advanced drug development

➡️ Pharmaceutical CDMO Market: Analyze global outsourcing trends reshaping drug manufacturing and development strategies

➡️ Bispecific Antibodies CDMO Market: Discover how next-generation antibody formats are transforming biologics production

➡️ Biologics Contract Development Market: Gain insight into early-stage biologics outsourcing and innovation-driven partnerships

➡️ Active Pharmaceutical Ingredients (API) CDMO Market: Track capacity expansion and supply chain shifts in global API manufacturing

➡️ Next-Generation Biologics Market: Explore emerging biologic modalities shaping the future of precision medicine

➡️ Vaccine CDMO Market: See how global immunization programs are boosting demand for scalable vaccine manufacturing

➡️ AI-Integrated CDMO Process Optimization Market: Understand how AI-driven automation is enhancing efficiency and quality in biomanufacturing

➡️ U.S. Pharmaceutical CDMO Market: Analyze domestic manufacturing growth supported by innovation and regulatory strength

➡️ Ophthalmic Drug CDMO Market: Discover outsourcing opportunities driven by rising eye disorder prevalence and novel therapies

What is Going Around the Globe?

- In 2024, with €16 million in seed funding, Commit Biologics came out of stealth to use its bispecific complement-engaging (BiCE) technology to create antibody therapeutics for treating autoimmune disorders and cancer.

- In May 2023, the healthcare-specialized acquisition firm EureKING, which focuses on bioproduction, offered to purchase Skyepharma, a contract development and manufacturing organization (CDMO) engaged in medication development and oral technology delivery innovation.

Biologics CDMO Market Segmentation:

By Type

- Mammalian

- Microbial

By Molecule Type

- Monoclonal Antibodies

- Recombinant Proteins

- Vaccines

- Hormones

- Others

By Product Type

- Biologics

- Biosimilars

By Indication

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Neurology

- Others

By Geography

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa (MEA)

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4943

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery, research efficiency, and precision medicine.

➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic proteins, and cutting-edge pharma pipelines.

➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient care and improving clinical outcomes.

➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and innovation trends in the life sciences sector.

➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene therapies and precision medicine.

➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements, functional foods, and lifestyle-driven markets.

➡️ Generative AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications enhancing diagnostics, treatment personalization, and patient engagement.

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter