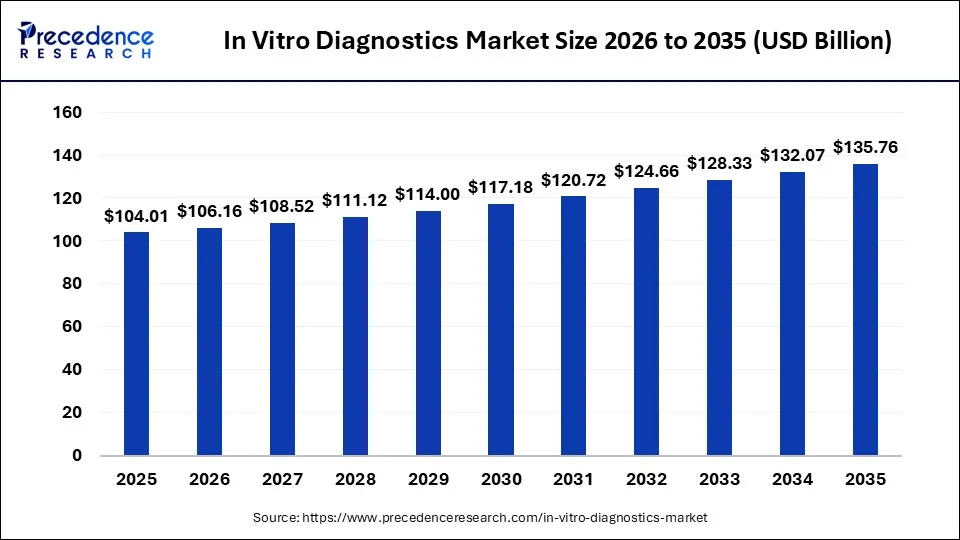

Ottawa, Dec. 16, 2025 (GLOBE NEWSWIRE) -- The global in vitro diagnostics (IVD) market size is valued at USD 104.01 billion in 2025, and it is projected to expand from USD 106.16 billion in 2026 to approximately USD 135.76 billion by 2035 with a compound annual growth rate (CAGR) of 2.7% between 2026 and 2035. Key drivers include demand for faster, more accurate tests for cancer, diabetes, and infections, with strong growth in North America and Asia-Pacific.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1130

In Vitro Diagnostics Market Highlights:

Regional Insight:

- North America dominated the market with a 42% revenue share in 2025.

- The Asia Pacific is expected to grow at a healthy CAGR during the forecast period.

Product Trends:

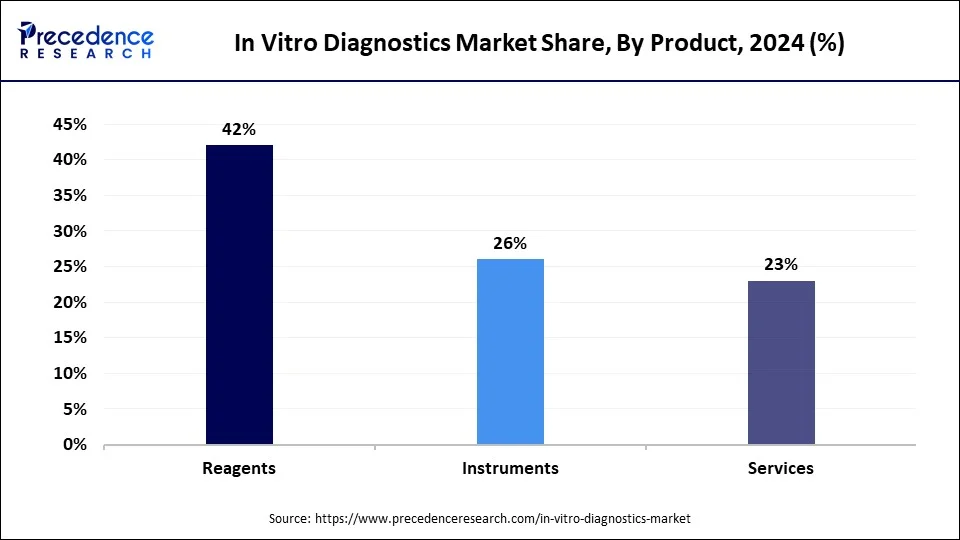

- Reagents held a significant share in 2025.

- Instruments are expected to witness considerable growth during the forecast period.

Test Location Trends:

- Point-of-Care testing led the market in 2025.

- Home Care testing is projected to grow significantly.

Technology Trends:

- Molecular Diagnostics captured the largest share in 2025.

- Immunoassay technologies are expected to experience strong growth.

Application Trends:

- Infectious Diseases dominated in 2025.

- Oncology is anticipated to show significant growth.

End-User Trends:

- Standalone Laboratories held a major market share in 2025.

- Hospitals are expected to see considerable growth in adoption.

In Vitro Diagnostics Market Revenue (USD Million), By Product Type, 2022 to 2024

| Product | 2022 | 2023 | 2024 |

| Instruments | 28,950.5 | 26,909.55 | 25,379.75 |

| Reagents | 75,883.9 | 70,996.28 | 67,404.76 |

| Services | 10,654.3 | 9,861.36 | 9,264.58 |

In Vitro Diagnostics Market Revenue (USD Million), By Technology, 2022 to 2024

| Technology | 2022 | 2023 | 2024 |

| Immunoassay | 34,688.2 | 32,433.72 | 30,774.22 |

| Hematology | 6,827.4 | 6,345.41 | 5,984.69 |

| Clinical Chemistry | 20,236.7 | 18,978.14 | 18,061.02 |

| Molecular Diagnosis | 38,255.7 | 35,662.26 | 33,736.25 |

| Coagulation | 4,680.5 | 4,328.27 | 4,061.72 |

| Microbiology | 6,384.9 | 5,916.29 | 5,563.15 |

| Others | 4,415.3 | 4,103.12 | 3,868.03 |

In Vitro Diagnostics Market Revenue (USD Million), By Application, 2022 to 2024

| Application | 2022 | 2023 | 2024 |

| Infectious Diseases | 61,149.9 | 56,833.27 | 53,602.44 |

| Diabetes | 9,146.6 | 8,475.36 | 7,969.48 |

| Oncology | 8,727.7 | 8,323.38 | 8,055.14 |

| Cardiology | 9,104.3 | 8,538.03 | 8,125.43 |

| Nephrology | 6,633.3 | 6,127.88 | 5,744.71 |

| Autoimmune Diseases | 5,350.6 | 4,987.83 | 4,718.45 |

| Drug Testing | 3,986.6 | 3,757.30 | 3,593.52 |

| Others | 11,389.6 | 10,724.14 | 10,239.92 |

✚ Note: This report is readily available for immediate delivery.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1130

What are In Vitro Diagnostics?

In vitro diagnostics market growth is driven by the high prevalence of infectious diseases, the rise in age-related conditions, increasing awareness about preventive care, the development of point-of-care testing, increasing adoption of personalised medicine, and growing healthcare spending.

In vitro diagnostics (IVD) are tests conducted on samples retrieved from human bodily tissues and fluids. IVD performs on biological samples like tissue, blood, urine, and others, and tests are performed in the laboratory. Tests help to diagnose various infections, diseases, & other health issues, and monitor patient health.

IVD helps in the early detection of diseases, avoids the spread of diseases, and enhances patient care. The common IVD tests are COVID-19, HIV tests, pregnancy tests, blood glucose monitoring, and many more. Factors like a rise in personalised medicines, increasing awareness about the early detection of diseases, growing cardiovascular diseases, and technological advancements in IVD contribute to the market.

➡️ Become a valued research partner with us https://www.precedenceresearch.com/schedule-meeting

Key Technological Shifts in the In Vitro Diagnostics Market:

The in vitro diagnostics (IVD) market is undergoing key technological shifts driven by the demand for performance efficiency, portable testing, and accessible diagnostics. The technological innovations like machine learning, nanotechnology, next-generation sequencing (NGS), automation, and digital integration automate workflows and support remote monitoring. One of the major shifts is the integration of artificial intelligence (AI) enhances accessibility and accuracy.

AI easily analyzes lab test, medical imaging, & genomic data and offers accurate results. AI automates tasks like quality control, sample handling, & image analysis and lowers turnaround times. AI identifies therapeutic approaches & novel biomarkers and helps in the development of personalized medicine by analyzing clinical history, genomics, & demographics. AI offers high-quality diagnostics at home, clinics, and remote places, and guides clinicians in selecting effective antibiotics. Overall, AI acts as a powerful tool and improves the accuracy of diagnostics.

Trade Analysis of In Vitro Diagnostics Market: Import & Export Statistics

- The leading exporter of IVD reagents is Ireland. The country exported a total of 18441 shipments of IVD reagents. (Source: https://www.volza.com/p/ivd-reagent/export/)

- The leading importer of IVD reagents is India. The country imported 26765 shipments of IVD reagents. (Source: https://www.volza.com/p/ivd-reagents/import/)

✚ Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

What are the Different Types of IVD Technologies?

| Technology | Working Principle | Uses |

| ELISA | Capturing the antigen-antibody reaction |

|

| NGS | DNA fragmentation and parallel sequencing |

|

| CLIA | The binding antibody and the corresponding antigen Chemiluminescence reactions |

|

| PCR/RT-PCR | Amplification of DNA & RNA |

|

| Flow Cytometry | Laser-based techniques for the analysis of cells |

|

| Lateral Flow | Sample amplification and target binding |

|

Government Initiatives for the In Vitro Diagnostics Industry:

- Production Linked Incentive (PLI) Schemes: These programs, such as those in India, offer financial incentives based on production performance to encourage domestic manufacturing, reduce import dependence, and attract investments in the medical device and IVD sectors.

- National Health Missions (NHM) Free Diagnostics Service Initiative: Initiatives like those under India's NHM provide a minimum set of essential diagnostic testing at no cost in public health facilities, driving demand for IVD products and promoting accessibility to healthcare.

- Regulatory Modernization (e.g., EU IVDR, US FDA pathways): Regulations like the EU's In Vitro Diagnostic Regulation (IVDR) introduce a new risk-based classification system and enhanced clinical evidence requirements to ensure higher safety and quality standards across markets, building patient trust and standardizing compliance.

- Funding for Research and Development (R&D): Government bodies like the Indian Council of Medical Research (ICMR) and the Department of Biotechnology (DBT) provide grants and co-funding opportunities (e.g., through BIRAC) to academic institutions and startups to support the development of innovative and affordable diagnostic tools for priority diseases.

- Creation of Medical Device Parks/Clusters: This initiative involves establishing dedicated industrial parks with common infrastructure, R&D labs, and testing centers, which reduces the cost of production and enhances the competitiveness of local manufacturers.

In Vitro Diagnostics Market Trends

- Expansion of Point-of-Care Testing (POCT): This trend involves bringing diagnostic tests out of central laboratories and closer to the patient (e.g., clinics, home-care settings), enabling rapid results and faster clinical decision-making.

- Integration of Artificial Intelligence (AI) and Automation: AI and machine learning algorithms are being integrated into IVD instruments and software to analyze complex data, improve diagnostic accuracy and speed, and automate laboratory workflows.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

In Vitro Diagnostics Market Opportunity

Growing Prevalence of Chronic Diseases Unlocks Market Opportunity

The growing prevalence of chronic diseases like cancer, diabetes, and cardiovascular diseases increases demand for in vitro diagnostics for early detection of diseases. The increasing patient demand for early detection of chronic diseases increases demand for IVD tests. The increasing demand for tracking the progression of chronic diseases increases the adoption of IVD for managing disease effectively and adjusting treatment plans.

The increasing development of personalised treatment requires IVD technologies. The availability of point-of-care testing increases the adoption of IVD for efficient management of chronic conditions. The increasing awareness of early disease detection and the increasing demand for regular health check-ups increase the adoption of IVD. The growing prevalence of chronic diseases creates an opportunity for the growth of the in vitro diagnostics market.

High Development Cost Limits Expansion of the In Vitro Diagnostics Market

Despite several benefits of in vitro diagnostics in various disease diagnoses, the high development cost restricts the market growth. Factors like the need for extensive clinical validation, the complex nature of IVD platforms, stricter regulation, high investment in R&D, and intensive clinical trials are responsible for high development costs. The need for high investment in personnel, equipment, and reagents directly affects the market.

The complexity of IVD technologies and lengthy development cycles increases the production costs. The stricter regulations for the development of IVD tests require a high cost. The need for extensive compliance, documentation, and quality assurance requires a high cost. The requirement of specialized materials and precision manufacturing increases the production cost. The high development cost hampers the growth of the market.

➤ Get the Full Report @ https://www.precedenceresearch.com/in-vitro-diagnostics-market

In Vitro Diagnostics Market Report Coverage

| Report Attribute | Details | |

| Market Size (2025) | USD 104.01 Billion | |

| Market Size (2026) | USD 106.16 Billion | |

| Market Size by 2035 | USD 135.76 Billion | |

| CAGR (2026–2035) | 2.7% | |

| Base Year | 2025 | |

| Forecast Period | 2026 to 2035 | |

| Segments Covered | Product, Test Location, Technology, Application, End User | |

| Regional Scope | North America, Asia Pacific, Europe, Latin America, Middle East & Africa, Rest of World | |

| Key Market Drivers | Rising prevalence of chronic & infectious diseases, aging population, growth of personalized medicine, increased adoption of point-of-care & remote testing, technological innovations including AI & molecular diagnostics | |

| Growth Opportunities | Expansion of remote/point-of-care testing, smart lab automation, increased government funding and healthcare investments in emerging markets | |

| Market Restraints | Complex regulatory landscape, high development & compliance costs, reimbursement challenges | |

| Market Trends | - AI and machine learning for diagnostic accuracy - Shift toward home care & decentralized diagnostics - Rapid expansion of molecular diagnostics technologies | |

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1130

Case Study: Transforming Healthcare with In Vitro Diagnostics (IVD) – The Role of AI and Point-of-Care Testing

Background

The global healthcare landscape is facing a dual challenge: the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, and the growing need for rapid, accurate diagnostics. Traditional laboratory testing often requires lengthy processing times and centralized lab infrastructure, limiting timely diagnosis and treatment decisions.

In response, the In Vitro Diagnostics (IVD) market is rapidly evolving. Innovations in point-of-care (POC) testing and artificial intelligence (AI) are reshaping how clinicians, laboratories, and patients approach early disease detection and management.

Objective

To illustrate how AI-powered IVD solutions and point-of-care testing can improve diagnostic accuracy, reduce turnaround time, and expand healthcare access globally.

Scenario

Hospital X, a leading healthcare provider in North America, faced challenges in timely disease diagnosis:

- Delayed test results: Patients had to wait 24–48 hours for lab results, delaying treatment decisions.

- Complex diseases: Early detection of cancer and infectious diseases required highly specialized molecular diagnostic tests.

- Rising patient volume: Growing demand for preventive healthcare and chronic disease management stressed laboratory capacities.

Solution Implemented:

- Point-of-Care Testing (POCT):

- Deployed portable molecular diagnostic devices in clinics and outpatient centers.

- Enabled rapid detection of infectious diseases (e.g., COVID-19, influenza, HIV) and chronic conditions (e.g., diabetes) within 30–60 minutes.

- AI Integration:

- AI algorithms were used to analyze patient data, lab results, and imaging for enhanced diagnostic accuracy.

- Automated workflows reduced manual errors and improved result interpretation.

- AI-assisted decision support helped clinicians identify personalized treatment plans and novel biomarkers.

- Home Care Testing Expansion:

- Home-based diagnostic kits integrated with AI platforms allowed patients to self-monitor chronic conditions like diabetes and hypertension.

- Data was transmitted securely to hospitals, allowing remote patient monitoring and timely interventions.

Results

- Faster Diagnosis: Test turnaround time reduced by 70%, enabling immediate clinical decisions.

- Improved Accuracy: AI algorithms enhanced diagnostic accuracy by 25%, reducing false positives and false negatives.

- Expanded Access: Patients in remote areas could access reliable diagnostic tests without traveling to hospitals.

- Revenue Growth: Hospital X saw a 15% increase in patient engagement and diagnostics revenue due to enhanced testing capabilities.

- Operational Efficiency: Automation and AI reduced manual workload by 40%, allowing lab staff to focus on complex analyses.

Key Insights

- Point-of-Care Testing (POCT) is essential for timely, decentralized diagnostics, particularly in managing infectious and chronic diseases.

- Artificial Intelligence (AI) enhances accuracy, reduces errors, and enables personalized treatment plans.

- Market Potential: The global IVD market is projected to grow from USD 104.01 billion in 2025 to USD 135.76 billion by 2035, driven by technological innovations and the growing need for early disease detection.

- Investment Opportunities: Healthcare providers, laboratories, and technology firms can leverage IVD advancements to meet patient demand, improve outcomes, and expand market presence.

Actionable Takeaways

- Healthcare organizations should adopt AI-driven IVD solutions to improve operational efficiency and patient care.

- Investors and startups can explore opportunities in point-of-care diagnostics, molecular testing, and AI integration.

- Policymakers should support regulatory frameworks and funding initiatives to accelerate the adoption of advanced diagnostic technologies.

Conclusion

The evolution of the IVD market demonstrates that timely, accurate, and accessible diagnostics are no longer a luxury but a necessity. Hospitals, laboratories, and healthcare innovators that integrate AI and point-of-care solutions can deliver better patient outcomes, streamline operations, and capture significant market growth in a rapidly expanding global market.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

In Vitro Diagnostics Market Regional Outlook

Which Region Dominated the In Vitro Diagnostics Market?

North America dominated the market in 2024. The well-established healthcare infrastructure, like research centers, modern clinical laboratories, and hospitals, increases the adoption of IVD. The ongoing technological innovations, like digital health integration, high-throughput systems, and lab-on-a-chip equipment in IVD, help the market growth.

The increasing prevalence of infectious and chronic diseases increases the adoption of IVD. The increasing healthcare spending and focus on personalised medicine increase the adoption of IVD. The presence of major players like BD, Abbott, and Thermo Fisher Scientific drives the market growth.

How Big is the In Vitro Diagnostics Market?

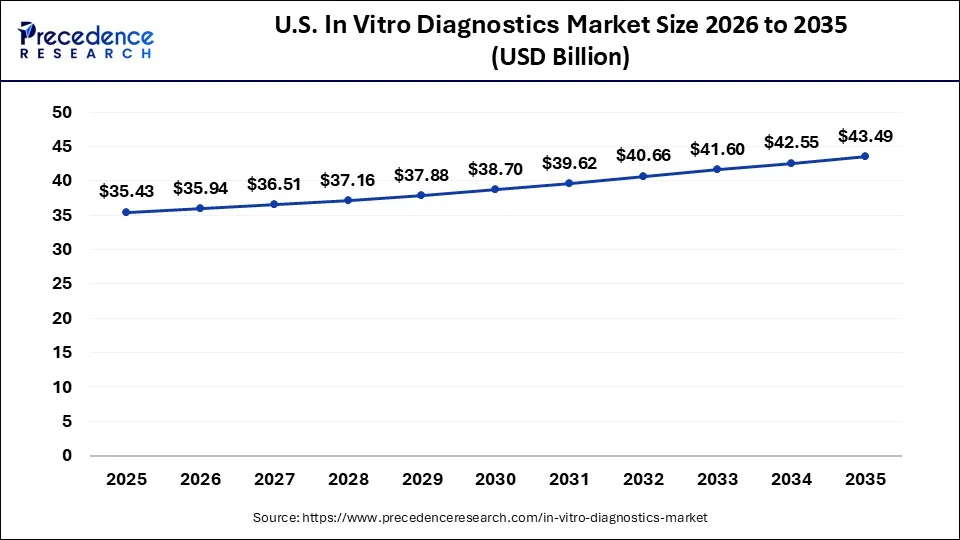

The U.S. in vitro diagnostics (IVD) market size is expected to be worth nearly USD 43.49 billion by 2035, increasing from USD 35.43 billion in 2025, growing at a CAGR of 2.07% from 2026 to 2035.

U.S. In Vitro Diagnostics Market Trends

The U.S. is a major contributor to the market. The growing rate of chronic diseases and the strong presence of healthcare infrastructure increase demand for in vitro diagnostics. The development of personalised medicine and high healthcare spending requires in vitro diagnostics.

The expansion of home & point-of-care testing and favorable reimbursement policies helps market expansion. The presence of key players like BD, Abbott, and Thermo Fisher Scientific supports the overall market growth.

U.S. In Vitro Diagnostics Market Leading Companies

- Alere, Inc.

- Beckman Coulter

- BD

- Bio-Rad laboratories

- Danaher

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- bioMérieux, Inc

- Quest Diagnostics

- Illumina, Inc.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/3712

Why is Asia Pacific Experiencing the Fastest Growth in the In Vitro Diagnostics Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing prevalence of chronic diseases like cancer, diabetes, and cardiovascular diseases increases the adoption of IVD. The growing government investment in healthcare infrastructure and increasing spending on diagnostics increase demand for IVD, helping the market grow.

The increasing awareness about the early detection of diseases and the growing expansion of healthcare facilities like clinics & hospitals increase the adoption of IVD, supporting the overall growth of the market.

China In Vitro Diagnostics Market Trends

China is a key contributor to the market. The increasing prevalence of cancer & diabetes and increasing investment in healthcare infrastructure increase demand for in vitro diagnostics. The strong presence of point-of-care testing and molecular diagnostics helps market growth.

The increasing awareness about health consciousness and the rapid growth in immunodiagnostics increase the demand for in vitro diagnostics. The presence of leading players like Shanghai Kehua Bio-Engineering, Maccura Biotechnology, and Dian Diagnostics drives the overall market growth.

Europe In Vitro Diagnostics Market Trends

Europe is growing at a substantial rate in the market. The growing rate of cardiac disease, cancer, and diabetes, and increasing age-related diseases, increases demand for IVD. The high patient preference for less invasive tests and increasing government spending on healthcare infrastructure increase the development of IVD. The rapid growth in home-based care and innovations like immunoassays & molecular diagnostics support the overall market growth.

Germany Innovations in In Vitro Diagnostics

Germany is growing significantly in the market. The robust healthcare infrastructure and the rise in age-related chronic diseases increase demand for IVD. The high prevalence of chronic & infectious diseases and increasing awareness about early detection of diseases increase the adoption of IVD. The rise in genetic screening & rapid growth in oncology testing and supportive regulatory environments drive the market growth.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

In Vitro Diagnostics Market Segmentation Analysis

Product Analysis

Why did Reagent Segment Dominate the In Vitro Diagnostics Market?

The reagent segment dominated the market in 2024. The compatibility of reagents with various diagnostics platforms, like point-of-care, clinical laboratories, and hospitals, helps market growth. The growth in personalised medicine increases the adoption of reagents. The growth in diagnostics like oncology, infectious diseases, and chronic diseases increases the adoption of reagents. The growing utilization of molecular diagnostic techniques increases demand for reagents, driving the overall growth of the market.

The instruments segment is the fastest-growing in the market during the forecast period. The growing prevalence of chronic diseases like cardiovascular conditions, diabetes, and cancer increases demand for instruments for early detection. The increasing focus on early detection of diseases and timely treatment increases demand for instruments. The ongoing innovations in diagnostic technologies and the expansion of point-of-care testing support the market growth.

Technology Analysis

How Molecular Diagnostics Segment hold the Largest Share in the In Vitro Diagnostics Market?

The molecular diagnostics segment held the largest revenue share in the market in 2024. The growing utilization of techniques like NGS & PCR for early disease diagnosis helps the market growth. The increased spread of infectious diseases increases the adoption of molecular diagnostics to control the spread of disease. The increasing development of personalised medicine and growth in at-home testing & point-of-care fuel demand for molecular diagnostics, supporting the overall market growth.

The immunoassay segment is experiencing the fastest growth in the market during the forecast period. The increasing detection of various analytes like proteins, drugs, hormones, and antibodies increases the adoption of immunoassays.

The increasing demand for ELISA and CLIA immunoassays helps the market growth. The increasing demand for POC testing and the increasing availability of central labs increase the adoption of immunoassays. The increasing risks of infectious diseases and chronic diseases increase demand for immunoassay-based diagnosis, driving the overall market growth.

Application Analysis

Which Application Segment Dominated the In Vitro Diagnostics Market?

The infectious disease segment dominated the market in 2024. The growth in infectious diseases like viral outbreaks, respiratory infections, and STDs increases demand for IVD. The increasing awareness about the early detection of infectious diseases and focus on reducing transmission increases the adoption of IVD. The increasing prevalence of hepatitis, HIV, and tuberculosis increases demand for IVD, supporting the overall market growth.

The oncology segment is the fastest-growing in the market during the forecast period. The increasing prevalence of cancer increases demand for IVD for accurate diagnosis and early detection of conditions. The ongoing advancements in molecular diagnostics, like liquid biopsies and next-generation sequencing, help in the market growth. The increasing demand for early detection of cancer and the growth in the development of personalized medicines increase the demand for IVD.

Test Location Analysis

How Point of Care Segment hold the Largest Share in the In Vitro Diagnostics Market?

The point of care segment held the largest revenue share in the market in 2024. The increasing demand for faster test results and focus on reducing turnaround times increases the adoption of point-of-care testing. The increasing need for IVD tests in underserved and remote areas increases the adoption of IVD. The focus on the management of chronic conditions like cardiovascular diseases and diabetes increases demand for POC. The increasing suitability of POC in various settings, like doctors' offices, hospitals, and clinics, drives the market growth.

The home care segment is experiencing the fastest growth in the market during the forecast period. The growing patients' preference for testing at home and the growing expansion of home-based testing help the market growth. The increasing development of automated, user-friendly, and portable IVD devices increases the adoption of care. The increasing management of chronic conditions like cardiovascular diseases & diabetes increases demand for home care, supporting the overall growth of the market.

End User Analysis

Why did the Hospital Segment Dominate the In Vitro Diagnostics Market?

The hospitals segment dominated the market in 2024. The high availability of a wide range of diagnostic tests and the increasing number of patients increase the adoption of hospitals. The growing demand for accurate and early diagnosis of diseases increases the demand for hospitals. The availability of advanced technologies like molecular diagnostic tools, automated analyzers, and others helps the market growth. The presence of trained personnel, well-established infrastructure, and high-quality equipment in hospitals drives the market growth.

The standalone laboratories segment is growing significantly in the market. The growing prevalence of diseases like cancer, infection, diabetes, and heart disease increases demand for standalone laboratories. The increasing awareness about preventive care and the growing use of personalised medicine require standalone laboratories. The shift towards specialized testing increases the use of standalone laboratories, supporting the overall market growth.

✚ Related Topics You May Find Useful:

➡️ Global In Vitro Diagnostics Enzymes Market: Explore how enzyme innovations are enhancing test accuracy, speed, and reliability across diagnostic platforms

➡️ Infectious Disease In Vitro Diagnostics Market: Discover how rising disease prevalence and rapid testing demand are reshaping global diagnostic strategies

➡️ In Vitro Inflammatory Bowel Disease Diagnostics Market: Gain insights into advanced biomarker testing driving early and precise IBD detection

➡️ Next-Generation IVD Market: Analyze how AI, molecular diagnostics, and automation are redefining the future of clinical testing

➡️ In Vitro Fertilization (IVF) Market: Understand how technological advancements and rising infertility rates are accelerating IVF adoption worldwide

➡️ Cancer In Vitro Diagnostics (IVD) Market: Track the growing role of precision diagnostics and early cancer detection technologies

➡️ IVD Contract Manufacturing Market: See how outsourcing trends and cost efficiencies are driving growth in diagnostic manufacturing partnerships

➡️ In Vitro Colorectal Cancer Screening Tests Market: Explore the expansion of non-invasive screening tests supporting early diagnosis and preventive care

➡️ In Vitro Toxicology Testing Market: Learn how ethical testing methods and regulatory shifts are boosting demand for in vitro toxicology solutions

Top Companies in the In Vitro Diagnostics Market & Their Offerings:

- Abbott Laboratories offers a broad menu of infectious disease, cardiometabolic, and toxicology point-of-care tests.

- Alere, Inc. was a global leader focused on developing near-patient point-of-care testing solutions, particularly for infectious diseases.

- Arkray specializes in the research, development, manufacture, and distribution of in vitro diagnostic products for diabetes management and urinalysis.

- Beckman Coulter provides a broad range of clinical diagnostic instruments, reagents, and automation for core laboratory applications like chemistry and immunoassay.

- Becton Dickinson (BD) focuses its in vitro diagnostics offerings on diagnostic systems for microbiology, molecular diagnostics, and specimen collection.

- Bio-Rad Laboratories offers a wide array of life science research and clinical diagnostic products, including test kits and instruments for quality control and blood typing.

- Danaher operates several diagnostic companies, offering a wide range of advanced diagnostic solutions through strategic acquisitions like Beckman Coulter.

- Hoffmann-La Roche Ltd. (Roche Diagnostics) provides a comprehensive portfolio of diagnostic instruments and digital health solutions spanning large automated systems to near-patient care.

- Sysmex Corporation specializes primarily in hematology and urinalysis diagnostics, providing instruments and reagents for clinical laboratories worldwide.

In Vitro Diagnostics (IVD) Market Concentration Analysis

The global In Vitro Diagnostics market is moderately to highly concentrated, with a small group of multinational companies controlling a large share of total revenues.

| Company / Group | Estimated Market Share (%) | Key Strengths |

| Roche Diagnostics | 18–20% | Market leader in molecular diagnostics, immunoassays, oncology testing, and digital diagnostics |

| Abbott Laboratories | 14–16% | Strong dominance in point-of-care testing, infectious disease, cardiometabolic, and rapid diagnostics |

| Danaher (Beckman Coulter, Cepheid, etc.) | 9–11% | Broad core lab automation, molecular diagnostics, and high-throughput testing |

| Becton Dickinson (BD) | 7–9% | Leadership in microbiology, specimen collection, and molecular diagnostics |

| Siemens Healthineers (industry benchmark) | 6–8% | Imaging-integrated diagnostics, automation, and clinical chemistry |

| Sysmex Corporation | 4–5% | Hematology and urinalysis specialization |

| Bio-Rad Laboratories | 3–4% | Quality control, blood typing, specialty diagnostics |

| Other Players (Arkray, niche & regional firms) | 25–30% (combined) | Diabetes care, urinalysis, regional diagnostics, emerging technologies |

Top 5 Players Control ~55–60% of the Global Market

This highlights a clear concentration at the top, driven by:

- Global distribution networks

- Strong regulatory approvals (FDA, CE, etc.)

- Deep R&D capabilities

- Integrated test menus across diseases

Strategic Implications for Readers (Actionable Insights)

For Investors

- Lower risk, stable returns with top players controlling over half the market.

- High M&A potential as large firms continue acquiring AI-driven, molecular, and point-of-care startups.

For New Entrants & Startups

- Direct competition with leaders is difficult.

- Best entry points:

- Point-of-care testing

- Home diagnostics

- Oncology & precision medicine

- AI-enabled test interpretation

For Hospitals & Labs

- Supplier concentration gives pricing power to top vendors.

- Opportunity to reduce dependency by adopting specialized or regional diagnostic providers.

For Contract Manufacturers

- Rising outsourcing trends as major brands focus on R&D and commercialization, creating growth in IVD contract manufacturing.

Recent Developments in the In Vitro Diagnostics Industry:

- In August 2024, InBios launched an in vitro diagnostic test, a serological ELISA kit for strongyloidiasis. The kit provides results under 75 minutes and is intended for use only in patients with symptoms, clinical history, and signs. (Source: https://www.prweb.com)

Segments Covered in the Report

By Product

- Reagents

- Instruments

- Services

By Test Location

- Point of Care

- Home Care

- Others

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By End User

- Standalone Laboratories

- Hospitals

- Academic & Medical Schools

- Point-of-Care

- Others

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1130

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

✚ Explore More Market Intelligence from Precedence Research:

➡️ Generative AI in Life Sciences: Explore how AI innovations are revolutionizing drug discovery, research efficiency, and precision medicine.

➡️ Biopharmaceuticals Growth: Understand the accelerating expansion of biologics, therapeutic proteins, and cutting-edge pharma pipelines.

➡️ Digital Therapeutics: Discover how technology-driven treatments are reshaping patient care and improving clinical outcomes.

➡️ Life Sciences Growth: Gain insights into emerging opportunities, market expansion, and innovation trends in the life sciences sector.

➡️ Viral Vector & Gene Therapy Manufacturing: Analyze the production advancements powering next-generation gene therapies and precision medicine.

➡️ Wellness Transformation: See how consumer wellness trends are shaping supplements, functional foods, and lifestyle-driven markets.

➡️ Generative AI in Healthcare: Unlocking Novel Innovations in Medical and Patient Care: Explore AI applications enhancing diagnostics, treatment personalization, and patient engagement.

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter