Austin, Dec. 16, 2025 (GLOBE NEWSWIRE) -- Driverless Car Sensors Market Size & Growth Insights:

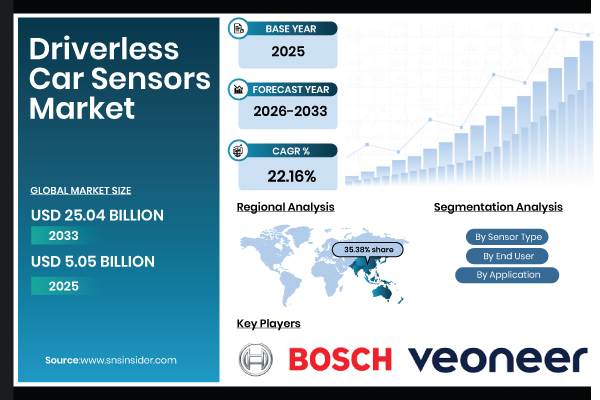

According to the SNS Insider,“The Driverless Car Sensors Market Size was valued at USD 5.05 Billion in 2025E and is projected to reach USD 25.04 Billion by 2033, growing at a CAGR of 22.16% during 2026–2033.”

Growing AI Integration in Vehicles to Drive Market Expansion Globally

The need for sophisticated driverless car sensors is being driven by the increasing integration of AI and semi-autonomous systems in automobiles. In response to a shift in customer and industry attention toward connection, automation, and safety, automakers are giving priority to intelligent driving technology above conventional automobile features. Manufacturers are compelled by this trend to use advanced sensor suites, including as LiDAR, radar, and high-resolution cameras, in order to facilitate autonomous navigation, obstacle identification, and real-time decision-making.

Get a Sample Report of Driverless Car Sensors Market Forecast @ https://www.snsinsider.com/sample-request/9032

Leading Market Players with their Product Listed in this Report are:

- Bosch

- Continental AG

- Denso Corporation

- Veoneer Inc.

- Hella GmbH

- Aptiv PLC

- Valeo SA

- ZF Friedrichshafen AG

- Velodyne Lidar

- Innovusion

- Hesai Technology

- Ibeo Automotive Systems

- Ouster Inc.

- RoboSense

- Luminar Technologies

- AEye Inc.

- Waymo LLC

- Mobileye

- Quanergy Systems

- NVIDIA Corporation

Driverless Car Sensors Market Report Scope:

| Report Attributes | Details |

| Market Size in 2025 | USD 5.05 Billion |

| Market Size by 2033 | USD 25.04 Billion |

| CAGR | CAGR of 22.16% From 2026 to 2033 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segmentation | • By Sensor Type(LiDAR, Radar, Ultrasonic, Camera and Others) • By Application(Navigation, Collision Detection, Lane Departure Warning, Traffic Sign Recognition and Others) • By Vehicle Type(Passenger Cars and Commercial Vehicles) • By End-User(OEMs and Aftermarket) |

Purchase Single User PDF of Driverless Car Sensors Market Report (20% Discount) @ https://www.snsinsider.com/checkout/9032

Market Growth May be Hampered Due to High Costs and Technical Complexity

The high costs and complexity of the technology make the implementation of driverless car sensors extremely difficult. Mass-market deployment of advanced LiDAR, radar, and camera systems is costly due to the significant hardware and software investments required. Development time and expense are increased by the need for accurate calibration, strong AI algorithms, and smooth communication with onboard systems for integration into cars. Adoption is further hampered by regulatory obstacles, regional variations in safety requirements, and worries about dependability in harsh weather or intricate urban settings.

Key Industry Segmentation Analysis

By Sensor Type

LiDAR remains the dominant sensor type with a share of 53.13% in the automotive and smart mobility market, widely used for navigation, collision detection, and autonomous driving due to its high accuracy, reliability, and long-range detection capabilities. Camera sensors are the fastest-growing segment at a CAGR of 28.58%, driven by increasing adoption in advanced driver-assistance systems, traffic monitoring, and vehicle perception applications.

By Application

Collision detection remains the dominant application with a share of 34.38% in the automotive sensor market, widely deployed for enhancing vehicle safety, preventing accidents, and supporting autonomous driving systems. Traffic sign recognition is the fastest-growing application at a CAGR of 25.99%, driven by increasing regulatory requirements, adoption of advanced driver-assistance systems.

By Vehicle Type

Passenger cars continue to dominate the market holding a share of 64.38% due to their high adoption of advanced sensors for safety, navigation, and driver-assistance features. Commercial vehicles is the fastest-growing segment at a CAGR of 23.69%, fueled by rising demand for fleet automation, logistics efficiency, and enhanced safety systems across transportation and delivery industries.

By End-User

OEMs remain the dominant end-user segment holding a share of 74.38% market share in 2025, integrating advanced sensors during vehicle manufacturing to meet safety and regulatory standards. The aftermarket segment is the fastest-growing segment at a CAGR of 24.24%, driven by increasing retrofitting of advanced sensors, upgrades for autonomous features.

Regional Insights:

Asia Pacific dominates the Driverless Car Sensors Market with a share of 35.38% in 2025E due to rapid technological adoption, supportive government policies, and extensive investments in autonomous vehicle infrastructure. The region benefits from strong automotive manufacturing hubs, growing urbanization, and rising consumer interest in advanced mobility solutions.

North America is the fastest-growing region in the Driverless Car Sensors market at a CAGR of 21.37%, fueled by robust R&D initiatives, early adoption of autonomous vehicle technologies, supportive regulatory frameworks, and strong presence of key automotive and technology players.

Do you have any specific queries or need any customized research on Driverless Car Sensors Market? Submit your inquiry here @ https://www.snsinsider.com/enquiry/9032

Recent Developments:

- In October 2025, NVIDIA Corporation– NVIDIA partnered with Uber to scale the world’s largest Level 4-ready robotaxi and autonomous delivery fleets using its DRIVE AGX Hyperion 10 platform, enabling Uber’s global rollout of 100,000 autonomous vehicles starting in 2027 and advancing the AI-driven mobility ecosystem.

- In August 2025, FORVIA HELLA launched its fifth-generation steer-by-wire sensors, enhancing electric steering precision for premium automakers in Germany and China, marking a major step toward fully electric steering systems.

Exclusive Sections of the Driverless Car Sensors Market Report (The USPs):

- SENSOR FUSION & AI INNOVATION INDEX – helps you assess the maturity of multi-sensor integration by tracking fusion of LiDAR, radar, camera, ultrasonic, and IMU systems, along with AI and deep-learning adoption for real-time perception and object recognition.

- R&D INTENSITY & PATENT LEADERSHIP – helps you identify technology leaders through analysis of patent activity in solid-state LiDAR, 4D radar imaging, neuromorphic vision sensors, and R&D expenditure trends among OEMs and Tier-1 suppliers.

- PERFORMANCE & RELIABILITY BENCHMARKS – helps you evaluate real-world sensor effectiveness using detection range, accuracy, latency, MTBF, calibration stability, and redundancy performance under diverse environmental conditions.

- MANUFACTURING CAPACITY & SUPPLY CHAIN DEPENDENCY METRICS – helps you understand production readiness and risk exposure by analyzing capacity utilization for sensor modules, semiconductor fab dependency ratios, lead times, inventory turnover, and localization strategies.

- PRICING, COST STRUCTURE & TCO ANALYSIS – helps you assess commercial viability by comparing ASPs by sensor type, component-level cost breakdowns, cost-per-vehicle across autonomy levels (L2–L5), and total cost of ownership for OEM and fleet deployments.

- TECHNOLOGY SCALABILITY & COST-DECLINE TRENDS – helps you identify inflection points by tracking declining LiDAR costs driven by solid-state innovation and advancements in MEMS, time-of-flight, and thermal imaging technologies.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.