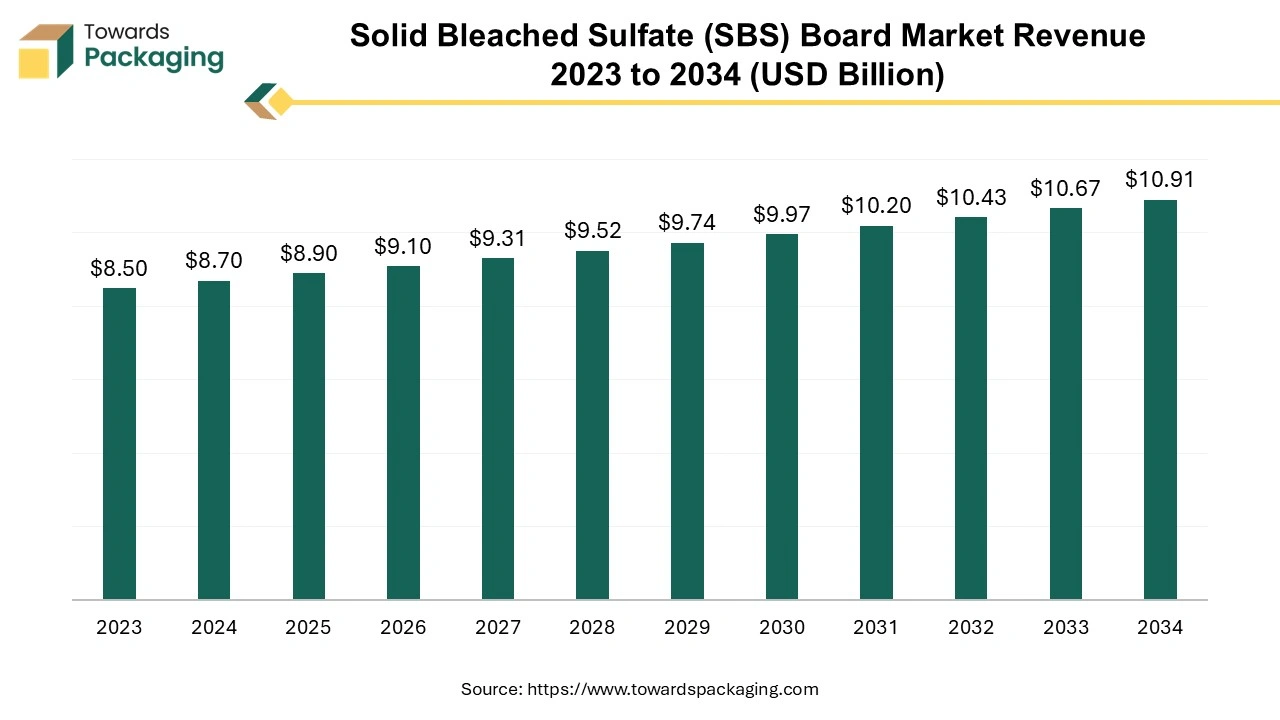

Ottawa, Dec. 18, 2025 (GLOBE NEWSWIRE) -- The global solid bleached sulfate (SBS) board market generated revenue of USD 8.90 billion in 2025, and this figure is projected to grow to USD 10.91 billion in 2034, according to research conducted by Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising demand for sustainable, high-quality packaging in the food, cosmetic, and e-commerce industries.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Takeaways

- Asia Pacific has dominated the solid bleached sulfate (SBS) board market, having the biggest share in 2024.

- Europe is expected to rise at a notable CAGR between 2025 and 2034.

- By type, the SBS C1S segment has contributed to the largest market share in 2024.

- By type, the SBS C2S segment will grow at a notable CAGR between 2025 and 2034.

- By application, the folding carton segment contributed to the largest share in 2024.

- By application, the liquid packaging segment will grow at a notable CAGR between 2025 and 2034.

Key Technological Shifts

- Shift toward sustainable barrier coatings, including recyclable fiber-based and bio-based coatings, replacing plastic and aluminum layers.

- Introduction of foil-free and plastic-free barrier systems, improving recyclability and reducing environmental impact.

- Lightweighting innovations using advanced multi-layer fiber structures that reduce material usage without compromising strengths.

- Improved pulp formulations that enhance stiffness, durability, moisture resistance, and overall performance of SBS boards.

- Rapid adoption of digital printing technologies enables high-quality graphics, on-demand customization, and short production runs.

- Growth of smart and interactive packaging, integrating RFID, NFC, QR codes, and AR to improve traceability and consumer engagement.

- Increased automation in manufacturing, using robotics and advanced continuous processing to optimize efficiency.

- AI-driven quality control systems for real-time defect detection, consistent product quality, and reduced wastage.

- Advanced coatings and surface engineering techniques, enhancing grease, moisture resistance, and premium printability.

- Use of eco–friendly chemicals and water-based coatings aligned with global sustainability and low VOC requirements.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5296

Market Overview

The solid bleached sulfate (SBS) board market is growing because there is a growing need for premium, high-quality packaging for food, drinks, cosmetics, and medications. It is a popular option for branded and highly visible products due to its superior printable stiffness and hygienic qualities. Recyclable, biodegradable, and plastic-free fiber solutions are becoming more popular due to sustainability trends. Furthermore, improvements in lightweight structure and coating technologies are increasing the use of SBS boards in packaging applications throughout the world.

Major Government Initiatives for Solid Bleached Sulfate (SBS) Boards:

- European Union (EU) Single-Use Plastics Directive: This directive restricts specific single-use plastic items, thereby encouraging the shift to fiber-based alternatives like SBS board for items such as cups and food containers in Europe.

- China's Ban on Solid Waste Imports: China's policy to ban the import of most solid waste has forced countries to develop domestic recycling infrastructure and focus on virgin fiber materials like SBS board, influencing global supply chains and production.

- India's Nationwide Ban on Single-Use Plastics: Effective from July 1, 2022, this ban prohibits specific single-use plastic items across India, creating significant opportunities and demand for SBS board alternatives in various packaging applications.

- Extended Producer Responsibility (EPR) Laws: Widely implemented in various regions (e.g., EU, North America, India), EPR regulations mandate that producers are financially or operationally responsible for the post-consumer collection and recycling of their packaging, promoting the use of easily recyclable materials like SBS.

- FDA and EU Food Contact Material Regulations: Strict regulations by bodies like the U.S. Food and Drug Administration (FDA) and the EU ensure the safety and material integrity of food packaging, which reinforces the use of virgin, high-quality SBS board for sensitive applications where recycled content might pose a contamination risk.

Market Opportunities

| Opportunity | Description |

| Sustainable & plastic-free packaging | Global shift toward eco-friendliness is boosting the adoption of recyclable and biodegradable SBS boards. Brands are replacing |

| Premium & Luxury Product Packaging | Growing demand for high-end cosmetics, perfumes, confectionery, and pharma products drives the need for visually appealing, high-quality SBS boards. Premium brands prefer SBS for its print clarity and smooth surface. |

| Digital Printing & Customization | Rise in short-run printing, personalized packaging, and vibrant graphics support SBS, which offers superior printability. This is especially strong in beauty retail and regional marketing campaigns. |

| Foodservice & RTE Packaging | Rapid growth in takeaway, frozen foods, and baker's to enter new high-performance applications such as liquid packaging and grease-resistant wraps. |

| Smart & Traceable Packaging | Increasing adoption of QR codes, digital watermarks, anti-counterfeit labels, and traceability solutions enhances SBS usage in pharmaceuticals, cosmetics, and premium foods. |

| Emerging Market Expansion | Rising urbanization and retail growth in the Asia Pacific, LATAM, and MEA are boosting demand for premium sustainable packaging formats, creating strong opportunities for SBS suppliers. |

More Insights of Towards Packaging:

- PET Shrink Film Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- Rigid Thermoform Plastic Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Biaxially Oriented Polyethylene Terephthalate (BOPET) Films Market Size, Trends, Key Segments and Regional Dynamics with Manufacturers and Suppliers Data

- PVDC-Free Packaging Solution Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Plastic Corrugated Sheets Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape Analysis

- Specialty Films Market Size, Growth Trends, Segments, Regional Insights, and Competitive Landscape Analysis 2025-2034

- Smart Containers Market Size, Trends, Segmentation Statistics, Regional Insights (NA, EU, APAC, LA, MEA), Value Chain & Competitive Analysis Report

- Expanded Polystyrene for Packaging Market Size, Trends, Segmentation, Regional Insights, Competitive Analysis & Trade Statistics Report 2025-2035

- Omnichannel Packaging Market Size, Trends, and Forecast Analysis 2025-2035

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Polypropylene Packaging Films Market Size, Share, Trends, and Forecast Analysis by Process Type, Product Type, Application, and Region

- Post-Consumer Recycled Plastic Market Size, Segments, Regional Insights, and Competitive Landscape 2025-2034

- Plant-Based Plastics Market Size, Trends, Segments, and Regional Outlook 2025-2035

- Bio-Based Packaging Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape, Value Chain and Trade Analysis

- Plastic Films and Sheets Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Trade Analysis (2025-2035)

Segmental Insights

By Type

SBS C1S segment dominated the market as it is the best option for high-end packaging because of its exceptional printability, smooth surface, and high stiffness. For visually appealing packaging designs, industries like cosmetics, pharmaceuticals, and high-end consumer goods mainly rely on C1S. Its demand across international brands is further strengthened by its capacity to preserve both structural integrity and aesthetic appeal.

SBS C2S segment is growing rapidly, driven by an increase in the use of double-sided printing in applications like promotional packaging, luxury cartons, and brochures. Excellent ink holdout and finishing are provided by its improved coating qualities on both sides, which support the trend toward packaging that is more visually appealing and informative. Adoption is quickening due to the expansion of upscale retail and food service packaging.

By Application

The folding carton segment is dominating the solid bleached sulfate (SBS) board market due to strong demand from food, pharmaceuticals, cosmetics, and FMCG industries. Its lightweight, printable, and recyclable properties make it ideal for cost-efficient, yet premium packaging. The segment benefits from large-scale retail expansion and the rise of branded goods requiring high-quality shelf presentation.

Liquid packaging is growing rapidly, backed by a rise in the consumption of ready-to-drink packaged dairy products and beverages. SBS boards provide significant benefits for liquid packaging formats, including superior moisture resistance, structural strength, and food safety compliance. Growing consumer demand for eco-friendly non-plastic cartons is propelling the market's expansion.

By Region

Packaging Powerhouse: Asia Pacific Dominates the Solid Bleached Sulfate (SBS) Board Industry

Asia Pacific is dominating the market due to a significant increase in the demand for packaging in the food, pharmaceutical, personal care, and e-commerce industries. SBS usage is rising due to organized retail expansion, rapid industrialization, and rising packaged goods consumption. Due to their sizable manufacturing bases and growing demand for upscale, high-quality packaging, China, India, and Southeast Asia lead the world in both production and consumption.

India Solid Bleached Sulfate (SBS) Board Market Trends

India is growing in the market due to the growing demand in the FMCG, food, pharmaceutical, and cosmetic industries for high-quality hygienic packaging. High-quality printable carton boards are becoming more and more popular as the retail and e-commerce industries grow. Adoption is also being accelerated by government support through trade actions and the move to environmentally friendly plastic-free packaging.

Sustainable Packaging Surge: Europe Emerges as the Fastest-Growing Solid Bleached Sulfate (SBS) Board Industry

The Europe region is growing rapidly in the market, motivated by stringent sustainability laws, a quick move away from plastics, and a strong need for recyclable food-safe packaging materials. SBS is being used more by the regions established packaging sector for high-end carton drinks and cosmetics packaging. Consumer demand for eco-friendly products and strong innovation in fiber-based packaging are driving the region's growth momentum.

Germany Solid Bleached Sulfate (SBS) Board Market Trends

Germany is leading by stringent environmental laws and a robust market for high-performing sustainable packaging. Because of its superior printability and safety standards, SBS is preferred by its sophisticated food, beverage, and cosmetic industries. Market uptake is further accelerated by growing consumer preference for high-end end environmentally friendly packaged goods.

Emerging Packaging Frontiers: Middle East and Africa Strengthen Their Growth Position in the Solid Bleached Sulfate (SBS) Boards Demand

The MEA region is steadily adopting SBS boards as demand rises for packaged food, pharmaceuticals, and consumer goods. Growing urbanization, expansion, and modern retail, and increasing awareness of premium packaging quality support market usage. The shift toward recyclable and hygienic packaging materials is further accelerating SBS adoption across key markets like South Africa, Saudi Arabia, and Egypt.

The UAE Solid Bleached Sulfate (SBS) Board Market Trends

The UAE is leading because of the strong demand for food service, growing consumption of luxury and products, and quick retail expansion. The nation's emphasis on environmentally friendly packaging and stringent quality regulations encourages the use of premium SBS for beverage cartons, confections, and cosmetics. The booming FMCG industry and rising tourism both contribute to the market's momentum.

Boardroom Boom: North America Records Notable Growth in Solid Bleached Sulfate (SBS) Board

The North American market remains strong due to high demand for premium packaging in food, beverage, pharmaceuticals, and cosmetics. Advanced printing technologies and a mature packaging industry drive consistent use of high-quality SBS grades. Growing sustainability commitments and the shift from plastics to recyclable fiber-based materials further support steady market growth across the region.

U.S. Solid Bleached Sulfate (SBS) Board Market Trends

U.S. shows strong growth in the market due to high demand for premium packaging across food, pharmaceuticals, cosmetics, and consumer goods. The country’s advanced printing technologies and strong preference for high-quality, visually appealing packaging further boost adoption. Growing sustainability commitments and a steady shift toward recyclable fiber-based packaging continue to support market expansion.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Developments in the Solid Bleached Sulfate (SBS) Board Industry:

- In September 2025, Stora Enso introduced Ensovelvet, a new uncoated solid bleached sulfate board optimized for premium packaging sectors like cosmetics and fragrances, combining natural texture with strong printability. The packaging is designed to meet with demands for natural and renewable solutions in luxury packaging.

- In July 2025, the Directorate General of Trade Remedies (DGTR) announced that it would conduct an anti-dumping investigation into imports of SBS board and related cartonboard products to protect domestic producers from unfair pricing. The Ministry of Commerce and Industry, Department of Commerce has initiated this anti-dumping investigation into imports of virgin multilayer paperboard from Indonesia.

Top Companies in the Solid Bleached Sulfate (SBS) Board Market & Their Offerings:

- Smurfit WestRock: A recently merged packaging giant producing a wide range of paper-based solutions globally.

- International Paper: A leading producer of fiber-based products with extensive operations in North America, Europe, Latin America, Asia, and North Africa.

- Stora Enso: A renewable materials company known for sustainable packaging, biomaterials, and paper products.

- Graphic Packaging International, LLC: A major provider of fiber-based consumer packaging for diverse markets, including food, beverage, and healthcare.

- Clearwater Paper Corporation: Specializes in manufacturing consumer tissue and bleached paperboard for private labels and high-end packaging.

- Sappi: A global company focusing on dissolving pulp, specialty, and packaging papers, operating across multiple continents.

- Georgia-Pacific LLC: A large US-based pulp and paper manufacturer distributing various building and paper products, including SBS.

- Holmen Iggesund: A producer of high-quality, virgin fiber paperboard brands like Invercote, catering to premium packaging applications.

- ITC Limited: One of India's largest manufacturers and traders of paper and paperboard products.

- Pankakoski Mill Oy: A Finnish mill specialized in producing thick, high-quality board materials.

Segments Covered in the Report

By Type

- SBS C1S

- SBS C2S

By Application

- Folding Carton

- Cup and Plate

- Liquid Packaging

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5296

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Towards Packaging Releases Its Latest Insight - Check It Out:

- Recycled Polypropylene in Packaging Market Size, Trends, Segments, Regional Insights, Competitive Landscape, Value Chain & Trade Data Analysis (2025–2035)

- Personal Care Packaging Market Size, Segments, Regional Data, and Competitive Analysis

- Thermoformed Trays Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Stick Packaging Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2034

- Retort Packaging Market Size, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Polypropylene Foam Trays Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Filling and Sealing Machines Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Flexible Industrial Packaging Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis 2025-2035

- Recyclable Beverage Packaging Market Size, Trends, and Global Segment Analysis 2025-2035

- North America Packaging Market Size, Trends, Share, Regional Data, Segments 2025-2035

- Packaging Solutions Market Size, Trends, Segments, and Regional Insights 2025-2035

- High Barrier Foil Pouches Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- North America Flexible Plastic Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Recycle-Ready Packaging Market Size, Trends, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035

- North America Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Australia Warehouse and Storage Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Trade Data Analysis 2025-2034

- Vertical Form-Fill-Seal (VFFS) Machines Market Size, Trends, Segments, Regional Outlook, and Competitive Analysis to 2035

- Self-storage Market Size, Trends & Regional Insights (NA, EU, APAC, LA, MEA) with Segments, Value Chain, Trade Data & Competitive Analysis 2025-2034

- UK Large Cardboard Boxes Market Size, Trends, Segments, Regional Insights, Competitive Landscape & Trade Analysis 2025-2034

- Sachet Packaging Machines Market Size, Trends, Segmentation, Regional Outlook, Competitive Landscape & Global Trade Analysis 2024-2035