Austin, Nov. 08, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Insights:

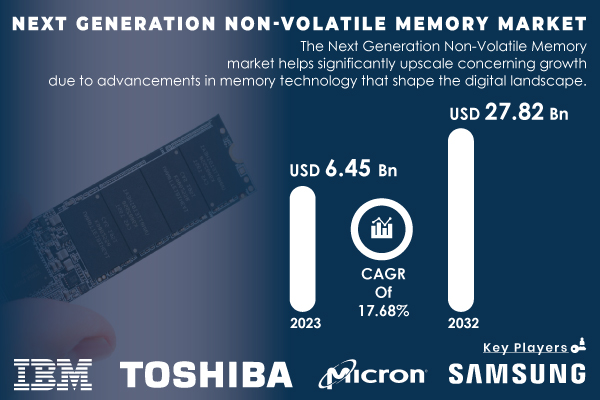

According to the S&S Insider, “The Next Generation Non-Volatile Memory Market Size was valued at USD 6.45 Billion in 2023 and is expected to reach USD 27.82 Billion by 2032 and grow at a CAGR of 17.68% over the forecast period 2024-2032.”

Innovative Non-Volatile Memory Technologies Propel Growth in High-Performance Data Storage Solutions

The Next Generation Non-Volatile Memory market is experiencing strong growth driven by advances in memory technology, transforming the digital landscape. Innovations in memory solutions that retain data without power are proving superior to traditional non-volatile memories like Flash. For example, SK Hynix has already filled all orders for its high-bandwidth memory (HBM) DRAM for 2024, crucial for AI processors in data centers, while Samsung Electronics is expanding its HBM production capacity at the Samsung Display Cheonan plant, with investments reaching 700 billion to 1 trillion won. Emerging memory technologies like Phase Change Memory (PCM), Spin-Transfer Torque Magnetic RAM, and ReRAM offer improved speed, endurance, and energy efficiency, catering to the high-performance demands of sectors such as enterprise storage. With rapid developments and growing industry adoption, next-gen non-volatile memory technologies are set to redefine data storage standards and support expanding applications in AI, data centers, and connected devices.

Get a Sample Report of Next Generation Non-Volatile Memory Market Forecast @ https://www.snsinsider.com/sample-request/4567

Leading Market Players with their Product Listed in this Report are:

- Samsung Electronics (Z-NAND, MRAM)

- Intel Corporation (3D XPoint, Optane)

- Micron Technology (3D XPoint, NAND)

- Toshiba Corporation (ReRAM, BiCS Flash)

- SK Hynix (PCM, NAND Flash)

- Western Digital Corporation (ReRAM, 3D NAND)

- IBM Corporation (Racetrack Memory, PCM)

- Cypress Semiconductor (FRAM, SONOS)

- NXP Semiconductors (MRAM, PCM)

- Everspin Technologies (STT-MRAM, Toggle MRAM)

- Avalanche Technology (STT-MRAM, Spin-transfer Torque MRAM)

- Adesto Technologies (CBRAM, ReRAM)

- Fujitsu Limited (FeRAM, MRAM)

- Crossbar Inc. (ReRAM, 3D RRAM)

- Rambus Inc. (ReRAM, Resistive RAM)

- Qualcomm Incorporated (ReRAM, MRAM)

- HGST (a Western Digital brand) (ReRAM, 3D NAND)

- Sony Corporation (ReRAM, MRAM)

- Seagate Technology (Heat-Assisted Magnetic Recording, MRAM)

- GlobalFoundries (STT-MRAM, ReRAM)

Next Generation Non-Volatile Memory Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 6.45 Billion |

| Market Size by 2032 | USD 27.82 Billion |

| CAGR | CAGR of 17.68% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hybrid Memory Cube (HMC), High-bandwidth Memory (HBM)), • By Wafer Size (200 mm, 300 mm) • By Application (BFSI, Consumer Electronics, Government, Telecommunications, Information Technology, Others.) |

| Key Drivers | • Emerging Non-Volatile Memory Technologies Driving the Future of Data Storage and Performance Enhancement. • Critical Role of NVM in Powering Connected and Autonomous Vehicles for Real-Time Data Processing. |

Do you Have any Specific Queries or Need any Customize Research on Next Generation Non-Volatile Memory Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4567

Rising Demand for Advanced Non-Volatile Memory Drives Growth in High-Speed, Energy-Efficient Data Storage Solutions

The demand for advanced non-volatile memory technologies is driven by the need for faster, energy-efficient data storage amid a rapidly evolving digital landscape. With AI, IoT, and big data expanding, industries require storage solutions that manage vast data volumes quickly and securely. Technologies like Resistive RAM (ReRAM), Magneto resistive RAM (MRAM), and Phase Change Memory (PCM) offer low latency and high endurance, making them ideal for high-performance computing and mobile devices. As companies focus on balancing power consumption with speed, adoption of next-generation non-volatile memory is expected to grow, especially across data centers, autonomous vehicles, and connected devices.

Market Dynamics by Type and Wafer Size: High-Bandwidth Memory and 300mm Wafer Segment Drive Next-Generation Non-Volatile Memory Growth

By Type

In 2023, high-bandwidth memory (HBM) led with a 58.85% revenue share, fueled by rising demand for high bandwidth, low power consumption, and the adoption of technologies like AI and big data analytics. The growing consumer interest in electronic devices and advancements in automotive technology have also driven HBM adoption, offering enhanced performance and faster data transfer rates.The hybrid memory cube (HMC) market is projected to grow at an 18.9% CAGR from 2024 to 2032. HMC’s unique architecture, advanced technology, and superior performance compared to traditional memory make it highly suitable for industries and applications that require energy efficiency, such as AI, IoT, machine learning, and data centers.

By Wafer Size

The 300mm wafer segment dominated the market in 2023, holding a 60.25% market share. With over twice the surface area of 200mm wafers, 300mm wafers enable greater production efficiency and cost savings. The growing demand for AI, 5G, and high-performance computing is expected to further drive the adoption of 300mm wafers. The 200mm wafer segment is anticipated to grow at a CAGR of 18.32%. This mature technology supports microprocessors, RF, and power chips, utilizing power and compound semiconductors essential for consumer electronics, automotive, and industrial applications.

"Asia Pacific and North America Lead Next-Generation Non-Volatile Memory Market Growth"

Asia Pacific dominated the market in 2023, capturing a significant revenue share of 48.50%, driven by its vibrant business environment. The rising demand for energy-efficient memory solutions and effective data retention is propelled by the growing adoption of mobile technologies and the Internet of Things (IoT). Key nations in this region, including China, Japan, and South Korea, are at the forefront of semiconductor production and innovation.

Purchase Single User PDF of Next Generation Non-Volatile Memory Market Report (33% Discount) @ https://www.snsinsider.com/checkout/4567

In North America, the next-generation non-volatile memory market is projected to experience a robust CAGR of 18.51% during the forecast period. This growth is attributed to the development of new infrastructures, particularly data centers, and the rapid expansion of the digital economy in countries like the U.S. and Canada. As of March 2024, the U.S. reported 5,381 data centers, the highest number globally.

Recent Development

- Micron Technology, Inc. announced on July 30, 2024, that it is shipping ninth-generation (G9) TLC NAND in SSDs, becoming the first in the industry to reach this milestone.

- Samsung Electronics is nearing completion of its 8nm embedded MRAM (eMRAM) technology, which promises non-volatile memory that is faster and more durable than traditional DRAM, with a write rate 1,000 times that of NAND, according to DRAMeXchange.

- TSMC achieved a breakthrough in next-generation MRAM technology in January 2024, collaborating with the Industrial Technology Research Institute to develop a spin-orbit-torque magnetic random-access memory (SOT-MRAM) array chip.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Next Generation Non-Volatile Memory Wafer Production Volumes, by Region (2023)

5.2 Next Generation Non-Volatile Memory Chip Design Trends (Historic and Future)

5.3 Next Generation Non-Volatile Memory Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Next Generation Non-Volatile Memory Market Segmentation, by Type

9. Next Generation Non-Volatile Memory Market Segmentation, by Wafer Size

10. Next Generation Non-Volatile Memory Market Segmentation, by Application

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access More Research Insights of Next Generation Non-Volatile Memory Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/next-generation-non-volatile-memory-market-4567

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.